Summary:

- Medtronic is a leading global medical technology company with diversified revenue streams across multiple segments.

- Medtronic has made significant strides in bolstering its product portfolio and strategic initiatives, positioning it for long-term growth.

- According to my DCF model, MDT is currently undervalued by around 26.4%. The development of EV/EBITDA confirms the result of my intrinsic value calculation.

- I think that buying MDT stock ahead of the report for fiscal Q4 FY2024 may be risky, but in the long term, my bullish bias should be justified.

Monty Rakusen

Intro & Thesis

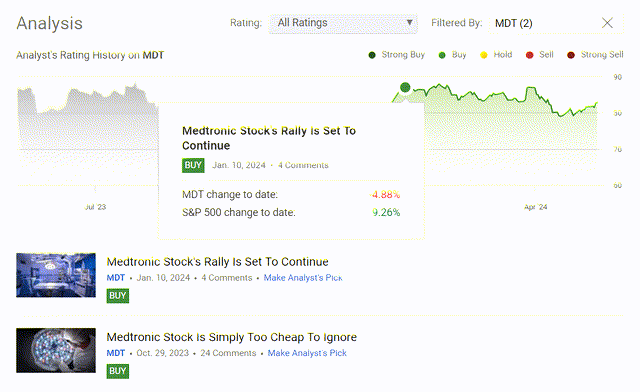

I initiated coverage of Medtronic plc (NYSE:MDT) stock in October 2023, with only one subsequent update on January 10, 2024. Up to that point, my rating remained bullish, but unfortunately, following the latest update, the stock has shown underperformance relative to the broader market, the S&P 500 (SP500) (SPX) index:

Seeking Alpha, the author’s coverage of MDT

Despite this weak performance, I’m still bullish on Medtronic and its prospects. I think that buying MDT stock ahead of the report for fiscal Q4 FY2024 may be risky, but in the long term, my bullish bias should be justified.

Why Do I Think So?

I propose to look at the company first from the perspective of its business organization, then move on to an analysis of the latest financials, and then preview the coming quarter.

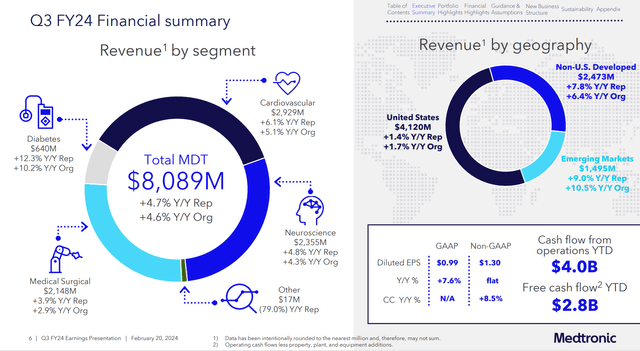

Medtronic is a leading global medical technology company headquartered in Minnesota, whose expertise spans across various medical device categories, encompassing cardiac rhythm management, spinal and surgical navigation, diabetes management, neurological treatments, and vascular therapies, as well as cardiac surgery. MDT’s revenue streams are diversified across multiple segments and end markets – here are the main 4 of the 5 operating segments MDT reports for:

-

Cardiovascular (36.2% of total sales): This is Medtronic’s largest segment, focusing on products for diagnosing and treating heart rhythm disorders, heart failure, and vascular diseases (pacemakers, implantable cardioverter defibrillators (ICDs), stents, and balloons);

-

Diabetes (7.9%): Products for managing diabetes, including insulin pumps, continuous glucose monitoring systems, and blood glucose meters.

-

Medical Surgical (26.6%): Products for various surgical procedures, such as staplers, energy devices, and instruments; it also includes treatments for respiratory, gastrointestinal, and renal disorders.

-

Neuroscience (29.1%): Products for treating neurological disorders, including spinal cord stimulators, deep brain stimulators, and pumps for delivering medication to the central nervous system.

In the last quarter, each of the above segments recorded positive sales growth, resulting in consolidated growth of 4.68% YoY in Q3 FY2024.

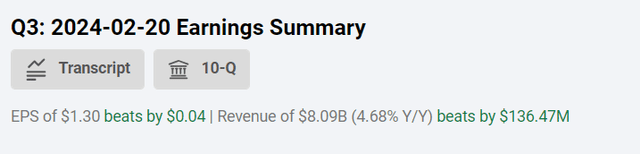

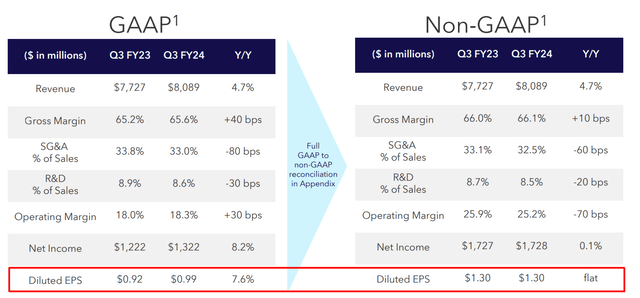

The strength in top-line amid reasonable cost management helped Medtronic exceed the consensus forecasts not just in terms of sales, but also in terms of EPS: MDT’s adjusted EPS stood at $1.30, surpassing consensus estimates by $0.04, with no year-over-year change.

