Summary:

- Medtronic’s stock price has dropped over the past month, making it a potential bargain in the healthcare technology sector.

- The company has shown respectable operating fundamentals, with revenue and EPS growth in the last quarter, and innovative products.

- Medtronic is well-positioned for international growth and has a strong balance sheet and well-covered dividend.

JuSun

Bargains may seem hard to come buy with market now seemingly back in risk-on mode, but I’m constantly reminded that it’s a market for stocks rather than the stock market. With the market chasing AI-related stocks, presumed ‘old economy’ companies are being left in the dust.

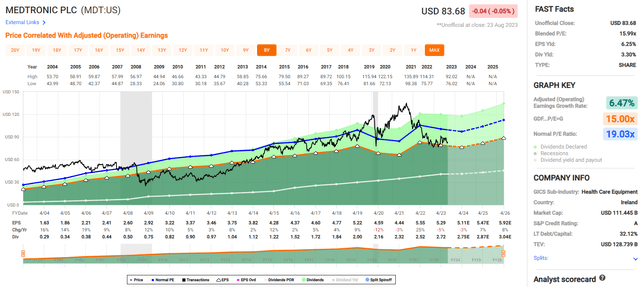

This brings me to Medtronic (NYSE:MDT), which just may be one perceived old economy stock in the healthcare technology products segment. MDT continues to trade weakly, having falling from the $90-level in recent weeks to $83. Looking farther out, MDT currently trades far below its 2-year high of $135, as shown below.

I last covered MDT here back in March, detailing its top-line growth, and while the stock price has risen by 7.5% since then, it still has a long ways to go before reaching what I would consider a normal valuation for the stock. In this article, I highlight MDT’s last reported results, outlook, and why the stock remains a solid bargain, so let’s dive in!

Why MDT?

Medtronic is a leading healthcare technology company that’s headquartered in Dublin, Ireland. It produces technologies and therapies that treat 70 health conditions and include cardiac devices, surgical robotics, insulin pumps, patient monitoring systems, and more. It has 95K employees worldwide and a presence in 150 countries.

MDT’s share price weakness belies respectable operating fundamentals. This includes fiscal first quarter (ended in July) revenue growing by 4.5% YoY and 6.0% YoY on an organic basis to $7.7 billion. Also encouraging, MDT also reported strong bottom-line results, with adjusted EPS rising by 6% YoY.

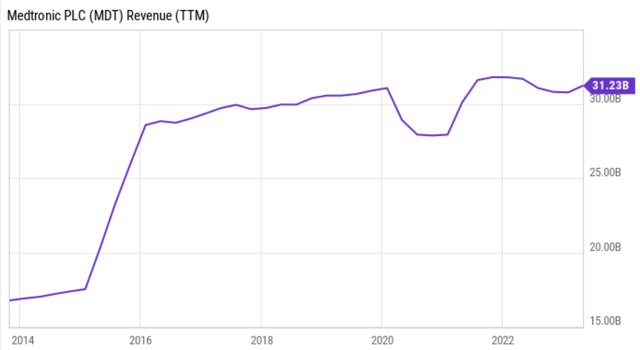

Notably, revenue growth was broad-based across businesses driven by Cranial/Spinal, Neurosurgery, and Surgical segments, whose sales grew between 5% and 7% YoY. As shown below, MDT’s sales are showing signs of a turnaround after taking a dip 6 months ago.

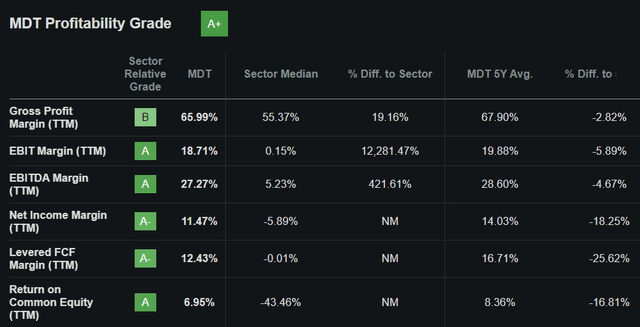

MDT is also picking up steam internationally, as non-U.S. revenue in developed markets grew by 18% YoY. Importantly, MDT has been able to maintain strong pricing power in spite of cost inflation, as gross margin remained flat compared to the prior year period at 65.9%. Other inflationary pressures are showing signs of easing as operating margin grew by an encouraging 120 bps to 16.5% during fiscal Q1. As shown below, MDT maintains a strong A+ grade for profitability with well above average margins.

Looking ahead, MDT should benefit from the U.S. seeing the largest number of approvals for medtech devices by the FDA in 10 years. It’s also innovating in the Smart Dosing market for patients living with diabetes. This includes MDT’s InPen, which is a smart insulin pen that uses Bluetooth technology and a Smartphone app to help people administer correction and meal-time insulin doses. At a recent investor conference, MDT’s CEO noted this as being a secular growth segment in a multibillion dollar market.

MDT should also benefit from secular growth in healthcare spend, as supported by a growing aging population in the U.S. and the rest of the world. According to the World Health Organization, 1 in 6 people in the world will be 60 years or older by 2030 and by 2050, the 60+ age group will double to 2.1 billion people.

Risks to MDT include potential for a future pandemic to delay elective surgeries that use its products and cause disruption to its supply chain, thereby harming margins. It could also be subject to litigation should its products malfunction and cause harm to a broad patient base. Plus, MDT does a significant portion of its business outside the U.S. and is therefore subject to currency risk from a stronger U.S. dollar.

MDT also retains a strong balance sheet with an A credit rating from S&P. This is supported by $7.88 billion in cash and short-term investments on hand and a reasonable net debt to EBITDA ratio of 1.98x. This gives MDT plenty of flexibility to invest in its business, do tuck-in acquisitions, and repurchase shares if it so chooses. This lends support to MDT’s 3.3% dividend yield with a 38% payout ratio, 9 years of consecutive growth, and a 7.8% 5-year dividend CAGR.

Turning to valuation, MDT remains a decent bargain at the present price of $83.68 with a forward PE of 16.4, sitting comfortably below its normal PE of 19. While MDT is far from being table-pounding cheap, it’s reasonably attractive considering the long-term growth prospects in the healthcare industry, the necessity-based nature of its products, and high margins. Considering all the above and the long-term annual 8% EPS growth expected by analysts, I don’t think a PE of 18 would be out of the question.

Investor Takeaway

MDT appears to be a solid bargain here at $83.68 with long-term growth prospects in the healthcare industry, secular trends like an aging population, necessity-based products, and high margins. If it can fetch a reasonable valuation of 18x earnings (which I think is fair), we’d be looking at a potential total return in the low teens based on a return to a more normal valuation and dividends alone.

Over the long-term, MDT may be able to sustain a high single digit to low double-digit total return based on the dividend and analyst expectations for ~8% annual EPS growth. This means that MDT could outperform the long-term 9-10% annual returns of the S&P 500 (SPY). As such, value and income investors may want to consider layering in at the current discounted price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!