Summary:

- Medtronic is a diversified medical device company with a low-growth value stock position.

- The Hugo RAS system has the potential to drive significant growth for Medtronic in the robotic-assisted surgery market.

- The impact of GLP-1 drugs on Medtronic’s diabetes and bariatric synergies businesses is a key consideration for investors.

JHVEPhoto

Medtronic plc (NYSE:MDT) is a well-diversified medical device company, and its products are quite broad, including the Cardiovascular Portfolio, Medical Surgical, Neuroscience, and Diabetes segments. The company has delivered relatively mediocre growth in the past, positioning it as a low-growth value stock with dividends and share buybacks. I am initiating coverage with a ‘Hold’ rating and assigning a fair value of $85 per share.

Hugo Could be A Notable Growth Driver

The Hugo RAS system represents their robotic-assisted systems for minimally invasive surgery. Presently, the market is dominated by Intuitive Surgical, Inc. (ISRG) with its da Vinci products. Medtronic is actively engaged in a catch-up strategy to establish a presence in this high-growth sector. For investors seeking more information on robotic-assisted machines, I recommend referring to my recent article on Intuitive Surgical.

In February 2022, Medtronic announced the successful completion of their first procedure in Europe utilizing the Hugo system. Additionally, they have obtained FDA approval to commence their pivotal trial for Hugo in the U.S., specifically for Hernia indications. I believe Hugo has the potential to become a significant growth driver for Medtronic, and here are a few reasons supporting this expectation.

Firstly, the robotic-assisted surgery market is currently low-penetrated, and its adoption involves a lengthy cycle. Hospitals must invest in or lease these expensive machines, followed by training their medical staff to proficiently operate these intricate systems. Despite Intuitive Surgical’s substantial $7 billion revenue, the entire market remains under-penetrated. With the full commercialization of Hugo, Medtronic stands to benefit from increased growth in this evolving sector.

Secondly, Touch Surgery Enterprise, integrated into Medtronic’s portfolio of AI and surgical robotic solutions, has the potential for comprehensive utilization in the Hugo system. The incorporation of AI-powered video solutions enhances system performance, differentiating it from Intuitive Surgical’s offerings.

Lastly, Medtronic possesses a robust distribution channel and an extensive customer base, enabling the company to leverage its global distribution capabilities for the expansion of its Hugo business. This well-established infrastructure positions Medtronic favorably in reaching a wider market and driving the growth of the Hugo system.

GLP-1 Impact on Diabetes and Bariatric Synergies

The diabetes business constitutes over 7% of Medtronic’s overall revenue, featuring offerings such as insulin pumps, continuous glucose monitoring systems, sensors, and smart insulin pens. The recent surge in GLP-1 drugs is poised to have a significant impact on businesses related to obesity and diabetes management. It is important to note that even prior to the emergence of GLP-1 drugs, Medtronic’s diabetes business experienced a decline of 3.1% in FY22, followed by an additional 3.3% decrease in FY23.

The introduction of GLP-1 drugs could influence Medtronic’s diabetes business in two main areas.

Diabetes Management: In addressing market concerns during their Q2 FY24 earnings call, Medtronic disclosed that the majority of their diabetes customers are Type I patients, with only 10% of their installed base comprising Type II insulin-dependent patients. The impact of GLP-1 drugs is more likely to be felt among Type II patients, as these medications can assist in dietary control and weight management. Management expressed optimism about the growth potential in the Type II business, emphasizing the currently low penetration rate of Type II pumps, indicating substantial room for expansion. I concur with their assessment that the impact of GLP-1 drugs on Medtronic’s diabetes business would be relatively limited, given their customer mix and the existing low penetration ratio.

Bariatric Synergies: Bariatric Synergies-related products account for a low-single-digit percentage of Medtronic’s group revenue. The rise of GLP-1 drugs has already led to a decline in Bariatric Synergy volumes. Medtronic’s management views this decline as short-term pressure and remains confident in the potential for recovery. However, I disagree with their management’s perspective, as GLP-1 drugs are likely to reduce the demand for bariatric synergies. I acknowledge that bariatric synergy was the gold standard for obesity treatment in the past; however, the effectiveness of GLP-1 drugs could significantly alter this landscape.

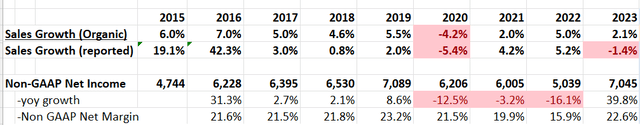

Financial Results and FY24 Outlook

Medtronic has consistently delivered low-single-digit organic revenue and adjusted income growth in the past. Despite earning over $31 billion in revenue in FY23, there is a belief that the company has a substantial base for rapid growth in the medical device industry. However, concerns have been raised about Medtronic’s overall lack of innovation and its failure to capture growth opportunities in certain areas. Notably, the Hugo system is seen as a catch-up effort in response to competitors, and the transcatheter aortic valve replacement (TAVR) is viewed as an attempt to catch up with the rival Edwards Lifesciences Corporation (EW). For further information on TAVR, please refer to my article on Edwards Lifesciences.

