Summary:

- Medtronic is one of the largest medical device companies in the world and it is a market leader.

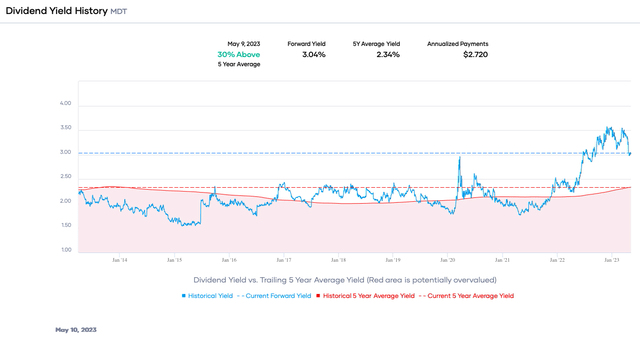

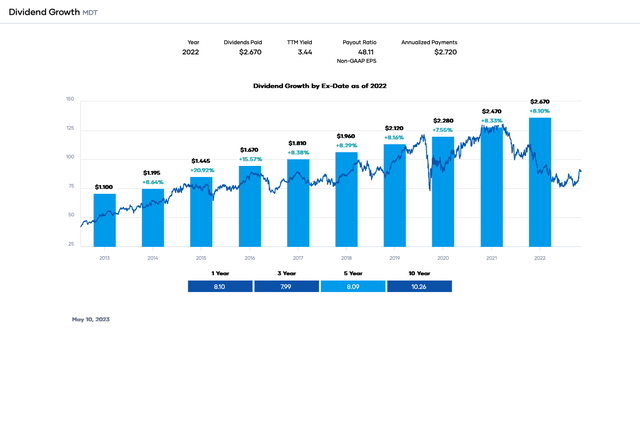

- The stock is yielding 3%+, almost at a decade high with a dividend growth rate of about 8% annually.

- The firm has resolved its FDA letter and has a new diabetes device on the market. Also, the pipeline is strong based on recent approvals.

- MDT stock is undervalued.

JHVEPhoto

Medtronic plc (NYSE:MDT) has struggled with growth and operational missteps in the past two years. As a result, the stock price fell from its all-time high in August 2021 to below $80 per share. Later, the firm received an FDA warning letter about its diabetes business. Simultaneously the dividend yield reached over 3.5%, a decade high. But Medtronic’s pipeline has been restocked, and the news has turned from negative to positive in the past month. Investors are starting to take notice, and the stock price has climbed by around 12% in the past month. Medtronic is still undervalued, and the combination of dividend yield, growth, and safety, makes it attractive. Hence, I view Medtronic as a long-term buy.

Overview of Medtronic

Medtronic is a more than 50-year old company and a global leader in medical devices. Although the operational headquarters is in Minnesota, the company’s corporate headquarters is in Ireland. In 2015, the firm acquired Covidien and took advantage of an extant tax inversion.

Today, Medtronic has a presence globally in 140 countries, with the greatest sales coming from the United States. The company operates in four business segments: Cardiovascular (~36% of total revenue in 2022), Neuroscience (~28% of total revenue), Medical Surgical (~29% of total revenue), and Diabetes (~7% of total revenue).

Business operating units include Cardiac Rhythm & Heart Failure; Structural Heart & Aortic; Coronary & Peripheral Vascular; Surgical Innovations; Respiratory, Gastrointestinal & Renal; Cranial & Spinal Technologies; Specialty Therapies; Neuromodulation; and Diabetes.

Total revenue was $31,686 million in the fiscal year 2022 and $30,771 million in the trailing twelve months.

Growth Challenges

Medtronic is struggling with challenges in two of its four segments, impacting revenue and earnings growth. They are both faced with different issues. Notably, the company has solutions in place or is addressing the problems.

Diabetes Segment Challenges

In an earlier article, I highlighted Medtronic’s FDA warning letter regarding its diabetes business. The share price plunged in response. Besides the letter, competition in the diabetes segment is increasing, pressuring revenue. The Diabetes segment’s revenue dropped nearly 15% year-to-date because of competition, the FDA warning letter, and the lack of new products.

