Summary:

- Shares of Medtronic look to still be a buy near their 52-week high.

- The medical device maker’s net sales climbed in the second quarter while non-GAAP diluted EPS dipped slightly.

- Medtronic enjoys an A credit rating on a stable outlook from S&P.

- The medical device manufacturer looks to be trading at a 21% discount to fair value.

- Medtronic could be positioned to outperform the S&P 500 in the next 10 years.

A surgical team operates on a patient in the OR. JohnnyGreig

My investing strategy is to buy excellent businesses at fair valuations or better. What I mean by excellent is companies that have decades-long dividend growth streaks, a track record for leadership within their industry, and wide moats.

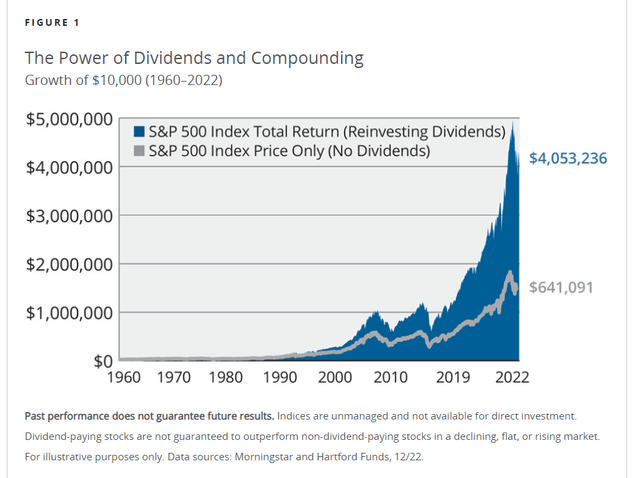

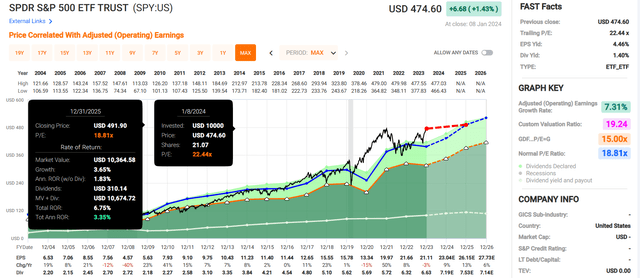

Why do I gravitate toward dividend growers? The answer is quite simple and is illustrated above. Over 62 years, reinvested dividends accounted for approximately 84% of the S&P 500’s (SP500) total returns. Put another way, a $10,000 investment in the S&P 500 would have been worth $4.1 million at the end of 2022 with dividends reinvested – – 6.3X the amount the same investment would have been worth without dividends reinvested.

Today, I’ll be taking the opportunity to discuss why Medtronic (NYSE:MDT) comprises 1% of my dividend growth stock portfolio and is my 40th largest holding. Please allow me to examine the company’s fundamentals and valuation to outline why I am initiating a buy rating on the medtech juggernaut.

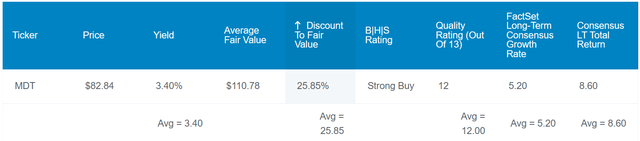

Dividend Kings Zen Research Terminal

Medtronic’s 3.1% dividend yield is enough to register at twice the 1.5% yield of the S&P 500, so I like the above-average starting income that it provides. But my interest in the company doesn’t end there.

Medtronic’s 51% EPS payout ratio is reasonably lower than the 60% EPS payout ratio that rating agencies view as safe for the medtech industry.

The company is also well-capitalized, with a 26% debt-to-capital ratio. For context, that’s comfortably below the 40% debt-to-capital ratio that rating agencies prefer from Medtronic’s industry.

