Summary:

- Medtronic remains an attractive investment due to its diversified revenue streams, robust product pipeline and improving margins.

- MDT’s growth is driven by strong performance in Neuroscience, Cardiovascular, and Diabetes care, with significant international revenue growth and a promising product pipeline.

- Trading below its historical valuation, MDT offers a compelling opportunity for conservative investors seeking quality at a reasonably low price.

MarsBars

Navigating this market can be a tricky endeavor. For one thing, there is plenty of interest rate uncertainty given the Fed’s delicate balancing act of controlling inflation without sinking the economy into a recession.

Most recently, the recently strong September jobs report gave economists plenty to cheer for, but at the same time, throws a wrench in the thesis that interest rates may be materially cut in the near term. Plus, conflict in the Middle East further exacerbates inflationary pressures driven by volatility in oil prices.

As such, investors may be well-served by remaining conservative in their approach by picking companies with strong balance sheets and durable business models at below-average prices. This brings me to Medtronic (NYSE:MDT), which I last covered in July, highlighting its undervaluation, strong operating performance and new product opportunities.

MDT has done well for investors since my last piece, producing a 14% total return, far outpacing the 2.5% rise in the S&P 500 (SPY) over the same timeframe. In this article, I revisit MDT including recent business performance and discuss why it remains a good bargain for income and total return potential, so let’s get started!

Why MDT?

Medtronic is a healthcare technology company with products that serve 70 different health conditions and a presence in 150 countries. Its products include cardiac devices, insulin pumps, surgical tools and robots, and patient monitoring systems, among others.

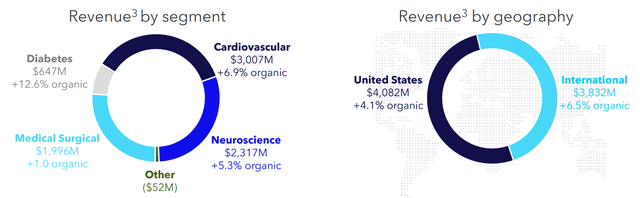

MDT’s revenues are well-diversified by segment, with roughly an even mix between Med/Surgical, Neuroscience, and Cardiovascular, with the balance going to Diabetes care. As shown below, slightly over half of revenues comes from the U.S. with the rest coming from International.

MDT continues to make good strides in growing since the last time I visited the stock. This is reflected by a respectable 5.3% YoY organic revenue growth to $8.0 billion during fiscal Q1 2025 (ended on July 26th). This was driven by strong growth across Neuroscience, Cardiovascular, and Diabetes care, which saw 5.3% 6.9% and 12.6% YoY organic revenue growth, respectively.

Moreover, International growth has picked up steam, with 6.5% YoY organic revenue growth, outpacing the 4.1% growth in the U.S. MDT hasn’t had to sacrifice margins to grow the top line, as adjusted gross margin improved by 30 bps YoY due to favorable product mix and operating margin grew by 60 bps YoY to 24.4% (constant currency) due to cost efficiencies. This contributed to adjusted EPS growth of 7.5% on an FX-neutral basis.

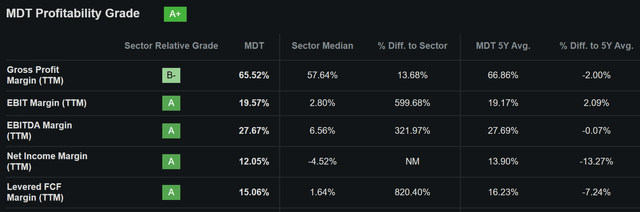

MDT’s strong, industry-leading margins contribute to its A+ score for Profitability. As shown below, this includes a high EBITDA margin of 28% and levered FCF margin of 15%, both of which sit well above the sector average.

Given the strong start to fiscal year 2025, management raised full-year revenue growth guidance to 4.75% at the midpoint of range, up from 4.5% previously. Management also expects to grow revenue by mid-single digits in the current fiscal Q2 in progress. This includes a robust product pipeline in areas like diabetes, robotics, pulse field ablation (for atrial fibrillation), and hypertension, which are positioned for strong growth in the coming years.

This is supported by the success and strong market demand for its PulseSelect launch for the treatment of atrial fibrillation, as noted by management during the recent conference call:

The PulseSelect launch has been successful, with more than 550 physicians in 20 countries having treated over 10,000 patients. To meet the strong market demand, we’re dramatically increasing our PulseSelect catheter manufacturing capacity and expanding into new accounts.

As a result, we expect PulseSelect to meaningfully accelerate our overall CAS growth rate through this fiscal year, including a strong acceleration in Q2. And then we have our differentiated Sphere-9 focal catheter. This all-in-one catheter can perform high-density mapping, as well as pulse field and RF ablations.

Meanwhile, MDT carries a strong balance sheet with an ‘A’ credit rating from S&P. This is supported by $7.8 billion cash and short-term investments and a reasonably low net debt to TTM EBITDA ratio of 2.2x, sitting comfortably below the 3.0x safe level.

Importantly for income investors, MDT yields a respectable 3.2%. MDT is a Dividend Aristocrat with 47 consecutive years of dividend raises. The current dividend rate is also well-protected by a 53% payout ratio and comes with a 5-year CAGR of 6%.

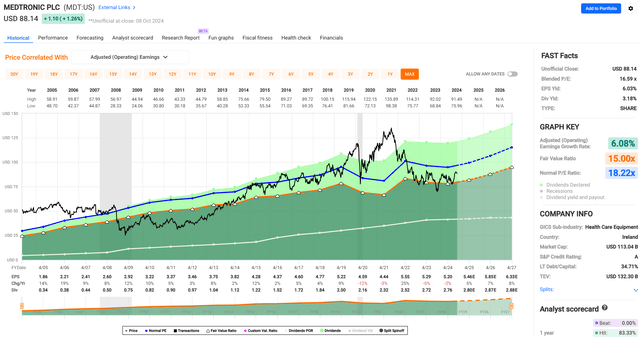

Lastly, I continue to see value in MDT at the current price of $88.14 with a forward PE of 16.2, which as shown below, sits comfortably below its historical PE ratio of 18.2.

Analysts estimate 7% to 8% annual EPS growth over the medium term, which, I believe, is reasonable considering the aforementioned pipeline and adoption of new products in the marketplace. This, combined with a 3.2% dividend yield and potential for a reversion to its mean valuation, means MDT could deliver market-beating returns from here.

Risks to the thesis include competition from peers like Abbott Laboratories (ABT), which could pressure margins. Technological innovation across the industry also means that MDT needs to consistently invest in R&D to stay atop the field. Macroeconomic risks could also put a dent on near term growth. Moreover, the GLP-1 class of weight loss drugs by Eli Lilly (LLY) and Novo Nordisk (NVO) could help patients better manage diabetes and obesity, thereby providing an alternative to MDT’s solutions.

Investor Takeaway

Medtronic remains an attractive investment for income and total return potential, supported by its strong balance sheet, diversified revenue streams, and growing product pipeline. The company has delivered solid recent top-line performance alongside improving margins.

MDT’s robust pipeline in diabetes care, robotics, and cardiac therapies positions it for continued growth. It also carries an A-rated balance sheet and is a Dividend Aristocrat. Trading below its historical valuation, MDT presents a compelling opportunity for conservative investors seeking quality at a reasonably low price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Read The Full Report on iREIT+Hoya

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.