Summary:

- The Magnificent 7 have outperformed the market, but they are actually historically undervalued.

- Alphabet stands out as offering the best value and promising outlook among the Magnificent 7.

- GOOGL has a strong balance sheet, revenue diversification, and resilience, making it a must-own stock and a good recession play.

AlexSecret

Thesis summary

Mega-caps stocks have been responsible for most of the market appreciation, but that doesn’t actually mean they are expensive. If we look at PEG specifically, they are quite cheap.

Given what’s to come, there’s a valid reason why mega-caps should trade at a premium.

Out of the Magnificent seven, Alphabet (NASDAQ:GOOGL) stands out, in my opinion, as offering the best value and the most promising outlook.

Mega-caps are relatively cheap

This year, we have witnessed the birth of the Magnificent 7, an extension of the original FAANG club.

The magnificent 7 include Alphabet, Microsoft (MSFT), NVIDIA Corporation (NVDA), Apple, Inc (AAPL), Amazon.com (AMZN), Tesla (TSLA), and Meta Platforms (META)

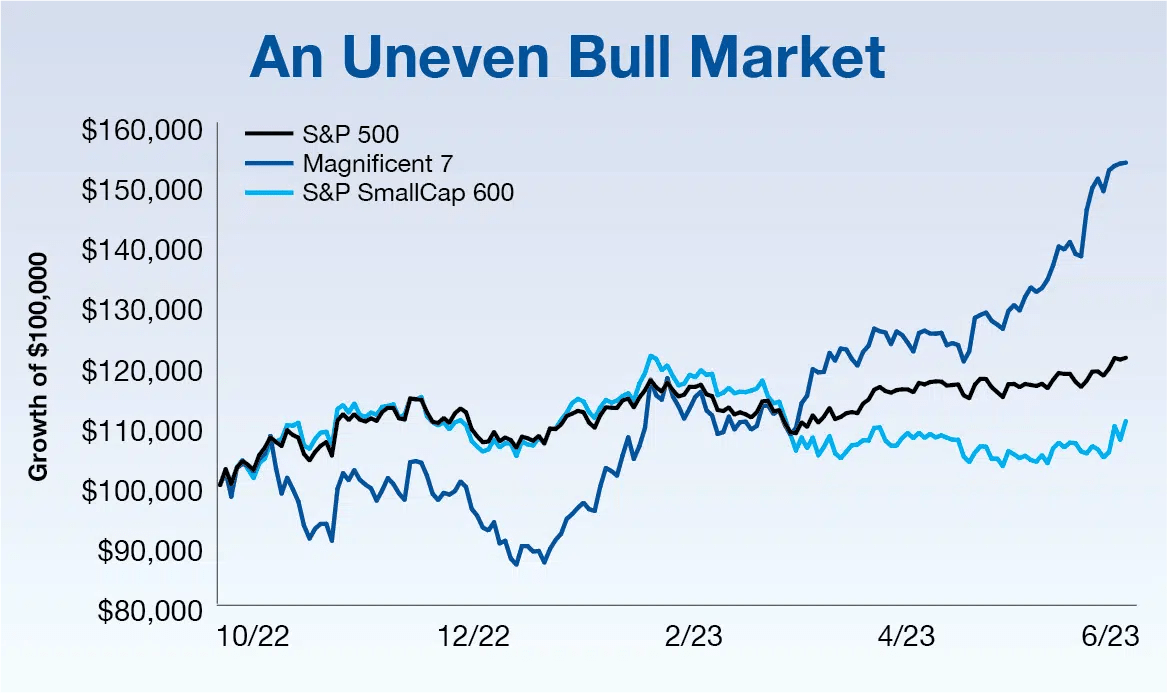

Mega-caps vs S&P (Adviser investments)

It’s easy to see in this chart that the mega-cap stocks have greatly outperformed the broader market. In fact, small-cap stocks in the Russell 2000 (IWM) are now pretty much flat over the last year, while META is up over 100% in the same time period.