What was noteworthy is that MDT’s GAAP gross margin expanded to 65.6% (+40 b.p. YoY), while the SG&A and R&D expenses as of sales declined by 80 and 30 basis points YoY, respectively, thanks to operational efficiencies. So based on that the EPS was actually up YoY by 7.6% on a GAAP basis:

MDT’s IR materials, the author’s notes

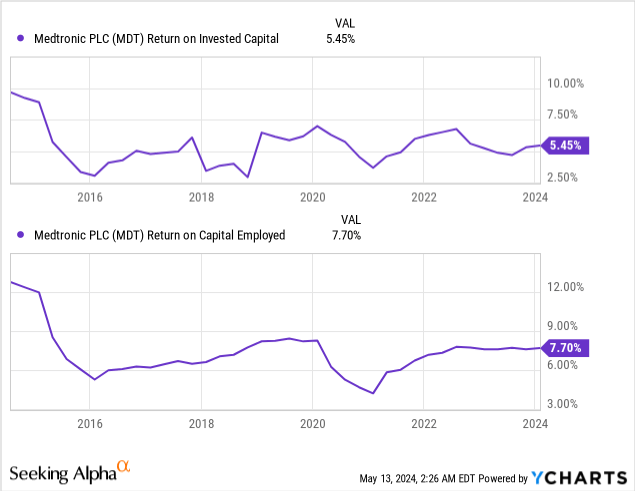

Overall, the company’s profitability appears to be resilient. MDT’s ROIC of 5.45% still leaves a lot to be desired, but in my opinion, has a pretty good upside potential from the current level.

I think about the profitability expansion because Medtronic has been making significant strides in bolstering its product portfolio and strategic initiatives throughout fiscal 2024. Among its notable developments, the FDA approval of the Evolut FX+ transcatheter aortic valve replacement (TAVR) system stands out, offering “a breakthrough solution for treating symptomatic severe aortic stenosis.” This innovative system not only broadens coronary access across diverse patient anatomies, including younger demographics, but also ensures optimal valve performance. Economically, it’s a great product addition, as the addressable market’s (the global aortic stenosis market) size is expected to reach almost $17 billion by 2030, from $8.33 billion last year (that’s a CAGR of 10.5%), according to Coherent Market Insights. Additionally, Medtronic’s pursuit of cutting-edge technology is evident in its FDA premarket approval application for the PulseSelect PFA catheter, poised to “revolutionize cardiac ablation as one of the pioneering pulsed-field catheters in the U.S. market.” According to Global Market Insights research, the global cardiac ablation market is going to experience a CAGR of ~13.5% over the next decade, so this is an additional opportunity for MDT to continue to accelerate its growth, in my opinion.

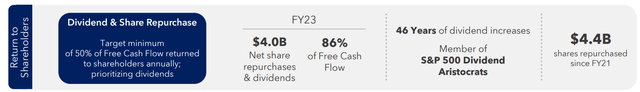

It cannot be overlooked that Medtronic is one of the world’s leading companies in the development of advanced surgical devices. MDT recently launched the Hugo robotic system for soft tissue surgery in Europe. Hugo’s versatility also extends to its participation in U.S. studies for urology and hernia procedures that promise breakthrough results in minimally invasive surgery. In addition to these groundbreaking innovations, the ongoing launch of the MiniMed 780G, an algorithm-driven insulin delivery system, underscores Medtronic’s dedication to innovation in diabetes care. This strategic move has not only led to a remarkable 10.2% increase in revenue in Q3 2024 in the Diabetes segment but also underscored Medtronic’s proactive approach to addressing critical healthcare needs. Also, with the FDA approval of the Symplicity Spyral Renal Denervation (RDN) system for blood pressure control, Medtronic is poised to gain even out of the global blood pressure monitors market’s share, which is projected to exhibit a CAGR of 8.8% during 2023-2030. In addition, Medtronic’s strategic reorganization, highlighted by the exit of the unprofitable ventilator product line within the Patient Monitoring & Respiratory Interventions (PMRI) business, reflects a prudent refocusing of resources on more promising ventures. This strategic decision, combined with the consolidation of the remaining PMRI businesses into the Acute Care and Monitoring unit, in my opinion, along with shifting the focus to profitable segments should allow MDT to continue to increase the volume of absolute shareholder returns in the foreseeable future. Today, the company boasts “dividend aristocrat” status, having raised its dividend for 46 years and also taken $4.4 billion worth of stock off the market since 2021.

