Summary:

- Medtronic has been under pressure over the past year based on soft growth and ongoing earnings weakness.

- The company appears to be losing U.S. market share in its high-profile diabetes management segment against competition from emerging technologies.

- We expect more downside in the stock with room for earnings to underperform going forward.

stefanamer/iStock via Getty Images

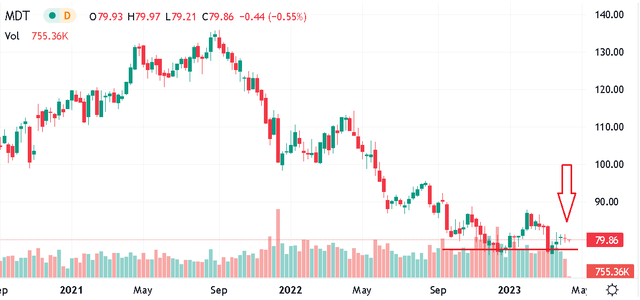

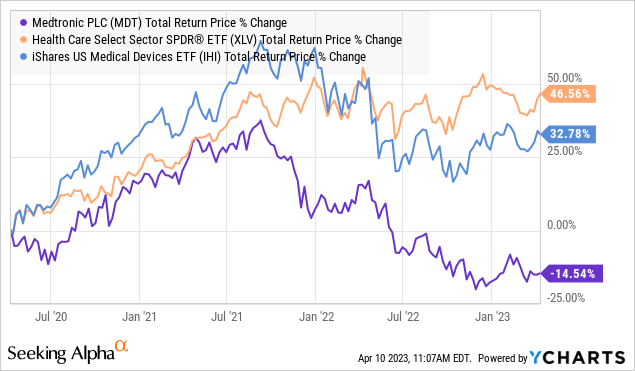

Medtronic plc (NYSE:MDT) is a leader in the medical devices industry across segments including surgical equipment, neuroscience technologies, cardiology therapies, and diabetes management solutions. While recognized as a global standard in several categories, the challenge in recent years has been slowing growth beyond ongoing macro headwinds. Indeed, shares are down more than 40% since 2021, also underperforming the broader sector.

We expect MDT to remain under pressure based on its weak outlook. In our view, sales declines from the company’s high-profile diabetes group highlight the impact of intense competition in several categories. Even as MDT screens well in terms of its fundamentals, this is a case of what could be a value trap with risks tilted for more downside.

MDT Financials Recap

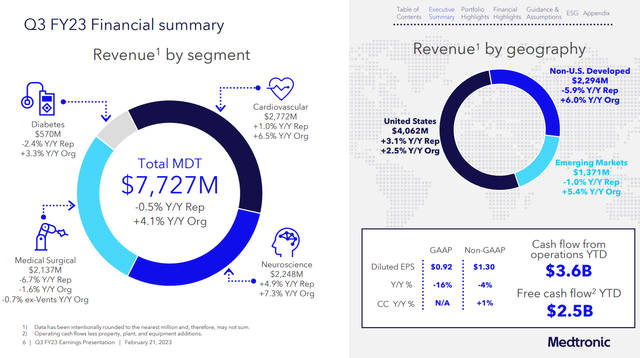

MDT last reported its Q3 fiscal 2023 earnings in late February with EPS of $1.30 which was $0.03 ahead of the consensus estimate. Revenue of $7.7 billion, climbed by 0.5% year-over-year and beat expectations by $170 million.

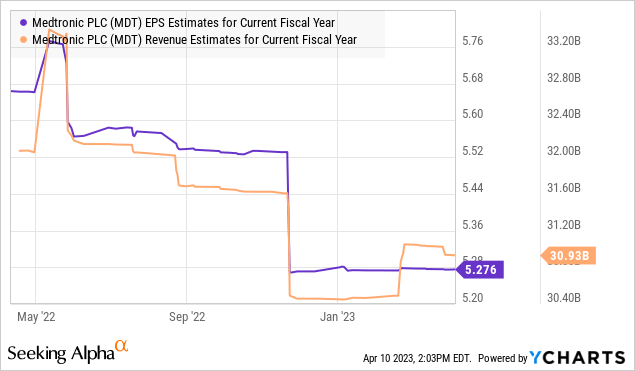

Keep in mind that these estimates had already been revised sharply lower going back to poor Q2 results making the headline results less than impressive. That weakness compared to expectations at the start of last year explains much of the selloff in MDT over the period.

For Q3, organic growth excluding the impact of divestitures was up 4.1% y/y, although the -1.6% y/y organic decline from the medical surgical segment and otherwise soft 3.3% organic increase from Diabetes products stood out as more telling of the overall operating environment.

The gross margin at 66.0% is down from 68.9% in Q3 2022 which reflects the sales mix along with the impact of inflationary cost pressures. The adjusted operating margin of 25.9% is down by 210 basis points from last year.

