Summary:

- When done right, pairing quality and value can be an especially potent investing strategy.

- Medtronic’s revenue edged higher as currency-neutral non-GAAP EPS dipped a bit in the fiscal fourth quarter.

- Relative to its size, the company’s $17 billion in net debt is quite manageable.

- MDT stock could be nearly 20% undervalued from the current share price.

- The MedTech company could be positioned for 45%+ cumulative total returns through fiscal year 2027.

A team of surgeons operate on a patient in the operating room. JohnnyGreig

Centering my portfolio around high-quality dividend stocks, I tend to be very much in tune with the get rich slowly mindset.

This is because, in my view, the speculation that leads to overnight wealth is unsustainable. The same wealth that was built overnight can be lost just as quickly.

That’s why I take a long-term, fundamentals-driven investing approach. Before I get into the dividend stock that I’m highlighting today, I just want to again clarify what I mean by quality:

- A track record of earnings growth over time. These results are usually consistent with a wide-moat business.

- An investment-grade balance sheet. So, under the right circumstances, anything BBB- and up could be in contention.

- An established reputation as a dividend grower. Along with the first point, this shows that a company has the means and motivation to reward shareholders.

The MedTech giant, Medtronic (NYSE:MDT), is a business that I believe meets these requirements. When I last outlined Medtronic with a buy rating in March, I liked the extensive product portfolio and product launches in the works. I also appreciated the company’s A rating from S&P. The 46-year dividend growth streak was another plus. Finally, shares looked to be attractively valued.

Today, I’m reiterating my buy rating. The company’s double beat with its fiscal fourth quarter results shared on May 23 was a positive sign. Medtronic’s debt load remains healthy. Lastly, my fair value estimate implies shares are discounted by double-digits.

Medtronic Is Trending In The Right Direction

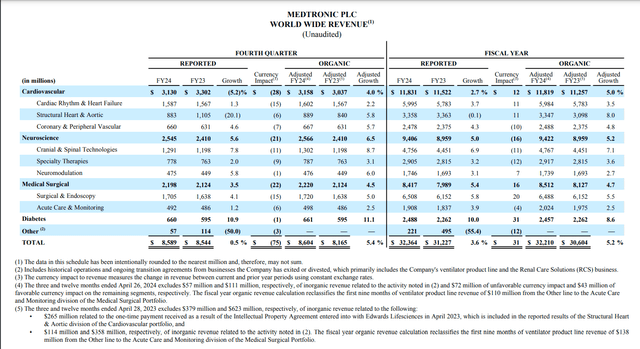

Medtronic Q4 2024 Financial Statements

Medtronic’s latest quarter of financial results was more proof that the company is on the right track fundamentally. Its total revenue grew by 0.5% year-over-year to $8.6 billion during the fiscal fourth quarter. For context, that topped Seeking Alpha’s analyst consensus by $150 million.

These results were made all the more impressive by the fact that Medtronic continued to face substantial foreign currency translation headwinds. Backing these out of the equation, organic revenue would have grown by 5.4% over the year-ago period.

In currency-neutral terms, all of Medtronic’s core businesses posted growth in the fiscal fourth quarter. This growth was led by the Diabetes business.

The segment put up $660 million in revenue, which was up 11.1% year-over-year for the fiscal fourth quarter. That double-digit topline growth was made possible by momentum from the MiniMed 780G insulin pump. The product doubled its new U.S. users, according to Chairman and CEO Geoff Martha’s opening remarks during the Q4 2024 Earnings Call.

The Neuroscience business generated $2.5 billion in revenue during the fiscal fourth quarter, which was enough for a 6.5% organic revenue growth rate. That growth was fueled by strength within its Biologics product offerings (high-single-digit growth) and Core Spine products (mid-single-digit growth) per Martha.

The Medical Surgical segment delivered $2.2 billion in revenue in the fiscal fourth quarter, which was equivalent to a 4.5% organic revenue growth rate. According to Martha, this was the result of its Advanced Energy product lines growing by high single digits and Wound Management also growing by high single digits.

Lastly, the Cardiovascular business produced $3.1 billion in revenue for the fiscal fourth quarter. That was a 4% organic revenue growth rate. Increased uptake of its leadless pacemakers was a key growth driver during the quarter. Moving forward, this should continue to be the case. That’s especially so considering that Martha pointed to UnitedHealth Group (UNH) updating its policies to cover leadless pacemakers.

Medtronic’s non-GAAP EPS decreased by 7% year-over-year to $1.46 in the fiscal fourth quarter. That was $0.01 better than the Seeking Alpha analyst consensus. Accounting for a $0.07 currency impact, currency-neutral non-GAAP EPS would have fallen by 2.5% over the year-ago period.

Upticks in the cost of products sold and SG&A expenses led the non-GAAP net profit margin to contract by 200 basis points to 22.5% for the fiscal fourth quarter. That was partially offset by a 0.6% reduction in the diluted share count via share repurchases.

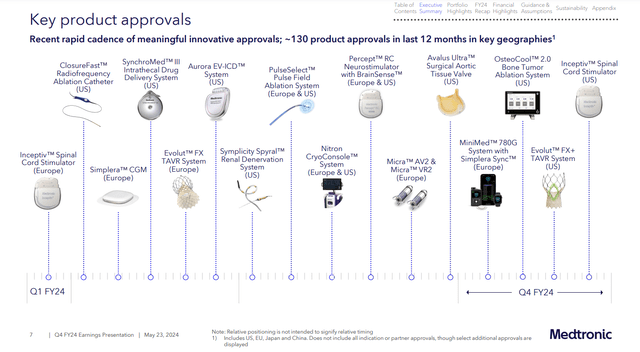

Medtronic Q4 2024 Earnings Presentation

Looking ahead, Medtronic’s future seems to be encouraging.