I think Medtronic will continue to raise dividends smoothly against the backdrop of monetizing its strong pipeline, and also buying back its stock from the market, at least while they’re as cheap as they are today.

Why do I say that the MDT’s stock is undervalued?

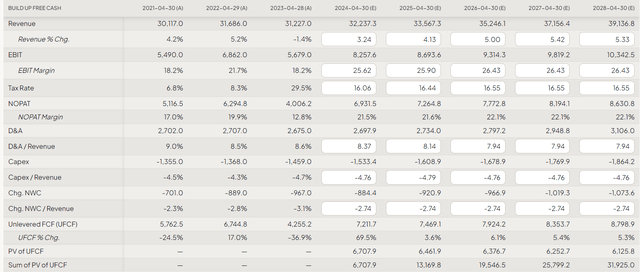

Let’s try to estimate MDT through a simple DCF model. As a basis for the forecast, I take the sales consensus for the next few years and also assume that the EBIT margin only rises to 26.43% by 2026 and remains there until the end of the forecast year (FY2028). Focusing on the average value of D&A-of-sales and CAPEX-to-sales in recent years and also assuming a systematic increase in net working capital as in the last three years, I arrive at the following forecast values for FCFF:

FinChat, MDT, the author’s notes

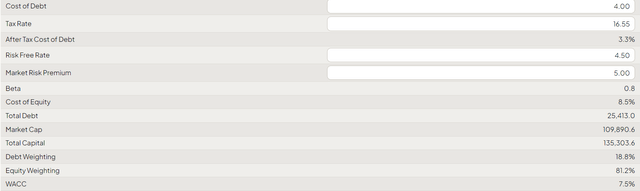

Assuming borrowing costs of 4%, an MRP at a standard 5% by default, and a risk-free interest rate of 4.5%, I obtain a WACC of 7.5% – an acceptable value in my opinion.

FinChat, MDT, the author’s notes

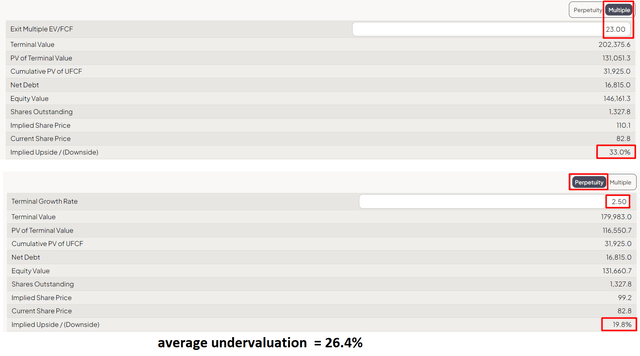

As I often repeat in my articles where I use DCF as a valuation tool, the calculation of the terminal value is always the most difficult issue. In the case of MDT, we can look at the terminal value from two angles: the exit multiple (EV/FCF) and Gordon’s g-rate (growth in perpetuity).

In the first option, I assume that MDT should trade at 23x EV/FCF, as this would correspond to the historical lows – I assume that the company’s business cycle is in the “late stage” in 5–8 years.

TrendSpider Software, MDT, the author’s notes

In the second option, I assume that MDT’s growth will fall to 2.5% in perpetuity – this also indicates the maturity of the company.

So, here are the results of both options:

As you can see, the company is currently undervalued by around 26.4% according to my DCF model.

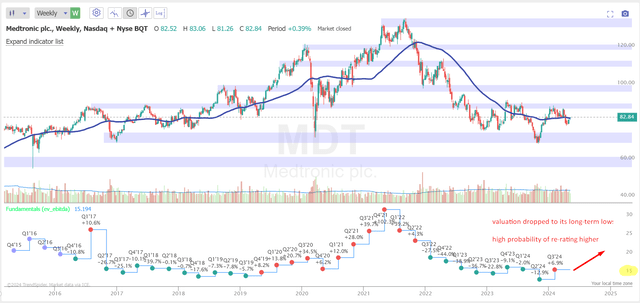

If we look at the current MDT multiples, we’ll see that MDT’s EV/EBITDA ratio started to recover gradually after many months of multiple contraction, but is not yet reaching historical averages. All this once again confirms my argument that there is a serious underestimation.

TrendSpider Software, MDT’s weekly chart, the author’s notes added

At this point, let’s assess the current state of affairs. Fundamentally, the company is showing promising signs. Profitability isn’t at the top of the industry, but it’s on the way up. In addition, the company has a solid pipeline for future projects and a high potential for monetizing its existing products. As we approach the release of the Q4 FY2024 report, the company’s valuation appears discounted and quite cheap. So there is the possibility that stock growth will pick up in the foreseeable future – it mainly depends on whether the upcoming financial print exceeds expectations and/or the company’s management delivers more optimistically than the market anticipates. So now let’s take a closer look at the market positioning and review the results.