Specifically, other diabetes medical device companies, like Insulet (PODD) and DexCom (DXCM), are growing rapidly based on innovative technologies. Granted, these companies are smaller, but they have approved technologies for pod-based insulin delivery with no pumps or needles and continuous glucose monitoring (CGM).

Next, the company received an FDA warning letter related to its manufacturing facility and the recall of the MiniMed 600. However, on April 25th, the letter was removed after Medtronic resolved the issues. This action removes a significant overhang for the Diabetes segment.

Lastly, Medtronic had not innovated sufficiently in the Diabetes space compared to its competitors. However, the FDA approved the MiniMed 780G, a successor to the 770G, 600, on April 21st, 2023, as discussed below. According to the company, the system is the only one that provides meal detection technology to automatically adjust and correct sugar levels every 5 minutes for both basal and bolus insulin needs.

Medical Surgical Challenges

Besides the Diabetes segment, the Medical Surgical segment is also confronting difficulties because of two business units, the Respiratory Interventions and Renal Care Solutions. First, ventilator sales are slowing and returning to pre-COVID-19 levels. Next, supply chain disruptions have been impacting availability for certain products in the past three quarters. This, combined with lower surgical procedure volumes, has caused sales to decrease.

Growth Strategy and Divestments

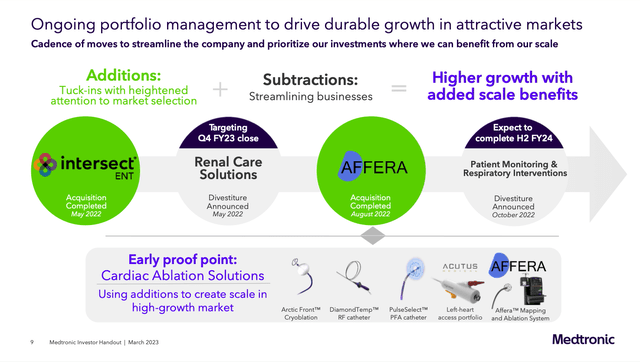

Medtronic has pursued a strategy of tuck-in acquisitions to address gaps in its product lineup, addressing some challenges. Since fiscal year 2021, the company acquired nine companies for more than $3.3 billion. The most recent acquisitions were Intersect ENT, Affera for its mapping and ablation system, and Acutus for its arrhythmia management technologies.

Medtronic Investor Relations

Like other medical device companies, Medtronic is conducting partnerships, minority investments, and incubators to expand its reach to another 80+ early-stage companies and spent almost $1 billion. In addition, small startups focus on higher-risk innovation and attempt to exit by selling to a larger device company, like Medtronic.

Beside tuck-in acquisitions, Medtronic has been spending on R&D to grow its device portfolio. The firm is increasing R&D spending at a 5% CAGR, matching sales growth. As a result, Medtronic is expanding its product approvals. In the last twelve months, the firm had roughly 150 approvals.

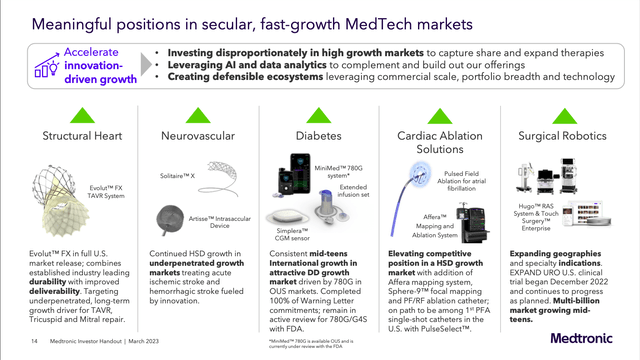

Furthermore, Medtronic is investing in high-growth markets to recapture share. Important new products include MiniMed and Simplera in diabetes, Evolut in structural Heart, Solitaire and Artisse in neurovascular, Affera’s system in cardiovascular, and HUGO in surgical robotics. In these cases, the business often grows at double digits and has large addressable markets.

