Summary:

- Medtronic has experienced several setbacks in addition to COVID-related headwinds.

- The earnings outlook is weak.

- The Wall Street consensus view on MDT has been too positive over the last several years.

- The market-implied outlook (calculated from options prices) is slightly bullish, with moderate volatility.

JHVEPhoto

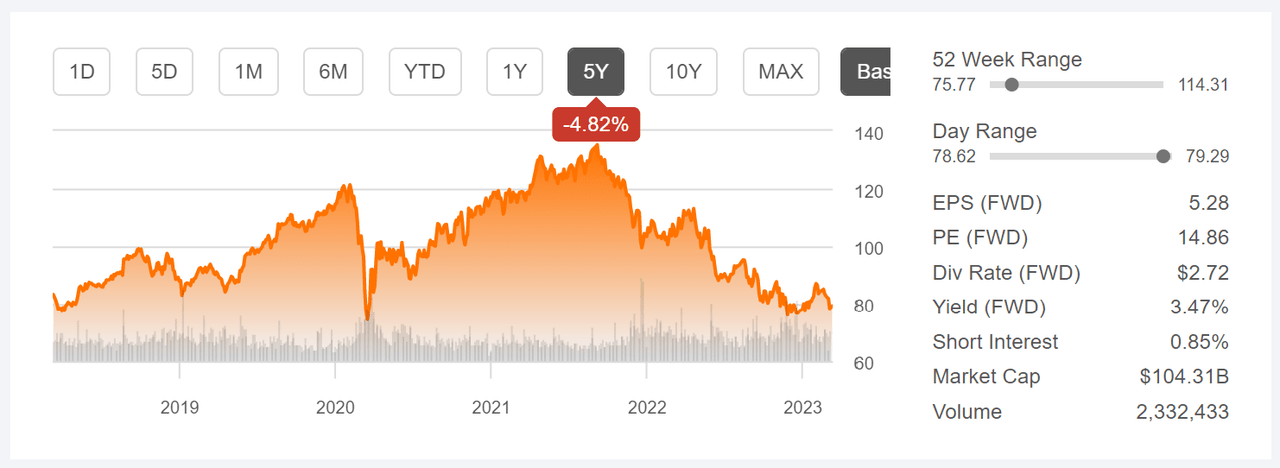

Medtronic (NYSE:MDT) is the largest medical device company in the world, with 90,000 employees in 150 countries and $31.7 Billion in revenues in 2022. After recovering steadily from the COVID-driven share decline in early 2020 to September of 2021, the stock currently trades at about 41% below the all-time high closing price of $135.17 on September 8, 2021. Medtronic has suffered some setbacks in recent years, in addition to the impacts of COVID. In late 2021, the company received a warning letter from the FDA about quality control in production of insulin delivery devices. In late 2022, trials of a treatment for hypertension, RDN, failed to perform satisfactorily. The rollout of Medtronic’s surgical robot, Hugo, has experienced delays. The company has been hampered by supply chain constraints in its medical surgery business. At the current price, the shares are not far above the levels during the worst of the COVID drawdown in early 2020. Management is implementing restructuring and cost cutting to help the company in weathering this difficult period.

5-Year price history and basic statistics for MDT (Seeking Alpha)

