Summary:

- Medtronic is a healthcare technology company that has seen encouraging growth in the current fiscal year.

- The company has maintained pricing power and has a strong balance sheet, with an A+ grade for profitability.

- Medtronic is well-positioned for future opportunities, including diabetes care, and is undervalued compared to historical norms with a decent starting dividend yield.

Moussa81

Buying quality companies at reasonable prices remains a winning investment strategy in my opinion despite all the noise around high-flying Al names on the market today. What’s even better is if those stocks pay you a decent yield for holding onto them, which makes natural price volatility easier to bear.

This brings me to Medtronic (NYSE:MDT), which I last covered in August with a ‘Buy’ rating, noting its undervaluation, strong balance sheet, and positioning for international growth.

Since my last piece, the stock had dipped to as low as $69 in October last year before climbing back up, and more-or-less plateauing in the low $80s, where it stands now, resulting in flat performance (0.8% decline in share price) since my last visit.

In this article, I provide an update on MDT’s recent business results, and discuss why the current valuation makes this dividend stock an opportunistic ‘Buy’, so let’s get started!

Why MDT?

Medtronic is a healthcare technology company that develops and manufactures products that treat 70 health conditions, including cardiac devices, surgical robotics, insulin pumps, surgical tools, patient monitoring systems, and more. It employs over 95,000 people worldwide and has a presence in 150 countries.

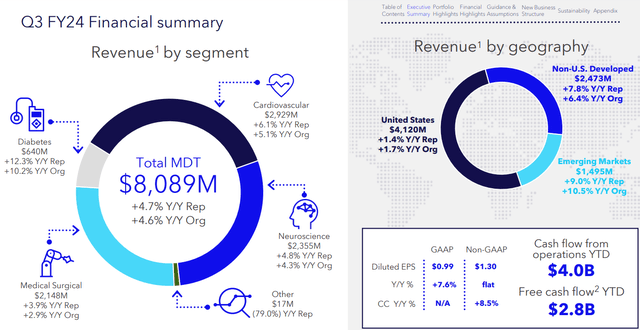

Despite what MDT’s flat share price might suggest, it’s actually seeing encouraging growth. This is reflected by fiscal Q3’24 (ended on Jan 26th, reported on Feb 20th) results, which showed 4.7% YoY revenue growth, driven by continued momentum around its Diabetes, Core Spine, and Cardiac products. Importantly, MDT returned to growth in the U.S. after having fallen and stagnated after the pandemic.

As shown below, results were more pronounced outside of the U.S., with high single-digit YoY growth, and all four of MDT’s major segments saw sales growth, particularly in the Diabetes space, which grew revenue by 10% on an organic basis.

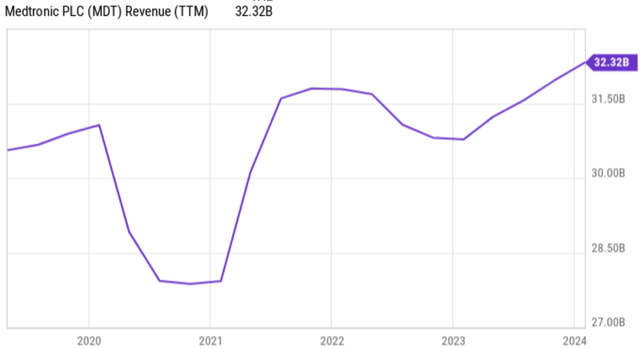

This follows on the 4.5% YoY revenue growth that MDT saw in fiscal Q1’24 when I last visited the stock. As shown below, MDT’s revenue is back in upward momentum over the past 5 years, after taking a dip in the early pandemic timeframe due to patients delaying elective surgeries.

MDT Revenue 5-Yr Trend (YCharts)

Also encouraging, MDT has been able to maintain pricing power, as reflected by FX-neutral adjusted gross margin rising by 70 basis points YoY to 66.7%. Moreover, cost improvements enabled 160 basis points YoY improvement in operating margin to 27.5% for fiscal Q3’24.

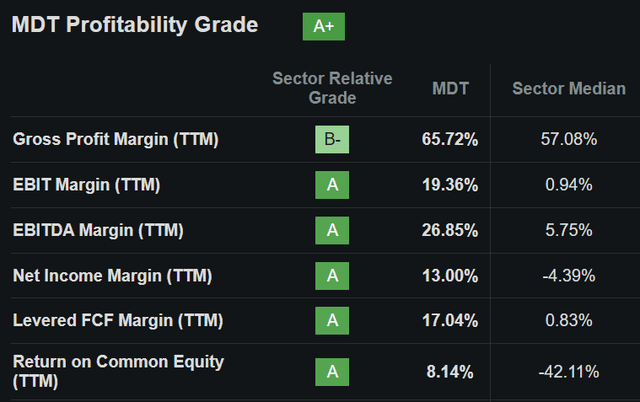

As shown below, MDT’s reputation and products as one of the only pure-play healthcare technology companies has helped it to achieve an A+ grade for Profitability, with industry-leading EBITDA and Net Income margins of 27% and 13%, respectively.