For these reasons, it shouldn’t come as a shock to learn that S&P rates Medtronic’s long-term debt an A on a stable outlook. That implies the chance of the company defaulting on its debt in the next 30 years is merely 0.66%. Taking this one step further, the probability of Medtronic remaining a going concern into 2054 is 151 out of 152.

This is why the risk of the Dividend Aristocrat cutting its dividend in the next average recession stands at just 0.5% – – the lowest probability allowed in the Zen Research Terminal. Medtronic’s 1.05% risk of a dividend decrease in the next severe recession is just above the floor of 1% for dividend payers in our coverage universe.

Dividend Kings Zen Research Terminal

Medtronic’s valuation is another appealing characteristic. Using its historical dividend yield and P/E ratio as a guide, shares of the medical devices company could be worth $111 each. Compared to the $87 share price (as of January 9, 2024), this suggests shares of Medtronic are trading at a 21% discount to fair value.

If the company can meet the analyst growth consensus and return to fair value, here are the total returns that it could generate in the next 10 years:

- 3.1% yield + 5.2% FactSet Research annual growth consensus + 2.4% annual valuation multiple expansion = 10.7% annual total return potential or a 176% 10-year cumulative total return versus the 8.6% annual total return potential of the S&P or a 128% 10-year cumulative total return

A Solid Second Quarter

Before diving into Medtronic’s operating results for its fiscal second quarter ended October 27, an overview of the business would be helpful. The company’s product portfolio includes 46,000 patents, which serve a total of more than 74 million patients in over 150 countries each year.

Medtronic operates in the following four segments:

- Cardiovascular: This segment designs, develops, and sells products that help diagnose, treat, and manage heart failure and heart rhythm disorders. These products include implantable devices and leads. The cardiovascular segment accounted for $11.6 billion or 37.1% of Medtronic’s total net sales in fiscal year 2023.

- Medical Surgical: The segment sells a variety of products, such as wound closure products, robotic-assisted surgery products, ventilators, and minimally invasive gastrointestinal therapies. The medical surgical segment contributed $8.4 billion in net sales to Medtronic’s total net sales base of $31.2 billion for the fiscal year 2023.

- Neuroscience: The products sold by this segment are used by spinal surgeons, neurosurgeons, orthopedic surgeons, and pain management specialists. Neuroscience segment products include spinal cord stimulation and brain modulation systems, coils, and flow diversion products. The segment made up $9 billion of Medtronic’s total net sales in fiscal year 2023.

- Diabetes: This segment sells products aimed at treating type 1 and type 2 diabetes, such as insulin pumps and continuous glucose monitoring systems (all details sourced from pages 6-12 and 66 of 204 of Medtronic’s 10-K filing).

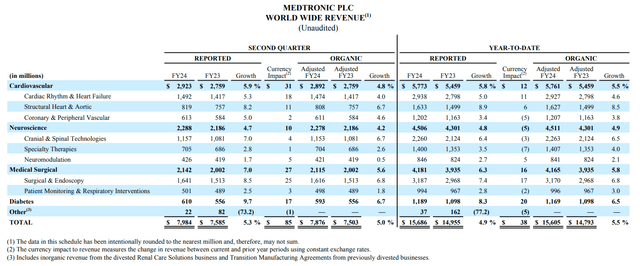

Medtronic Q2 2024 Financial Statements

Medtronic’s net sales edged 5.3% higher year-over-year to $8 billion during the second quarter. The Ireland-based company’s topline results came in $80 million ahead of the analyst consensus.

Medtronic’s net sales growth was fueled by strength throughout its business. For one, the company’s cardiovascular segment net sales increased by 5.9% over the year-ago period to $2.9 billion in the second quarter. Also, Medtronic’s neuroscience segment net sales edged 4.7% higher year-over-year to $2.2 billion for the quarter. Third, the company’s medical surgical segment grew net sales by 7% over the year-ago period to $2.1 billion during the quarter. Finally, Medtronic’s diabetes segment net sales surged 9.7% higher year-over-year to $610 million in the quarter.

