Summary:

- Medtronic plc is a well-established medical devices company with a diverse range of products and a strong track record of financial performance.

- Medtronic operates in business segments that are well-positioned for the future.

- At its current price of $80, Medtronic represents a strong buy for investors looking for a combination of stability and growth potential.

JHVEPhoto

Introduction

As a dividend growth investor, I seek new investment opportunities in income-generating assets. I take advantage of market fluctuations by starting new positions and diversifying my holdings, which allows me to increase my dividend income while using less capital. When I find an asset that is attractively valued, I will also add it to my existing positions.

The healthcare sector is exciting, as more people can afford healthcare and medical devices. This area is often overlooked, but it has the potential for solid growth as demand for medical services and technology increases. As the population ages and healthcare becomes more accessible, the market for medical devices is likely to expand significantly. In this article, I will analyze Medtronic plc (NYSE:MDT), one of my current holdings.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

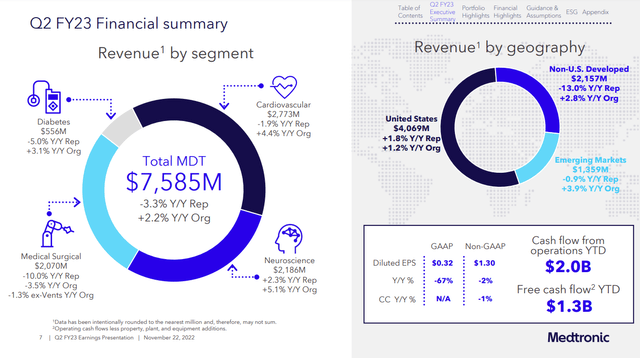

Medtronic develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. Its Cardiovascular Portfolio segment offers implantable cardiac pacemakers, cardioverter defibrillators, and cardiac resynchronization therapy devices. The company’s Medical Surgical Portfolio segment offers surgical stapling devices, vessel sealing instruments, wound closure, electrosurgery products, surgical artificial intelligence, and robotic-assisted surgery products. Its Neuroscience Portfolio segment provides products for spinal surgeons, neurosurgeons, neurologists, and pain management specialists. The company’s Diabetes Operating Unit segment offers insulin pumps, consumables, and continuous glucose monitoring systems.

Fundamentals

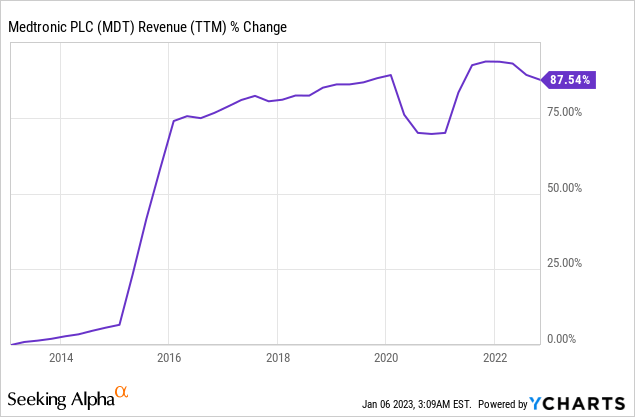

Revenues of Medtronic have almost doubled over the last decade, as sales are up 87.5%. The revenue growth is the result of organic growth and the rollout of new products, as well as acquisitions. The most significant acquisition over the last decade was the Covidien acquisition. It allowed the company to offer a broad portfolio in four business segments. In the future, as seen on Seeking Alpha, the analyst consensus expects Medtronic to keep growing sales at an annual rate of ~2% in the medium term.

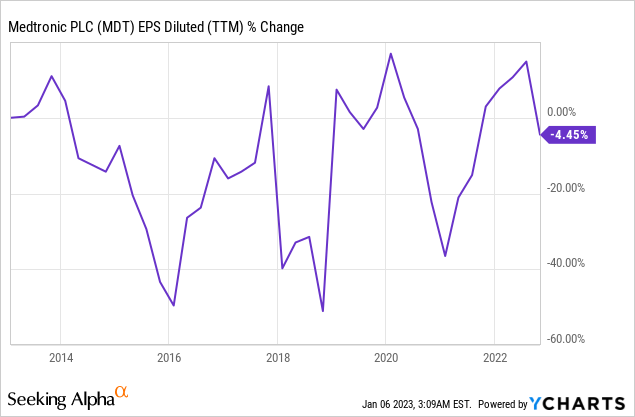

The EPS (earnings per share) is misleading in this graph. Over the last decade, the EPS has decreased by 4.5%. These figures are GAAP figures, and they include one-time non-cash expenses that are distorting the growth. Using non-GAAP figures, it can be seen that Medtronic has grown its EPS by 48% over the last decade. In the future, as seen on Seeking Alpha, the analyst consensus expects Medtronic to keep growing EPS at an annual rate of ~3% in the medium term.

