Summary:

- Medtronic’s revenue soars 88%, leading healthcare innovation, while Non-GAAP EPS up 40%, showcasing steady growth.

- Medtronic has decent growth opportunities and limited risks.

- With Medtronic’s P/E ratio below average, I believe it’s a buy.

SOPA Images/LightRocket via Getty Images

Introduction

Medical devices remain a very stable business within the healthcare sector, even in times of economic uncertainty. Medical devices can be a suitable investment with fluctuating markets and economic cycles due to macro data that postpone the anticipated interest rate decrease. This segment is stable due to the constant demand for market medical procedures, thus making it more stable. I believe companies within this b sector that lead innovation are particularly compelling, as there is less competition than generic manufacturers.

Medtronic (NYSE:MDT) is a leader with a diversified portfolio and global presence in the medical devices field. It has a robust product pipeline that focuses on high-growth areas such as diabetes. Medtronic is well-positioned to capitalize on the healthcare sector’s evolving needs. This article will describe my BUY thesis for the company.

Seeking Alpha’s company overview shows that:

Medtronic develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. Its Cardiovascular Portfolio segment offers implantable cardiac pacemakers, cardioverter defibrillators, and more. The company’s Medical Surgical Portfolio segment offers surgical stapling devices, vessel sealing instruments, wound closure, electrosurgery products, surgical artificial intelligence and robotic-assisted surgery products, hernia mechanical devices, and more. Its Neuroscience Portfolio segment offers products for spinal surgeons, neurosurgeons, neurologists, pain management specialists, anesthesiologists, orthopedic surgeons, and more. The company’s Diabetes Operating Unit segment offers insulin pumps and consumables, continuous glucose monitoring systems, smart insulin pen systems, and consumables and supplies.

Fundamentals

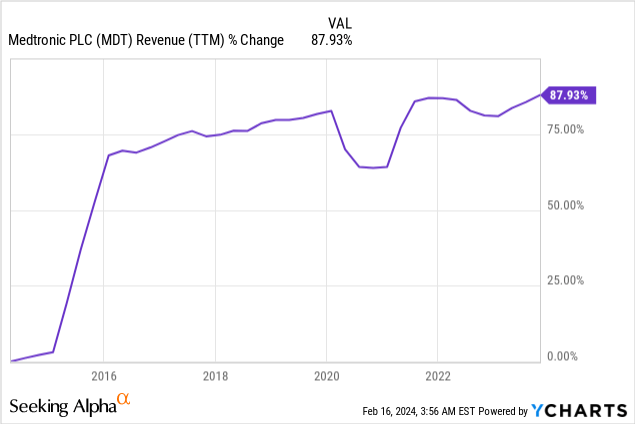

Medtronic’s revenues have increased by 88% over the last decade. This increase is attributed mainly to the acquisition of Covidien in 2015 for $42.9 billion, substantially expanding Medtronic’s product portfolio and global reach in Europe. Besides this acquisition, Medtronic has continued to grow through other mergers and acquisitions alongside organic growth. Looking ahead, analysts’ consensus, as seen on Seeking Alpha, predicts that Medtronic will grow sales at 4% annually in the medium term.