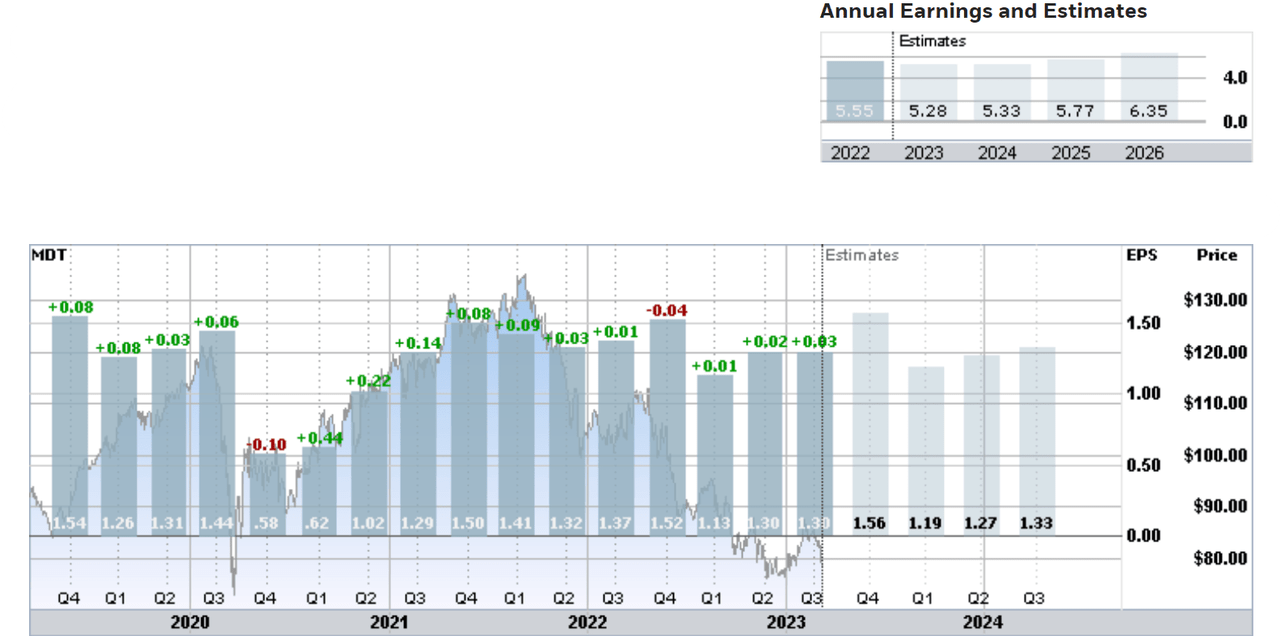

The earnings history clearly illustrates why the share price has been in decline. Earnings were on a steady upward trajectory after COVID-induced lows in Q4 of 2020 and Q1 of 2021. This growth stalled out after Q4 of 2021, however, and earnings have been in decline since then. The expected EPS for 2023 is $5.28 vs. EPS of $5.55 in 2022. The earnings outlook for 2024 is also weaker than the 2022 results. The consensus estimate for EPS growth over the next 3 to 5 years is 4.75% per year.

Historical and estimated future quarterly and annual EPS for MDT (ETrade)

MDT has TTM and forward non-GAAP P/Es slightly below 15. The GAAP TTM P/E of 25.8 is in the low range of values since 2015. A stock’s P/E is largely driven by expectations of growth. Stocks with higher potential earnings growth can support a higher P/E. The current valuation matches the weakening outlook for growth.

MDT’s forward dividend yield is 3.47% and the 3-, 5-, and 10-year dividend growth rates are 8%, 8.1%, and 7.8% per year, respectively. On the basis of the Gordon Growth Model, an expected total return of around 11.5% is reasonable. For context, the trailing 3-, 5-, and 10-year annualized total returns for MDT are -4.7%, 1.8%, and 7.9% per year, respectively.

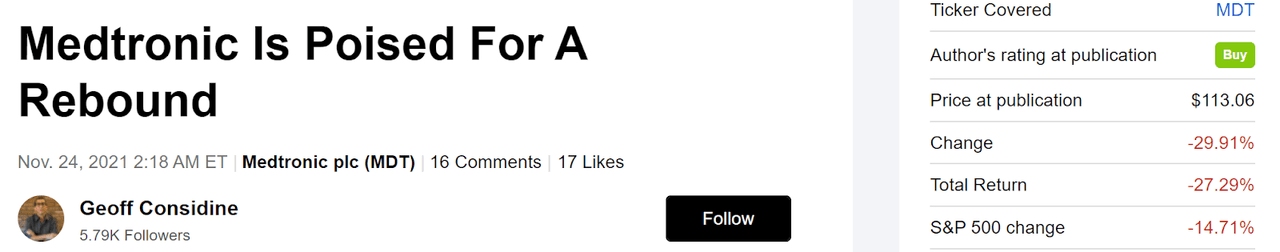

I last wrote about MDT on November 24, 2021, just after the company reported results for Q2, slightly beating expectations on earnings and missing on revenue. The Wall Street consensus rating for MDT stock was a buy and the consensus 12-month price target was 30% above the share price at that time. The market-implied outlook, a probabilistic price forecast that represents the consensus view from the options market, was bullish and the expected volatility was quite low, at about 25% (annualized). In the period since this post, MDT has significantly underperformed the S&P 500, so the positive views from Wall Street and the options market have not been vindicated.

