Summary:

- Confronting the hard issues of glut head on is the new beginning the streaming sector needs more than earnings call happy talk.

- The Walt Disney Company’s fiscal Q2 2023 results are less critical to arriving at a realistic valuation than a pressing need to trim, slim, and emerge stronger than ever.

- The core issue: How do you squeeze a size 12 foot into an 8 size shoe?

Jerod Harris

To: CEOs of all media giants.

From: Howard Jay Klein—just me, maybe others, et al.

“The future ain’t what it useda be…” Yog Berra

The results of The Walt Disney Company (NYSE:DIS) in fiscal Q2 2023 provide clear warning signs to all other media giants badly in need of a wake-up call. Wokeism is merely a symptom of a far more threatening disease effecting the sector. Namely, the pretense of media leaders that they know what’s best as to what the public will want going forward and how much they will be willing to pay. They simply don’t know and neither do investors. Some may be beginning to get it—i.e., Netflix. Either way, Disney is now the poster child for how not to move ahead in big media.

The slight earnings miss disguises the deeper problem

The fiscal Q2 2023 earnings release of The Walt Disney Company (DIS) the other day, heavy breathing pom pom twirlers aside, is in reality a non-event. There’s been tons of crystal ball gazing running up to estimates of the degree to which earnings have surged, kept abreast of the current chaos, or been dead-pooled in a price shrug going forward. Given the mix of Mr. Market these days, the short-sighted, knee-jerking of a quick up or down spike on news flows can be expected to linger. It means zilch.

So, now looking at the actuals, it’s a big ho-hum. CEO Robert Iger proved nothing before he retired, and apparently since his resurrection, has shown his penchant for taking refuge in same old same old.

We’ve seen the stock tick up a few bucks since the strong $289m global opening of Guardians of the Galaxy, a bright spot in an otherwise aging Marvel IP universe. Add to that Iger had reasonably happy news on Theme Parks, progress in cost cutting and focus on continued chipping away at the Gibraltar-like $45b debt fortress. Yawn.

google

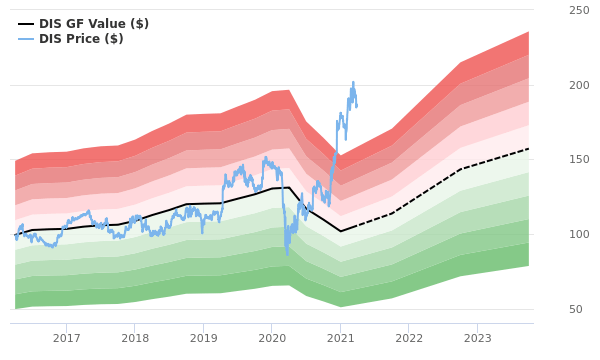

Above: Growing indications that Disney stock may be way overvalued.

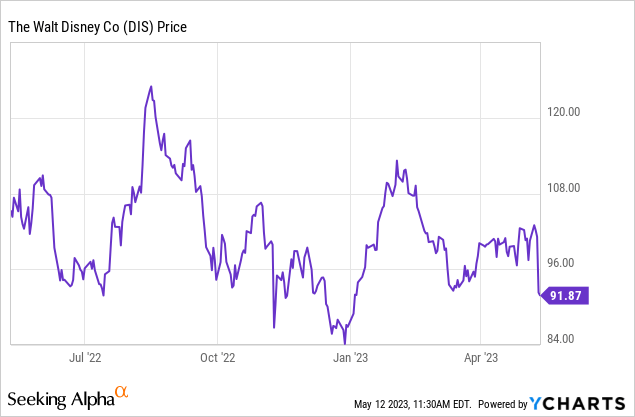

Since the earnings call, Disney has tanked almost 9%. It will recover in time, then tank again. That’s mostly because in our view Mr. Market knows that Iger and his hench people still don’t really get it. Our sense is that its multiple—assuming best case—makes it “a fair value” of ~$77 a share. Holders have to realize the glory days of Disney dazzle are long gone when it traded as high as $200. Since then, a new world has formed, and they are clearly using old world nostrums to face the challenges ahead. There is a time to grow the grass, a time to manicure it and a time to mow it. And a time to take weed killer and spray.