But just because the stocks have rallied doesn’t mean they are overvalued. In fact, they might be historically undervalued after the last sell-off.

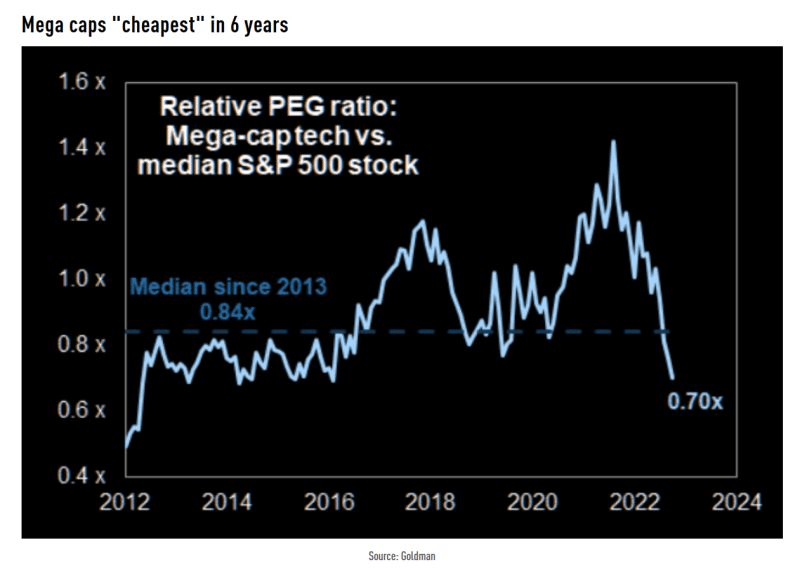

PEG mega-caps vs S&P (Goldman)

Measuring the PEG of the Mega Cap tech stocks vs the S&P 500. The magnificent 7 actually have an average PEG of 1.3, compared to an average PEG for the broader market of 1.9. This is the steepest “discount” since 2013 and is currently below the median over the last ten years.

Magnificent 7; royal rumble

From what I can see, the PEG ratio used by Goldman Sachs (GS) is the Non-GAAP FW PEG.

Now, if we accept that the magnificent 7 are worth buying, which is the best in the pack?

|

GOOGL |

META |

TSLA |

AMZN |

AAPL |

NVDA |

MSFT |

|

|

PEG Non-GAAP (FWD) |

1,39 |

1,03 |

3,24 |

1,54 |

2,74 |

1,23 |

2,28 |

|

EV/EBITDA (FWD) |

13,42 |

11,24 |

46,67 |

14,31 |

21,19 |

38,70 |

19,96 |

|

Price/Cash Flow (TTM) |

17,23 |

14,17 |

59,40 |

21,19 |

24,01 |

91,42 |

27,06 |

|

Revenue 5 Year (CAGR) |

18,50% |

19,97% |

47,03% |

20,92% |

8,51% |

22,44% |

13,94% |

|

EPS Diluted 3 Year (CAGR) |

27,57% |

1,45% |

200,38% |

-0,96% |

21,81% |

44,84% |

18,89% |

Source: Seeking Alpha

The table above compares all of the magnificent 7 on various metrics.

Based on the PEG, META stands out as the most attractive, followed closely by NVDA and GOOGL.

META once again wins on EV/EBITDA, with GOOGL coming in at a close second. These two companies once again excel in terms of Price/cash flow, and we can see quite a marked difference. While META and GOOGL trade at 14x and 17x cash flow the next best stock is AMZN at 21.

In terms of revenue, TSLA and NVDA are in a league of their own. The rapid growth over the last five years has also translated into very high EPS growth. Tesla grew EPS by 200%, NVDA by 44.8%, and in third place, GOOGL.

Each investor has his own set of preferences, but if you ask me, GOOGL is the mega-cap tech stock that offers the best balance of growth, valuation and is probably the best set-up for what comes next.