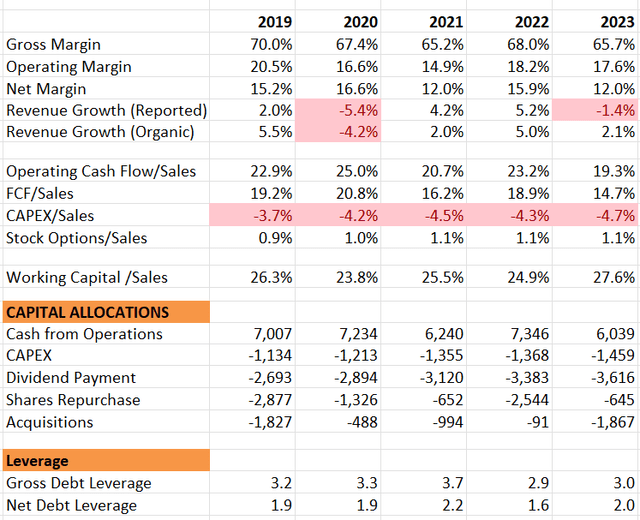

Having said that, Medtronic boasts a robust financial profile, characterized by a respectable free cash flow margin and a solid balance sheet. The company’s net debt leverage stands at only 2x, reflecting a conservative financial structure. Furthermore, Medtronic allocates a significant portion of its cash to dividend payments and share buybacks, showcasing a commitment to returning value to its shareholders.

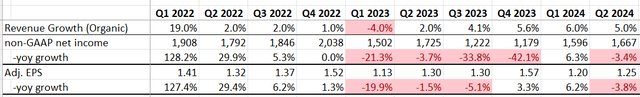

During Q2 FY24 reported in November, their revenue grew by 5% organically, while the adjusted net income declined by 3.4% year-over-year. They slightly increased the full-year revenue growth guidance from the previous 4.5% to 4.75%. Medtronic is expected to be more impacted by foreign exchange in FY24, with the reported revenue growth forecasted to be 2.6%. The non-GAAP EPS guidance was raised from the previous range of $5.08 to $5.16 to the new range of $5.13 to $5.19.

I believe their current guidance aligns well with their historical record. According to their recent conference at JPMorgan, only 20% of their total revenue is in high-growth categories, including structural heart, neovascular, and surgical robotics. To accelerate growth, there is a need to increase exposure to high-growth categories. For example, on January 8th, 2024, the FDA approved their Percept RC neurostimulator system. Innovative products like these could contribute to Medtronic’s accelerated revenue growth and margin expansion over time.

Over the near term, I expect Hugo and Structural Heart to generate meaningful growth for the company. However, I hold a pessimistic view of their diabetes business due to the impact of GLP-1 drugs. In summary, I anticipate that Medtronic is more likely to deliver low-to-mid single-digit organic revenue growth. With the support of dividends and share repurchases, investors could potentially expect high-single-digit total returns over time, in my opinion.

Valuations

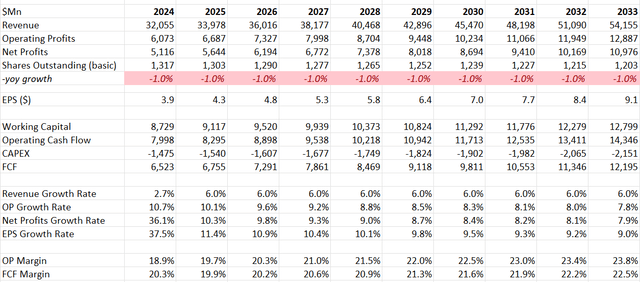

The assumptions for FY24 are consistent with their formal guidance. I anticipate the company will persist in paying dividends and repurchasing shares. In the model, normalized revenue growth is assumed to be 5% for organic growth and 1% for acquisition growth, aligning with their historical averages.

For the GLP-1 impact, given their revenue exposure is around mid-single-digit, even with a 20% year-over-year decline, it would create about a 1% growth headwind. On the other side, Hugo would have strong growth potential for the company. Assuming they can generate above $3 billion of revenue in three years, Hugo could potentially add around 1% to the top-line growth over time. Therefore, I think the company could continue its historical growth pattern of a mid-single digit organic rate.

Margin expansion is expected to be propelled by the moderate growth of operating expenses, advancements in their high-growth categories, and the global rollout of their Hugo systems.

Medtronic DCF – Author’s Calculations

The model utilizes a 10% discount rate, a 4% terminal growth rate, and a 14% tax rate. I apply the same discount rate to all valuation models, and I think a 4% terminal growth rate is suitable for a mature medical device company. Based on these assumptions, the fair value is estimated to be $85 per share.

Currently, the stock is trading at 18x of forward free cash flow, and it is quite in line with their historical trading multiple.

Key Risks

Huge Emerging Market Exposure: Emerging Markets account for more than 17% of the group’s revenue. In these markets, medical device companies are susceptible to challenges such as bribery, unforeseen local regulations, and reimbursement issues. I perceive exposure to emerging markets as a double-edged sword. While these markets offer the potential for superior growth, they also present significant risks for the company.

Medtronic InPen system: In August 2023, Medtronic faced a class-action lawsuit from users of the InPen system. The lawsuit alleged that Medtronic shared health information with Alphabet Inc. (GOOG, GOOGL). Notably, as a medical device company, Medtronic has been subject to various lawsuits in the past, including the Hernia Mesh Litigation in 2020 and the Diabetes Pump Retainer Ring Litigation in 2021, among others.

Takeaways

I believe Medtronic is well-suited for low-growth value investors. Their diversified portfolio, regional exposure, and customer bases help minimize business risks. I am initiating coverage with a ‘Hold’ rating and assigning a fair value of $85 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.