Summary:

- Medtronic is working through top-line headwinds.

- The company actually stands to benefit from incremental top-line and EPS growth over the long term.

- At 13x FY25 earnings and a 3.3% dividend yield, this price appears to be a good entry point.

JHVEPhoto

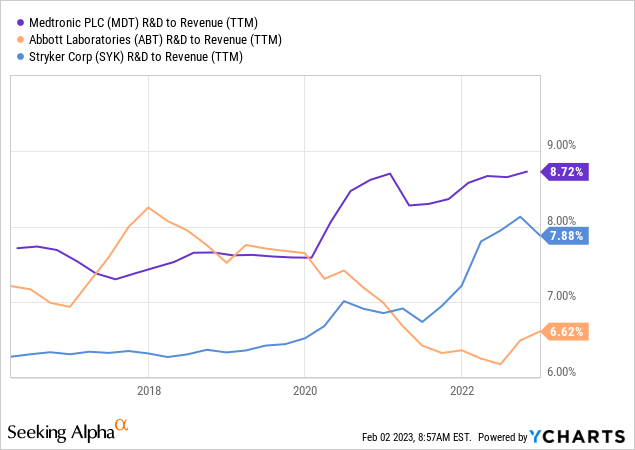

Medtronic (NYSE:MDT) is a developer and manufacturer of medical devices for cardiac, neuroscience, surgery, and diabetes. MDT has revenue exposure diversified across countries and has maintained its R&D budgets equal to or higher than its revenue growth. In other words, MDT prioritizes product innovation that spurs revenue growth, rather than pushing products into its selling channels. MDT’s R&D to revenue spend is also almost consistently higher than its two largest industry peers, which has enabled its category leadership across a variety of medical products.

MDT has also made nine acquisitions, along with varied minority interest investments and strategic partnerships exceeding $4.2 billion over the last two fiscal years. That’s a decent chunk of annualized free cash flow, which shows management has identified opportunities for growth as it divests underperforming assets. In particular, management has prioritized allocating capital to higher growth and higher margin businesses to help overall performance, but also to manage against inflation.

What has driven the most recent sell-off in the stock has been the following issues:

- post-pandemic product sluggishness (particularly elective procedures returning) and supply chain bottlenecks,

- a surgical robot, Hugo, being delayed,

- and a product recall of its HVAD pumps since mid-2022.

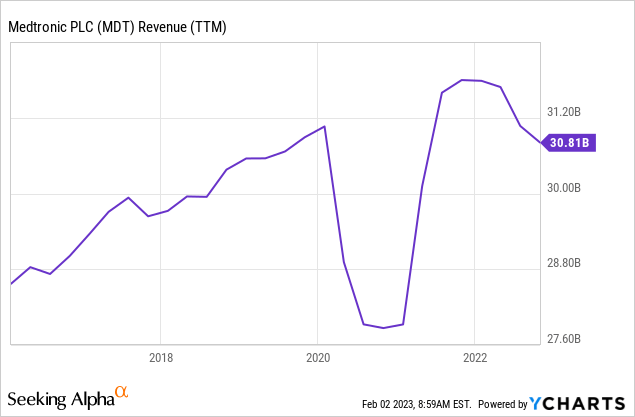

As shown below, COVID put a dent in 2020 sales and now the company is working through all three bullet points with its 2022 sales hiccup, albeit to a lesser degree.

However, MDT management discussed in early January that half its product portfolio would be growing by ~3-4% while the rest of its portfolio in the range of mid-to-high single digits over the long term. Currently, FY24 guidance remains off the table, and management outlined in the J.P. Morgan Healthcare Conference that their end markets won’t be accelerating quickly:

we’re not assuming any like big acceleration in markets, right, in the end markets. As a matter of fact, our last quarter guidance, we called out a few of the segments that we’re in that hadn’t come back all the way. We just said for the back half of our year, we’re just assuming they stay where they are at 95% or whatever it is.”

Management provides detail for longer term catalysts though. All in all, we can expect as a base case that sales will grow in the range of 3-5% as the product pipeline opens up.

MDT is also facing a number of EPS headwinds, which management has been looking to offset through expense reduction. Margins likely won’t improve, but they shouldn’t deteriorate much either due to inflationary pressures. FX headwinds should also roll off as the USD has weakened in the last three months. Despite Medtronic’s significant debt outstanding, it maintains solid credit ratings of “A” and “A3” from S&P and Moody’s, respectively. The company also has an excellent debt maturity profile, which will help maintain its low borrowing costs even as rates rise.

