Summary:

- Medtronic is seeing a decent rebound to its topline, as the healthcare segment recovers.

- Management is transforming the company through cost reductions and investments in high growth and synergistic areas.

- The stock pays a decent dividend and appears to be value priced at present.

turk_stock_photographer

Higher interest rates have caused plenty of indigestion for the market, as reflected by performance over the past few weeks.

Banks in particular were hit hard on March 9th, when SVB Financial Group (Silicon Valley Bank (SIVB)) announced an equity raise to shore up its balance sheet, as its prior investments in lower yielding government bonds have lost substantial value amidst a high rate environment.

Investors seeking shelter from leveraged banks may want to consider financially sound companies that make real products that are essential in nature.

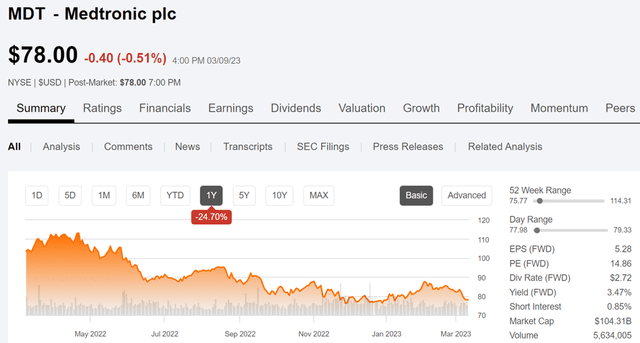

Such I find the case to be with Medtronic (NYSE:MDT), which has been no stranger to volatility over the past 12 months, with shares trading near their 52-week low at present. Let’s explore what makes now a good time to pick up this high quality stock on the cheap.

Seeking Alpha

Why MDT?

Medtronic is a medical device giant with a presence in over 150 countries, generating $31 billion in total revenue over the trailing 12 months. Its broad array of products includes pacemakers, stents and insulin pumps, treating 70 various health conditions. Its patent base and track record of medical innovation give it pricing power and helps to insulate it from headwinds in any one particular product category or geography.

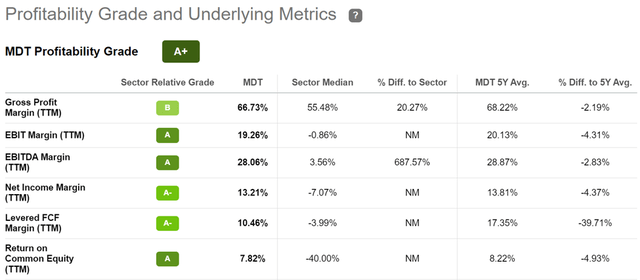

MDT’s wide reach and innovative patents in the essential healthcare space enables it to charge a premium for its products. This is reflected by its strong gross and EBITDA margins of 67% and 28%, respectively, comparing favorably to the overall healthcare sector. As shown below, MDT scores an A+ for profitability.

Seeking Alpha

Meanwhile, MDT saw its organic revenue rise by 4.1% YoY during its fiscal third quarter, landing ahead of expectations, and it also saw revenue rise sequentially over the second quarter. This was driven by strength in MDT’s bread and butter cardiology products as well as Core Spine and Neurosurgery, which saw 6% an 8% growth, respectively.

Moreover, problems such as supply disruptions and hospital staffing shortages have eased, and management expects these headwinds to continue to dissipate over the course of this year.

While MDT isn’t out of the woods yet, I believe the long-term thesis is intact, as management continues to pivot the company towards high growth areas while also focused reducing complexities, which should result in cost reductions. Looking ahead, management plans to maintain its leadership position in its core businesses, while also moving into high growth and synergistic businesses, as noted during this month’s industry conference:

Where we have our three largest businesses that are market leading franchises, in cardiac rhythm, in surgical innovations, and in spine, and so those market leading businesses, our focus is on growing those in line with the company average. And so, that’s the foundation of the formula.

And then we’ve got very high growth market opportunities and businesses that we add on top of that, and there are five areas. It’s neurovascular, it’s surgical robotics, it’s cardiac ablation, it’s diabetes, and neurovascular. So, we’re going to add those on top.

We’ve got a group of synergistic businesses, and those synergistic businesses, in the aggregate, were focused on growing at least in line with the company average. So, we think about that growth formula, as an important way for us to ensure that we’re delivering that durable mid-single digit top line growth going forward.

Importantly, MDT carries a strong A rated balance sheet with a net debt to TTM EBITDA of 1.96x. I would expect for this ratio to trend down towards the 1.7x level in the near to medium term, as margin pressures ease, thereby improving the EBITDA part of the equation.

Plus, MDT carries plenty of liquidity, with $11.1 billion worth of cash and short-term investments on hand, giving it plenty of leeway in the current high interest rate environment. This also supports the 3.5% dividend yield, which comes with a reasonably low 51% payout ratio, an 8.1% 5-year CAGR, and 9 years of consecutive growth.

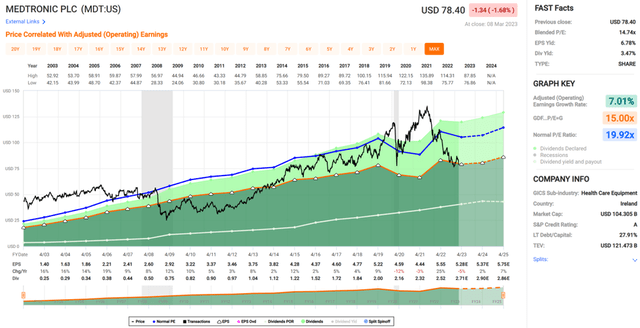

Lastly, MDT is in bargain territory at the current price of $78 with a forward PE of 14.8, sitting well under its normal PE of 19.9. Analysts expect EPS growth to start picking back up in 2025 in the high single digit and be sustained at that level thereafter. They also have a consensus Buy rating on the stock with an average price target of $92, which translates to a potential 21% total return over the next 12 months.

FAST Graphs

Investor Takeaway

MDT’s market leading products, innovative patents, and profitable margins have allowed it to stay ahead of the competition. While its recent fundamentals have been hampered by market forces largely outside of its control, these issues are starting to subside and should allow MDT to return to its long-term average of mid-single digit top line growth.

Plus, with a strong balance sheet and plenty of liquidity on hand, MDT is well positioned for the current interest rate environment. It could also come out the other side as a strong enterprise with focus on cost efficiencies, growth and synergistic areas. As such, MDT could be a great value buy at present for long-term dividend growth investors.

Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!