If we do see real progress along such lines, the basic happy talk we’ve gotten from all “we’re excited about…” remains an inane corporate speak mantra. No matter the numbers, ahead we’ll get the knee-jerk mini-move on the stock. That is, until someone can make the case that this in pure reality of today, is really a $72 stock in hiding, taking a worse-case scenario multiple of your choice that reflects how the gears of today’s media world mesh with where the consumer is headed on streaming.

google

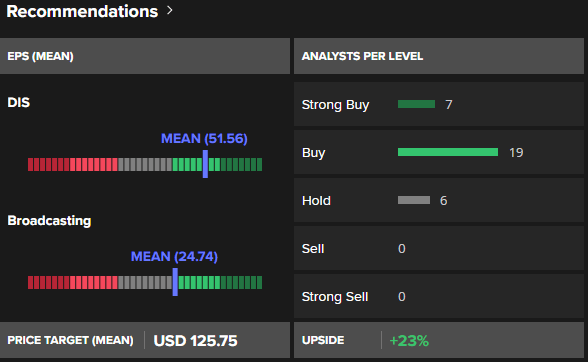

Above: Many pom pom twirlers still abound in the analyst universe. The price target is reachable to a degree, but also vulnerable to a sharp decline IMHO.

What will be missing no matter what the numbers show, is a realization that a core, structural pivot in the Disney business model is the only place where we see a considerable upside move in store after a possible deep dive. Failing that, we’re treading water again.

The likeliest scenario could sound like this:

Positives

Continuing solid performance and gains in theme parks. The reasoning here is not so much the appearance of this new ride or that pop culture adaptation, but the abiding reality that has driven Disney park business from day one:

You pick the macro disaster—recession, depression, inflation, price rises, unemployment. Not one of them has ever proven it would be a huge obstacle to this enduring truth:

Save atomic war, there is no single barrier to the gut need of parents to spend whatever it takes, live on a tight budget, even border on penury for a while, to get their kids at least a once in a lifetime visit to a Disney Park.

The talents of Disney “imagineers” dwarf those of competitors in bringing lots of oohs and aahs to ever more jaded visitors to come in the years ahead. It’s an undervalued asset. And over time proves parents are willing to be fleeced to bring a passing few days of pure joy to their kids.

The smiles, giggles and hugs one sees all over Disney parks is the pure gold moment of parenthood sunk deep in the cultural recesses of everyone who has a kid, loves a kid, or is, in fact, age notwithstanding, a kid at heart. So, Iger can report that post-covid or not, inflation or not, job losses or not, Disney parks will have performed admirably. And that is what we got. Yes, It can even overcome the parent heartburn when the credit card bill arrives proving you are one of the shorn Disney sheeple.

Therefore, as a unit that is literally the heartbeat of the company, Parks, must remain a key element in the company’s future under any foreseeable or black swan economic conditions. It may be less price elastic in this insane inflated economy—but that’s no match for parental delight.

Negatives

Hulu and ESPN: Sell them, cash out and slash the debt

We can’t say the same thing for both ESPN and HULU as that of Parks. These two verticals are disparate contributors to the chaos that surrounds parsing a sensible future out of the current Disney lineup of businesses. They’re nice to have but while they still have possible value to a buyer, they could provide a massive injection of cash to be used to slash at least half the debt.

Here’s why:

ESPN continues to shed total subscribers, ten years straight. Much of it is due to cord cutting, its programming blather is worsening as content, its runaway wokeism (that they will never acknowledge) is also contributing to their subscriber losses. It pays far too much for sports rights, fires the peons but keeps the overpaid host panels who rarely do more than laugh and chuckle at each other’s absurd opinions. After the great Charles Barkley and Shaq, and PTE there is little worth watching outside of game content. ESPN shows the growing signs of zombie survival. ESPN and Hulu are presumably worth ~$50b together, in total enough to wipe all Disney debt off the books with proceeds. But we think corporate health will be great if Disney only used 60% of proceeds to reduce debt.

But ESPN even valued at ~$22b there will be a willing buyer out there who sees a path to a money machine ahead. The regional sports networks are dying and at some point take ESPN with them as glut overrules fandom’s seeming insatiable appetite for sports content. Real world: It’s about the NFL driving the bus with the NBA, MLB and NHL, the kids in the back throwing paper spitballs at one another for laughs.

