Summary:

- Medtronic plc exceeded Q4 FY2023 expectations with revenues of $8.5 billion, and plans to acquire insulin patch maker EOFlow, expanding its diabetes management portfolio.

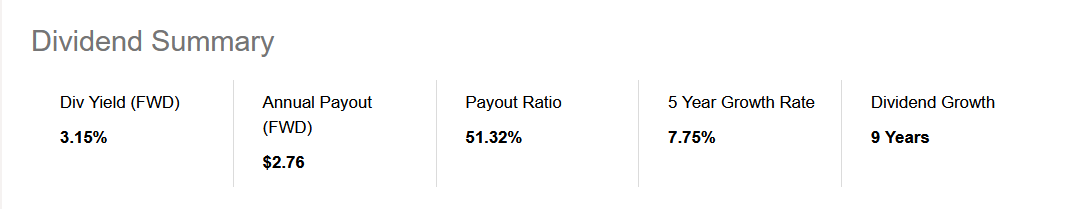

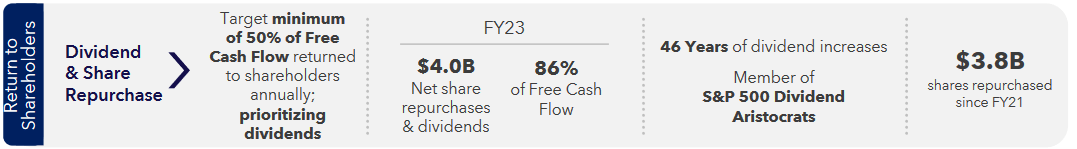

- Despite a high debt level, Medtronic maintains a payout ratio of over 50% and continues to buy back shares, offering a dividend yield of over 3%.

- The company’s long-term growth, strong free cash flow margins, and market position make it a valuable addition to a healthcare-focused portfolio.

Anchiy

Investment Outline

Beating out their expectations for Q4 FY2023 as revenues reached $8.5 billion. The company has stable growth dynamics which makes them out to be a very stable addition to a portfolio seeking more exposure to the healthcare industry. Founded back in 1949 the company has grown into a business that diverts a lot of the cashflows to investors as they have a payout ratio of over 50% currently.

The dividend yield of over 3% paired with stable growth expectations makes me very positive towards Medtronic plc (NYSE:MDT) right now. They have grown the division for 9 years consequently and I think more increases are to come. The valuation is attractive and I am rating MDT a but right now.

Recent Developments

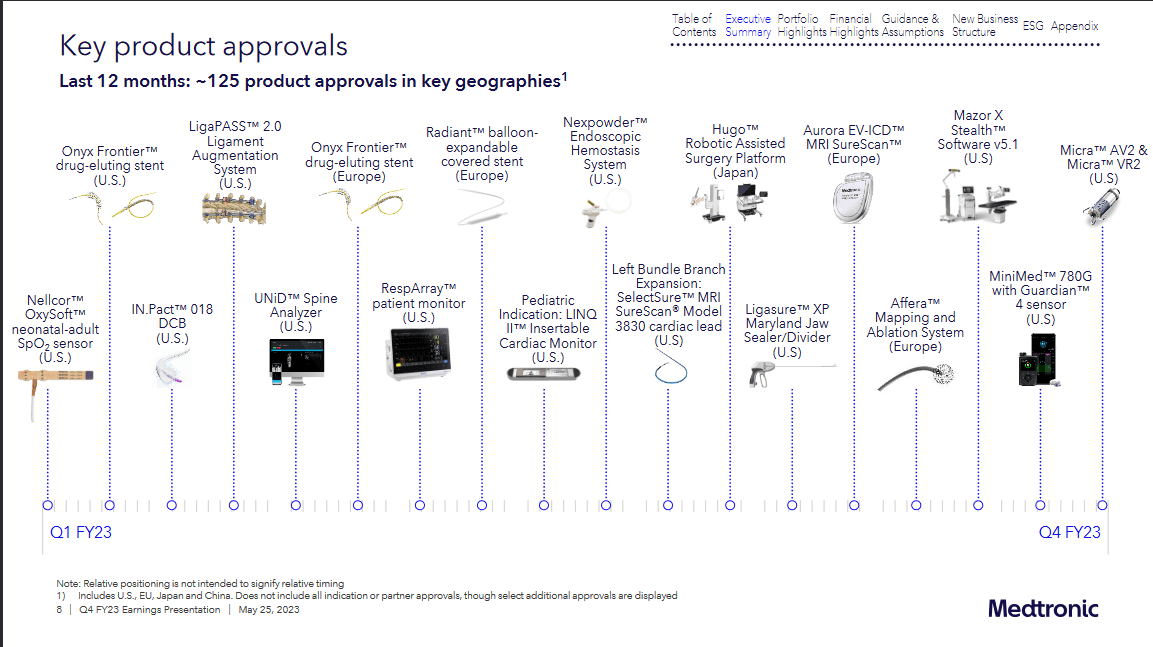

Medtronic primarily focus on manufacturing and selling device-based medical therapies to healthcare systems internationally. Within the cardiovascular portfolio, the company offers implantable cardiac pacemakers and cardioverter defibrillators. As the company strives to build out its portfolio of offerings further it often is involved in acquiring smaller companies. In late May one such announcement was made, as MDT aims to acquire EOFlow, an insulin patch maker. This broadens the diabetes management portfolio of MDT and as estimates suggest the US will have more people diagnosed with diabetes in the coming decades, this addition is setting up MDT very well to serve the coming demand for such products.

