Summary:

- Mr. Market has overemphasized the potential negative impacts of GLP-1 drugs on conventional diabetes care since there is no miracle one-time drug.

- Medtronic’s bottom lines have also been impacted by the elevated inflationary pressure and FX headwinds, naturally depressing its profitability metrics compared to pre-pandemic levels.

- However, we are not overly concerned since the diabetes segment only accounts for a small portion of its sales, with the PPI inflation already cooling.

- Combined with the growing demand for “complementary diabetes care” and projected expansion in its top/bottom lines through FY2026, we believe that MDT offers a compelling dividend investment thesis here.

- With the stock likely to be rerated closer to its pre-pandemic averages once the macroeconomic outlook normalizes, we are rating MDT as a Buy with a long-term PT of $101.20.

izusek/E+ via Getty Images

The Conventional Diabetes Care Investment Thesis Remains Robust

For now, the GLP-1 drug and generative AI hypes appear to have taken the stock market by storm, with many companies similarly benefitting from the boom, namely Novo Nordisk (NVO)/Eli Lilly (LLY) for the former and NVIDIA (NVDA)/Microsoft (MSFT)/Palantir (PLTR) for the latter.

The opposite is also true for companies expected to be negatively impacted, one of which is Medtronic (NYSE:MDT).

As a company that produces device-based medical therapies and services for Surgical use, Cardiovascular, Neuroscience, and Diabetes care, it is unsurprising that some have postulated a potential deceleration in its medical device demand. This is especially if GLP-1 drugs succeed in controlling diabetes.

These fears had partly triggered the MDT stock’s decline by over -20% since early 2022, with Wegovy/Ozempic launched in mid-2021 and Mounjaro approved in May 2022.

However, we believe that these fears are overblown, since these GLP-1 therapies are no miracle one-time drugs, with weight gain/diabetes usually rebounding with vengeance after a year of stopping.

In addition, the diabetes segment only comprises $610M (+5.5% QoQ/+9.7% YoY) or the equivalent 7.6% (+0.1 points QoQ/+0.3 YoY) of MDT’s FQ2’24 sales of $7.98B (+3.6% QoQ/+5.2% YoY). If anything, the segment continues to command more than decent operating margins at 16.5% (+2 points QoQ/-0.9 YoY).

The misconception has also been debunked by another medical device company, Abbott Laboratories (NYSE:ABT), with the management similarly highlighting the overblown fears of GLP-1 medications replacing the need for conventional diabetes care products:

A recent analysis of our U.S. user base showed that a growing number of Libre users are using Libre in combination with GLP-1 medications as part of a companion therapy approach for managing their diabetes. On average, those using both Libre and a GLP-1 exhibited a higher rate of use for both products, wearing Libre sensors more often and taking GLP-1 medication more frequently compared to other users.

This increase in use or better compliance is a positive sign that these users are taking an even more active role in managing their diabetes. While we traditionally think of therapy choices as having to compete against one another, this is a good example of a complementary relationship between two products that both help optimize the treatment of diabetes. (Seeking Alpha)

The same development is also observed in ABT’s global diabetes care sales of $1.47B in the latest quarter (+3.5% QoQ/+26.7% YoY), implying the growing demand for “complementary diabetes care.”

If anything, MDT’s top and bottom line driver, the Cardiovascular segment continues to record a profitable growth trend, with FQ2’24 revenues of $2.92B (+% QoQ/+6.1% YoY) and operating profits of $1.11B (+1.8% QoQ/+3.7% YoY).

The other two segments report excellent numbers as well, with Neuroscience revenues of $2.28B (+3.1% QoQ/+4.5% YoY)/ operating profits of $929M (inline QoQ/+3.1% YoY) and Medical Surgical at $2.14B (+5.4% QoQ/+7% YoY)/ $790M (+9.8% YoY/+3.8% YoY), respectively.