Valuation

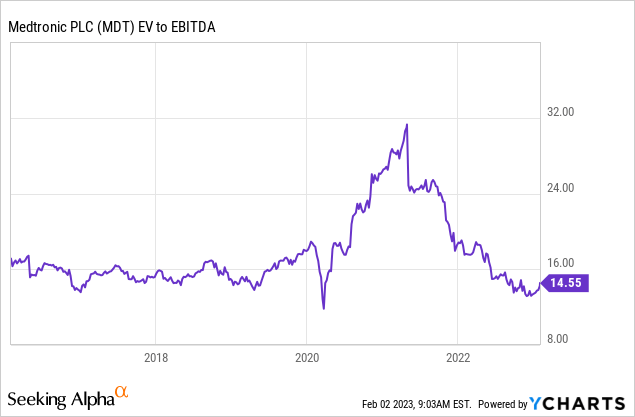

What’s unique about this opportunity is that MDT is currently selling at a valuation comparable to the lows of the COVID pandemic, when the medical device industry was in a crisis. MDT is now selling around trough EBITDA multiples, including relative to pre-pandemic performance.

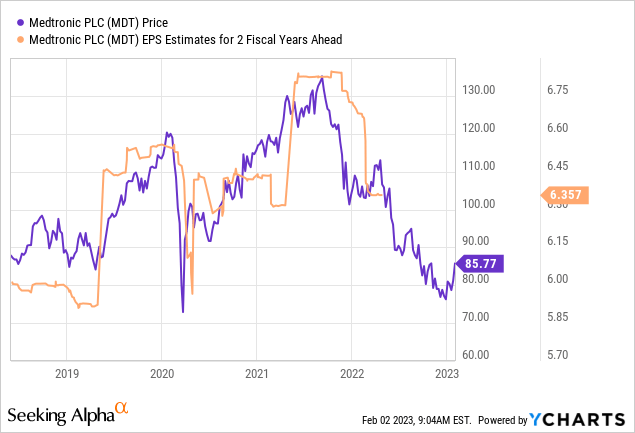

Looking forward, MDT sells for 12-15x FY25 estimated earnings depending on earnings performance, and around 13x at its mid-point. That’s not a very demanding price and the valuation becomes very compelling at lower prices.

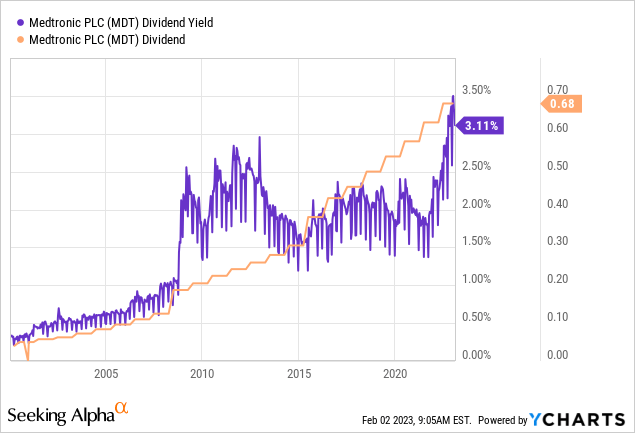

Finally, the company sports a historically high dividend yield of 3+% and has a long history of dividend increases. In fact, its dividend growth rate has been 8% per year for the last five years, which would equate to a 4.7% yield five years from now and a 7% dividend yield in 10 years. That’s not even factoring in potential returns associated with stock price appreciation.

Bottom Line

MDT is an interesting opportunity at its current stock price in the $80s to leg into a position. If the stock decides to sell off further, i.e. falls to the $70s, then that will be enough of a reason to create a full position. How do you think MDT will perform? Let me know in the comments section below. As always, thank you for reading.

Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you enjoyed this article and want more direct access to my research and ideas as well as the chance to chat with me and review my two model portfolios (dividend and long-only total return stocks) and my overall investing strategy, please note that my Marketplace Service called Equanimity Research is now live. I am very excited to foster a community of like-minded investors. You can now sign up for a two-week free trial* and there is a considerable discount for early annual subscribers.

*Free trial only valid for first-time subscribers.