The company anticipates currency-neutral non-GAAP EPS to come in at a midpoint of $5.45 ($5.40 to $5.50). This would represent a 4.8% growth rate over the FY 2024 base of $5.20.

Aside from continued growth in existing products, that is expected to be powered by a wide array of recent product launches. In FY 2024, Medtronic secured approximately 130 product approvals around the world.

That includes the Evolut FX TAVR system in Europe and the U.S. According to Martha, the feedback that the company has received from physicians has been positive. This supports Medtronic’s expectation that as the product ramps up in the fiscal second quarter of 2025, growth in this category should be at or above the market.

Medtronic’s Simplicity Spyral treatment also figures to be a growth driver for the company. This is because more than a billion people live with hypertension worldwide. Martha estimates that each percent of penetration into the target market can add over $1 billion of revenue.

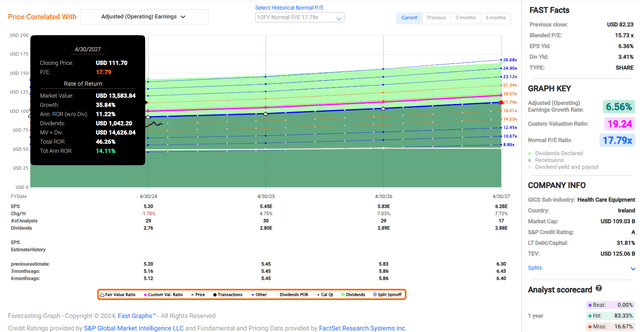

That’s why the FAST Graphs consensus from 29 analysts is that currency-neutral non-GAAP EPS will grow by 7% to $5.83 in FY 2026. Another 7.7% growth in currency-neutral non-GAAP EPS to $6.28 is currently being projected for FY 2027.

Moving to the balance sheet, Medtronic is fundamentally sound as well. The company ended the fiscal year with $17 billion in net debt. Accounting for the $8.2 billion in EBITDA posted during FY 2024, this is a leverage ratio of 2.1. That is what backs up the company’s A credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to Medtronic’s Q4 2024 Financial Statements and Medtronic’s Q4 2024 Earnings Presentation).

Fair Value Is Approaching $100 A Share

Since my previous article, Medtronic has been the inverse of the S&P 500 index (SP500): Shares have retreated 3% as the S&P has gained 3%. From my vantage point, this just makes it a better buy, especially after the latest results confirm it is fundamentally rebounding.

Medtronic’s current-year P/E ratio of 14.9 is well below the 10-year normal P/E ratio of 17.8 per FAST Graphs. Additionally, I believe that a reversion to the 10-year normal valuation multiple is reasonable. That’s because the 6.6% forward annual growth consensus for the next three years would be an acceleration from the 10-year average just below 4%.

Being about seven weeks into Medtronic’s current fiscal year, I’m proceeding with an approximately 86% weighting for this fiscal year and a 14% weighting for FY 2026. That provides me with a $5.50 forward 12-month currency-neutral non-GAAP EPS input.

Coupling this with a 17.8 valuation multiple, I get a fair value of $98 a share. This would represent a 17% discount to fair value from the current $81 share price (as of June 13, 2024). If Medtronic grows as predicted and returns to said valuation multiple, it could generate 46% cumulative total returns by the end of FY 2027.

The Dividend Is Adequately Covered

Medtronic’s 3.4% forward dividend yield is quite attractive in comparison to the 1.4% median forward yield of the healthcare sector. This is enough for an A- grade for forward dividend yield from Seeking Alpha’s Quant System.

Better yet, Medtronic’s payout appears to be secure. The company generated $5.2 billion in free cash flow in FY 2024. Against the $3.7 billion in dividends paid during that time, this equates to a 70.5% free cash flow payout ratio.

The excess free cash flow was almost enough to cover the $2.1 billion in share repurchases executed for the fiscal year. As the momentum from its existing products continues and more products are launched, Medtronic expects free cash flow to grow again in FY 2025. Combined with a viable payout ratio, I believe this should translate into steady dividend growth for the foreseeable future (figures per Medtronic’s Q4 2024 Financial Statements).

Risks To Consider

Medtronic appears to be successfully reinvigorating its growth prospects through innovation and new product launches. However, no equity investment is without risks. Medtronic is no exception to this rule.

The company operates as a leader in a sizable and growing market. This means that Medtronic has the detriment of having a bullseye on its back. The company must keep executing at a high level and delivering products to the market that are widely adopted by healthcare professionals. If Medtronic can’t do so, it risks losing market share to competitors. That could weigh on the company’s future growth.

As a MedTech company, the company’s revenue is mostly derived from healthcare systems. This comes with the risk that another global pandemic could disrupt healthcare systems across the globe.

If that happened, the elective procedures that Medtronic is dependent on for its revenue could be deferred to treat patients. Just as what happened when the COVID-19 pandemic temporarily setback the company, another pandemic could do the same.

Summary: Potentially Strong Total Returns From A Dividend Aristocrat

Medtronic occupies a 0.8% weight within my portfolio. The company’s product launches have it on the right track from my perspective. Medtronic’s balance sheet is doing just fine. Shares also look to be quite undervalued, which could set the stock up for double-digit annual total returns over the next few years. That’s why I’m comfortable maintaining my buy rating here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT, UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.