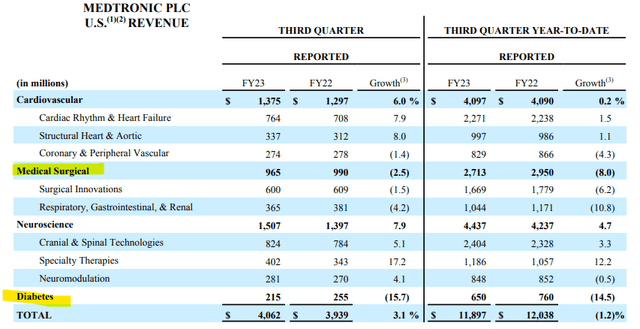

A theme for the company has been the better momentum internationally compared to softer trends in the United States, which represents around 50% of the business. Within U.S. revenue, the medical-surgical segment is down by -8.0% year to date, while diabetes sales are down by -15%. In many ways, these two groups are dragging firm-wide results lower.

In addition to the international sales, cardiovascular and neuroscience segments rebounded in Q3. Management is building on that overall performance in Q3 compared to the weaker first half of the year to tighten the full-year EPS guidance to a range between $5.28 to $5.30, from the prior $5.25 to $5.30. The company also added half a percent to its full-year organic sales target of 4.5%.

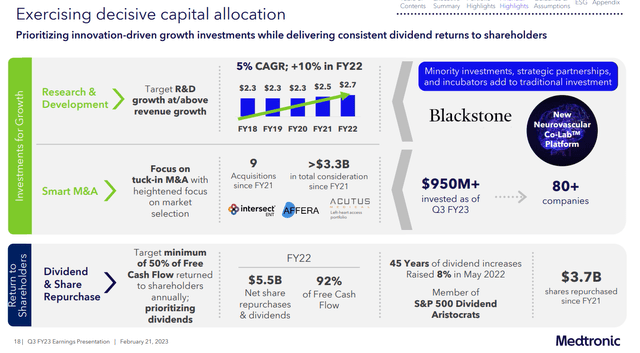

Longer term, the plan is to generate “durable topline growth” while leveraging significant expense reductions to support stronger earnings. Historically, MDT has been active in strategic acquisition as part of its growth investments. That said, a lower level of free cash flow this year under a less flexible balance sheet with a rising debt level may limit some larger ambitions.

Notably, MDT has been completing large share buybacks while continuing its consecutive 45-year record of annual dividend increases. We see the dividend as safe for the foreseeable future.

MDT Facing Disruptive Competition

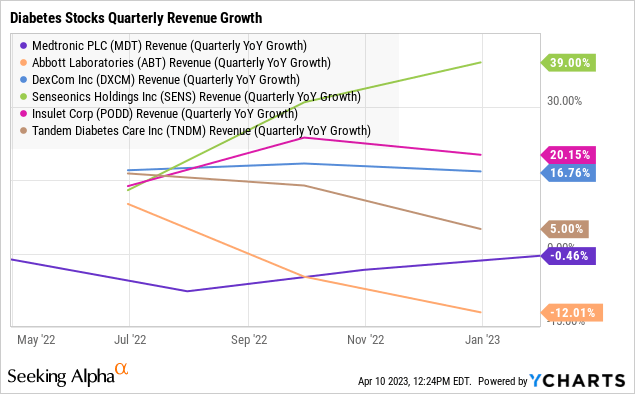

We mentioned the intense competition in several categories. That aspect of Medtronic losing market share is evident focusing on the diabetes management segment that led to the decline in Q3. That’s in contrast to other diabetes-focused companies and emerging players delivering double-digit growth. Senseonics Holdings Inc (SENS), for example, generated a 39% revenue increase while Insulet Corp (PODD) and DexCom Inc (DXCM) were closer to 20%.

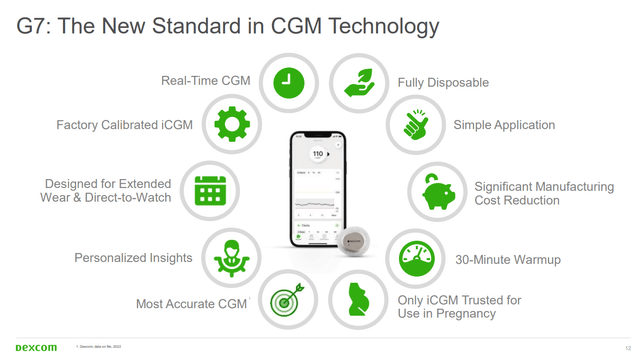

Keep in mind that the CGM market is expected to grow by more than 17% on average annually over the next decade. This captures not only the higher diagnosed prevalence of diabetes worldwide but also the greater awareness of the new technological advances.