Looking ahead, MDT is well-positioned to regain momentum across its key business segments, and this is supported by a robust pipeline in its highest growth opportunities. This includes several recent approvals that are just starting or are yet to contribute to growth including Aurora EV-ICD, PulseSelect, Nitron CryoConsole, and Percept, to name a few. It’s also advancing core technologies in robotics and Al, with 5 Al products having already been FDA-approved.

MDT also has opportunities to turn around its diabetes business, which saw a decline in U.S. business last year due in part to competitive pressures. This is supported by its new innovative product, Simplera Sync, which management noted as being a highly competitive product due to ease-to-use attributes. This was highlighted by Medtronic’s CFO during last month’s Barclays (BCS) healthcare conference:

We’ve got a new very competitive sensor coming to market right now in limited release in Europe, it’s the Simplera Sync. It is 50% smaller than our current sensor, it’s seven-day wear, it’s easy insertion. It’s no tape, no finger sticks. It’s just highly competitive. And we’re really excited to bring that to the United States. We’re going to be submitting to the FDA in the first half of the calendar year for our 780G and Simplera Sync, and so the diabetes franchise is back and just improving from here.

Risks to MDT include competitive pressures in the healthcare device market, with well-funded players like Abbott Laboratories (ABT) that also compete in the same space including diabetes care. As such, MDT will need to continue to innovate in order to stay relevant in a dynamic healthcare landscape.

Other risks include the new GLP-1 drugs on the market from Eli Lilly (LLY) and Novo Nordisk (NVO), which some investors may fear as a threat to conventional diabetes care. However, it’s worth noting that those drugs are expensive and many patients regain their weight after they get off the drug. The CEO of MDT believes that bariatric surgery remains the ‘gold standard’ of addressing obesity and that GLP-1 will have limited effect on MDT’s products.

Over the next few quarters, I would look for further evidence of GLP-1’s impact or lack thereof on MDT’s business and whether if the two different therapies can be complementary. In addition, I’d also look for more meaningful revenue recovery in the U.S. business.

Meanwhile, MDT maintains a strong balance sheet with an A credit rating from S&P. It’s reduced its net debt balance by $524 million since the start of the current fiscal year (last 3 reported quarters) and carries a solid net debt-to-EBITDA ratio of 1.94x.

MDT currently yields a respectable 3.4% yield and the dividend is well-supported by the safe balance sheet and a 52% payout ratio. MDT is also a Dividend Aristocrat and has a 5-year dividend CAGR of 6.7%.

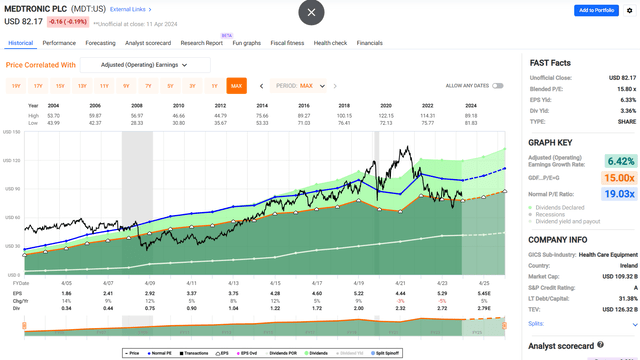

Turning to valuation, I see MDT as being good value at the current price of $82.17 with a forward PE of 15.8, comparing favorably to the 16.4 PE when I last visited the stock. This also compares favorably to MDT’s normal PE of 19.0 over the past 20 years, as shown below.

Sell-side analysts who follow the company estimate 5% to 9% annual EPS growth in the 2025-2027 timeframe, which could be achieved by growth in diabetes care among other segments as well as a continued recovery on the U.S. side of the business. Considering the quality of the enterprise with moat-worthy attributes and the strong balance sheet, I believe a near-term PE in the 16-18x range would be a reasonable target.

Investor Takeaway

Overall, MDT offers investors a high-quality business with a strong balance sheet and a respectable dividend yield that’s well above that of the S&P 500 (SPY). The company is now back in growth mode and is well-positioned for future opportunities, including diabetes care. MDT remains undervalued compared to historical norms and with consideration to its growth prospects. Considering all the above, I maintain a ‘Buy’ rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!