GOOGL is well set up for what comes next

Higher rates have been driving down the market. It seems like higher for longer could actually be a lot longer, so how should investors prepare for this new environment?

If credit is going to be tight, and this may possibly lead to a recession, then a strong balance sheet is a must.

Look no further than GOOGL.

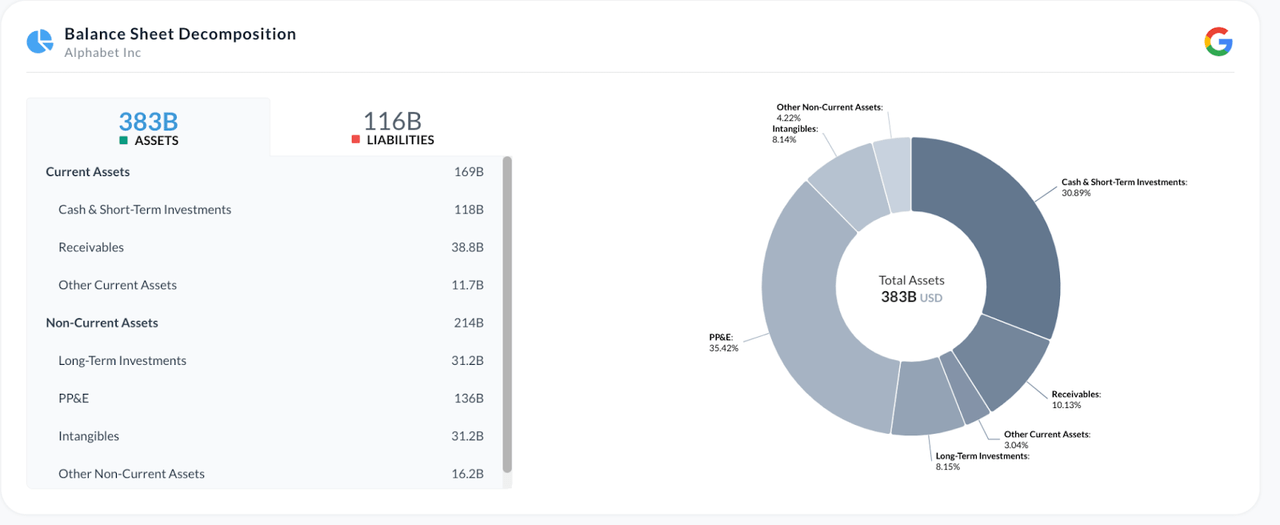

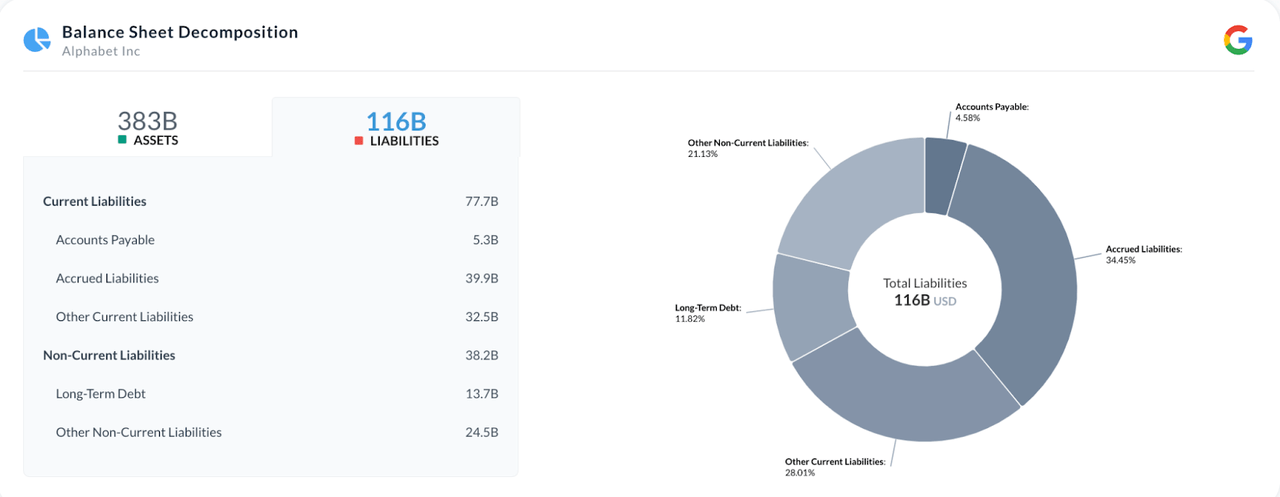

Google assets (Alpha spread) Google liabilities (Alpha spread)

With $383 billion in assets and only $116 in liabilities, GOOGL has a fortress balance sheet. The company also boasts $118 billion in cash and short-term investments.

These will come in very handy in the coming years. 1 month T-bills are paying 5.56% right now. This means GOOGL could be adding over $6.5 billion yearly just from holding T-bills.