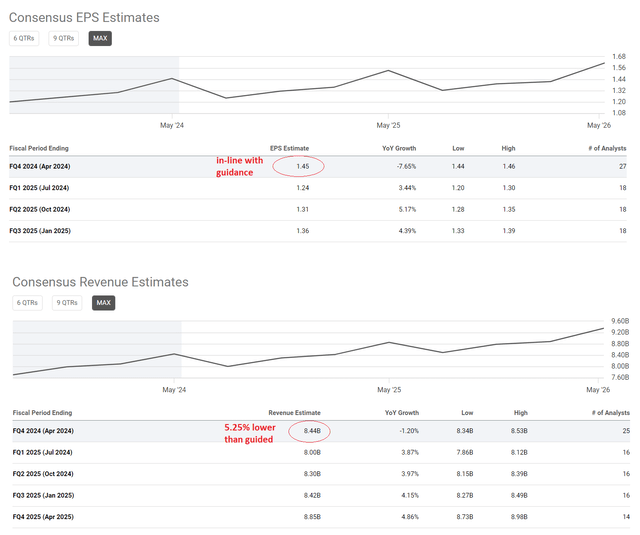

First off, let’s take a look at what MDT’s management guided for:

For the fourth quarter, we’re expecting organic revenue growth to be in the range of 4 to 4.5%. On a comp-adjusted basis, this is an acceleration from the third quarter, as we continue to ramp up our recent product launches. We expect adjusted EPS of $1.44 to $1.46. And, regarding currency, based on recent rates, we’re seeing an unfavorable impact of 7% on full-year EPS, including an unfavorable 5% impact in the fourth quarter.

Source: Management’s Q3 FY2024 commentary, emphasis added

So if the actual results come in the middle of the above guidance, we should see ~$8,908 million in sales and $1.45 in adjusted EPS. And if the market consensus for earnings per share today is exactly $1.45, then Wall Street is assuming a revenue figure that is far below management’s forecasts.

Seeking Alpha, MDT, the author’s notes

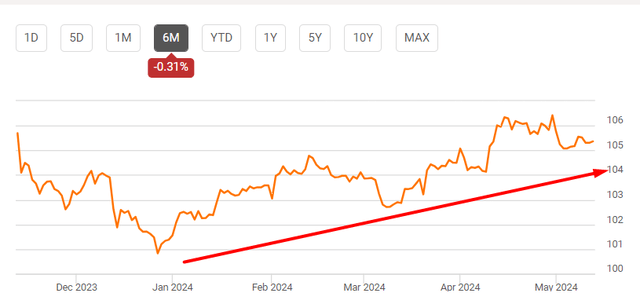

In my opinion, the main risk for MDT’s Q4 is the exchange rate development, which could have a more negative impact than management had originally expected. Especially considering that the US dollar index (DXY) increased by more than 5% since January 2024 – that was definitely a headwind for MDT in the fourth quarter of fiscal 2024.

SA data, DXY, the author’s notes

Also among the most important risks, Medtronic also faces fierce competition as it tries to defend its market share advantage from competitors who are expanding its distribution and product offering.

It is therefore difficult to say how Q4 performance will actually turn out – there are too many uncertainties, and the current market consensus does not underestimate (and at the same time does not overestimate) the prospects for EPS.

The Verdict

Despite many short-term uncertainties – especially in connection with the Q4 FY2024 expected on May 23, 2024 – Medtronic seems to me to be an interesting long-term pick.

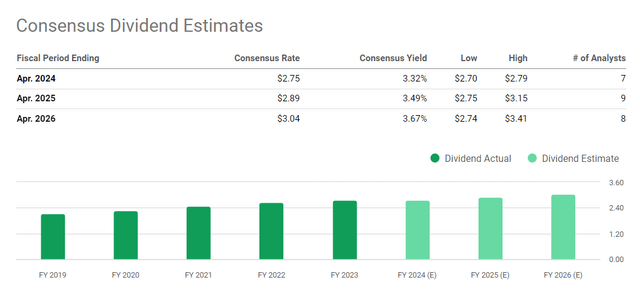

First, the business fundamentals are improving, and the company clearly has an upside in terms of profitability and margin expansion. Secondly, the company’s undervaluation is at a fairly comfortable level after MDT’s multiples have fallen sharply since the end of 2021 and have not yet risen again. Third, Medtronic pays a dividend of more than 3% per year and continues to increase it – the consensus suggests that this will continue for at least the next three years:

Seeking Alpha, MDT’s Dividend Estimates

That’s why, based on a combination of factors, I reiterate my “Buy” rating today.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!