Hulu, along with its streaming competitors will never make money because It has still not found the secret sauce between free stuff and ad supported content. And like its sector peers will be fiercely competing for the same residual eyeballs as everyone else. It will each have its share of monumental hits. But that only encourages subscription cancellations and switching for a handful of shows and waving bye bye. That leave ad support as the potential savior—precisely the reason that streaming was born: avoid ads, avoid goofy programmers who fall in love with junk shows.

A bit of U.S. media history here is warranted

The 70-odd year silent compact between TV audiences and broadcasters was this: We give you free stuff in exchange for your enduring X amount per hour of intrusive and in many cases, abusive ad time.

Fair enough. It was a workable formula that created a huge, profitable industry that periodically reinvented itself. Then cable came alone and shook up the broadcast world by saying, look, instead of the paltry handful of network programming you now have from the four biggies and a sprinkling of local channels, we’ll give you 100 channels. But ads stay.

We got you covered: history buff, sure, gardening lover, sure, foodie, absolutely, raunchy reality tv, man o’ man, idiotic competition shows, naturally, and yes, all the sports you want—BUT you still need to abide advertising.

And then came the ultimate solution: the early seductive call of streaming. See you don’t need to endure advertising, you don’t need to schedule your viewing life according to some pinhead network scheduler. You can click what you want, when you want it, how you want it. You can get your favorite network show, cable show and tons of movies and documentaries. You are now the boss at a nifty $4.50 a month. Great, sounds like a plan. Here’s my money. Love it—tons of movies, sports, niche interest shows. Everyone into the pool. And on came the media lemmings.

The massive entries of all the media verticals flooded the sector, happily watching monthly subscriptions accelerate during the pandemic. Stock values skyrocketed. There were zillions of eyeballs out there to harvest. So let’s load up on content and woke it up because we really don’t need anyone to the right of Bernie Sanders. We’ve got plenty of millennials, tons of old folks who frankly could care less about woke or sleeping shows.

One of the lemmings that burst of out biggest and best was Disney+, of course. Loaded with IP stretching over 80 years. A company proven inventive, creatively superior, hefty of scale, a proven generator of billions over time. A pristine balance sheet ripe for abuse.

While all this was going on, something caught the wind and slowly began to change its direction. All you got from big media was a few fat fingers raised into the wind to muse about direction. But all managements did was shrug, continue to babble of happy talk at earnings calls and wait for the post covid era to prove how smart they were.

Needed: A Disney slimmer, smarter, easier to understand

Unload ESPN and HULU, together could bring in near $50b in cash. Use half the haul to slash corporate debt down to $20b and send joy down share holders collective spines. Its cost of debt runs around $2b a year—at a comfortable rate without doubt. That’s not quite the point here.

Dump the cruise business to an existing cruise licensee, stay in port and collect a nice flow of fees forever.

Assume you extinguish 60% of the debt with the proceeds of sale from ESPN and Hulu bringing in net proceeds of say $26b. First you lose over $1b in interest cost that falls to the bottom line. Second you say move $20b into interest bearing cash and security investments with an average 5% return—modest enough right? That brings another $1b to the bottom line. That still leaves the company with a ton of cash to invest in whatever opportunity comes their way.

Wind up with Parks and merchandise, Disney Plus priced two tier ad or no ads, the movie studio pledged to only do films that meet strict guidelines of production cost—no more. Nobody can forecast movie grosses naturally. but productions made against a serious budget will be so much more a thick Comstock lode if they develop legs than the normal crap shoot that abounds big budget productions

A three legged stool never topples no matter the weight. Parks, Disney + and Movies plus a treasury loaded with cash and investments that do nothing but lie there collecting interest is a Disney that will literally coin money. It will be positioned to undertake any and all opportunities in its three core businesses in building their profitability.

And, at a range of $72 to $81 a share, The Walt Disney Company would make immense sense to investors especially since the return to lovely dividends would be a nifty plus.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gmaing sector, subscribe to The House Edge. New: Free excerpts from our book in progress “The Smartest ever Guide to Gaming Stocks” – free to existing members and new subscribers.