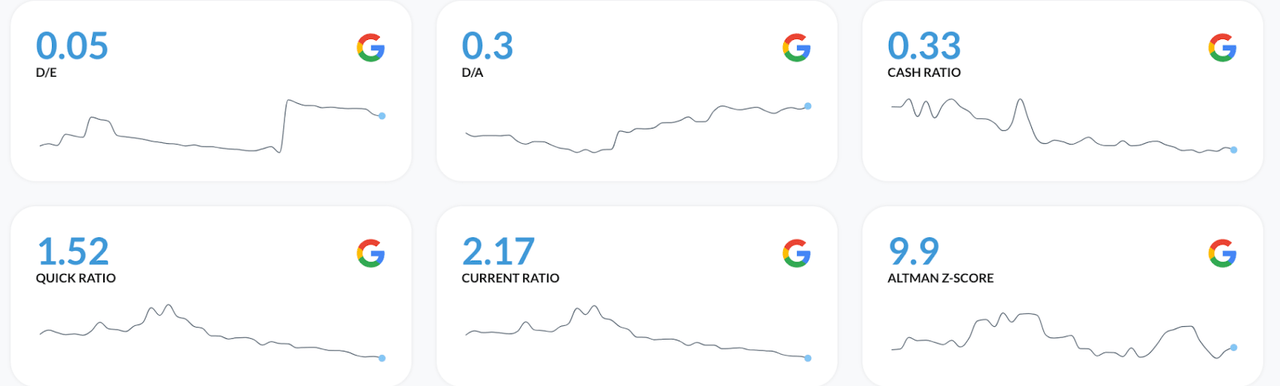

Solvency ratios (Alpha spread)

GOOGL is incredibly strong in all solvency measures, and in fact, it is the strongest of the magnificent 7.

|

GOOGL |

META |

TSLA |

AMZN |

AAPL |

NVDA |

MSFT |

|

|

Debt/Free Cash Flow |

1,70 |

3,59 |

12,68 |

14,62 |

3,03 |

2,22 |

4,35 |

|

Long Term Debt/Total Capital |

8,92% |

20,70% |

6,56% |

42,44% |

57,84% |

24,70% |

24,71% |

|

Current Ratio |

2,17 |

2,32 |

1,59 |

0,95 |

0,98 |

2,79 |

1,77 |

|

Quick Ratio |

2,02 |

2,20 |

0,97 |

0,67 |

0,81 |

2,23 |

1,54 |

Source: Seeking Alpha

GOOGL has the best debt/FCF and LT debt to Capital. It is beaten by META and NVDA on current and quick ratio, but this is not as important.

The other great thing about GOOGL is its revenue diversification.