The idea here is that while Medtronic was a pioneer in glucose testing going back to the traditional “finger prick” blood sample diagnostic tool and even insulin pump solutions, the market is moving toward next-generation alternatives. That includes alternative more mobile and high-tech continuous glucose monitoring (CGM) and insulin pumping systems.

Medtronic offers the “Guardian” GGM sensors but patients simply now have more options on the market, each with various advantages. DexCom‘s G7, for example, is approved for kids as young as 2-years old while Medtronic’s Guardian is indicated for patients at least 14-years old.

Insulet Corp is also making advances with its “Omnipod” series of devices that are tubeless insulin pumps. Separately, Senseonics has made strides with its implantable “Eversense CGM” sensor that offers the convenience of lasting six months. We’re not suggesting Medtronic has inferior products, but simply that the innovation edge may have waned compared to five or ten years ago.

In other words, it appears Medtronic simply dropped the ball on innovation and is lagging behind its competitors. This is a theme that goes back to an FDA warning letter in 2021 citing quality control issues observed during a facilities inspection and recall of its “MiniMed 600” series insulin infusion pump which have added to R&D delays.

Beyond diabetes management, there are also signs some of the segments among low-tech surgical instruments and consumables are facing competition from increasingly commoditized generic alternatives. That includes Chinese surgical tools and devices that can be highly competitive in emerging markets and the Asia-Pac region at different price points.

MDT Weak Growth Outlook

So putting it all together, we don’t see a clear path for a financial turnaround where growth re-accelerates in the foreseeable future. The difficult global economic backdrop considering high-interest rates amid stubborn inflation likely doesn’t help the overall operating environment.

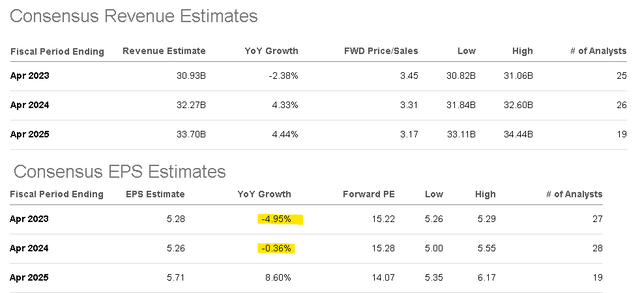

According to consensus estimates, the forecast is for full-year fiscal 2023 revenue to fall by -2.4%. The EPS estimate at $5.28, consistent with management guidance represents a decline of -5% from 2022.

Again, these estimates have been trending lower all year and we expect aspects of poor sentiment to continue through 2024 weighing on the outlook. Looking ahead, the market eyeing just flat earnings in 2024 into a 4% rebound in revenue which will be up against the currently soft results as the comparison. There’s not much to get excited about in our opinion.

So when we see the stock trading at a 15x forward P/E multiple, MDT doesn’t stand out as reflecting good value considering the uncertainties of its potential turnaround that may or may not play out by 2025.

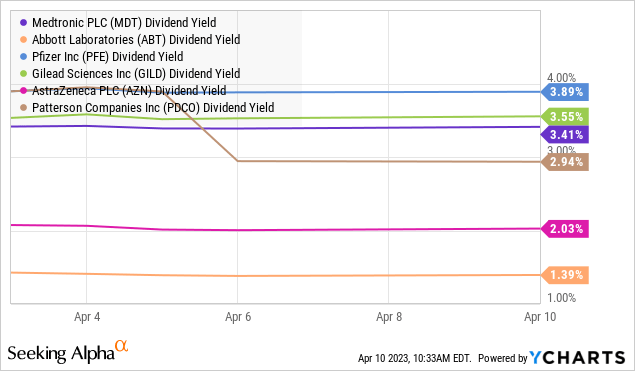

We can point out MDT’s 3.4% dividend yield which is well above competitor Abbott Laboratories’ (ABT) 1.4% example, but not necessarily exceptional among other healthcare sector stocks. Pfizer Inc (PFE) and Gilead Sciences Inc (GILD), for example, both yield more than 3.5%.

This is a case where MDT is “fine” financially, but that’s just not good enough to drive a sustained rally in shares. The stock would need to sell off further for the dividend to indicate a major under-valuation. It’s not there yet.

MDT Stock Price Forecast

We rate MDT as a sell with a price target for the year ahead at $65.00, representing a 12.5x multiple of the consensus year-ahead fiscal 2024 EPS of $5.26. This would also imply a 4.2% dividend yield which would better capture the necessary discount to the sector under weak growth and flat earnings trajectory. A further deterioration to Medtronic’s diabetes management market share could open the door for even more downside in the stock.

On the upside, the bulls will want some stronger evidence of improving margins and new top-line momentum to justify a more sustained rally. Monitoring points over the next few quarters include the sales trends from the U.S. market alongside diabetes management industry trends.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in MDT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.