Summary:

- Medtronic’s recent earnings report has boosted investor confidence, suggesting the worst may be over for the company.

- The impact of the weight loss drugs on Medtronic’s long-term growth prospects is expected to be limited and could be overstated.

- MDT’s valuation isn’t cheap relative to its sector peers, but its best-in-class profitability grade likely justifies the premium.

- I argue why MDT has likely bottomed out in early November, bolstered by positive buying sentiment. The recovery from its hammering from its 2021 highs could be just starting.

DNY59

Medtronic plc (NYSE:MDT) investors have had somewhat of a respite over the past month since it bottomed out in early November 2023, ahead of its fiscal second-quarter 2024 earnings release.

The company reported its earnings on November 21, as recent buyers held their positions firmly, lifting my confidence that the worst in MDT could be over. I last updated MDT investors in mid-August, anticipating a more constructive macroeconomic outlook could spur buying sentiment on MDT. However, I also stressed that MDT’s $80 support zone must be observed carefully. I indicated it represented “a critical support zone underpinning MDT’s nascent uptrend recovery that must be resolutely defended.”

As a result, I wasn’t surprised that a massive wave of technical selling occurred when MDT sellers forced an intense selloff in early October before dip buyers returned. Notably, with buyers managing to lift MDT above the $80 zone, I believe it’s timely for buyers to assess whether it’s appropriate to consider adding more exposure.

Observant med tech investors should be keenly aware of the battering in MDT and its peers, as investors likely rotated out of these stocks in favor of Novo Nordisk (NVO) and Eli Lilly (LLY), given their relative outperformance. As a result, management provided critical insights about whether it anticipates a structural impact from the GLP-1 drugs.

Accordingly, Medtronic expects “a limited effect on the bariatric surgery market, which is expected to be temporary.” However, the company doesn’t believe there’s a significant effect on the company’s “long-term growth prospects.” Management also questioned the sustainability of the GLP-1 drugs, as it indicates that “many patients trying GLP-1s do not remain on them for an extended period.” Medtronic cited factors relating to “durability issues, side effects, or affordability concerns” that could affect the sustained uptake of these drugs.

RBC also indicated in a research note in late October that the “growth in GLP-1 agonists’ usage is primarily driven by new prescriptions rather than refills.” As a result, the research firm believes there are significant uncertainties about “the long-term sustainability of these drugs’ impact.” In addition, Novo Nordisk CEO Lars Fruergaard Jørgensen cautioned investors about being too pessimistic about the long-term impact of these weight loss drugs. He articulated that the fears could have “all gone a bit too far.”

As a result, I believe the guidance upgrade presented by Medtronic is constructive, suggesting that the near-term growth normalization headwinds have subsided. Given its well-diversified portfolio, I assessed that Medtronic remains well-positioned to continue delivering robust earnings and dividend growth for its shareholders over time.

Despite that, the current appeal of its forward dividend yield of 3.6% pales in comparison to the 2Y (US2Y), which last printed at 4.66%. However, with the Fed expected to end its hiking regime, we should expect income investors to start considering reallocating to battered med-tech stocks like MDT. It should be noted that the company boasts a 46-year record of dividend increases and is a proud member of the S&P Dividend Aristocrats.

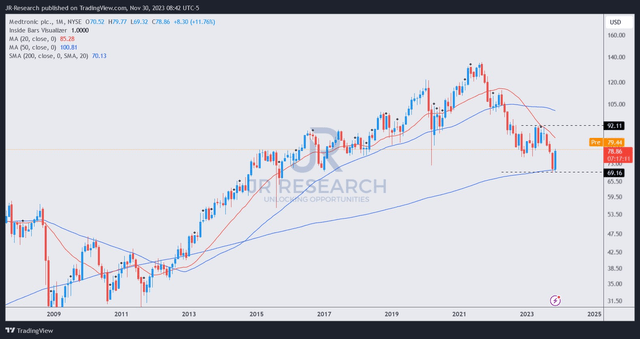

MDT price chart (monthly) (TradingView)

As seen above, MDT’s long-term price action suggests investors returned to underpin a bottoming signal at its pivotal 200-month moving average (purple line).

As a result, it helped fend off selling pressure that threatened to break down its long-term uptrend bias, which could have resulted in more intense technical selling.

MDT’s “D” valuation grade suggest a premium against its healthcare sector peers. However, wide-moat med tech leaders like Medtronic boast a best-in-class “A+” profitability grade, justifying their premium valuation.

Despite that, the concerns about its valuation are valid, as seen by the hammering from its highs since it topped out in late 2021. However, I gleaned that if MDT dip-buyers could help sustain the $70 level, in line with its long-term moving average, the risk/reward looks increasingly attractive.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!