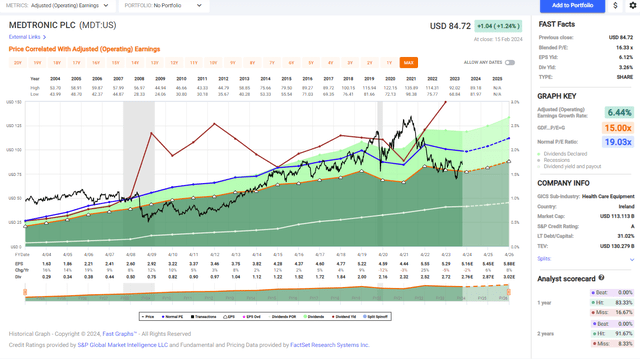

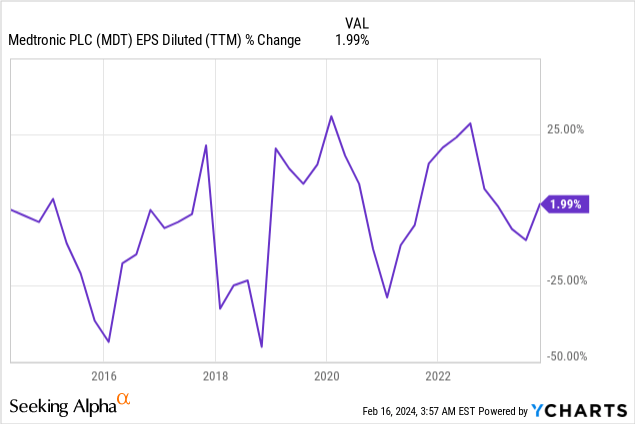

Medtronic’s EPS (Earnings Per Share) shows a modest 2% growth rate increase over the past decade. This is GAAP EPS, which includes one-time non-cash expenses. The non-GAAP EPS shows a 40% growth rate during that time. This gap between sales and EPS growth shows that sales growth hasn’t fully translated into EPS growth. This is due to margin pressures and share issuance related to Covidien acquisition funding. The analysts’ consensus, as seen on Seeking Alpha, predicts a 6% annual growth rate in EPS over the medium term.

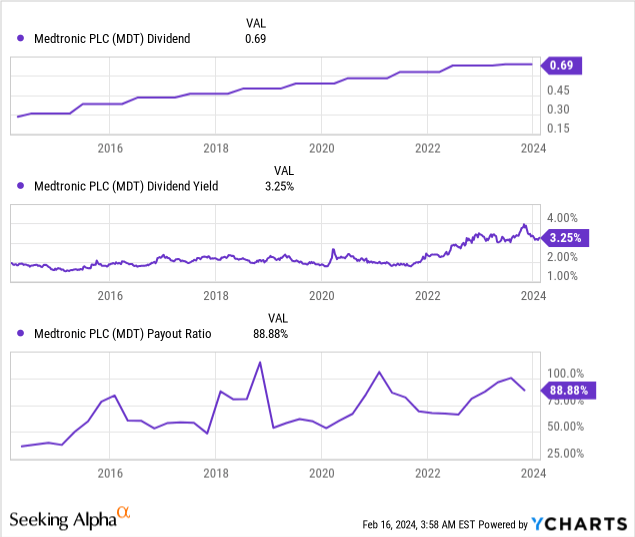

Medtronic is a dividend aristocrat that has paid a growing dividend for 45 years. In May 2023, the company announced a tiny dividend increase of 1.5% due to the EPS decline in 2023. The high payout ratio of 88% based on GAAP EPS is misleading, and using more accurate non-GAAP EPS, the payout ratio is 52%, implying that the dividend is likely to be safe. With a yield of 3.25%, investors should anticipate continued mid-single-digit dividend increases aligned with EPS growth.

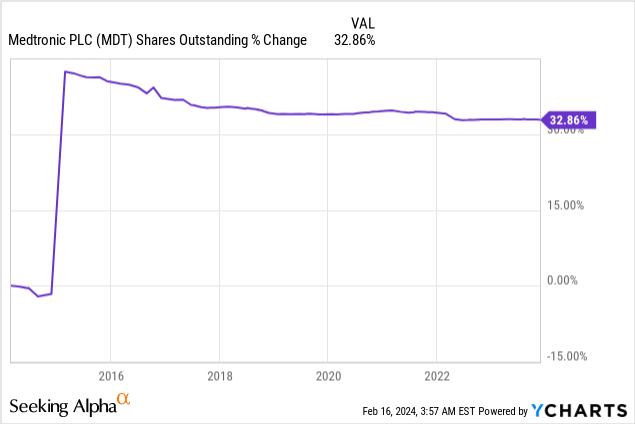

In addition to dividends, Medtronic has bought back its shares to return capital to shareholders, spending $4.2 billion on buybacks since FY 2021. The Covidien acquisition increased the number of shares by more than 33%, but the count gradually decreased. Buybacks support EPS growth as the company believes shares are undervalued and invests capital in reducing the share count. Buybacks are extremely efficient when shares are attractively priced, and this is the case here.

