Summary:

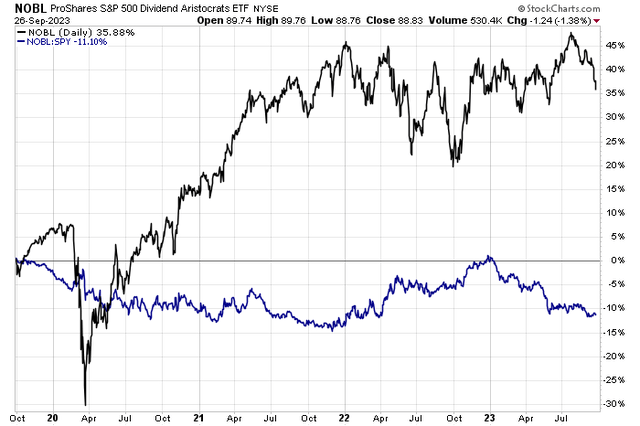

- Dividend aristocrats underperforming the S&P 500 by more than 10 percentage points in 2023.

- Medtronic, a major aristocrat, has a low P/E ratio, high yield, and potential earnings growth.

- Positive signs of top-line growth and outperformance suggest recent stock price decline may be overdone.

- I highlight key price levels to watch as MDT looks to bottom.

FatCamera

Dividend aristocrats have had a tough 2023. While the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is about flat on the year, it is underperforming the SPX by more than 10 percentage points. That came after a strong 2022, though. Big picture, alpha has been negative going back 4 years, leaving the factor in the dust compared to the broad market.

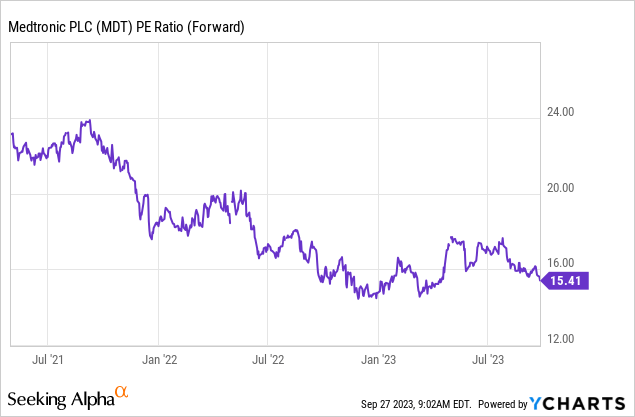

One major aristocrat, Medtronic (NYSE:MDT), features a historically low P/E multiple, high yield, and a potential earnings inflection. While technical momentum is weak, the chart offers some hope for the bulls.

Dividend Aristocrats Lagging the S&P 500

According to Bank of America Global Research, Medtronic is a medical technology firm that develops, manufactures, and markets medical devices and technologies to hospitals, physicians, clinicians, and patients. The company operates in four business segments: Cardiac & Vascular Group, Medical Surgical, Neuroscience, and Diabetes.

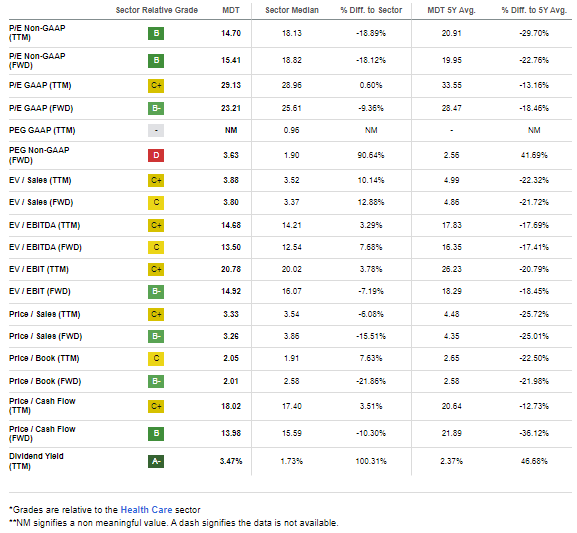

The Ireland-based $105 billion market cap Health Care Equipment industry company within the Health Care sector trades at a high 29.1 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.5% forward dividend yield. Ahead of earnings in November, shares trade with low implied volatility of just 20% while MDT’s short interest is also modest at 0.5%.

