Summary:

- Medtronic has upped its dividend for 46 consecutive years.

- The MedTech company topped analysts’ expectations in the fiscal third quarter for revenue and non-GAAP EPS.

- Medtronic’s financial health is vibrant enough to possess an A rating from S&P on a stable outlook.

- Shares of the MedTech leader could be priced 24% below fair value.

- Medtronic may be poised to generate robust total returns in the long term.

A surgical team works in the operating room. gorodenkoff

My investing strategy naturally attracts me to Dividend Aristocrats on a routine basis. No company is perfect, but companies that belong to this distinguished class didn’t get there (or stay there) by accident.

Upping a dividend for at least 25 consecutive years and being dominant enough to be a component of the S&P 500 (SP500) is no small feat. Such an accomplishment often requires an impressive competitive position, steady profitability, and a strong balance sheet.

Medtronic (NYSE:MDT) is one such holding I own in my portfolio with a 0.9% weighting within my 99 stock portfolio. When I initiated coverage with a buy rating in January, I liked its manageable payout ratio and debt load, status as a Dividend Aristocrat, and reputation as a proven leader within its industry.

Since that time, shares have fallen 4% as the S&P has rallied 9%. Together, with fiscal third-quarter results last month that I thought were solid, I am reiterating my buy rating of shares today. Please allow me to elaborate further on the fundamentals and valuation to lay out my updated buy case.

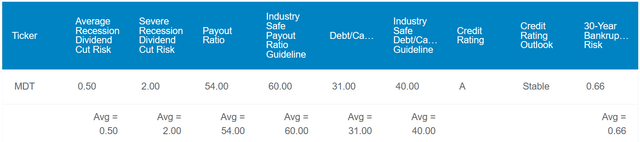

Dividend Kings Zen Research Terminal

Medtronic’s 3.3% forward dividend yield clocks in at double the 1.6% forward yield of the healthcare sector. This is what earns it a B+ grade from Seeking Alpha’s Quant System for forward dividend yield. In my view, the payout also appears to be quite secure.

Medtronic’s 54% EPS payout ratio is moderately below the 60% EPS payout ratio that rating agencies like to see for the MedTech industry. Additionally, the company’s 31% debt-to-capital ratio is also meaningfully less than the 40% debt-to-capital ratio that rating agencies have set forth as the industry-safe guideline.

Along with Medtronic’s industry leadership, these factors are why S&P awards an A credit rating to the company on a stable outlook. This suggests Medtronic’s risk of going bankrupt in the next 30 years is 0.66%. Put another way, the company would remain in business in 151 out of 152 30-year simulations.

Considering these elements, the estimated probability of a dividend cut in the next average recession from Medtronic is 0.5%. If the next recession is severe, this risk remains subdued at 2%. For more perspective, these respective likelihoods are the minimums in the Zen Research Terminal.

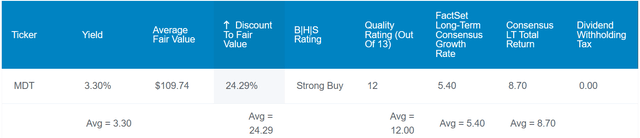

Dividend Kings Zen Research Terminal

At a glance, Medtronic’s fundamentals look to be attractive. The valuation looks to be even more enticing. Medtronic’s five-year average dividend yield of 2.3% could mean shares are worth $121 each.

The stock’s P/E ratio since 2003 of 19 suggests that it could be fairly valued at $99 apiece. Given the ongoing recovery in Medtronic’s business, I believe a return to such a fair value could be a reasonable assumption in the years to come.

Blending these fair value estimates, shares of the stock could be worth $110 each. Relative to the $83 share price (as of March 26, 2024), Medtronic could be trading at a 24% discount to fair value.

