Summary:

- Medtronic’s diabetes business is expected to experience sustained growth with the introduction of the 780G system and the lifting of a warning letter in the U.S.

- The company’s focus on innovation and expansion into growth markets, such as AFib, robotics, and structural heart, positions it for substantial future growth.

- Medtronic has taken measures to enhance its supply chain resiliency and reduce costs, strengthening its global operations.

Dragoljub Bankovic/iStock via Getty Images

My grandfather who passed away a number of years ago was a good guy. Near the end of his life he suffered from Diabetes and had multiple strokes. I first learned about Medtronic (NYSE:MDT) from him. He used some of their medical equipment and it along with a slew of pills from other companies helped him survive for decades with this debilitating disease. With the growing number of potential Diabetes patients in the modern world, it would be easy to assume that Medtronic would be poised for long term growth. However, the last few years have been tough for the company because of supply issues due to covid 19 and a recently lifted government restriction on their 780G system. Due to these issues, the stock has been rather volatile over this period trading from a low of around $75 to a high of over $130. I believe the current fair value of MDT to be around $88 which would technically make it a buy, but the current margin of safety is not significant enough for me to personally buy shares.

5 Year MDT Chart (Seeking Alpha)

Medtronic plc, a global leader in healthcare technology, specializes in developing, manufacturing, and delivering device-based medical therapies to benefit patients and healthcare professionals worldwide. The company operates across various segments, each catering to specific medical needs.

In the Cardiovascular Portfolio segment, Medtronic offers a range of cutting-edge solutions, including cardiac pacemakers, defibrillators, and cardiac resynchronization devices. They also provide advanced cardiac ablation products, monitor systems, and innovative aortic and pulmonary valve solutions. Their commitment extends to percutaneous coronary intervention products and related medical devices.

Three Major Divisions

The Medical Surgical Portfolio segment focuses on surgical innovations, offering stapling devices, vessel sealing instruments, wound closure solutions, and robotic-assisted surgery products. They also provide therapies for various medical conditions, including gastrointestinal diagnostics and patient monitoring.

Medtronic’s Neuroscience Portfolio addresses the needs of specialists across multiple medical fields. It encompasses products for spinal, neuro, orthopedic surgeons, and more. Their advanced systems aid in robot-assisted spine procedures and therapies for vascular conditions in and around the brain.

The Diabetes Operating Unit develops cutting-edge solutions for diabetes management. This includes insulin pumps, continuous glucose monitoring systems, and smart insulin pen systems to empower individuals in managing their diabetes effectively.

Since its founding in 1949, Medtronic has remained dedicated to advancing healthcare technologies and improving patient outcomes. Headquartered in Dublin, Ireland, the company continues to lead the way in shaping the future of medical therapies and solutions.

Current Valuation

I ran a number of types of DCF analysis on MDT and found the current fair value range to be between $72 and $115. This put a fair market value for Medtronic at around $88 which represents a 10% margin of safety. This is not enough of a margin of safety for me personally. If the growth story I outline below becomes true, I would revise my estimate upwards.

Potential For Growth

Automated Insulin

Medtronic’s diabetes business seems poised for sustained growth, driven by its automated insulin delivery technology, including the 780G system.

The company’s diabetes business has experienced a divergence in growth trends between its U.S. and international markets. While the international market has seen robust double-digit growth, the U.S. market faced challenges due to a warning letter from regulatory authorities. However, the recent lifting of the warning letter and the introduction of the 780G system are expected to turn the tide in the U.S. market. Geoff Martha, CEO, recent comments support this narrative, “Now that we’ve got the warning letter lifted and we’re launching this technology in the U.S., you’ve seen a 30% growth in pumps overall… In the next couple of quarters, you’ll see the U.S. start to flip to growth.”

In international markets, the adoption of the 780G system, which integrates patches, pumps, sensors, and algorithms, has led to significant growth and market share gains. Patients are benefiting from increased ease of use, safety, and effectiveness. Medtronic’s strategy of focusing on consumables, such as sensors and infusion sets, has contributed to revenue growth.

-

Geoff Martha, CEO of Medtronic, highlighted the success of the 780G system in international markets, where it has driven high teens growth.

-

The international market has experienced a notable increase in the attachment rate of Medtronic’s sensors and other consumables.

-

The recent lifting of the warning letter in the U.S. allowed Medtronic to launch the 780G system domestically, resulting in a 30% growth in pump sales in the last quarter.

With the warning letter resolved and the 780G system gaining traction in the U.S. market, Medtronic’s diabetes business is poised for sustained growth. The combination of innovative technology, increasing adoption among new patients, and upgrades among existing customers bodes well for the future performance of the diabetes business.

