Summary:

- Medtronic is a premium quality enterprise that trades at a significant discount to its historical valuations.

- It has a long runway of growth with exposure to popular health categories.

- Supply chain issues could be easing, setting up the stock for potentially strong returns.

MarsBars

As the current bear market drags on, it’s easy to get complacent and think that the cheap prices are here to stay for the foreseeable future. However, there’s no telling what the market will do, and if history is of any indication, the S&P 500 (SPY) could see double-digit returns in the mid-teens in the 12 months after the U.S. mid-term elections this month.

This brings me to Medtronic (NYSE:MDT), which remains cheap compared to its historical valuations. In this article, I highlight why the low valuation combined with a respectable dividend makes MDT an attractive high quality value buy in today’s environment.

Why MDT?

Medtronic is a medical device giant with a presence in over 150 countries. Its broad array of products includes pacemakers, stents and insulin pumps, treating 70 various health conditions. Its patent base and track record of medical innovation gives it pricing power and helps to insulate it from headwinds in any one particular product category or geography. MDT employs over 90K employees around the world, and in the trailing 12 months, generated $31 billion in total revenue.

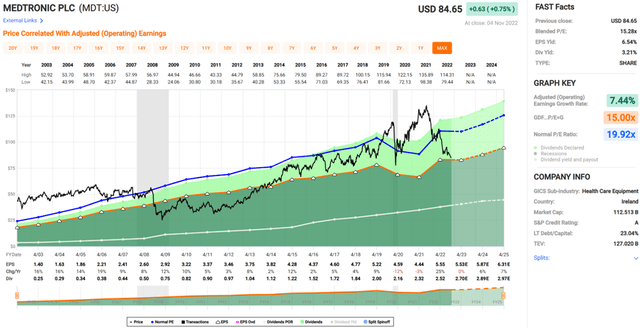

MDT is currently trading at levels Wall Street could not have anticipated only a year ago. At the current price of $84.65, the stock is down 30% over the past 12 months.

It’s fair to say that the past 9 months have been challenging, as MDT has had to contend due to chip shortages that have caused disruptions on the supply side. This was a contributing factor for why adjusted EPS declined by 17% YoY in the last reported quarter (ended July 29th) and organic revenue declined by 4% YoY.

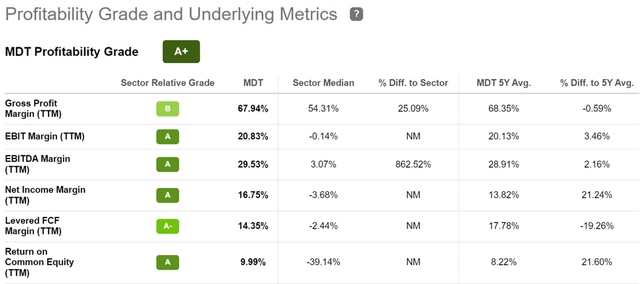

However, MDT holds a lot of margin buffer due to its leadership position and patents, enabling it to charge premium pricing. As shown below, MDT carries an A+ grade for profitability, with sector-leading EBITDA and Net Income margins of 30% and 17%, respectively.

MDT Profitability (Seeking Alpha)

Moreover, I believe the market has not fully awakened to the fact that the chip shortage has greatly eased in recent months. As the Wall Street Journal recently reported, the picture has flipped from a chip shortage to a supply glut.

Also encouraging, Fortune Business Insights expects Medtronic, Abbott (ABT) and Johnson & Johnson (JNJ) to be the top 3 medical devices companies to benefit from an increased demand for medical devices. The firm sees CAGR for the industry to be 5.5% between this year and 2029. This is expected to benefit MDT’s deep portfolio of cardiovascular products along with its products in medical surgical, neuroscience, and diabetes.

Also, analysts expect MDT to be a more focused organization after spinning off its Patient Monitoring and Respiratory Interventions businesses under a new unit. RBC Capital Markets remarked that the spin will help narrow MDT’s focus while aiding in simplification, and has a $110 per share price target. Morningstar also carries a favorable view of the spinoff, as noted in its recent analyst report:

Wide-moat Medtronic’s plan to spin off its patient monitoring and respiratory innovations businesses strikes us as strategically sound and underscores CEO Geoff Martha’s ongoing efforts to turn the firm’s portfolio toward faster-growing markets. Our fair value estimate is unchanged at $129 per share. If anything, we anticipate that the separation of these two product segments should leave Medtronic with greater concentration of differentiated technologies with significant opportunities for innovation, physician preference items, and a portfolio that should be further insulated from price pressure.

Importantly, for dividend investors, MDT carries a strong A rated balance sheet. At the current price of $84.65, MDT yields a respectable 3.2%. The dividend is also well-protected by a 48% payout ratio, and comes with a 5-year CAGR of 8%.

The stock also trades cheaply relative to its historical valuations, with a forward P/E of 15.3, which sits well below its normal P/E of 19.9, as shown below.

Given the quality of the enterprise, long-term growth attributes, and the turnaround in the chip supply chain, I believe the shares are too cheaply valued at present. Analysts who follow MDT seem to agree, as they have a consensus Buy rating and S&P Capital IQ has an average price target of $104, implying the potential for strong double-digit returns over the next one or two years.

Investor Takeaway

In summary, I believe Medtronic is a premium quality enterprise that trades at a significant discount to its historical valuations. The company has a long runway of growth ahead as it expands its global reach and introduces new innovative products. Meanwhile, I believe the market is not paying attention to the fact that supply shortages may be easing on the microchips side. As such, I view MDT as being a high quality buy for income and potentially strong total returns.

Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!