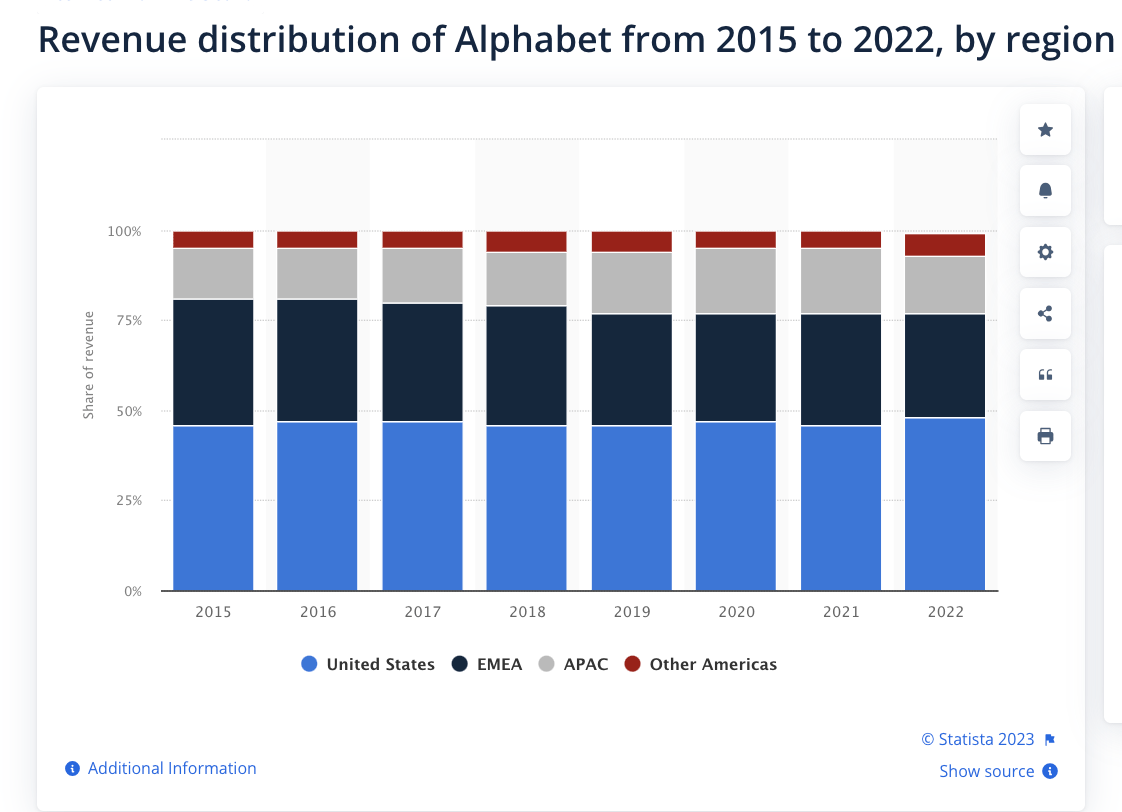

Alphabet revenue distribution (Statista)

Though half the revenues still come from the US, it has a strong presence in Europe, The Middle East and Africa, and also in ASIA.

