Summary:

- Medtronic is a healthcare behemoth, developing and manufacturing medical devices for chronic diseases, with a broad and dominant portfolio of industry-leading products.

- The company has increased its dividend for 46 consecutive years, which qualifies Medtronic for its status as a vaunted Dividend Aristocrat.

- The 10-year dividend growth rate is a strong 9.8%, although more recent dividend raises have been in mid-single digits.

Just_Super/iStock via Getty Images

Medtronic PLC (NYSE:MDT) is a global developer and manufacturer of medical devices for chronic diseases. Founded in 1949, Medtronic is now a $111 billion (by market cap) healthcare behemoth that employs 95,000 people. The company reports results across four segments: Cardiovascular, 37% of FY 2023 revenue; Neuroscience, 29%; Medical Surgical, 27%; and Diabetes, 7%.

Medtronic’s product portfolio is comprised of a variety of life-saving and life-improving medical devices that include implantable defibrillators, heart valves, insulin pumps, glucose monitoring systems, pacemakers, stents, and surgical tools.

Not only is Medtronic’s product portfolio broad, but it’s also dominant. Morningstar puts it like this: “Medtronic has historically held roughly 50% share in its core heart devices. It’s also the market leader in spinal products, insulin pumps, and neuromodulators for chronic pain.”

Healthcare is one of my favorite areas of the economy to invest in. That’s because healthcare demand is uncorrelated with economic cycles. One’s demand for healthcare is uniquely tied to one’s health. If one has a serious health issue, rectifying the issue is all that matters to that person at that point in time – no matter what’s going on with the economy. Since health issues are a common feature of the human condition – human bodies slowly deteriorate as they age – there’s a constant base level of demand for healthcare purely from a human existence standpoint.

Plus, healthcare products and services usually feature inelastic demand. The spending on these products is usually non-discretionary in nature, especially if it’s a life-or-death circumstance that does not lend itself to price sensitivity or on-the-spot negotiation. If something like emergency surgery is suddenly called for, one is naturally far more concerned with survival than the exact pricing of the medical devices needed to save one’s life.

Another aspect of healthcare that is highly appealing for long-term investment? Demographic trends. First, our global population is growing. Second, people are, on average, living longer than ever before. Third, the wealth of the average person continues to rise.

A greater number of older and wealthier human beings walking around nearly guarantees more demand for quality healthcare, in general, and Medtronic’s industry-leading products with inelastic demand, in particular.

All of this is why Medtronic should continue to grow its revenue, profit, and dividend for years to come, just as it’s been doing for years already.

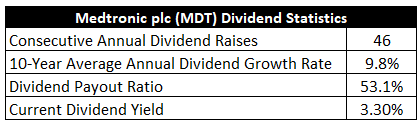

Dividend Growth, Growth Rate, Payout Ratio and Yield

To date, Medtronic has increased its dividend for 46 consecutive years. That lengthy and impressive track record easily qualifies Medtronic for its status as a vaunted Dividend Aristocrat. In fact, it’s nearly a Dividend Aristocrat twice over.

The 10-year dividend growth rate is 9.8%, and that is quite strong, although more recent dividend raises have been in the mid-single digit range.

On the other hand, the stock’s yield has been recalibrated by the market and adjusted upward in order to compensate for that slower growth rate.

The yield is now at 3.3%. If you’ve been following Medtronic for a while, you’ll notice how unusually high that yield is for this stock. For perspective on that, it’s 90 basis points higher than its own five-year average. Less growth but more yield. And for investors who lean more toward income, that might be a very acceptable trade-off.

Moreover, as I’ll delve into later, I don’t think this slowdown is permanent in nature, and a higher growth rate in the near future may force the market to readjust the yield back down to its historical norm. That kind of adjustment would require the stock price to go higher, and that’s where the near-term opportunity could be.

With a payout ratio of 53.1%, based on midpoint guidance for FY 2024 adjusted EPS, the dividend appears to be as secure as ever. For investors seeking an above-average dividend from a Dividend Aristocrat, this is a pretty interesting setup.

Revenue and Earnings Growth

As interesting as these metrics might be, though, many of the numbers are looking into the rearview mirror. However, investors must always be looking through the windshield, as the capital of today is put on the line and risked for the rewards of tomorrow. Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be of great aid when the time comes to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth. And I’ll then reveal a professional prognostication for near-term profit growth. Lining up the proven past with a future forecast in this way should give us the information necessary to make a judgment call on where the business could be going from here.

