Summary:

- Medtronic’s Q1 2024 earnings show 6% annual growth in revenues and EPS, marking a third consecutive quarter of mid-single-digit growth.

- The company’s use of AI-driven tools and services, as well as innovative products, has contributed to growth across all divisions. Issues in Russia and China slowed growth slightly.

- Medtronic’s diabetes division faces competition from new weight loss drugs, but the launch of its latest MiniMed device may help gain market share from rivals.

- Medtronic shares have fallen substantially in value since hitting highs of >$135 in late 2021. These latest earnings can stop the bleeding and drive long-term top and bottom-line growth.

- As a global company, Medtronic faces many different kinds of headwinds, which may prevent the stock price from recapturing former highs for some time, but a generous dividend offsets this issue somewhat.

Wolterk/iStock Editorial via Getty Images

Background To Q124 Earnings: Stagnant Recent Growth Ups The Ante For Med Device Giant

Medtronic (NYSE:MDT), founded in Minneapolis in 1949, and responsible for producing the world’s first battery powered pacemaker, has grown into the world’s largest medical device company, with a market cap valuation (at the time of writing) of $111bn.

Between 2009 and mid 2021, Medtronic rewarded shareholders handsomely, its share price rising from ~$30, to ~$130, resulting in a 330% return on investment. The company also is a strong dividend payer – between 2010 and 2022, the payout has increased from $0.86 per annum, to $2.67 per annum, for a current yield of ~3.3%.

After seeing shares drop from ~$118, to ~$75 in 2020 when the stock market crashed in response to the declaration of a pandemic, Medtronic stock mounted a strong recovery, reaching its all-time peak price of $135 in August 2021, but the reality was that revenue growth, operating income and earnings per share were becoming stagnant.

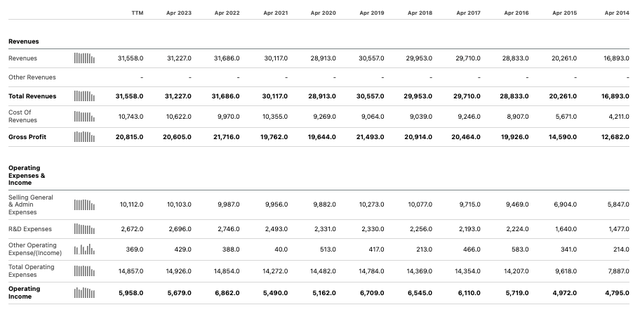

Medtronic annual income statements (Seeking Alpha)

As we can see above, total revenues grew from $16.9bn in 2014 to $30.6bn in 2019 – a compound annual growth rate of ~13% – but since then, revenue growth has been broadly flat year-on-year, while operating profit has only once been higher the $6.7bn reported in 2019 – last year, it missed this high water mark by >$1bn.

The stagnant top and bottom line growth has exasperated the market, triggering a bear run on the stock price that lasted throughout 2022 and into 2023, with shares reaching their lowest value since the pandemic low in May this year – around the time the company released its results for the fiscal year 2023.

Medtronic outperformed analysts expectations on revenues of $8.5bn and non-GAAP EPS of $1.57, although for the year as a whole, net income and diluted EPS were $3.758 billion and $2.82, respectively, representing annual decreases of 25% and 24%.

Analysts were also underwhelmed by Medtronic’s guidance for 2024, which was originally for organic revenue growth of 4 – 5%, and non-GAAP EPS of $5 – $5.1 – implying a forward price to earnings ratio of ~17x, which is adequate if not impressive.

In summary, ahead of its Q1 2024 earnings, Medtronic was looking to placate disgruntled investors, and persuade the investing community that a return to growth was imminent, thanks to what Medtronic Chairman and CEO referred to on Tuesday’s earnings call as “a comprehensive transformation which is designed to get at the root of what has held back our growth.”

Now let’s take a look at how Medtronic actually did perform in the first quarter of fiscal year 2024.

Q1 2024 Earnings Overview – Fundamentals

The headline news was that in Q1 2024 Medtronic was able to beat analyst consensus estimates, announcing revenues of $7.7bn for the quarter, and non-GAAP EPS of $1.2, whilst GAAP EPS of $0.59 represented a narrow miss.

The revenue figure represents annual growth of 6% on an organic basis (4.5% on a reported basis), while non-GAAP EPS also increased by 6% – in fact, all 4 of Medtronic’s major business divisions – Cardiovascular, Neuroscience, Medical Surgical and Diabetes – all drove ~6% year-on-year growth.