Previous post on MDT and subsequent performance vs. the S&P 500 (Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate the probable price forecast that reconciles the options prices. This is the market-implied outlook and represents the consensus view among buyers and sellers of options. For a deeper discussion than is provided here and in the previous link, I recommend this outstanding monograph published by the CFA Institute.

I have calculated an updated market-implied outlook for MDT and I have compared this with the current Wall Street consensus outlook in revisiting my rating.

Wall Street Consensus Outlook for MDT

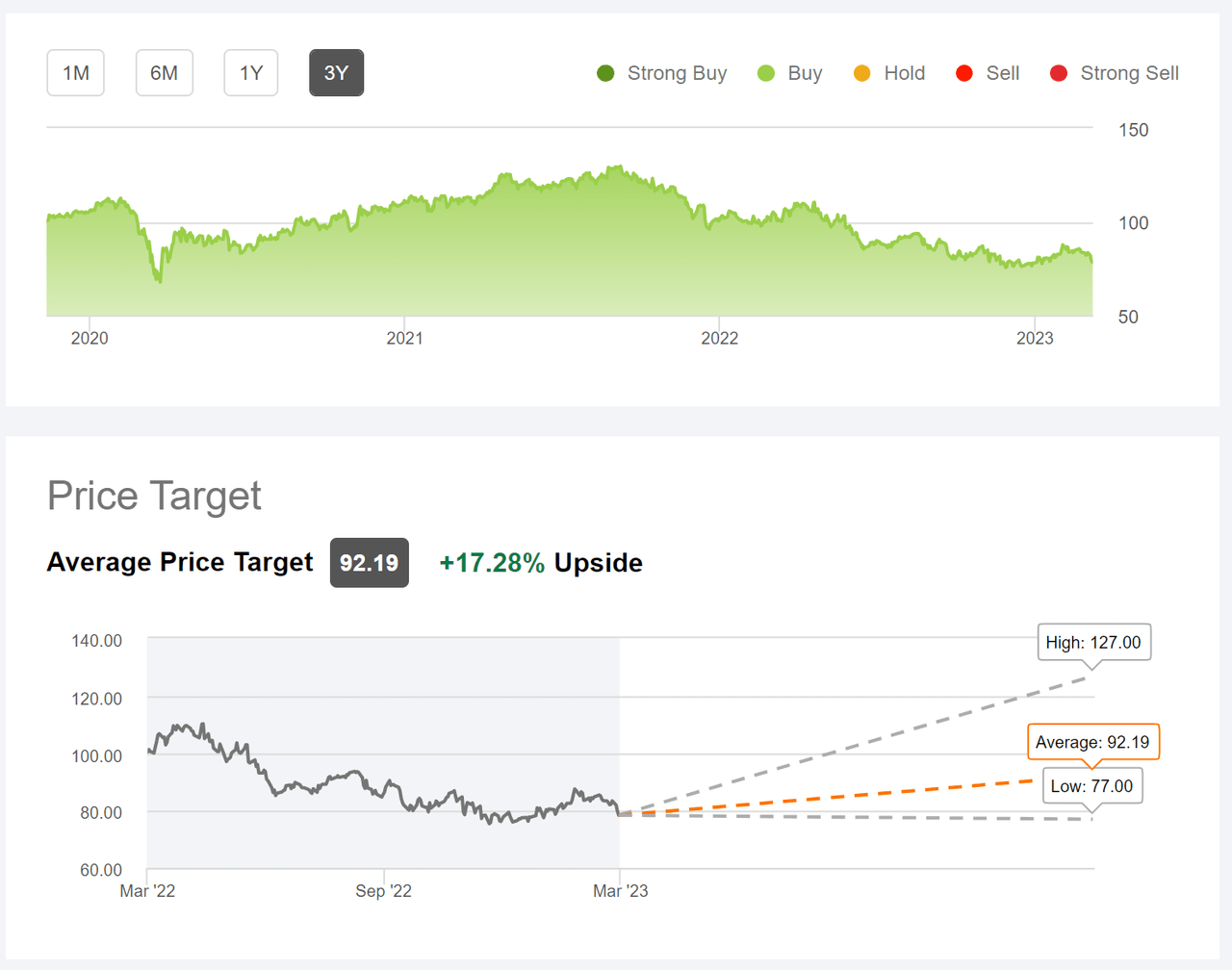

Seeking Alpha calculates the Wall Street consensus outlook for MDT by combining the views of 28 analysts who have published ratings and price targets over the past 90 days. The consensus rating is a buy, as it has been for all of the past 3 years, a period over which the annualized total return is -4.7% per year. The Wall Street consensus rating has not proven helpful in recent years. The Wall Street consensus 12-month price target is 17.3% above the current share price, which maps to a total return of 20.8%.