Growth Markets

Medtronic’s focus on innovation and expansion into key growth markets, such as Atrial fibrillation (AFib), robotics, and structural heart, positions the company for substantial future growth.

Medtronic recognizes the importance of diversifying its portfolio and investing in areas with significant growth potential. The company is actively pursuing opportunities in AFib treatment, robotics for soft-tissue procedures, and structural heart interventions. Geoff Martha highlighted this strategy at the Bank of America Global Healthcare Conference, “We are focused on becoming a bigger player in Atrial fibrillation. This is a big market.” By strategically allocating resources to these high-growth areas, Medtronic aims to capitalize on emerging healthcare needs and expand its market presence.

-

Geoff Martha emphasized the company’s commitment to driving growth through innovation and market expansion.

-

Medtronic is actively developing products and solutions in AFib, robotics, and structural heart to address evolving patient needs.

-

The acquisition of Affera, a company specializing in AFib treatment, highlights Medtronic’s dedication to capturing market share in this growing segment.

Medtronic’s strategic focus on innovative solutions and expansion into growth markets positions the company for substantial future growth. By addressing emerging healthcare trends and patient needs, Medtronic aims to diversify its revenue streams and enhance its competitive advantage and change the recent trajectory of the company.

Supply Chains

Covid 19 severely disrupted supply chains for Medtronic and had deleterious effects on earnings. Medtronic’s has addressed the issue with investments in supply chain optimization, supplier consolidation, and technology enhancements are strengthening its global operations and improving resiliency and cost-effectiveness.

Recognizing the significance of a robust supply chain, Medtronic has undertaken comprehensive measures to enhance its global operations. Geoff Martha focused on these new hires in this comment, “We’ve brought in a lot of new people, made investments in new technology and automation, and I believe our global operations and supply chain under Greg Smith is in a very good spot from a resiliency perspective and actually a cost perspective.”

These initiatives include supplier consolidation, the adoption of advanced technologies, and strategic talent acquisition. These efforts are geared towards improving supply chain resiliency, reducing costs, and ensuring a stable production environment.

-

Geoff Martha highlighted the investments made in supplier consolidation, technology, and automation to enhance supply chain resilience.

-

Medtronic’s focus on reducing the number of suppliers and optimizing contracts is leading to better pricing and increased cost savings.

-

The company’s efforts to fortify its supply chain under the leadership of Greg Smith are expected to yield long-term benefits

Medtronic’s investments in supply chain optimization, supplier consolidation, and advanced technologies are strengthening its global operations. These efforts are expected to enhance supply chain resiliency, reduce costs, and contribute to the company’s long-term stability and competitiveness. These steps also directly address the problems Medtronic had over the past five years meeting demand.

Additional Positives

-

Accelerated market share gains in transcatheter aortic valve replacement (TAVR) and the successful launch of the Hugo soft-tissue robot.

-

Some innovations are already impacting Medtronic’s growth, while others are expected to contribute significantly over the next few years.

-

The company’s expansion into Atrial fibrillation (AFib) is noted as a strategic move in response to market trends and patient needs.

-

The reduction in general and administrative expenses (G&A) and the company’s commitment to growing G&A at a rate lower than revenue, highlighting a focus on cost efficiency.

-

The impact of inflation on the cost of goods sold (COGS) and the company’s efforts to improve COGS productivity, which is expected to contribute to gross margin improvement.

Medtronic’s strategic focus on innovative solutions and expansion into growth markets positions the company for substantial future growth. By addressing emerging healthcare trends and patient needs, Medtronic aims to diversify its revenue streams and enhance its competitive advantage.

