Summary:

- Investing in stocks carries risks, but not investing can also be risky, especially with potential declines in savings account yields.

- Medtronic is a strong dividend aristocrat with top-line growth, profitability, and new product opportunities in the healthcare tech sector.

- MDT remains a good value stock with strong financials, dividend growth, and potential for market-beating returns.

MicroStockHub/iStock via Getty Images

Everybody knows buying stocks entails risk, whether it be failure of the business model or from paying too much for a stock. While those are legitimate concerns, a lesser talked form of risk is the risk of not buying stocks, or not putting capital to work in a meaningful way outside of a high yield savings account and Treasury Bonds.

While savings accounts still yield a meaningful amount compared to 2 years ago, those yields may decline over the next 12 months and beyond. This is considering comments this week by Jerome Powell that the Fed won’t wait until inflation is down to 2% before cutting rates.

That’s why I continue to add to undervalued equities that could provide meaningful investment returns above and beyond that of supposed ‘risk free’ assets that promise safety of principal, but could erode in real value terms over time due to inflation.

This brings me to Medtronic (NYSE:MDT), which I last covered in April, highlighting its top-line growth so far into its current fiscal year, with pricing power and a pipeline of opportunities.

The stock has declined by 4% since then and, as shown below, has not yet caught the bid in the July rally on dividend stocks, on expectations of a rate cut in September.

MDT Stock 1-Yr Price Trend (Seeking Alpha)

Let’s explore what makes MDT a great dividend aristocrat ‘buy’ at present while the market is asleep on the stock!

Why MDT?

Medtronic is a healthcare tech company that operates in 150 countries and serves 70 different health conditions. Its products include insulin pumps, cardiac devices, surgical tools and robots, patient monitoring systems, and others. Notably, MDT is also a dividend aristocrat, having raised its dividend for 47 consecutive years.

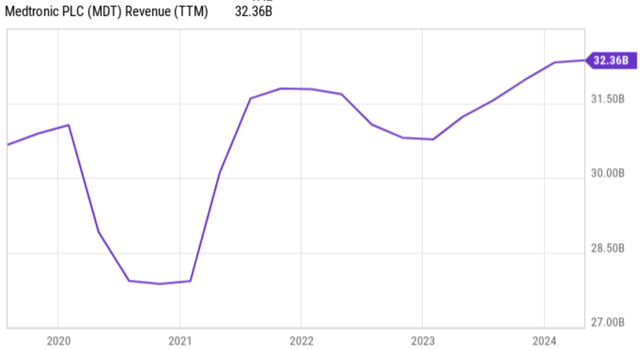

Despite what MDT’s share price underperformance might suggest, it’s actually demonstrating strong top-line performance. As shown below, MDT has more than recovered from the COVID-era sales due to patients putting off elective procedures, and has regained momentum after another trough in 2023.

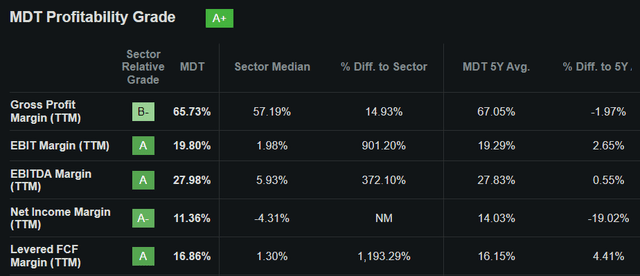

MDT’s respectable growth includes 5.4% YoY organic revenue growth during Q4 2024 (ended on April 26th) to $8.6 billion, which bested analyst expectations by $150 million. It also saw strong profitability, achieving the upper end of EPS guidance at $1.46 during the quarter, and growing free cash flow by 14% YoY $5.2 billion.

As shown below, MDT scores an A+ grade for profitability, with sector-leading EBITDA and Net Income Margins of 28% and 11%, respectively.

MDT is seeing mid-single digit revenue growth from the U.S. and Europe, plus 13% growth from emerging markets. The latter of which includes China, where surgical procedures continue to rebound after the lifting of COVID restrictions.

