Summary:

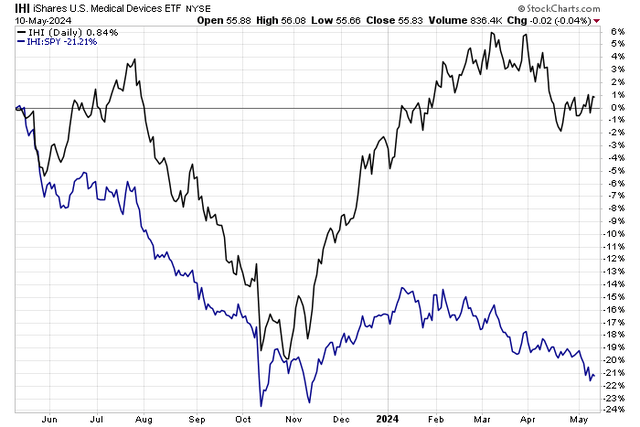

- Medical device stocks have underperformed the broader market, with the iShares U.S. Medical Devices ETF up only 1% in the past year.

- Medtronic, a dividend aristocrat, has shown decent organic revenue growth in the last five quarters, but the stock price continues to sag.

- With EPS growth expected in FY 2025, I highlight key price levels on the chart to monitor ahead of Q4 2024 results next week.

J Studios

Shares of medical device stocks continue to sag compared to the broader market. The iShares U.S. Medical Devices ETF (IHI) is up just 1% (total return) over the past 12 months compared to a better than 20% performance by the S&P 500. Healthcare sector stalwarts Eli Lilly (LLY) at home and Novo Nordisk (NVO) abroad have powered higher on the back of GLP-1 weight-loss drugs. Still, the bar is somewhat low for out-of-favor industries, such as the medical device niche.

I reiterate a buy rating on Medtronic (NYSE:MDT). I see this dividend aristocrat as attractively valued with room for growth should the firm begin to build EPS momentum. With earnings on tap, let’s get a refresh on where the company stands across its fundamentals and with respect to share-price momentum.

Medical Devices ETF Relatively Weak in 2024

According to Bank of America Global Research, Medtronic is a medical technology company that develops, manufactures, and markets medical devices and technologies to hospitals, physicians, clinicians, and patients. The company operates in four business segments: Cardiac & Vascular Group, Medical Surgical, Neuroscience, and Diabetes.

Back in February, Medtronic reported a solid set of FY Q3 results. Quarterly non-GAAP EPS of $1.30 topped the Wall Street consensus estimate of $1.26 while revenue of $8.1 billion was a small beat, growing 4.6% organically from year-ago levels. It was the fifth straight quarter of mid-single-digit revenue growth.

What should have helped the stock was the management team’s increase of both MDT’s organic revenue growth and EPS guidance. At the time, the firm expected 4.75% to 5% top-line growth with non-GAAP diluted EPS for FY 2024 in a new range of $5.19 to $5.21, which was slightly above the consensus. It was the seventh consecutive bottom-line beat, but shares rose just 1.7% the following session.

What is also encouraging from a shareholder’s perspective is that a month later, Medtronic announced that it approved an additional $5 billion share repurchase program while declaring a $0.69 quarterly dividend, in line with the previous payout.

Looking ahead, the options market has priced in a modest 3.2% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the Q4 report next week – that is a smaller-than-average straddle on the $110 billion market cap Healthcare stock.

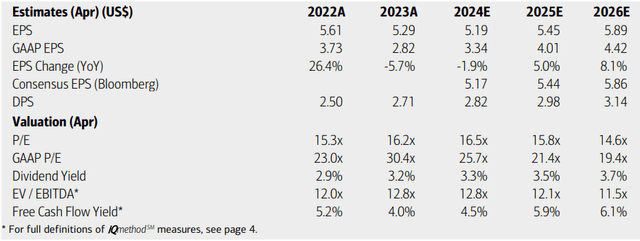

On valuation, analysts at BofA see earnings having fallen about 2% this year, but per-share profits are expected to accelerate in the years ahead. FY 2025 operating EPS should rise closer to $5.50 while FY 26 EPS could approach $6. The current Seeking Alpha consensus forecast numbers are about in line with what BofA forecasts. Revenue growth is seen accelerating from 3.2% in the current year to 5% by 2026.