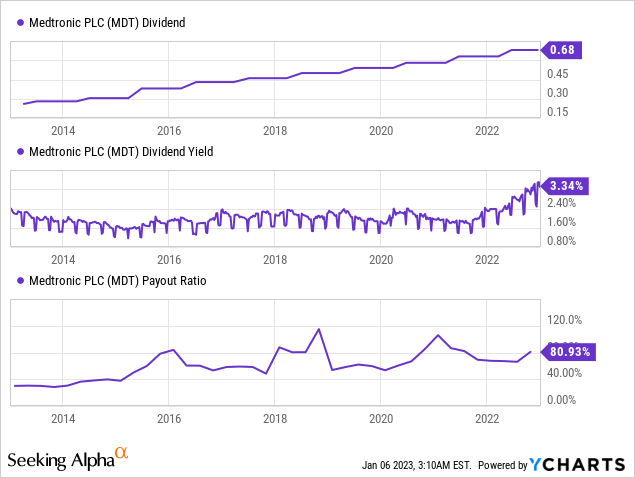

The dividend is one of Medtronic’s brightest points. The company has been paying and increasing its dividend annually for 44 years. The dividend is likely safe as the payout ratio is 81% using GAAP earnings and 50% using non-GAAP earnings. The current yield is attractive at 3.34% as the future growth of the dividend offers inflation protection to investors. Medtronic is a very reliable dividend growth payer.

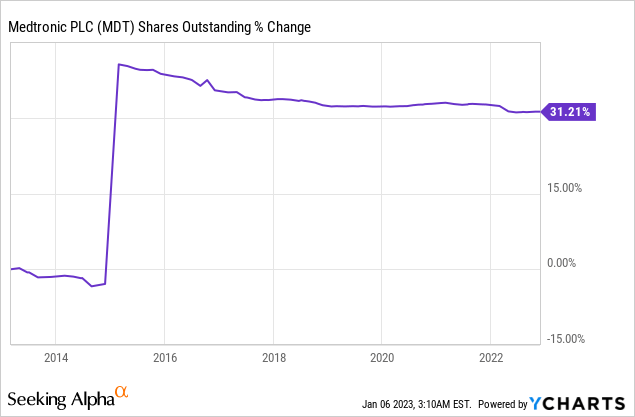

In addition to dividends, companies tend to return capital to shareholders via share repurchase plans. Buybacks supplement the EPS growth as they lower the number of outstanding shares. Therefore, they are most efficient when the share price is low. Medtronic has seen its number of shares increase by 31% in the last decade due to the acquisition of Covidien, which used both cash and stock. However, before and after the acquisition, the company constantly returns capital through buybacks.

