Summary:

- Medtronic is a strong option for investors seeking both low volatility and consistent dividend growth.

- I am quite positive about recent developments related to new crucial FDA approvals.

- Various valuation approaches suggest that the current share price is attractive.

JHVEPhoto

Investment thesis

My initial bullish thesis about Medtronic (NYSE:MDT) aged somewhat good as the stock delivered a total 1.9% return since mid-February. As I underlined in my initial thesis, MDT is a good option for investors seeking low-volatility stock with solid dividend growth.

The company reports its fiscal Q1 earnings soon, on August 20. Today I want to update my thesis and explain why I believe there are robust reasons to remain moderately bullish about MDT. Moreover, the valuation still looks good. All in all, I reiterate my “Buy” rating for MDT.

MDT FQ1 earnings preview

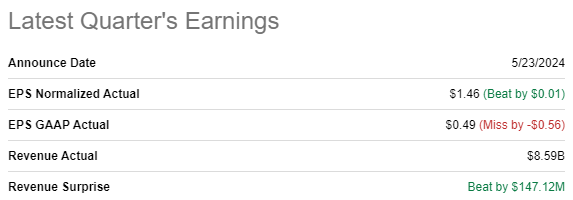

MDT released its latest quarterly earnings on May 23, surpassing revenue and adjusted EPS consensus estimates. On the other hand, there was a big miss against consensus from the perspective of GAAP EPS. Revenue was almost flat YoY with a shallow 0.5% growth.

Seeking Alpha

The upcoming quarter’s earnings are scheduled next week, for August 20. Wall Street analysts expect FQ1 revenue to be $7.90 billion, around 2.5% higher on a YoY basis. The adjusted EPS is expected to be flat YoY at $1.2. Sentiment of Wall Street analysts around the upcoming earnings release is quite bearish with 17 downgrade EPS revisions over the last 90 days.

Seeking Alpha

MDT has a solid earnings surprise record and several previous quarters there were only positive revenue and adjusted EPS surprises. What is also important is that the stock is rarely a big mover after earnings releases, according to historical share price movements.

Recent developments are mostly positive for MDT investors. The company declared a $0.70 quarterly dividend on August 16, in line with the previous one. Moreover, MDT got upgraded from “Sell” to “Hold” by UBS analysts, with optimism around the ability to drive growth in the company’s diabetes segment. The optimism looks sound since the industry is expected to demonstrate solid growth. According to Statista, diabetes care devices industry is expected to deliver a 12.2% CAGR between 2024 and 2029, which is a solid tailwind for MDT’s diabetes business. Moreover, Medtronic has recently won an FDA approval for its Simplera continuous glucose monitor [CGM].

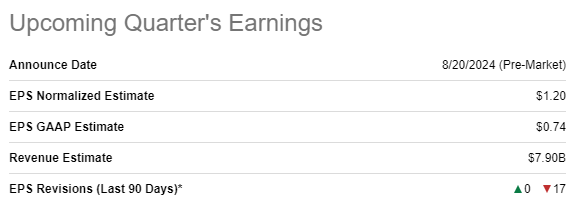

Parkinson’s Foundation

Recent information also suggests that Medtronic received another important FDA approval for its asleep deep brain stimulation [DBS] surgery. Medtronic claims that it has become the first and only company getting an FDA approval to conduct DBS surgeries. The DBS surgery solution is for people with Parkinson’s disease and with essential tremor. This is also a crucial positive development for MDT as Parkinson’s disease is also a big problem in the U.S. According to Parkinson’s Foundation, nearly 90,000 people in the U.S. are diagnosed with this disease each year and the combined direct and indirect cost of Parkinson’s is estimated to be nearly $52 billion per year in the U.S. alone.

All these developments are crucial for the company’s long-term revenue prospects. The good part is that the management is not also focused on driving revenue growth, but also expand value for shareholders. The company restructured its facilities, which allowed it to optimize the headcount in 2023. According to news as of mid-June 2024, the company continues laying off employees.

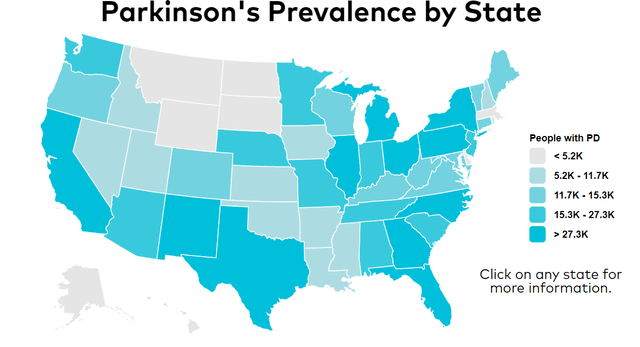

Valuation update

MDT demonstrated a modest 3.7% share price increase over the last twelve months, and the 52-week range varied between $69 and $89. The stock’s performance has lagged behind the broader U.S. market and the Health Care sector (XLV) over the last 12 months. Seeking Alpha Quant assigns MDT a low “D” valuation grade mainly due to the massive forward PEG ratio, but other ratios look attractive. What is crucial is that most of the valuation ratios are notably lower than MDT’s historical averages.

Seeking Alpha

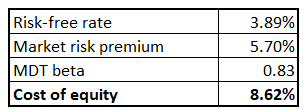

Since MDT is a mix of a growth and value stock, in my opinion, simulating both the dividend discount model [DDM] and discounted cash flow [DCF] approaches will be sound for my valuation analysis. I will use an 8.62% discount rate for both models, which was figured out using the CAPM approach below.