Product Buys (Investor Presentation)

When the announcement was made the deal was valued at $738 million and with MDT generating over 3.8 billion in FCF, I think they are in an excellent position to make the purchase. As mentioned earlier, the payout ratio for MDT right now is over 50%, and even with this deal, I don’t fear the dividend will take a hit or lack a raise. Buybacks are also happening at a decent rate.

Margins

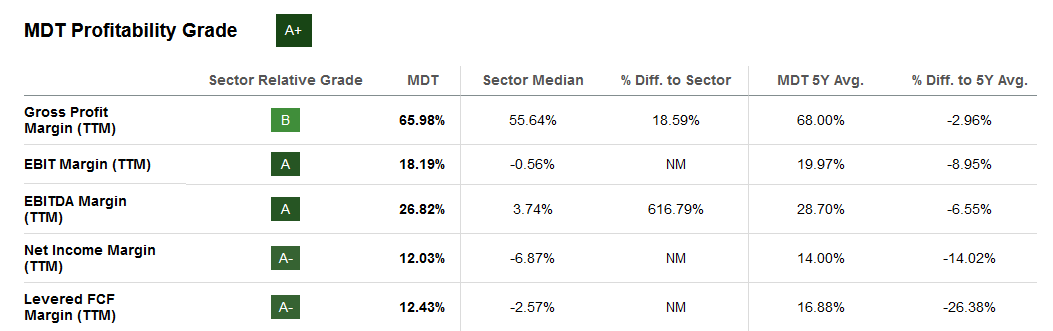

As far as margins for MDT, it remains in my option a key highlight when viewing the business.

Margin Profile (Seeking Alpha)

As we have discovered, MDT generates a very strong amount of FCF and the margin sits at over 12% TTM, beating out the sector a fair bit. MDT is beating the sector average in all of the above metrics. What I find more bullish about MDT is that they are also operating below their current historical averages. Why I view this as bullish because as they are growing their product line, I think as inflation and the high cost of materials are easing the likely scenario seems to be that MDT sees stronger margins. Viewing the cash flow margins I think will be key going forward. It will tell the story of the flexibility that MDT has in terms of making more acquisitions or raising the division.

Value For Investors

For investors the value comes a lot from the dividend yield of over 3% that MDT currently distributes, but also the fact that they have a decent history of buying back shares. A long-term EPS growth of 7 – 8% seems fair as buybacks help with this. Pair that with a 3% dividend yield and we have a market-beating investment opportunity for the long term here.

Dividend Profile (Seeking Alpha)

With a 5-year dividend growth rate of 7.75%, I view it as likely we continue to see dividend increases going forward, especially if MDT maintains solid FCF margins.

Valuation

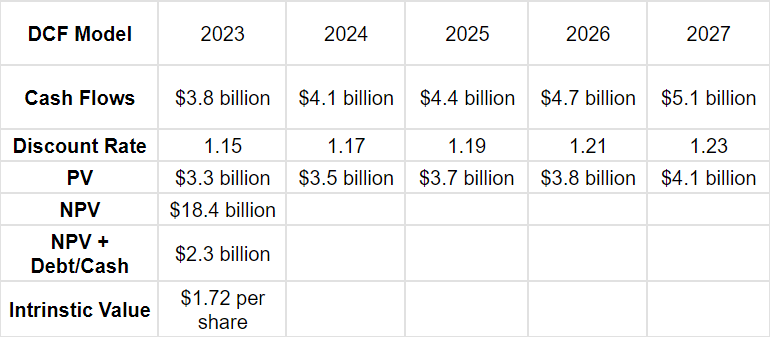

DCF Model (Author)

For the DCF model above here, it highlights that MDT does have some issues with debt that need to be resolved to justify a higher multiple. When accounting for the debt in the model the intrinsic value drastically drops to $1.72 per share. The estimated FCF growth rate I have is 8% terminally, which seems fair, given historical performance. Without the debt and cash accounted for the intrinsic value would be $13.8 per share. Currently, MDT is trading around 6.3 times this amount. I think we will unfortunately see a slightly lower multiple applied to MDT until they show strong progress in decreasing the long-term debts. Looking at the last report from MDT they seem to have no issue paying down the debt though, $5.9 billion was paid QoQ between Q4 and Q3 of FY2023. I think that discounting for the debts seems fair here and paying a 6.3 premium to the intrinsic value is fair here given the moat and the market position the company holds.

Risks

Some of the risks associated with MDT right now seem to be volatile currencies. In the last report, this resulted in MDT having a $250 million revenue decline. The 5.6% organic revenue increase the company posted excludes this amount. In the short-term, volatility like this might result in some shifting reports. But over the long term, it often balances out and has little impact on the actual results and growth of the business.

Investor Takeaway

For those seeking a healthcare addition to their portfolio which specializes in the equipment side of the sector then MDT might be the one. They are broadening their portfolio of offerings at a strong rate with the recent announcement of acquiring EOFlow for over $700 million back in May.

Capital Allocations (Investor Presentation)

The company may hold a lot of debt on its balance sheet but they seem to face a little challenge in paying it down. They are still able to maintain a payout ratio of over 50% and not let go of buying back shares. I think MDT is a value play for the long-term and a buy rating will be applied to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.