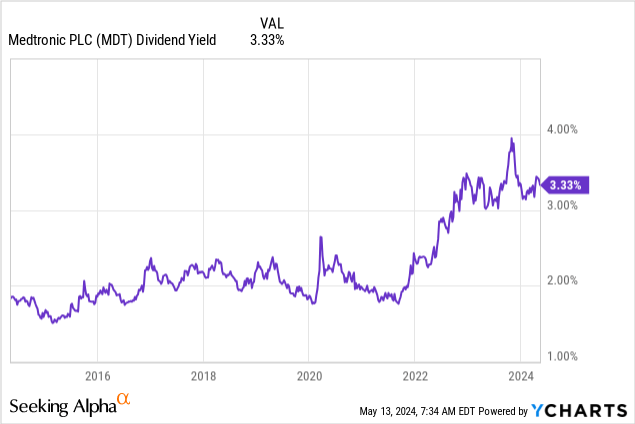

Dividends, meanwhile, are forecast to rise at a solid clip, further MDT’s dividend aristocrat status. MDT’s yield of 3.3% is about 80 basis points above its 5-year average, suggesting shares could be a bargain today. Finally, the firm’s free cash flow outlook is likewise sanguine.

Medtronic: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume $5.50 of non-GAAP EPS over the next 12 months and apply a somewhat conservative 18x multiple, below its 5-year average of 19.7, then shares should be near $99.

If the net sales and earnings acceleration come to fruition faster than expected, then there’s upside risk to that intrinsic value target. Either way, with a strong yield, solid free cash flow, and a modest multiple, I see MDT as undervalued today.

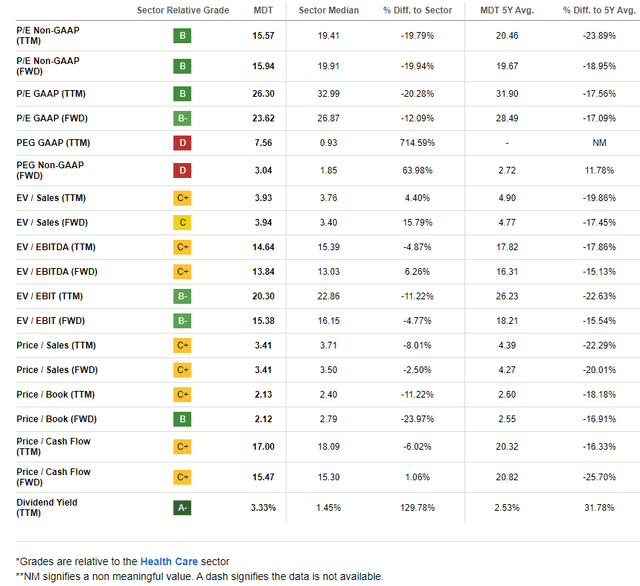

MDT: A Low P/E By Historical Measures, High Dividend Yield

MDT Yield: 3.33%

YCharts

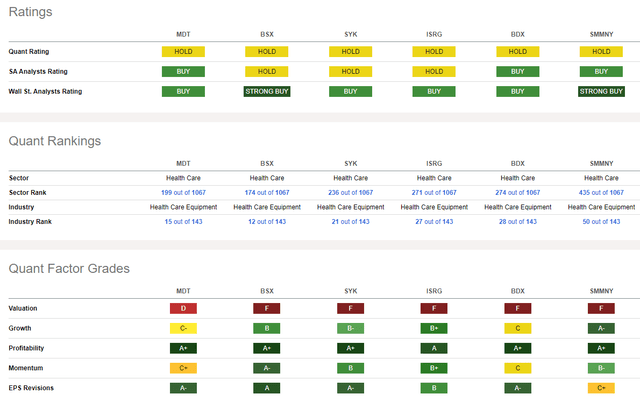

Compared to its peers, MDT features a middle-of-the-road valuation rating, but earnings multiples are attractive on an absolute basis. And while the company’s growth trajectory has been lackluster lately, a growing top line appears likely to translate into solid EPS growth going forward.