Medtronic Investor Relations

Divestments

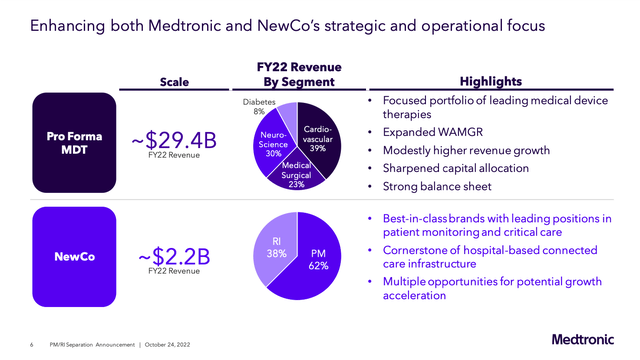

The second effort is divesting approximately 8% or $2.2 billion of revenue in two businesses: Renal Care Solutions and Patient Monitoring & Respiratory Interventions. Both businesses are experiencing sales declines and possibly margin compression but are market leaders. After the spinout, the remaining Medtronic will have 70% of sales from the Cardiovascular and Neuroscience segments.

The proceeds will be used in a way consistent with capital allocation priorities. Notably, management has stated the divestment will not impact the dividend.

Medtronic Investor Relations

Dividend Analysis

The increasing share price has caused the dividend yield to come down, but it is still more than 3%. The forward rate is currently $2.72 per share. The yield is still greater than the 5-year average but short of the decade high.

Portfolio Insight

The company has raised its annual dividend for 46 years, making the stock a Dividend Aristocrat because of its membership in the S&P 500 Index. The growth rate is approximately 8% per year in the trailing five years. The last quarterly dividend increase was $0.68 per share from $0.63 in May 2022. Investors should expect another increase this month.

Portfolio Insight

Medtronic has excellent dividend safety based on earnings per share, free cash flow (FCF), and its balance sheet.

Consensus earnings estimates for the fiscal year 2023 are $5.28 per share, and the annual dividend rate is $2.72 per share. These numbers result in a dividend payout ratio of ~51%. Our target value is 65%, meaning the dividend is well covered by earnings.

Medtronic produced around $4,166 million in FCF in the last twelve months. The dividend required ~$3,554 million, resulting in a dividend-to-FCF ratio of ~85%. This value is higher than our preferred value of 70% or less. But FCF was lower because of expenses related to inventories, which should not repeat itself in 2023.

The company has $11,137 million in total cash and short-term investments against $5,918 million in current and $22,210 in long-term debt. Interest coverage is approximately 10X, and the leverage ratio is ~1.9X. Moreover, the company has an A/A3 upper-medium investment grade credit rating from S&P Global and Moody’s. Therefore, the balance sheet is not a significant concern for dividend safety.

Valuation

Medtronic’s stock price is up 14%+ year-to-date, but the 1-year return is negative at roughly (-11%). The stock price’s drop has pushed the earnings multiple to 17X, near the lower end of its 5-year range.

The consensus analyst earnings per share estimate is $5.28 in 2023. We will use 20X as a baseline for the earnings multiple because of Medtronic’s market leadership but acknowledging the firm is facing challenges. Thus, our fair value estimate is $105.60. The current stock price is ~$89.41, suggesting Medtronic is undervalued.

Applying a sensitivity calculation using P/E ratios between 19X and 21X, we obtain a fair value range from $100.32 to $110.88. Hence, the stock price is approximately 81% to 89% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

19 |

20 |

21 |

|

|

Estimated Value |

$100.32 |

$105.60 |

$110.88 |

|

% of Estimated Value at Current Stock Price |

89% |

85% |

81% |

Source: dividendpower.org Calculations

How does this calculation compare to other valuation models? Portfolio Insight’s blended fair value model combining the P/E ratio and dividend yield gives a fair value of $112.88 per share.

The two-model average is ~$109.24, indicating Medtronic is undervalued at the current price.

Final Thoughts

Medtronic has a long history of innovation and market leadership in medical devices. Unfortunately, the COVID-19 pandemic and operational missteps caused the firm to struggle in the past few years. However, new leadership, emphasis on innovation and bringing new products to market, and spinout out underperforming businesses may right the ship. In addition, the stock is undervalued, has a good history as a dividend growth stock, and has a nice yield. Hence, we view Medtronic as a long-term buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.