Wall Street analyst consensus rating and 12-month price target for MDT (Seeking Alpha)

The positive view on MDT from the Wall Street consensus outlook is tempered by the poor performance of the consensus guidance in recent years. Granted, setbacks for medical device and pharmaceutical companies resulting from trials are especially hard to predict. The long-term supply chain disruptions following COVID have also confounded predictions.

Market-Implied Outlook for MDT

I have calculated the market-implied outlook for MDT for the 10.3-month period from now until January 19, 2024, using the prices of call and put options that expire on this date. I chose this specific expiration date to provide a view through 2023.

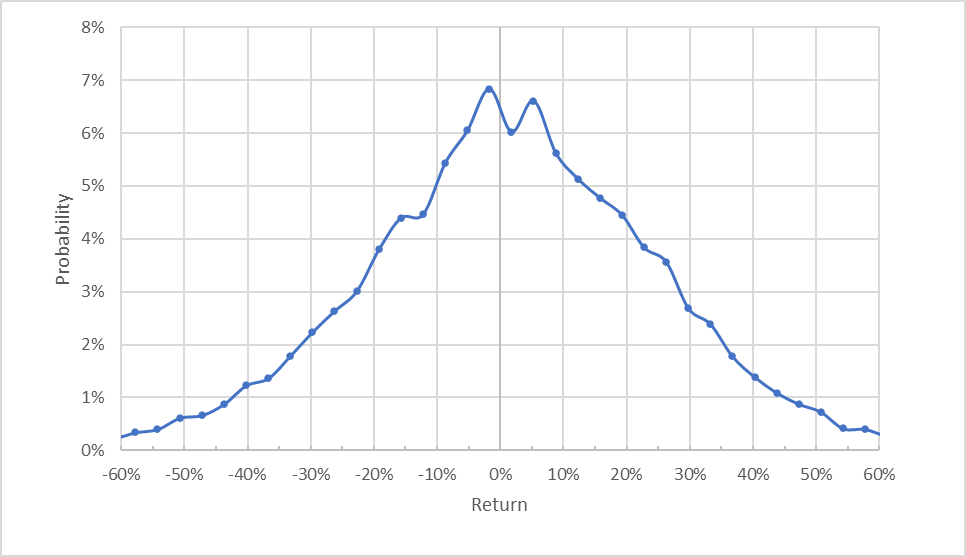

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Market-implied price return probabilities for MDT for the 10.3-month period from now until January 19, 2024 (Author’s calculations using options quotes from ETrade)

The market-implied outlook for the next 10.3 months appears generally symmetric. The expected volatility calculated from this distribution is 26% (annualized). For comparison, ETrade calculates a 24% implied volatility for the options expiring on January 19, 2024.