If Medtronic can meet the growth consensus and return to fair value, here are the total returns that could be ahead in the next 10 years:

- 3.3% yield + 5.4% FactSet Research annual growth consensus + a 2.8% annual valuation multiple expansion = 11.5% annual total return potential or a 197% 10-year cumulative total return against the 9.8% annual total return potential of the S&P or a 155% 10-year cumulative total return

A Double Beat In Fiscal Q3 2024

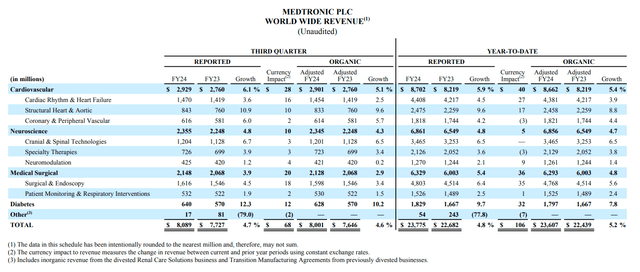

Medtronic Q3 2024 Financial Statements

When Medtronic shared its financial results for the fiscal third quarter ended Jan. 26 on Feb. 20, I was left feeling optimistic. The company’s revenue grew by 4.7% year-over-year to $8.1 billion during the quarter. This came in $150 million better than the analyst consensus per Seeking Alpha.

These results were powered by growth within each of Medtronic’s core businesses. The cardiovascular segment’s revenue surged 6.1% over the year-ago period to $2.9 billion in the fiscal third quarter. Every operating unit in the segment besides cardiac ablation solutions (-0.7% growth rate) recorded growth for the fiscal quarter. This ranged from low single-digits in cardiac rhythm management to low double-digits in cardiac surgery. According to Chairman and CEO Geoff Martha’s opening remarks during the Q3 2024 Earnings Call, launches for next-gen leadless pacemakers Micra AV2 and VR2 devices were major growth catalysts.

The neuroscience segment posted almost $2.4 billion in revenue during the fiscal third quarter, which was a year-over-year growth rate of 4.8%. This growth was fueled by mid-single-digit growth within the cranial and spinal technologies, neurovascular, and ENT operating units.

Medtronic’s medical surgical segment generated $2.1 billion in revenue in the fiscal third quarter, which was 3.9% higher over the year-ago period. Low single-digit growth in the surgical operating unit and mid-single-digit growth in the endoscopy and patient monitoring units countered a mid-single-digit decline in respiratory interventions operating unit growth for the quarter.

Finally, diabetes segment revenue climbed 12.3% year-over-year to $640 million during the fiscal third quarter. These healthy results were due to growing momentum for the company’s recently launched MiniMed 780G insulin pump. According to Martha, a third-party survey of nearly 2,000 diabetes pump users found the continuous glucose monitor scored the highest in overall satisfaction. This is why the CGM’s revenue grew by another 5% sequentially versus Q2.

Medtronic’s non-GAAP EPS was flat at $1.30 in the fiscal third quarter, which was $0.04 ahead of the analyst consensus from Seeking Alpha. On the surface, this isn’t inspiring. However, it is better than meets the eye.

Adjusting for $0.11 of unfavorable foreign currency translation stemming from Medtronic’s global presence and devaluation of key currencies versus the U.S. dollar (e.g., the Argentine Peso), the company’s currency-neutral non-GAAP EPS rose by 8.5% over the year-ago period.

Medtronic’s non-GAAP EPS is expected to dip by 1.7% from $5.29 in FY 2023 to $5.20 in FY 2024 per the FAST Graphs analyst consensus. Next fiscal year and beyond looks to be promising, though.

This is because the company’s product launches that I alluded to should keep picking up steam in their respective markets. The year-over-year doubling of MiniMed’s 780G insulin pump users in the U.S. demonstrates that Medtronic is being rewarded for the incredible efficacy of this life-changing product.

Martha also noted that during the quarter, the company secured CE Mark for its Simplera Sync sensor to be used with the 780G. This sensor is half the size of Medtronic’s current sensor, which further enhances the user experience and patient compliance. In the first half of calendar year 2024, Medtronic plans to submit the 780G with Simplera Sync to the FDA. The approval of this combo could drive even more growth within this market for the company.