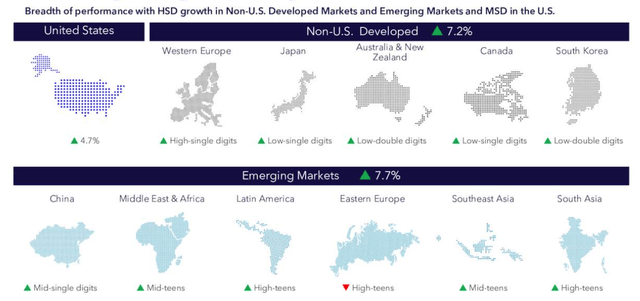

Medtronic regional performance Q124 (Medtronic earnings presentation)

As we can see above, geographically speaking, other than in Eastern Europe where revenues slumped, likely due to the ongoing war between Ukraine and Russia and sanctions imposed on the latter, the US recorded the slowest growth, of 4.7%, while non-US developed markets and emerging markets showed impressive buoyancy. Across the past 12 months, Medtronic says it has achieved ~125 product approval in “key geographies” – a sign that Medtronic still knows how to innovate, and stay ahead of the chasing pack.

With that said, on a GAAP and non-GAAP basis, Medtronic did reduce its R&D spending so that it represented 8.7% and 8.5% of total revenue respectively, which may not have impressed analysts given the importance placed on innovation driven growth. On a more positive note, SG&A spending as a percentage of sales fell 33.4% (non-GAAP), and operating margin improved to 24.8%, up 90 basis points year-on-year. On a GAAP basis, EPS actually fell 16% to $0.59, while on a non-GAAP basis, as mentioned, the increase was 6%.

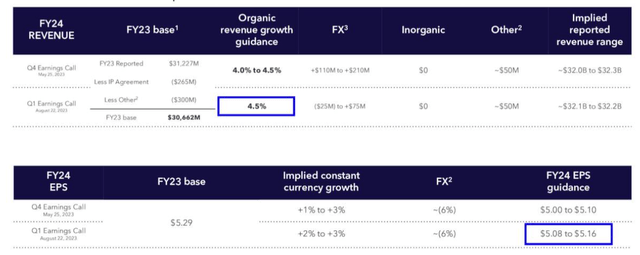

Medtronic FY24 guidance and assumptions (earnings presentation)

Finally, as we can see above, Medtronic upgraded its FY24 guidance, forecasting for growth of 4.5% – the higher end of former guidance and EPS of $5.08 – $5.16, bringing the forward PE ratio down to ~16.5x. The implied full-year revenue figure is ~$32bn, which if achieved, would represent Medtronic’s best ever year, although only narrowly.

The market could be forgiven for being dismissive of the upgraded guidance, but in fact, it responded positively after earnings were reported, pushing the share price from $81.5, to >$84, and so far, the upward adjustment has held.

By The Divisions – AI Driven Client Services Driving Growth Today, and Tomorrow?

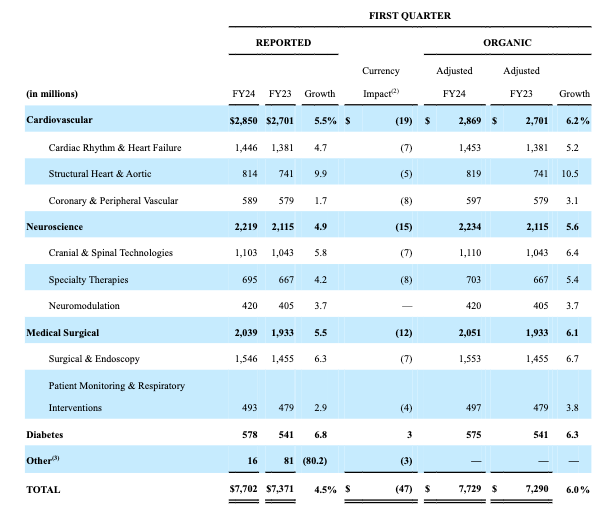

Cardiovascular was Medtronic’s largest division by revenue in Q124, recording $2.85bn of revenues, followed by Neuroscience – $2.2bn, Medical Surgical, $2bn, and finally Diabetes – $578m.

Medtronic revenues by division – Q124 (Medtronic 10Q submission)

As we can see above, every one of Medtronic’s divisions posted >3% annual growth

On the Q1 2024 earnings call, CEO Geoff Martha enlarged on some of the key growth areas across the divisions. A recurring theme is Medtronic’s use of AI-enabled tools and services to help clients navigate through the often complex product offerings. For example, the CEO name checked Medtronic’s Aible digital intelligence neurosurgical solution as being key to driving growth in cranial and spinal technologies, and within neuroscience, Martha commented that the 7% and 9% respective annual growth:

Demonstrates our successful strategy of offering surgeons a differentiated and innovative ecosystem including our AI-enabled surgical planning platform and patient-specific customized implants, along with imaging, navigation and robotic technologies.