Medtronic advanced its revenue from $17 billion in FY 2014 to $31.3 billion in FY 2023. That’s a compound annual growth rate of 7%. I’m usually looking for a mid-single digit top-line growth rate from a mature business like this. Medtronic more than delivered.

But it’s important to keep in mind that a major chunk of this revenue growth resulted from the acquisition of Covidien PLC in 2015 for almost $50 billion. This complementary addition to the company (with Covidien focusing on endomechanical instruments, adding to Medtronic’s cardiovascular and orthopedic offerings) gave a large boost to the business in absolute terms.

Relative profit growth, on a per-share basis, should better inform us, especially since Medtronic used equity to help finance the acquisition. Earnings per share grew from $3.02 to $5.29 (adjusted) over this period, which is a CAGR of 6.4%. Even during a tough stretch, Medtronic still put up decent numbers.

This business could have done better, if not for two serious headwinds (one of which is not the company’s fault). First, Medtronic’s outstanding share count increased substantially as a result of that large acquisition, making growth on a per-share basis more difficult. Second, the pandemic negatively affected Medtronic in a major way.

The overwhelming focus on the pandemic by the global healthcare complex led to the delaying of anything that could be delayed (such as elective surgeries). Worse yet, key product launches coincided with the onset of the pandemic and the lessened demand. In addition, the pandemic made it difficult to bring new supply to market. What this means is, Medtronic has faced challenges both on supply and demand.

But there are silver linings here. Surgeries that could not be performed previously are almost certainly demand deferral, not demand destruction. These delays could be causing pent-up demand, which would be a strong driver of accelerated growth for the business over the next few years. Furthermore, the arrival of new products to the market precisely at the same time as rising demand could be a potent mix for the business, turning a former headwind into a new tailwind.

Looking forward, CFRA believes that Medtronic will compound its EPS at an annual rate of 4% over the next three years. CFRA seems to be assuming that effects from the pandemic will linger for a bit longer. Indeed, CFRA states: “We also see growth around 4% in FY 25 with pandemic disruptions to supply and demand finally ending, in our view.”

I suppose the key question for long-term investors is this: What kind of growth is Medtronic capable of delivering over the next 10+ years? This is obviously a very difficult question to answer, but I don’t see why the business can’t do at least as well as the last decade – a very troubled and challenging period for the business that includes a global health crisis which is unlikely to repeat again over the next decade. Seeing as how the last decade was really quite respectable, in spite of the pandemic, that actually bodes pretty well, in my view.

All that said, near-term catalysts (pent-up demand and new products) are present. CFRA dives into this a bit: “We expect strong results from [Medtronic] as its health care provider customers serve pent-up demand for procedures that had to be postponed due to the pandemic and then subsequent staffing shortages at medical facilities. [Medtronic] also stands out from medical device peers because of its product innovation and new launches, which drove market share gain during the pandemic and should continue to do so over the long term. One product line that has particularly immense potential is [Medtronic’s] robotic assisted surgery platform, which we see ultimately being adopted worldwide, up from around 13 countries using the technology in FY 23.” The robotic-assisted surgery platform CFRA is referring to is Hugo, and it’s quite a promising release.

The near term is shaky, whereas the long term still looks good. I wouldn’t expect much in the way of dividend raises over the next year or two, and that’s okay. If Medtronic can simply get back to where it was before the pandemic hit, that could set up the business for high-single digit dividend growth over the next decade or so.

Starting off with a 3%+ yield, which pays investors to wait for that turnaround to play out, quickly paints a picture where ~10% annualized total returns are realistically achievable – before factoring in any kind of multiple rerating from improving operations. That’s not bad at all.

Financial Position

Moving over to the balance sheet, Medtronic has a good financial position that should strengthen over the coming years (as the business normalizes). The long-term debt/equity ratio is 0.5, while the interest coverage ratio is nearly 9.

Medtronic ended last fiscal year with nearly $8 billion in cash on hand, while the long-term debt load of approximately $24 billion is not overly concerning for a business of this size.

Profitability is only so-so, and I’d really like to see pronounced improvements in this department. Return on equity has averaged 8.4% over the last five years, while net margin has averaged 14.1%. I like the margins.

However, Medtronic has been putting up single-digit ROE and ROIC for most of the last decade, and that’s basically right in the range of WACC – making it difficult to generate excess returns. Medtronic has a lot of wood to chop here.