What’s more, profitability trends are very strong, evidenced by a rising FCF yield. Particularly encouraging is the slew of Wall Street sellside EPS upgrades since the Q3 report, but we haven’t seen that translate into better share-price momentum yet.

Competitor Analysis

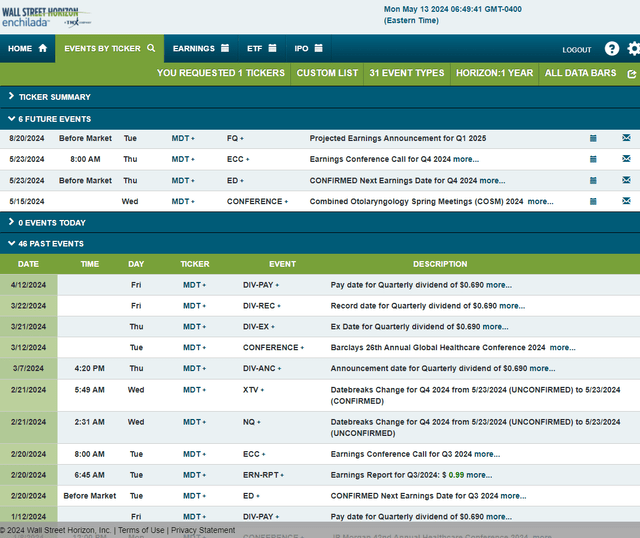

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2024 earnings date of Thursday, May 23 BMO with a conference call immediately after the numbers cross the wires. You can listen live here.

The firm also presents at the Combined Otolaryngology Spring

Meetings (COSM) 2024 from May 15 to 19 which could draw share price volatility.

Corporate Event Risk Calendar

The Technical Take

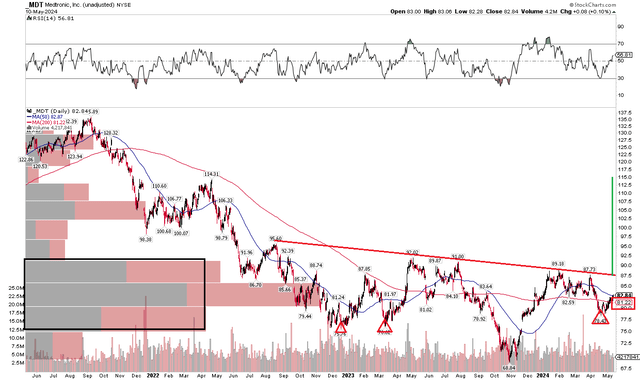

With an attractive valuation, high free cash flow, reliable yield, and an optimistic growth outlook, MDT’s chart continues to disappoint investors. Notice in the graph below that shares are in a downtrend going back several years. A new development is a softer downtrend line off the summer 2022 peak of $96. Since then, a series of lower highs has been made.

But also take a look at what appears to be an increasingly important spot in the mid-$70s. It has the look of an inverse head and shoulders bottoming pattern. The height of the range from the head to the neckline is slightly more than $20, so if MDT rallies through the upper $80s, then an upside measured move price objective to just shy of $110 would be in play.

For now, though, a falling long-term 200-day moving average suggests that the bears are in control of the primary trend, but I would like to see the mid-$70s support spot hold if we see a bearish reaction to earnings next week.

Overall, MDT keeps underperforming, so the technicals are not as favorable as the fundamentals and valuation.

MDT: Ongoing Downtrend, Watching Resistance in the Upper $80s, Mid-$70s Support

The Bottom Line

I reiterate a buy rating on MDT stock. With a free cash flow yield above 4% and a dividend yield significantly above its long-term average, the outlook for shareholders looks good. The earnings growth trend likely is also reason for optimism.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.