Management is guiding for 4% to 5% organic revenue growth for the current fiscal year 2025 in progress, to be driven by leadership positioning in the key business segments of Medical Surgical, Cardiovascular, and Diabetes. New products to drive growth include MDT’s recently launched Hugo robotic-assisted surgery system, Aurora EV-ICD, an implantable defibrillator for the treatment of cardiac arrest, and the upcoming Simplera Sync sensor for Diabetes.

Risks to MDT include the potential impact of GLP-1 class of drugs from competitors Eli Lilly (LLY) and Novo Nordisk (NVO), which treats patients with Diabetes and Obesity. Management, however, believes that their impacts will be muted, as noted during last month’s Goldman Sachs (GS) Global Healthcare Conference:

Q: And I feel like you have to ask the GLP-1 question in any of these settings, when you talk about competing with other solutions, you’ve talked about the impact in bariatric surgery, as has J&J (JNJ), as has Intuitive Surgical (ISRG). Can you maybe just sort of talk more broadly about the interplay between your portfolio and some of those other solutions and what you’re seeing today and how we should think about it going forward?

A: Look, we’ve done a lot of analysis on this and it’s kind of hard to predict. These drugs are still new. First of all, it’s an important new class of drugs. They’re getting the weight loss for sure. And what we’re seeing right now is impact on bariatric surgery and that’s a relatively small part of our business. And you have bariatric surgeons saying that, hey, look, this is going to come back. You’re getting morbidly obese patients to be less obese and make them safer for surgery.

Diabetes, we get questions and especially given that we’re automated insulin delivery, these are type 1s in intensively managed, insulin dependent type 2s. We’ve seen zero impact. The markets continues to grow even faster because the technology gets better.

Meanwhile, MDT maintains a strong balance sheet with an ‘A’ credit rating from S&P and a safe net debt to TTM EBITDA ratio of 1.9x, sitting well below the 3.0x mark generally considered safe by ratings agencies.

Moreover, MDT currently yields 3.6%. MDT recently raised its dividend for the 47th consecutive year. The dividend is well-covered by a 53% payout and comes with a 5-year CAGR of 6.3%.

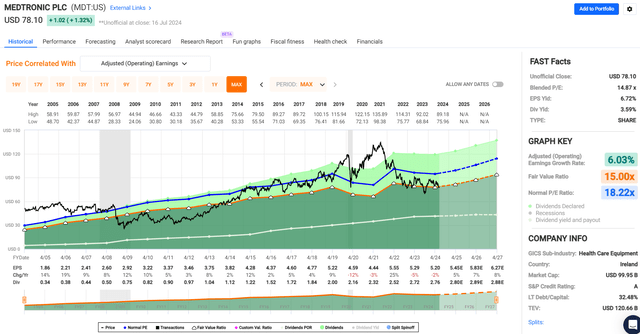

MDT remains a good value stock at the current price of $78.10 with a forward PE of 14.4, sitting far below its historical PE of 18.2, as shown below.

Sell side analysts who follow the company have an average price target of $93 on the stock and estimate 7-9% annual EPS growth in the 2026 to 2028. I believe those are reasonable estimates considering the expected growth in the baby boomer population and catalysts stemming from new product introduction.

It appears that negative market sentiment, potentially due to perceived fears around GLP-1 drugs, are overblown, thereby creating an outsized total return opportunity (including the dividend) that could provide market-beating returns for investors.

Investor Takeaway

Medtronic is currently an attractive, undervalued dividend aristocrat with strong fundamentals and growth prospects. Despite recent share price underperformance, MDT has demonstrated solid top-line growth and profitability, with significant contributions from its key business segments and emerging markets.

The company’s robust pipeline, including innovative products, underscores its potential for sustained growth. Coupled with a healthy balance sheet, a consistent dividend track record, and a favorable valuation relative to historical norms, MDT offers an attractive total return opportunity for investors, especially amidst potential market overreactions to competitive threats from GLP-1 drugs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!