Valuation

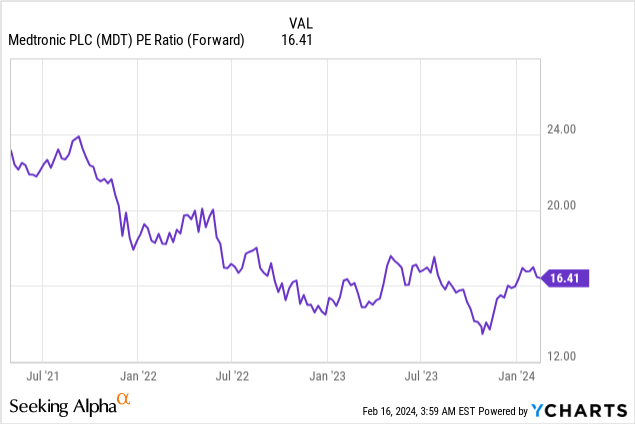

Medtronic’s current P/E ratio is 16 based on the 2024 EPS forecast. This is the lowest P/E ratio over the last twelve months. Thus, the shares look attractive. The consensus analysts forecast a 6% annual growth rate of the EPS, so the current P/E ratio seems fair. The average valuation of the healthcare sector is higher, with a P/E ratio of 17.5, implying once again that the company is attractively valued at the moment.

The graph below from Fast Graphs also implies that the shares are attractive. Over the last 20 years, Medtronic’s average P/E ratio is 19, much higher than its current P/E of 16. Moreover, the company’s historical growth rate is in line with its current forecasted growth rate of 6%. With a lower-than-average P/E ratio yet similar growth rates, Medtronic seems attractively valued based on this analysis as well.

Opportunities

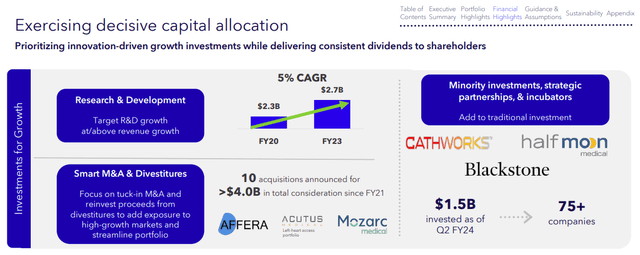

Medtronic invests in high-growth areas in the medical devices segments. It spends R&D investment on robotics and AI to develop more sophisticated tools. By allocating capital toward these fast-growing medical device markets, Medtronic is positioning itself as a leader in medical device innovation. The company increases R&D and uses M&A spending to improve margins with innovative products. Following the Covidien acquisition, the company focused on smaller acquisitions ($4B for ten companies since 2021) to enhance its value proposition. This trend began beforehand, for example, when the company acquired Mazor Robotics for almost $2B in 2018.

“We’re decisively allocating capital into fast growth medtech markets and fueling innovative technologies in areas like robotics, AI, and closed-loop systems that will drive our growth over the next decade.”

(Geoff Martha, Chairman and Chief Executive Officer, Q2 2024 conference call)

Medtronic’s pipeline of products across its portfolio is robust. The company has achieved mid-single-digit revenue growth, driven by new launches and several recent regulatory approvals. Specifically, the diabetes segment accelerated to high-single-digit growth. This segment is the fastest growing with a presence in various developed and emerging markets, and the pipeline in this segment is likely to be a growth engine. While still small, the diabetes segment is fast growing and has excellent potential for double-digit growth and increase the company’s global presence.

“Our new product launches are performing well and driving growth across many businesses…combined with several recent regulatory approvals, give us confidence in our ability to continue delivering dependable growth.”