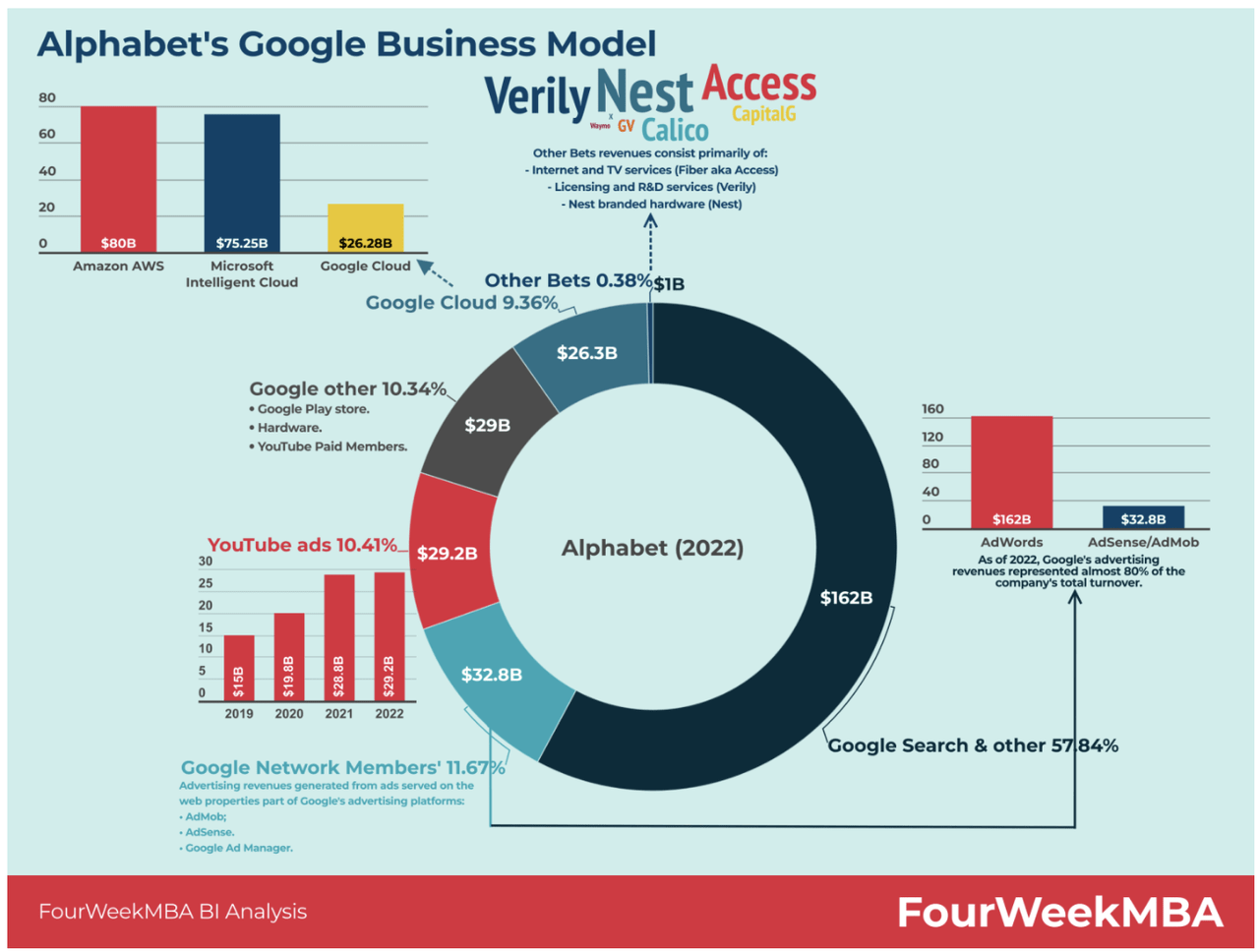

The revenue diversification doesn’t only apply to geographies but also to its segments:

Alphabet revenue by segment (FourweekMBA)

While a little over half of revenues still comes from ads, there are a lot of other sources of revenue, including Google Cloud, YouTube, and Google Other.

Google is a lot more than just an ad company. It has a global footprint and essentially a monopoly on the internet. 93% of all web traffic passes through Google. This company is not going anywhere.

Risks

The only real risk with Google doesn’t come from the market but from regulators. Google is too big for many countries’ liking, making it a target in various lawsuits. Just last month, UK consumers launched a multi-billion pound lawsuit against the company.

But the fact that GOOGL can just shrug these off is a testament to just how powerful this company is.

Final Thoughts

I think there’s a good reason why the magnificent 7 have rallied while other stocks have not. For better and for worse, the big are getting bigger, and there is no bigger than GOOGL. This is a must-own stock, in my opinion, and it makes for a very good recession play thanks to its strong balance sheet and revenue resilience. GOOGL is perhaps the highest conviction stock in my End Of The World Portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.