Author’s calculations

MDT has an exceptional dividend consistency, which gives me high conviction that consensus dividend estimates are reliable to incorporate into my DDM. That said, I use an FY 2025 $2.74 projection. MDT also has a solid dividend growth record, but to be on the safe side, I use the last three-years’ dividend CAGR of 5.34%. According to my DDM analysis, the stock’s fair price is $83.5. This is very close to the current share price, meaning that MDT is approximately fairly valued.

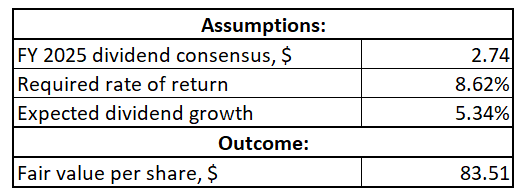

Author’s calculations

Now I will proceed with the DCF simulation. I use a 54% revenue CAGR for the next decade, which looks like a fair deceleration compared to the last decade’s 7% rate. Moreover, my projected revenue growth rate is approximately in line with the revenue consensus estimates. I use a flat 16.87% FCF margin, which is the TTM level. To be conservative, I will also deduct from my fair value calculation the current $18.01 billion net debt position.

Author’s calculations

According to my DCF simulation, the business’s fair value is around $118 billion. This is 10% higher than the current market cap, meaning that DCF meaning that MDT is attractively valued from the perspective of future cash flows.

Risks update

The stock price declined by 17.8% over the last five years, meaning it was not a good choice for investors who were seeking capital gains apart from the solid dividend growth. Potential investors, especially those targeting growth, should be ready for “boring” share price dynamics. On the other hand, considering the length of the timeframe below, we can see that the stock has been trading in a relatively narrow corridor and is currently much closer to the lower edge of the range, which increases the probability of a rebound to higher levels in the short term.

Seeking Alpha

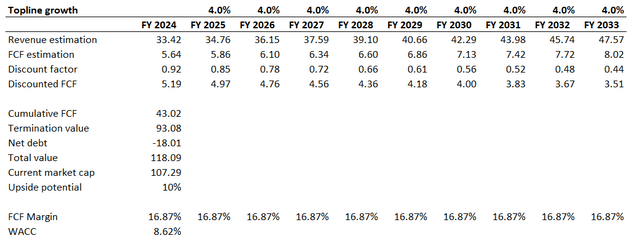

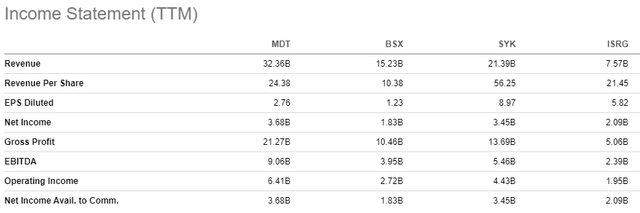

The major business risk that I see is the fierce competition. There are numerous competitors in the Health Care Equipment industry, which are approximately of the same market cap as MDT, which includes Boston Scientific Corporation (BSX), Stryker Corporation (SYK), and Intuitive Surgical (ISRG). I will not dig deep into comparisons of offerings of each company because the environment and technologies are rapidly evolving, and I would better look from the perspective of financial metrics and their dynamics.

Seeking Alpha

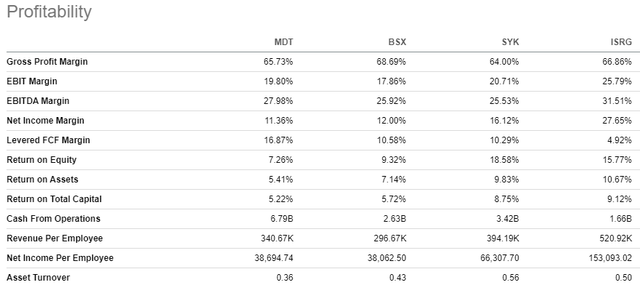

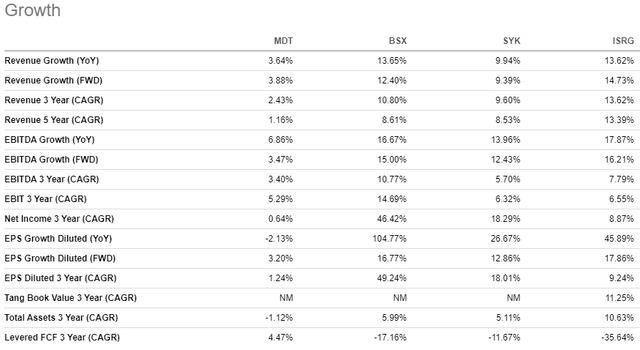

Despite the fact that the market caps of all these companies are not very far from MDT’s, we can see that Medtronic is far larger from the perspective of revenue. Such an inconsistency between the differences in market cap and revenue highly likely means that investors perceive MDT as weaker than peers. Indeed, from the perspective of profitability ratios, I cannot call MDT an undisputed leader as it lags behind competitors across some metrics.

Seeking Alpha

Moreover, MDT demonstrates a much more modest revenue growth than its peers. While investors apparently highly value growth dynamics and prospects, I do not think it is a big red flag for MDT. First, the company is still by far the largest from the perspective of revenues and operating cash flows generated, meaning that MDT generates more resources to reinvest into business in absolute terms. Second, the management’s efficiencies initiatives are working, which we have seen in the financial analysis, which means that MDT will close the gap in terms of profitability metrics compared to the competition.

Seeking Alpha

Bottom line

To conclude, I believe that MDT is still a “Buy”. Recent developments are quite positive and historical share price movements suggest that buying this stock before earnings is not very risky. Moreover, the valuation is still attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.