This fits well with Medtronic and CEO Martha’s plans to put robotics and artificial intelligence at the forefront of its strategy for growth – as Martha puts it in his introductory statement:

We’re also decisively allocating capital, particularly to our programs and fast secular growth markets as well as focusing our R&D investments on technology megatrends like robotics and artificial intelligence that will drive growth in our industry over the next decade.

As a robotics company, it certainly makes sense for Medtronic to pursue such a strategy, focusing on innovation as opposed to simply being a supplier of goods and services. With that said, AI is undoubtedly in the midst of a hype cycle and some might argue it’s not quite ready to deploy within mainstream business divisions, particularly where identifying specialist medical devices is a part of its remit.

The early evidence suggests Medtronic is getting the balance right, given the good growth showed last quarter, but in the prevailing post pandemic economic environment, it could also be the case that Medtronic is benefiting from a return to Business As Usual (“BAU”), and a resultant rise in non-elective surgeries, and the AI integration is yet to be fully tested. On the whole, however, it is encouraging to see Medtronic pushing the boundaries of what is possible using AI, and I believe this strategy can pay off for the company in the long run.

Pacemakers continue to be an important part of Medtronic’s business and the company’s new Micra leadless pacemaker franchise enjoyed “strong, mid-teens growth” with next-generation devices offering a battery life of 16-17 years, apparently, which is “well beyond average battery life of competing products,” according to Martha. Meanwhile, countless other products – the “Hugo” robotic assisted surgery device, Pulsed Field Ablation (“PFA”) catheters, Shield technology for treating aneurysms, a new spinal cord stimulator, Inceptiv, unlocking the ability to listen and respond to signals from the spinal cord – all seem to offer hope that, as management has promised, Medtronic is capable of driving growth once again.

Diabetes Division Has X-Factor Appeal – But Affected By New Weight Loss Drugs?

Despite it being the smallest, I would rate Medtronic’s diabetes division as arguably its most important, and a decisive factor in how the company is likely to perform over the next couple of years, and beyond.

The key product within this division is Medtronic’s latest integrated continuous glucose monitoring system (“iCGM”), the MiniMed 780G. For years, Medtronic has been locked in a three-way battle for supremacy in the iCGM market, competing against DexCom (DXCM), whose latest device is the G6, and Abbott Laboratories (ABT), whose latest product is the Freestyle Libre 3.

Abbott’s Freestyle Libre delivered $4.3bn of revenues in 2022 – up 20% year-on-year, while Dexcom – solely focused on iCGMs – reported revenues of $2.9bn. Comparatively speaking, then, Abbott is a long way behind in this market, but there are several reasons why the company might believe it can play catch up.

Firstly, Abbott – whose device is considered the best value for money, if not the best quality product on the marketplace – was recently forced to issue a recall of >4m FreeStyle Libre, Libre 14 day, and Libre 2 Flash Glucose Management Systems’ reader devices due to concerns around the lithium-ion batteries catching on fire, while the app that keeps track of glucose readings also stopped working on some Apple devices in July.

Dexcom, on the other hand, is a far smaller company than either Abbott (ABT) or Medtronic (MDT), with no other product lines besides iCGMs, therefore despite its initial success, the company could struggle to keep pace with its better-resourced rivals in the long run.

With Abbott struggling slightly on the technical side, and Dexcom potentially experiencing growing pains, the door may have opened a crack for Medtronic to gain market share in the iCGM space. Medtronic’s latest device – the 780G – is the only product to offer five minute adjustments in auto-corrections and meal detection technology, and Medtronic says:

our real-world evidence indicates that 90% of users are achieving or exceeding their glycemic targets when using our recommended settings

Medtronic added that

Non-US developed markets grew 18%, our highest growth in four years, driven by both 780G adoption and increased CGM attachment rates. And in the US, we’re seeing great results and momentum from the 780G launch. First, the launch drove low 30s growth in our US durable pump sales. Second, we’re seeing our prescriber base rapidly expand. Since we last talked to you at ADA in late June, we’ve had a 30% increase in unique prescribers with now over 13,000 since launch. Third, we’ve had over half of our 770G installed base upgrade or place an order for the 780G since launch.

