Summary:

- Merck & Co., Inc.’s payout ratios suggest that the market-beating dividend is well-covered.

- The company’s stacked portfolio of therapies and candidates should lead to solid growth moving forward.

- My inputs into the discounted cash flows model show shares of Merck to be trading at a modest discount to fair value.

- The big pharma company could do well for shareholders over the next few years.

A researcher working in a laboratory. AzmanJaka/E+ via Getty Images

Everybody in the audience is probably familiar with the advice to never put all your eggs into one basket. That is to say that you should always be prepared for one idea or plan to fail. Because if you aren’t and don’t have a backup plan, the aftermath of your only plan falling through can be devastating.

This is especially important to apply to investing as a dividend growth investor. Dividend growth investors would be well-suited to diversify their portfolios across economic sectors and industries. That is because as some of your investments in certain economic sectors and industries languish, some will almost certainly thrive and compensate for the former.

Due to the immense profitability and durability of the pharmaceutical industry in every economic environment, eight of my 100-plus investment holdings are in the pharmaceutical industry. Merck & Co., Inc. (NYSE:MRK) is one of the more prominent dividend stocks in my portfolio. Let’s dive into the company’s fundamentals and valuation to understand what I like about it.

Merck Can Keep Growing Its Dividend

Merck isn’t the type of company that will blow you away with its dividend growth. In the past 10 years, its annual dividend growth rate has been a tad under 6%. Relative to the healthcare sector median of 8%, this is why Seeking Alpha grades dividend growth at a C.

But to its credit, Merck has been steady with dividend growth. Its most recent 5.8% dividend raise announced last fall suggests that dividend growth isn’t showing any signs of slowing down.

It isn’t hard to see how Merck can fund this dividend growth, either. The company posted $7.48 in non-GAAP EPS in 2022. Compared to the $2.76 in dividends per share paid during the year, this works out to a 36.9% non-GAAP EPS payout ratio.

Merck also generated a staggering $19.1 billion in operating cash flows in 2022. Subtracting its $4.4 billion in capital expenditures, this works out to a free cash flow of $14.7 billion. Against the $7 billion in dividends paid during the year, this is equivalent to a 47.7% free cash flow payout ratio (info sourced from page 76 of 374 of Merck 10-K filing).

These payout ratios leave the company with ample capital for debt repayment and acquisitions to support steady fundamentals. That is why I believe Merck can maintain its annual dividend growth rate of roughly 6% over the long run.

A Drugmaker With A Bright Future

Before discussing Merck’s future, it would help to have an understanding of its history. The pharmaceutical company traces its beginnings back to 1891, when George Merck founded Merck to distribute fine chemicals in the New York City area. But it wasn’t until over 40 years later that the company would begin to emerge as what we now know today, with the opening of Merck’s first laboratory in 1933 in New Jersey.

Since that time, the company has been credited with breakthroughs for medical conditions: These include streptomycin for tuberculosis in the 1940s and cortisone in the 1950s for rheumatoid arthritis and the like.

Working our way up to more to the modern-day Merck, the company is most known for its miraculous oncology medicine Keytruda. Thanks to its amazing efficacy, the therapy is currently approved by regulatory authorities to treat 16 types of cancer. The $6.3 billion in sales that the company logged in the second quarter of 2023 accounted for just over two-fifths of the total $15 billion in revenue during that period. But with a multi-billion-dollar animal health business and five other medicines on pace to top at least $1 billion in 2023, Merck has a lot going for it.

This is part of why aside from a sharp and brief decline in sales and non-GAAP EPS following Keytruda’s loss of exclusivity in 2028, the company should continue to do just fine. Not to mention that Merck had over 120 programs in either phase 2/3 clinical trials or under review by regulatory authorities as of August 2, including the potential multi-billion-dollar cardiovascular drug candidate Sotatercept. For these reasons, analysts believe that Merck’s non-GAAP EPS will rise by 10.8% annually over the next five years.

Risks To Consider

Even as a high-quality pharmaceutical company, Merck faces its share of risks which investors should know.

In the pharmaceutical industry, patent cliffs can result in the loss of billions of dollars of annual revenue overnight. Just like any other drugmaker, Merck faces the operating risk of its pipeline and development deals not being sufficient to replace lost revenue from Keytruda. But the good news for Merck is that with such a deep pipeline of medicines and the financial means to fund further acquisitions, the risk of this happening is rather low.

Another risk facing Merck that is common to the entire industry is pricing pressure. As the U.S. government negotiates with pharmaceuticals with the intent of saving money to preserve its Medicaid and Medicare programs, Merck’s revenue and profits could be adversely affected.

An Undervalued Dividend Stock

As an investor, valuation matters just as much, if not more than fundamentals. You could buy the best business on the planet, but you shouldn’t expect to do well if you vastly overpay for ownership in it. That is why I will use a valuation model to get an idea of what the business could be worth to investors.

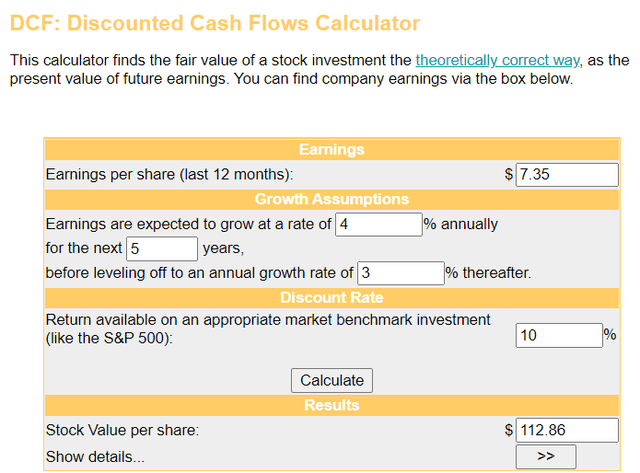

The valuation model that I’ll be using to estimate the fair value of shares of Merck is the discounted cash flow or DCF model. This valuation model consists of three inputs.

The first input into the DCF model is non-GAAP EPS for the last 12 months. Excluding the $4.02 acquisition charge for Prometheus Biosciences, Merck’s non-GAAP EPS for the past four quarters is $7.35.

The next input for the DCF model is growth projections. Out of an abundance of caution, I will assume a five-year annual non-GAAP EPS growth rate of 4% for Merck. I’ll then factor a slowdown to 3% annually in the years thereafter.

The final input into the DCF model is the discount rate, which is the annual total return rate. Since my annual total return preference as an investor is 10%, that is what I will be using.

These assumptions for the DCF model led me to a fair value output of $112.86 a share. That indicates Merck’s shares are trading at a 4.9% discount to fair value and offer a 5.1% upside from the current price of $107.34 a share (as of September 19, 2023).

Summary: Merck Can Provide Safe Income And Decent Growth

Merck has been growing its dividend for 12 consecutive years. Based on the company’s recent payout ratios, I would be surprised if annual dividend growth of around 6% didn’t continue moving forward.

This is especially true when considering that Merck’s non-GAAP EPS is expected to grow at a double-digit clip each year for the next five years. Finally, the modestly discounted valuation puts the buy case for the stock over the top. That is why I am initiating a buy rating on shares of Merck & Co., Inc. for dividend growth investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.