Valuation

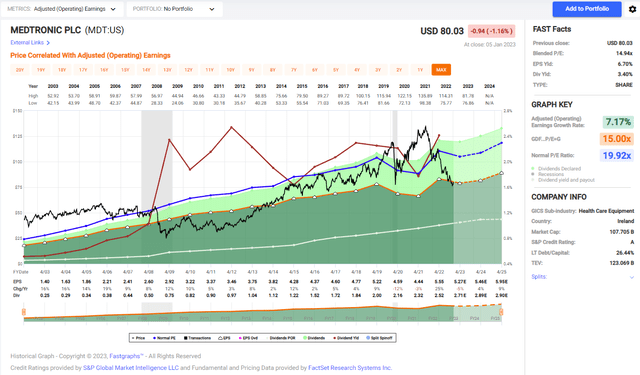

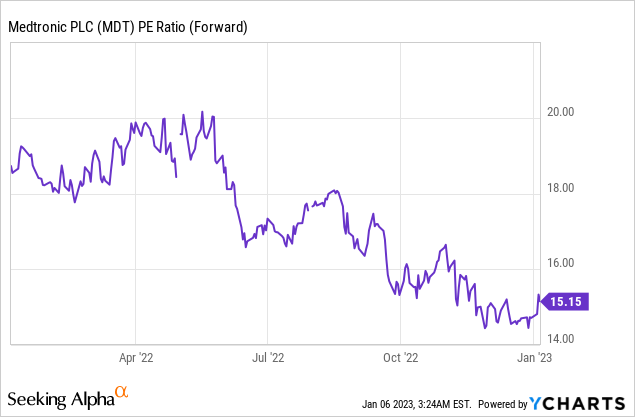

The P/E (price to earnings) ratio of Medtronic stands at 15.15 when using the forecasted EPS of the current year (ending on April 2023). The expectations are that we will see a ~4% EPS decline. The current P/E ratio is at its lowest over the last twelve months, making Medtronic attractive. The company is dealing with a challenging year, yet analysts expect it to keep growing. Thus, paying 15 times the earnings for a company with such a track record seems attractive.

The graph below from FAST Graphs shows how attractively valued Medtronic is right now. Over the last two decades, the average P/E ratio of the company was 20. The P/E ratio is 15, 25% lower than the average. While the growth rate in the short term will be lower than average, it is still not enough to justify such a valuation. It is the lowest valuation we have seen since 2014, making the shares attractive.

To conclude, Medtronic shows excellent fundamentals across the board with sales, EPS, dividend, and buybacks growth. Short-term forecasts indeed show that the growth will slow down. However, I believe that at the current valuation, Medtronic plc shares are attractive and offer a decent entry point as the company is working on its products.

Opportunities

First, Medtronic is a leader in the medical technology industry, with a wide range of products used in various healthcare settings. The company’s products span several different therapeutic areas. Medtronic also sells its products globally to leverage trends inside and outside the United States, its primary market. Diabetes in the U.S. is turning into a major pandemic that hurts even teenagers. As their quality of life increases in emerging markets, they start suffering from cardiovascular disease and diabetes, and Medtronic can also help these markets.

Medtronic has a strong track record of financial performance. The company has consistently grown its revenue and profits and has a history of returning value to shareholders through dividends and share buybacks. Combining that track record, the portfolio diversification, and the margin of safety that the company has due to its valuation gives us an opportunity for short to medium-term gains due to valuation expansion as the company keeps executing well.

The healthcare industry is expected to continue growing in the coming years, driven by an aging population and technological advances. As a leading player in the medical technology space, Medtronic is well-positioned to capitalize on these trends and deliver strong returns to investors. The company’s focus on innovation and its partnerships with leading healthcare providers give it a competitive advantage. It has access to hospitals, doctors, and clinics to offer its top products as they get approved by regulators worldwide. The track record and the band play a significant role in sensitive medical devices.

Risks

Medtronic is still struggling with the aftermath of the pandemic. During the pandemic, there was an effort to avoid any unneeded procedures. Following the pandemic, there has been a slow market and supply recovery. Therefore, the company suffers from lower sales and EPS in the short term. Even today, there is a challenge with some procedures due to staffing challenges in the developed world, and once these challenges are resolved, it will support demand growth.

The medical devices industry is highly competitive and subject to rapid changes in technology and regulatory requirements. It creates risks for companies like Medtronic, which must constantly innovate and adapt to keep up with the market. Medtronic competes with other giants such as Abbott (ABT) and Johnson and Johnson (JNJ). Suppose the company is unable to maintain its competitive edge. In that case, it could struggle to grow and deliver strong returns to investors, and this is the company’s current challenge as its works on its pipeline to ignite growth.

The regulation is a massive challenge and risk that Medtronic must deal with. It operates in a heavily regulated industry, which can create additional risks and uncertainties. Changes to healthcare policy and regulatory requirements significantly impact the company’s operations and financial performance. For example, the company is now working with the FDA to approve its 780G system with the Guardian4 sensor for diabetes. Every delay means that competitors can increase market share and challenge Medtronic.

Conclusions

Medtronic plc is a well-established medical devices company with solid fundamentals and long-term growth opportunities. The company has a diverse range of products used in various therapeutic areas, which helps to protect it from fluctuations in demand for any product or service. However, the medical technology industry is still risky with competition and regulatory changes, which can present short-term challenges for the company. Medtronic’s attractive valuation and long-term growth potential make it an exciting investment despite the challenges.

Given its strong fundamentals, attractive valuation, and long-term growth opportunities, Medtronic plc is a strong buy at $80. The company’s diversified product portfolio and solid track record of financial performance provide a margin of safety that should help it weather any short-term challenges that may arise. Medtronic’s combination of stability and growth potential makes it an attractive investment opportunity at its current price.

Disclosure: I/we have a beneficial long position in the shares of MDT, JNJ, ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.