With its diabetes division contributing $2.3bn of revenues in 2022, Medtronic is not far behind Dexcom, and if Abbott continues to struggle, there will be market share up for grabs. This could be a major positive for Medtronic, although there is a drawback.

The Glucagon-like peptide-1 receptor agonists (“GLP-1 RAs”) developed by Novo Nordisk (NVO) and Eli Lilly (LLY) and approved to treat Type 2 Diabetes could have an impact on Medtronic’s ability to grow its sales of iCGMs.

When questioned about this on the earnings call, Martha strenuously denied that these newly approved drugs – marketed and sold as Ozempic and Mounjaro, and forecast to become all-time best-selling therapies, with peak sales potential in excess of $25bn per annum (by conservative estimates), would have an effect on sales of MiniMed. Martha told analysts:

No impact in Type 1 diabetes, which is the vast majority of our Diabetes business. And this is overall, I just don’t see GLP-1s having a material impact on our business and medical device therapies at large. That’s what our work is showing us at this point.

While it’s true that Ozempic and Mounjaro are primarily focused on Type 2 Diabetes (“T2D”), it also could be argued that T2D, or obesity, was a major expansion opportunity for MiniMed, given its range of features and ability to measure blood sugar levels. Furthermore, Medtronic had developed a smart insulin pen for Type 2 diabetics – a device that may be rendered obsolete if Ozempic and Mounjaro take hold of the market – and it should be noted their efficacy and safety profiles to date suggest that will very much be the case.

As such, there’s a tangible threat in my view that these two drugs could, long term, affect sales of MiniMed and of the smart insulin pen – and given these drugs treat weight loss also, there may ultimately be less demand for iCGMs altogether.

Concluding Thoughts – A Strong Recovery Quarter For Medtronic – But Case For Share Price Growth Not Yet Made

To summarize my take on Medtronic’s Q2 2023 earnings: First of all, Medtronic needed a set of strong results, and by and large the company got them, with 6% annual growth across all divisions, and 6% growth in EPS, marking a third consecutive quarter of mid-single digit growth.

The guidance upgrade was another welcome development, although when asked if it may be increased again in subsequent quarters, Chief Financial Officer Karen Parkhill sounded a cautious note, citing issues in Russia and in China where volume-based pricing concerns limit the growth opportunity.

Medtronic’s leveraging of cutting edge technology and AI-driven systems and services also is a welcome development in my view that befits a company like Medtronic, that ought to be leading the way in these fields. And finally, Medtronic may have an opportunity to take market share away from key rivals Abbott and Dexcom with the launch of its latest MiniMed – in this market, even a few percentage points could make a significant difference to the top line and help Medtronic achieve the growth investors want to see.

As promising a set of earnings as this was, however, I’m not sure there’s a strong case to make for Medtronic to soon be challenging former highs of $100 per share, let alone $135 per share.

Part of the reason for this is that it’s not quite clear whether a post-pandemic return to a BAU environment is having a more meaningful impact on revenue growth than e.g. new AI technology, or an improved product suite, or more efficient sales practices. Until this conundrum is resolved, it may be unwise to draw the conclusion that Medtronic is a mid-to-high single-digit growth story going forward.

Even if Medtronic were to achieve the desired growth, with a current forward PE ratio of ~16.5x, and price to sales (“P/S”) ratio of >3x, fundamentally speaking, Medtronic does not necessarily deserve a higher valuation than it has today.

What I like about Medtronic is that the company is the 800-pound gorilla of the medical device world, and its business divisions have the ability to generate attractive margins, and massive sales volumes are pretty much rock solid. So even if growth is somewhat stagnant, it’s hard to imagine Medtronic revenues dipping significantly, protecting the downside risk.

As such, I would not have any qualms around investing in Medtronic at the current price, and benefiting from a generous – and likely growing – dividend. Equally, if I was buying Medtronic stock, it would not be in expectation of major share price upside. Being a global company with >90k employees makes strong growth hard to achieve, and continuously throws up unexpected issues, such as sanctions, changes to government policy, FX volatility and many other issues.

It’s not as easy to identify growth products at Medtronic as, say, at a major pharma, because Medtronic develops so many products – apparently, there are 49k patents within the company’s portfolio.

I would be fairly confident that new and innovative products building on a rock solid base will have a significant role to play in helping Medtronic achieve top and bottom line growth going forward, although I’d be doubtful if the company can achieve what analysts predict will be ~$41bn of revenues per annum by 2029. Let’s not get carried away! Nonetheless, Medtronic represents an attractive buy and hold opportunity in my view for an investor with an appetite for moderate risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MDT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.