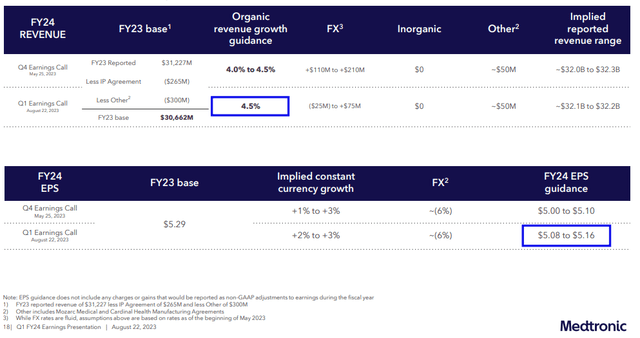

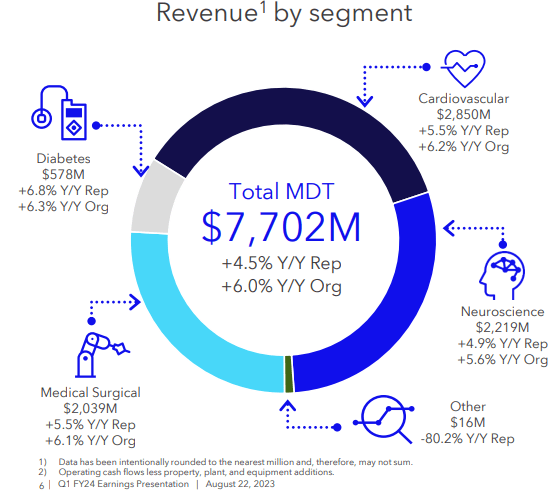

Back in August, Medtronic reported a solid earnings beat. Operating EPS verified at $1.20, a 9-cent beat, while quarterly revenue of $7.7 billion was a 4.5% year-over-year jump and a $140 million beat. The management team also raised its FY 2024 organic revenue growth outlook to 4.5% from the previous range of 4-4.5% as well as a bump up in earnings guidance.

In general, there were positive signs with top-line growth and a strong outperformance in its margin figures. New products like 780G, EV-ICD, and Intellis are expected to drive a sequential revenue acceleration on this somewhat cheap stock. Unfortunately, China is a sore spot – delays in provincial value-based pricing (VBP) have been a challenge, but the management team hopes that will turn around in FY 2025. Overall, though, business-wide outperformance suggests the recent stock price decline may be overdone.

Q1 2024: Guidance Boost

Strong Top-Line Growth Across Segments

MDT IR

Key risks for Medtronic include slower-than-expected growth in new products, challenges with its pipeline, higher competition, and weakness in VBP in China.

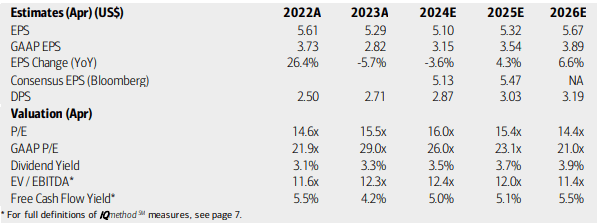

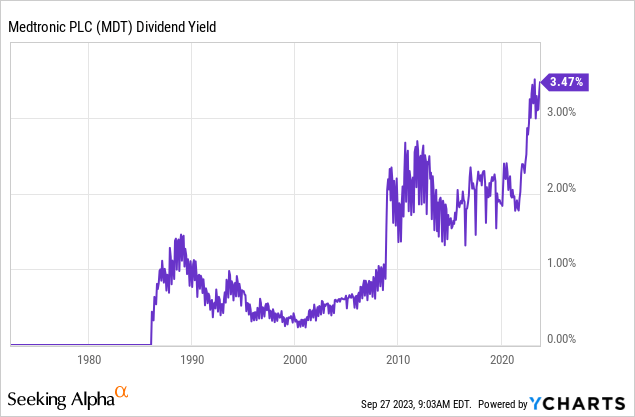

On valuation, analysts at BofA see earnings having fallen 6% in its FY 2023 that just wrapped up with continued weakness in 2024. Outer-year EPS estimates turn more sanguine, and the Bloomberg consensus forecast is about on par with what BofA projects. Dividends, meanwhile, are seen as rising at a steady clip, making for a better yield compared to previous quarters. MDT’s operating earnings multiple has turned much better. Recall just two years ago that the firm’s forward non-GAAP P/E was lofty near 24 – it’s close to 15 today. Its yield is also just about at all-time highs while free cash flow remains steady.

Medtronic: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

MDT: Historically Attractive P/E Ratio

YCharts

MDT: Near-Record-High Dividend Yield

YCharts

If we assign an 18 multiple on next 12-month EPS of $5.20, then shares should be in the mid-$90s, considerably above the current stock price. I don’t see that much has changed from a valuation perspective since my initial coverage of the stock earlier this year.