That is why the FAST Graphs analyst consensus is for 4.8% growth in non-GAAP EPS to $5.45 in FY 2025 and another 7.5% growth to $5.86 in FY 2026. As Medtronic innovates throughout its business and launches additional products, I think these are sensible growth forecasts.

The company’s financial condition is also decent in my view. Medtronic’s interest coverage ratio through the first nine months of its current fiscal year was 8.7 (unless otherwise noted or hyperlinked, all details were sourced from Medtronic’s Q3 2024 Financial Statements and Medtronic’s Q3 2024 Earnings Presentation and Medtronic’s Q3 2024 Earnings Call). In what should be an earnings trough year for the company, this provides Medtronic with enough earnings to adequately service its debt.

Free Cash Flow Is Improving

Medtronic’s quarterly dividend per share has cumulatively compounded by 38% in the last five years to the current rate of $0.69. That’s equivalent to a 6.6% compound annual growth rate. I would expect a similar level of dividend growth to continue over the long run. This provides a nice mix of starting income and growth potential in my opinion.

This is because Medtronic has produced over $2.8 billion in free cash flow through the first three quarters of fiscal year 2024. Against just over $2.7 billion in dividends paid, this left the company with $96 million in retained free cash flow. In absolute terms, this isn’t the best free cash flow/dividend coverage.

I would contend, though, that the trajectory of free cash flow is what matters. Year-to-date free cash flow is up 14.1% over the $2.5 billion in the first three quarters of fiscal year 2023 (details according to page 9 of 61 of Medtronic’s 10-Q filing). Substantial improvements in operating cash flow due to product launches more than offset higher capital expenditures.

As Medtronic bears more fruit from its recent innovations, I anticipate free cash flow to pick up even further. This is what supports my argument that solid dividend growth can persist.

Risks To Consider

Medtronic is a quality business, but it has risks that need to be navigated to maintain and build on its success moving forward.

Operating in the MedTech space, Medtronic faces extensive regulatory risk. The company’s financial success routinely exposes it to the possibility of being targeted by regulators around the world. If more stringent price controls are implemented in major markets, Medtronic’s fundamentals could be negatively impacted.

The company’s facilities and suppliers are also regularly examined by regulatory authorities. If these authorities find any issues with manufacturing processes or product safety, Medtronic could be hit by product recalls, lawsuits, and fines. Such occurrences could harm the company’s image and fundamentals.

Summary: Valuation Reversion Could Drive Total Returns

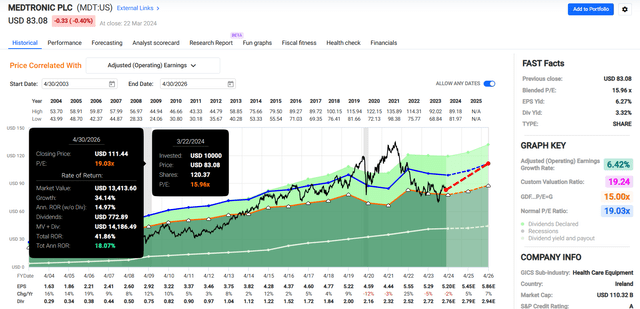

FAST Graphs, FactSet

Medtronic is a business that I like quite a bit. Driven by new product launches and greater market adoption of existing products, the company’s operating fundamentals are coming along. Medtronic’s balance sheet is A-rated by S&P and also enjoys an A3 (A- equivalent) rating from Moody’s.

Topping it off, the company’s shares are trading for a blended P/E ratio of 16. That’s a sizable discount compared to the normal P/E ratio of 19 per FAST Graphs. As I believe Medtronic will deliver in the quarters to come, sentiment could improve enough to result in a reversion closer to its normal P/E ratio. If that happened, shares could return 42% through the end of fiscal year 2026. That’s why I am maintaining my buy rating right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.