Summary:

- Medtronic’s investors endured a steep selloff in early March but formed a constructive bottom, lending optimism to its battered holders.

- We assessed that MDT buyers returned to defend the lows last seen in December and not give them up.

- The company’s near-term earnings profile is not expected to be spectacular. But, MDT’s battered valuation has likely reflected these headwinds.

- However, Medtronic has underperformed its Healthcare peers over the past four years, suggesting that the market remains unconvinced over its performance.

- We think the current zone has a decent margin of safety. Therefore, investors who bought at its 2021 highs can consider using the current levels to average down their costs.

JHVEPhoto

Medtronic plc (NYSE:MDT) investors who bought into its February highs were given a rude awakening in March. It demonstrated that dip buyers from its December/January lows waited for the rip to take profit and force late buyers to flee rapidly, as MDT collapsed toward its lows in March.

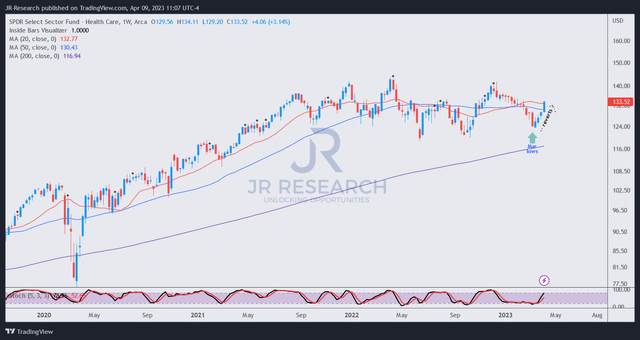

XLV price chart (weekly) (TradingView)

Healthcare stocks represented in the Health Care Select Sector SPDR ETF (XLV) were sold off broadly through early March, reaching a low before recovering over the past four weeks.

However, while MDT also formed a bottom, its recovery had lagged behind its XLV peers. As such, the market remains unconvinced about its medium-term recovery, as MDT has underperformed its XLV peers since MDT/XLV topped out in September 2019.

Moreover, in the current high-interest rates environment, MDT’s NTM dividend yield of 3.4% offers little solace to income investors. With the 2Y Treasury yield still printing nearly 4%, it likely isn’t enough to attract long-term income investors, as the Fed remains hawkish.

Furthermore, the Fed is expected to lift its Fed Funds rate or FFR by another 25 bps in May and is likely to keep rates higher for longer to effectively fend off elevated inflation rates.

Hence, we believe investors will likely focus on Medtronic’s forward earnings profile, even as it raised the lower end of its adjusted EPS guidance range at last quarter’s earnings release in February.

The company is expected to post revenue recovery through H2 CY2023. However, Medtronic is expected to post an adjusted EPS decline of 4.9% for FY23 (year ending April 2023).

With Medtronic lapping FY22’s remarkable 25% growth in its adjusted EPS, it should help reduce the headwinds toward a medium-term earnings recovery.

Despite that, Medtronic is not expected to recover its earnings growth trajectory until FY25, when it’s expected to deliver 8.6% in EPS growth. Therefore, near-term execution risks relating to its supply chain challenges and hospital labor and inflation issues could hamper hospital capacity expansion in the near term, impacting its outlook.

However, Medtronic’s wide economic moat rating suggests that high conviction investors could find its current valuation attractive if they are confident that the company and its partners could resolve these challenges eventually.

Notably, the company is still expected to be highly profitable through FY25, indicating its robust moat. Accordingly, Medtronic is expected to post an FY24 FCF margin of 15.3% before improving to 16.6% by FY25.

Despite that, the underperformance against the Healthcare sector shouldn’t be ignored, suggesting investors need to assess their entry points carefully if they intend to add exposure.

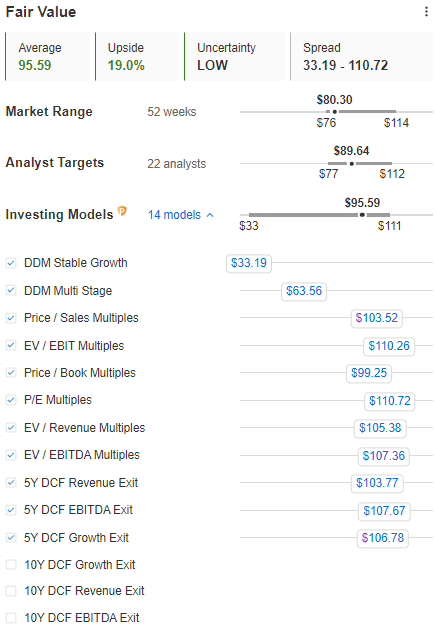

MDT blended fair value estimate (InvestingPro)

MDT’s blended fair value estimate of $96 suggests a considerable margin of safety at the current levels. We usually demand a lower margin (about 12.5%) for highly profitable wide-moat stocks like MDT. However, given its relative underperformance against the XLV over the past four years, a higher margin of safety is justified.

Hence, we would consider a buffer between 20% to 25% as appropriate, which is very close to the current buy levels.

However, do the buyers agree when assessing MDT’s price action?

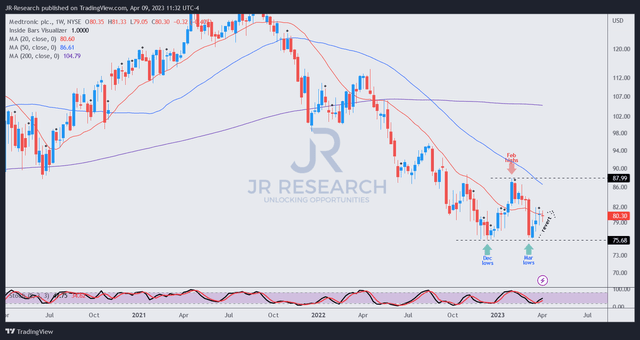

MDT price chart (weekly) (TradingView)

MDT formed a bottom in early March, which saw buyers returning to defend the lows it established in December/January.

As such, we assessed that the bottoming process was constructive, even though it underperformed XLV’s recovery over the past four weeks.

Notably, there was a bull trap or false upside breakout in early February (pre-earnings), resolved with the recent bottom.

Therefore, we believe MDT is still within the buy zone, although the optimal level would have been closer to the levels at its March lows (with a much wider margin of safety).

However, if MDT could continue to hold its recent lows, it should corroborate our thesis that it bottomed out in January. Notwithstanding, investors must be realistic about its recovery, especially if they bought at its 2021 highs.

We believe those levels will not be likely in the near- and medium-term, but they can still reduce their average costs markedly by adding at the current levels (if still within capital allocation).

Rating: Buy (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!