Aside from volume growth for the second quarter, the company’s more recent product launches are paying off. This was no more clear than in the diabetes segment. According to Chairman and CEO Geoff Martha’s Q2 2024 earnings call opening remarks, the ~7% organic growth rate of the segment was the highest in five years. That’s excluding the COVID comp in the fourth quarter of its fiscal year 2021. Driving this growth was the first full quarter of the MiniMed 780G insulin pump system in the U.S. This led to a 30% growth rate in U.S. pump sales over the previous quarter per Martha.

Medtronic’s non-GAAP diluted EPS fell 3.8% over the year-ago period to $1.25 for the second quarter. This topped the analyst consensus by $0.07. The company’s higher net sales base was more than offset by a nearly 190 basis point decline in non-GAAP net profit margin to 20.9% during the quarter.

Looking ahead, there are growth catalysts for Medtronic. The company’s MiniMed 780G insulin pump is the only system that makes correction boluses every five minutes according to Martha, which helps to keep users in an optimal blood sugar range more often. Continued adoption of this system should drive growth for the company moving forward.

Medtronic’s Hugo robotic-assisted surgery system also received clearance to begin its hernia indication trial in the U.S. If this is ultimately approved by the Food and Drug Administration, it could be another growth driver for the company.

Medtronic’s interest coverage ratio also remained decent at 8.6 through the first six months of its current fiscal year.

Medtronic Is On Its Way To Becoming A Dividend King

Medtronic has grown its dividend for 46 consecutive years, which puts it just four years away from achieving Dividend King status. In the last five years, the company has also compounded its dividend by 7% annually. The most recent dividend increase of 1.5% was lackluster, but dividend growth should soon accelerate again as Medtronic’s growth prospects are revitalized.

This is especially true because analysts anticipate that non-GAAP diluted EPS will come in at $5.16 in fiscal year 2024. Against the $2.76 in dividends per share that are slated to be paid, this is a 53.5% payout ratio.

Risks To Consider

Medtronic is among the most dominant medtech businesses in the world. Yet, it still faces risks that must be assessed before investing.

Medtronic’s status as an industry leader in the future depends on whether it will be able to out-innovate its competition. If the company can’t do so, it could risk losing market share to industry peers. That could weigh on the company’s growth prospects.

As evidenced by the COVID-19 pandemic, Medtronic’s results can be influenced by public health emergencies. If another pandemic were to happen, elective procedures may be delayed again. That could disrupt volume for elective procedures, which could hurt Medtronic’s results for at least a few quarters.

Finally, recalls or product liability claims are another risk. That’s because such events could harm Medtronic’s reputation and result in litigation that could put a damper on its growth potential.

Summary: Medtronic Is A Magnificent Medtech On Sale

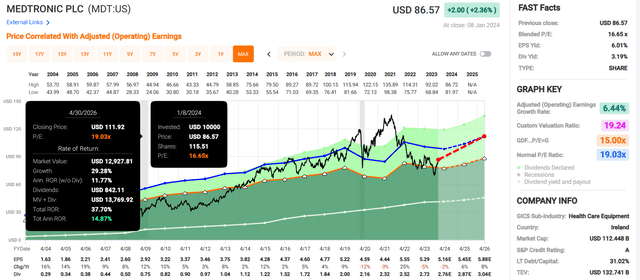

FAST Graphs, FactSet FAST Graphs, FactSet

Medtronic has all of the makings of a wonderful company. Its patent portfolio is deep and well-diversified, the dividend growth track record is top-notch, and it keeps launching new products that are gaining share in their respective markets.

Medtronic’s blended P/E ratio of 16.7 is also moderately below the normal P/E ratio of 19. If the company reverted to fair value and grew as expected, it could deliver 38% cumulative total returns through April 2026. That’s well ahead of the 7% cumulative total returns anticipated from the SPDR S&P 500 ETF Trust (SPY) through 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.