Medtronic has undoubtedly lost some of its shine, but a firming of demand from catch-up procedures could quickly return the business back to some of its former glory. And with IP, R&D, switching costs, economies of scale, a global distribution network, high barriers to entry, and a diversified portfolio of entrenched products, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry. All three of these risks are elevated for this business model in comparison to many other business models, in my view.

Any changes in the way healthcare spending is managed, especially in the United States, would almost certainly impact the company.

Medtronic occasionally recalls products, which involves costs and possible damage to reputation.

Demand for medical devices is fairly disconnected from economic cycles, but a recession could cause people to delay or cancel elective surgeries.

Any major technological changes in medical devices can alter the competitive landscape, which pressures Medtronic to constantly innovate and stay ahead of the tech curve.

The rise of GLP-1s may reduce or even eliminate a range of health issues, and this could lead to less demand for many medical devices across the board.

There are some risks to seriously consider. But the valuation, which looks attractive after a 35%+ fall in the stock’s price from its all-time high, should also be seriously considered…

Valuation

The stock is trading hands for a forward P/E ratio of 16.5, based on midpoint guidance for this year’s adjusted EPS. That is not egregious at all for a business of this stature, quality, and market positioning.

The sales multiple of 3.5 is well off of its own five-year average of 4.3. And the yield, as noted earlier, is significantly higher than its own recent historical average.

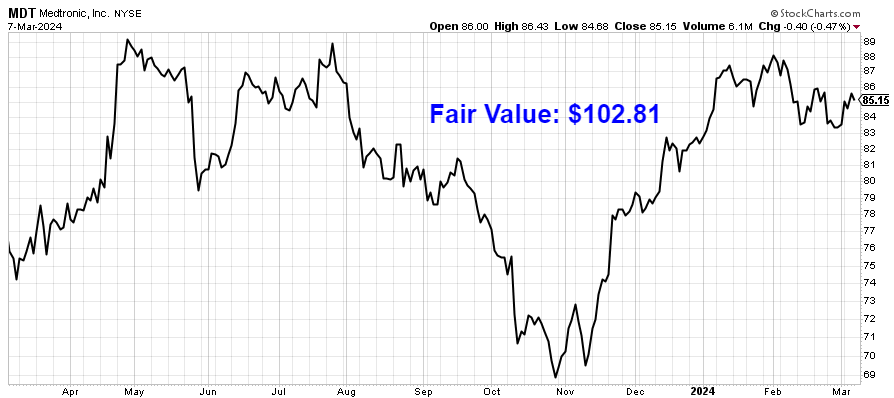

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis. I factored in a 10% discount rate and a long-term dividend growth rate of 7%. To be honest, this is a tough one to gauge.

If we go by Medtronic’s longer-run numbers, a high-single-digit dividend growth rate isn’t an unreasonable expectation at all. If anything, 7% is selling the Medtronic of old short. However, since the big acquisition and the pandemic, Medtronic has been struggling. And the new weight-loss drugs throw a wrench into things. I’m giving Medtronic the benefit of the doubt here, assuming the business can return to some (but not all) of its former glory.

The DDM analysis gives me a fair value of $98.44. The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth. It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today. I find it to be a fairly accurate way to value dividend growth stocks. From my vantage point, the stock looks at least modestly undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at. This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system. 1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value. Morningstar rates MDT as a 4-star stock, with a fair value estimate of $112.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line. They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a Strong Sell and 5 stars meaning a stock is a Strong Buy. 3 stars is a Hold. CFRA rates MDT as a 4-star “Buy”, with a 12-month target price of $98.00.

I came out very close to CFRA’s number. Averaging the three numbers out gives us a final valuation of $102.81, which would indicate the stock is possibly 17% undervalued.

Bottom line

Medtronic PLC is a great healthcare business benefiting from favorable demographic trends, secular growth, and pent-up demand. With a market-beating yield, high-single digit dividend growth, a moderate payout ratio, more than 45 consecutive years of dividend increases, and the potential that shares are 17% undervalued, this Dividend Aristocrat is a prime investment candidate for long-term dividend growth investors looking to up their healthcare exposure.

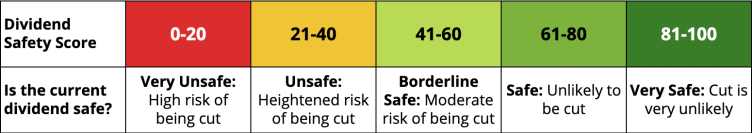

Note from D&I: How safe is MDT’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 99. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, MDT’s dividend appears Very Safe with a very unlikely risk of being cut.

Disclosure: I’m long MDT.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.