MDT: Improved Valuation Metrics, Near-Term Growth Risks

Seeking Alpha

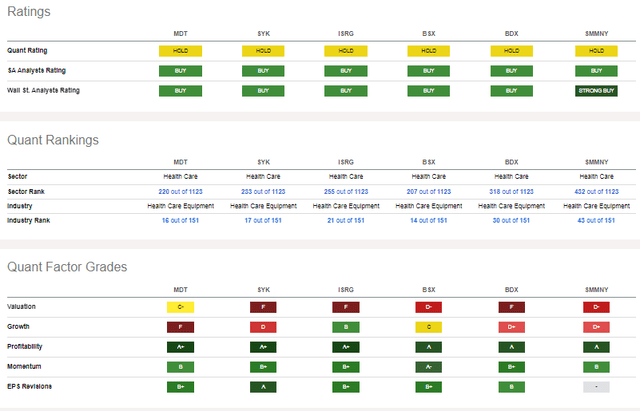

Compared to its peers, MDT features a relatively strong valuation grade while its growth outlook is not so rosy. But consider that profitability should inflect over the coming quarters while its FCF per share, already at $3.34 on a trailing basis, would likely turn up. I assert the stock’s technical momentum is quite weak today, different from the B rating below, but EPS revisions, like many of its peers, have been robust lately.

Competitor Analysis

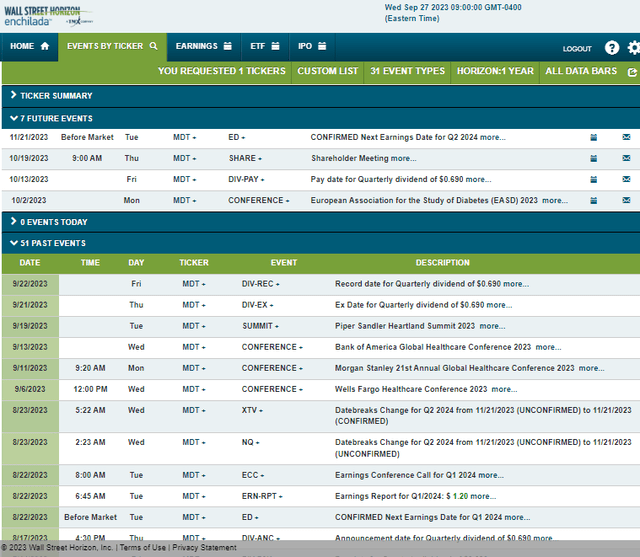

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Tuesday, November 21 BMO. Before that, I have my eyes on a pair of potential volatility catalysts: (1) the MDT management team’s speaking event at the European Association for the Study of Diabetes (EASD) 2023 from October 2 to 6, and (2) MDT’s shareholder meeting on Thursday, October 19.

Corporate Event Risk Calendar

The Technical Take

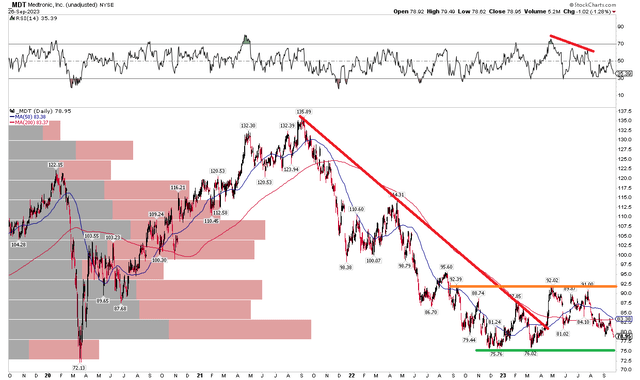

I was admittedly bullish on MDT stock in early Q1. I highlighted some inklings that the brutal 45% drawdown off the late 2021 peak had run its course. Indeed, shares found a floor in the mid-$70s with a successful retest in March. A rally then ensued to early May, with the stock jumping about 20% to the low $90s. A double top was put in over the summer, however. Notice in the chart below that sellers appear to have a stronghold in the $91 to $92 area, snapping what could have been a bullish rounded bottom pattern.

I now see critical long-term support in the $75 to $77 zone – a break of that range could portend a bearish measured move price objective to the upper $50s based on the trading range over the past year. For now, long with a stop under $72 (the March 2020 low) looks to be a favorable risk/reward play. With a bearish death cross taking place (in which the shorter-term 50-day moving average crosses below the longer-term 200dma), the bears may have a near-term grip on shares. Moreover, the 200dma is flat after having been negatively sloped for about 18 months.

Overall, the risk/reward setup today is actually favorable, and a rally above the aforementioned moving averages would help support the case for a near-term uptrend resuming.

MDT: Downtrend Halted, Trading Range Has Emerged

The Bottom Line

I reiterate my buy rating on MDT stock. Shares appear cheap and the technical situation has some rays of hope from a risk/reward point of view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.