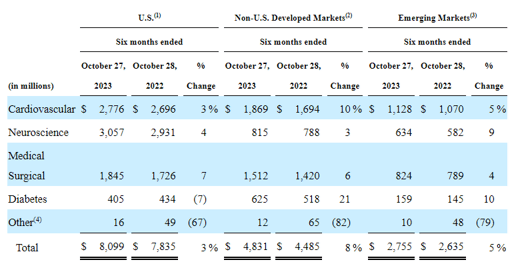

MDT’s Declining Diabetes Sales In The US

Seeking Alpha

Therefore, while MDT’s diabetes offerings have been notably underperforming in the US over the past two quarters, we are not overly concerned, since the segment’s Non-US and Emerging Markets continue to exceed expectations, well balancing the “customer attrition.”

This further exemplifies the company’s highly strategic and well-diversified offerings across different segments and geographical regions, allowing the management to sustainably deliver top and bottom line expansions thus far.

MDT Valuations

For now, MDT’s FWD P/E valuations of 15.31x and FWD Price/Cash Flow valuation of 14.71x appear to be impacted compared to its 3Y pre-pandemic mean of 17.27x/19.90x and the sector median of 18.04x/15.86x, respectively.

Part of the headwinds is probably attributed to the elevated inflation and volatile FX, contributing to its impacted gross margins of 65.6% (-0.5 points QoQ/-1.3 YoY) and operating margins of 19.3% (+0.8 points QoQ/+0.9 YoY), compared to its pre-pandemic averages of 69.6% and 21.5%, respectively.

However, with the PPI already cooling in November 2023, we may see the company’s intermediate-term headwinds moderate, allowing its profit margins to slowly return to their pre-pandemic levels, significantly aided by the management’s optimized operating expenses and supply chains thus far.

As a result, we are cautiously confident that MDT remains well positioned to achieve its long-term target of “driving durable mid-single-digit top growth, of driving leverage down the P&L, of driving a strong free cash conversion and a growing dividend, which all combined ultimately, delivers a double-digit total shareholder return.”

The Consensus Forward Estimates

The same has been estimated by the consensus over the next few years. For now, MDT is expected to generate an impressive top and bottom line expansion at a CAGR of +4% and +3.5% through FY2026, compared to its historical CAGR of +0.8% and +2.4% between FY2017 and FY2023, respectively.

Perhaps part of the headwind is attributed to the company’s impacted FCF margins of 12.7% over the last twelve months, compared to its FY2023 levels of 14.7% (-4.2 points YoY) and FY2019 levels of 19.2% (+7.1 points YoY). The reversal may prove to be detrimental indeed, given its dividend income stock status.

However, we believe that the fears are overblown since the company continues to report a more than decent TTM Interest Coverage of 8.84x, compared to the sector median of 7.84x.

This is on top of the recently raised FY2024 guidance, with approximate revenues of $32.7B (+4.75% YoY) and adj EPS of $5.16 (-2.4% YoY). This is compared to the previous guidance of $32.54B (+4.25% YoY at the midpoint) and $5.05 (-4.5% YoY) offered in the FQ4’23 earnings call, respectively.

With the impacted profitability merely attributed to the inflation and FX headwinds, we believe that MDT may outperform expectations at these depressed levels, with the stock’s valuations likely to be rerated nearer to its pre-pandemic averages once the macroeconomic outlook normalizes.

Based on its normalized P/E valuation of 17.27x and the consensus FY2026 adj EPS estimates of $5.86, there appears to be an excellent upside potential of +27.2% to our long-term price target of $101.20

Its dividend income thesis is robust as well, based on the expanded forward yields of 3.49% compared to the sector median of 1.71%, and the projected dividend per share growth at a CAGR of +4.1% through FY2026 to $3.07.

So, Is MDT Stock A Buy, Sell, or Hold?

MDT 10Y Stock Price

For now, despite the recovery of +11.8% from the recent October 2023 bottom, the MDT stock is still trading below its 50/100/200 moving averages, with it currently retesting the critical resistance levels of $79.

However, we believe that the recovery is here to stay, thanks to the raised FY 2024 guidance and the optimistic outlook for its bottom lines, as discussed above.

As a result of the highly attractive dual-pronged (prospective) returns through capital appreciation and dividend income, we are rating the MDT stock as a Buy.

Do not miss this undervalued play here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.