The Dividend

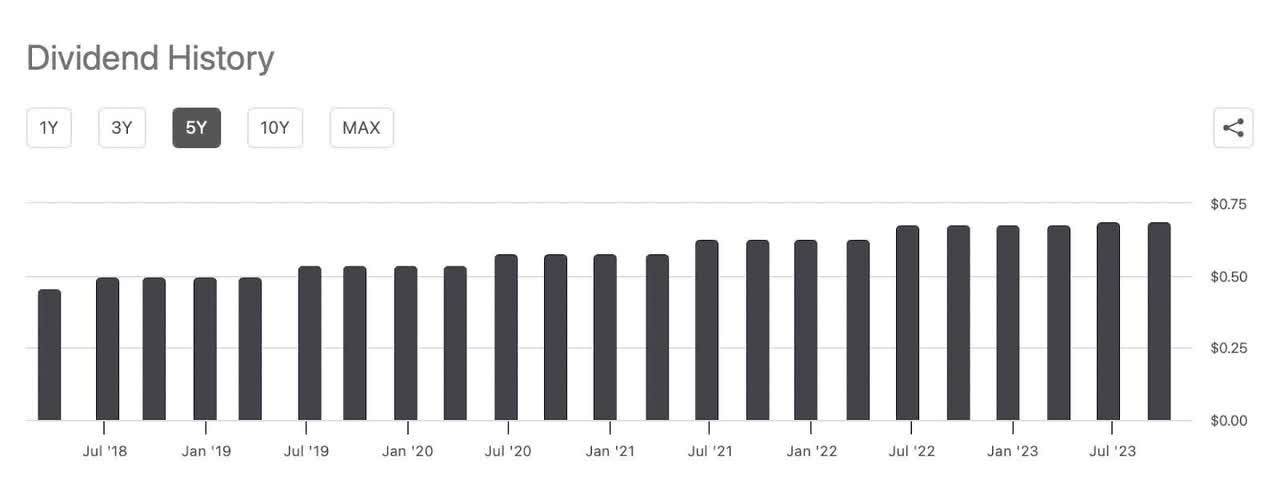

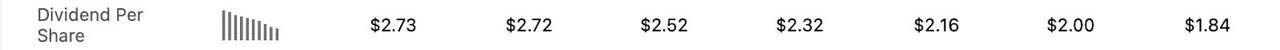

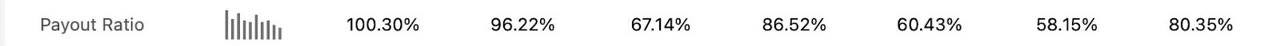

Dividend growth has been consistent even given the supply problems of the last few years.

However, the payout ratio has risen to an unhealthy level of over 100% which you can read more about in the income statement. I do not believe the dividend is currently at risk because this is only about 83% of current free cash flow, and since earnings for this year are poised to grow by over 50%, the future payout ratio is likely to drop significantly to somewhere between 50% and 69%.

Seeking Alpha Seeking Alpha Seeking Alpha

Potential Risks

Regulatory and Compliance Risks: The healthcare industry is heavily regulated, and changes in regulations, compliance issues, or failure to meet regulatory requirements can affect Medtronic’s ability to market and sell its products. Regulatory approvals are crucial for new product launches.

Product Liability and Litigation: Medtronic manufactures and sells medical devices, and there is always a risk of product liability claims or lawsuits related to the safety and efficacy of its products. These can lead to substantial legal expenses and damage the company’s reputation.

Competition: Medtronic faces intense competition from other medical device companies. Rapid technological advancements and the entry of new competitors could erode its market share or lead to pricing pressures.

Final Thoughts

Medtronic’s wide-ranging product portfolio, spanning the Cardiovascular, Medical Surgical, Neuroscience, and Diabetes segments, reflects its commitment to improving healthcare outcomes.

Despite the recent challenges stemming from supply disruptions due to the COVID-19 pandemic and regulatory issues related to the 780G system, Medtronic has shown resilience. While the stock has experienced volatility in recent years, the company’s long-term prospects appear promising.

The potential for growth in Medtronic’s diabetes business, driven by innovations like the 780G system and its focus on international markets, suggests a positive trajectory. The recent lifting of the regulatory warning in the United States is also expected to boost sales and growth of the device.

Medtronic’s strategic initiatives in high-growth areas like Atrial fibrillation (AFib), robotics, and structural heart interventions position the company for substantial future expansion. By addressing evolving patient needs and investing in innovation, Medtronic aims to diversify its revenue streams and bolster its competitive edge.

To address the challenges posed by supply chain disruptions, the company has undertaken comprehensive measures, including supply chain optimization, supplier consolidation, and technology enhancements. These efforts are expected to improve operational resiliency and cost-effectiveness.

While Medtronic has demonstrated consistent dividend growth, it’s important to monitor the payout ratio, which has risen to potentially unsustainable levels. Future earnings growth is expected to alleviate this concern.

Medtronic is not without risks. Regulatory and compliance challenges, product liability, and competition remain key concerns. The company must navigate these hurdles while maintaining its commitment to quality, innovation, and patient well-being.

Medtronic’s dedication to advancing healthcare technologies and addressing critical medical needs continues to drive its mission. While the road ahead may have its share of obstacles, Medtronic’s legacy of innovation and adaptability positions it well for continued growth and impact in the healthcare sector. I currently rate it a buy but believe the margin of safety is currently not significant. If the company executes on its plans, I expect revenue to grow and the company’s valuation to grow as well. I will definitely be watching MDT for a potential pullback and an opportunity to buy shares at a bigger discount. As always please do your own due diligence before buying any positions and good luck investing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.