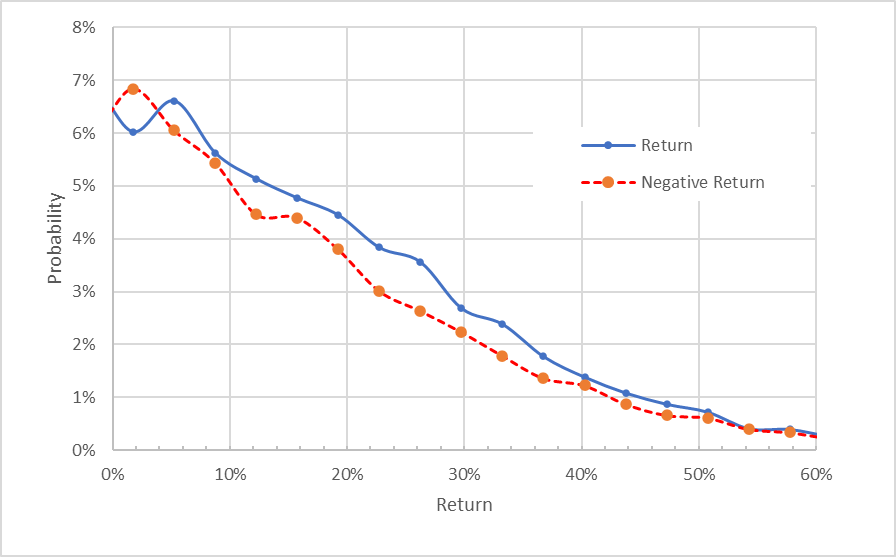

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Market-implied price return probabilities for MDT for the 10.3-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Author’s calculations using options quotes from ETrade)

This view shows that there is a small but persistent tilt in the probabilities that favors positive returns (the solid blue line is above the dashed red line over almost all of the chart above). This asymmetry in the probabilities indicates that the consensus view from the options market is slightly bullish. I note that the market-implied outlook from my previous post was also somewhat bullish. The market-implied outlook shows that the prevailing view, as reflected in options prices, favors gains over losses but the overall distribution shows that there is a large probability of having returns less than zero.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the bullish interpretation of this outlook.

One interesting way to invest in MDT is to sell covered calls. This morning, I bought shares of MDT for $79.54 and sold call options with a strike price of $80, expiring on January 19, 2024, for $7.59. This net position provides option premium yield of 9.54% ($7.54 / $79.54) in addition to the expected dividend yield of 3.42%, for total income of 12.96% between now and January 19, 2024. Buying MDT and selling the call options with a strike very close to the current share price means that I am getting paid to hold the downside on MDT. If the shares rally, the maximum I will make is 12.96%. If the shares decline, the premium income offsets the loss. The market-implied outlook indicates that there is a 74% probability that this net position will have a positive return between now and then the options expire on January 19, 2024.

Summary

Medtronic has had a rough time in the wake of COVID’s global disruptions. Earnings have recovered substantially since early 2020, but a combination of ongoing supply chain issues and setbacks in product development, trials, and production have reduced the company’s performance. The consensus outlook has earnings for 2023 and 2024 below the level in 2022. Over the next 3 to 5 years, the consensus for EPS growth is low, at 4.75% per year. Management is engaged in a restructuring plan to streamline processes and reduce costs. The Wall Street consensus rating is a buy, with a consensus 12-month price target that corresponds to expected total return of 20.8%. This is an attractive level of return for a stock with expected volatility of 26%. The problem, however, is that the Wall Street consensus has been bullish on MDT for all of the past 3 years, a period over which the stock has returned -4.7% per year (including dividends). Simply put, the prevailing opinion among the analysts has been consistently too favorable. The market-implied outlook to mid-January of 2024 indicates a slightly bullish view from the options market. While Medtronic has a large portfolio of high value products, notably including the robotic surgery system, the company is struggling to generate growth in the current environment. I am downgrading MDT to a hold. I have established a covered call position because the option premium offsets a lot of the potential declines over the rest of 2023.

Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have sold covered calls as described in the text.