(Geoff Martha, Chairman and Chief Executive Officer, Q2 2024 conference call)

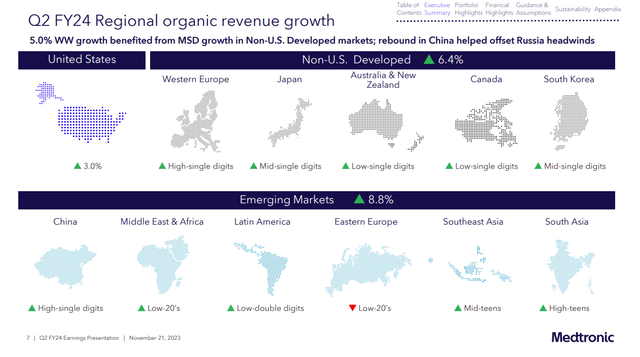

Another growth opportunity is Medtronic’s strategic focus on expanding its global reach, especially in emerging markets. The company reported a 9% growth in emerging markets, with notable increases in the Middle East and Africa (low-20s growth), South Asia (high-teens growth), Southeast Asia (mid-teens growth), and Latin America (low-double-digit growth). This geographic diversification and penetration into new markets are crucial for growth. It gives the company an opportunity to enter new markets with less competition, and protects it from relying too heavily on several markets. With emerging markets accounting for 18% of sales, achieving ~9% growth can help the company diversify and leverage its growth engines.

“Emerging markets grew 9%…with low-20s growth in the Middle East and Africa, high-teens growth in South Asia, mid-teens growth in Southeast Asia, and low-double-digit growth in Latin America.”

(Karen Parkhill, Chief Financial Officer, Q2 2024 conference call)

Risks

Medtronic’s most critical risk is regulations and reimbursement from insurance companies (public and private). Medtronic has to secure reimbursement rates from insurers and cope with a regulatory environment that may delay new products. It is critical as Medtronic is focused on innovative tech like the Ardian Symplicity Renal Denervation System. The outcome of these efforts is crucial for adopting new technologies and devices.

“The ramp is going to be highly gated by reimbursement…we’re working hard on reimbursement. It’s really critical for the ramp of this technology.”

(Sean Salmon, EVP and President, Cardiovascular Portfolio, Q2 2024 conference call)

The second risk is the competition. This risk can be seen in robotics. The company offers a Hugo robotic system, which deals with harsh competition in the highly competitive area of surgical robots. Medtronic is working to differentiate its offering from its peers. Its claim to fame is an open console and a modular design. The surgical robot realm is evolving and changing constantly, making it harder and expensive to compete and lead. Medtronic must keep innovating and invest significantly in R&D or lose market share quickly.

“I know we’re up against a big competitor in Intuitive in the surgical space, but we believe we’ve got a lot to offer here.”

(Geoff Martha, Chairman and Chief Executive Officer, Q2 2024 conference call)

A third risk is more of a short-term risk. It revolves around operational and supply chain challenges that make it harder for Medtronic to fulfill the demand for its products. Medtronic is working on enhancing its operations globally and strengthening the supply chain. However, it still suffers from disruptions that affect its ability to meet market demand. The company is working on a transformation of its operational model which is aimed at decreasing these risks. However, the challenges of supply chains can hurt Medtronic in the short term. Every quarter with delayed shipments is hindering sales and EPS growth.

“We’re executing on our comprehensive transformation, including enhancing our global operations, quality, and supply chain.”

(Geoff Martha, Chairman and Chief Executive Officer, Q2 2024 conference call)

Conclusions

To conclude, Medtronic is a leading player in the medical devices realm. It has solid fundamentals and promising growth opportunities. Over the last ten years, Medtronic enjoyed growing revenues and EPS. To further grow, Medtronic expands into fast-growing businesses such as robotics and AI assisted devices. As it grows, it’s returning capital to shareholders via dividends and buybacks.

However, investors must consider the risks to the investment thesis. They include regulatory challenges, supply chain disruptions, and fierce competition. Despite the risks, Medtronic’s current valuation is attractive. Medtronic is attractive when trading for 16 times its 2024 earnings. Therefore, I believe that Medtronic stock is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.