Summary:

- Merck has crushed the market since I last covered it in December.

- The pharmaceutical’s sales surged higher in Q4, topping analysts’ expectations.

- Merck’s balance sheet is A-rated.

- Shares of the big pharma stock could be trading 12% above fair value.

- From the current share price, I believe Merck is likely to underperform the S&P 500.

A pharmacist serves a customer at a pharmacy. Hispanolistic/E+ via Getty Images

Anybody who has followed the stock market for some time knows that it can be quite volatile. All it takes is a poor or great earnings report, or underwhelming or better-than-expected guidance, and a stock can slump or jump by 5%, 10%, or more.

One stock that has climbed higher since I last recommended it as a buy in December is Merck (NYSE:MRK). As the S&P 500 (SP500) has gained 6%, the pharmaceutical juggernaut has soared 19% in that time.

The bad news for those who aren’t shareholders is that this has overextended the valuation of shares from my perspective. In this article, I will outline the company’s fourth-quarter operating results and valuation to discuss why I am downgrading shares from a buy to a hold.

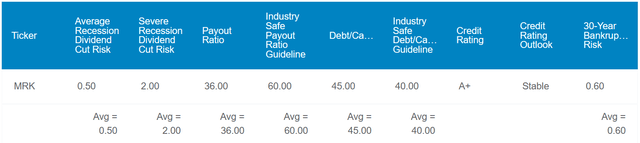

Dividend Kings Zen Research Terminal

Merck’s 2.4% dividend yield is 100 basis points higher than the S&P’s 1.4% yield. The cherry on top is that I believe respectable dividend growth can keep up for the foreseeable future.

Merck’s 36% EPS payout ratio is substantially less than the 60% EPS payout ratio that rating agencies have set as the industry-safe guideline. The company’s 45% debt-to-capital ratio is also not far off the 40% debt-to-capital ratio that rating agencies desire from the pharmaceutical industry.

Combine that with an excellent pipeline, and S&P awards an A+ credit rating to Merck on a stable outlook. That implies the chance of the pharmaceutical defaulting on debt in the coming 30 years is just 0.6% per rating agencies. Put a different way, which means Merck would be expected to survive 166 out of 167 30-year simulations.

This is why the respective probabilities of dividend cuts in the next average and severe recessions are just 0.5% and 2% according to Dividend Kings. For context, those are the floors in the Zen Research Terminal.

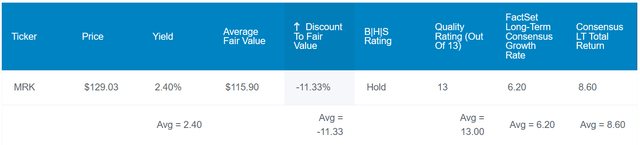

Dividend Kings Zen Research Terminal

Although I believe Merck’s fourth-quarter operating results demonstrate it to be a great company, the valuation is no longer appealing after the latest rally. According to the Zen Research Terminal, Merck’s shares are worth $116 apiece. This is the mean of fair value estimates in the Dividend Kings’ Automated Investment Decision Score Tool Master List. These fair values consist of the five-year dividend yield ($104 a share) and the fair value P/E ratio for this year ($128 a share).

My assessment of Merck using the dividend discount model comes out to a fair value of $112 a share. This was arrived at by using the following inputs into the DDM: A $3.08 annualized dividend per share, a 10% discount rate, and a 7.25% annual dividend growth rate. My assumption for the annual dividend growth rate is based on both the current annual growth consensus and the idea that Merck has room to further expand the payout ratio.

Averaging my fair value together with DK’s, these fair values could mean shares of the big pharma company are 12% overvalued relative to the $128 share price (as of February 28, 2024). If Merck can match the growth consensus, and it falls to the average fair value estimate, these are the total returns that could be generated by this time in 2034:

- 2.4% yield + 6.2% FactSet Research annual growth consensus – 1.1% annual valuation multiple expansion = 7.5% annual total return potential or a 106% 10-year cumulative total return versus the 10% annual total return potential of the S&P or a 159% 10-year cumulative total return

A Thriving Product Portfolio And An Extensive Pipeline

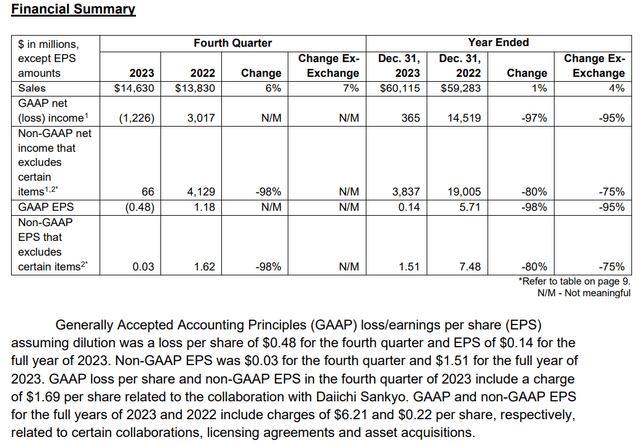

Merck Q4 2023 Earnings Press Release

In the fourth quarter, Merck once again came through for shareholders. The company’s sales grew by 5.8% year-over-year to $14.6 billion during the quarter. For context, that outpaced the analyst consensus by $120 million. It was also the tenth consecutive quarter that Merck outperformed the analyst consensus, according to Seeking Alpha’s Earnings Page for Merck.

Further adjusting for unfavorable foreign currency translation and diminished demand for the COVID-19 oral antiviral therapeutic Lagevrio, the company’s sales would have grown by 13% for the fourth quarter. Like in recent quarters, Merck’s sales growth has been largely powered by its two top-selling products.

The mega-blockbuster Keytruda became the world’s top-selling drug in 2023, with $25 billion in sales, overtaking AbbVie’s (ABBV) Humira. In the fourth quarter, the oncology drug posted $6.6 billion in sales – – a 21.2% growth rate over the year-ago period. Thanks to Keytruda’s globally trusted reputation among oncologists, the therapy benefited from greater uptake in earlier-stage cancers like triple-negative breast cancer, according to Merck.

The drug’s momentum should also keep up in the quarters ahead. This is because it was approved for a slew of indications recently that could move the growth needle further alongside continued uptake growth. In the European Union, Keytruda plus chemotherapy was recently given the green light as a first-line treatment for patients with advanced HER2-negative gastric or GEJ adenocarcinoma and advanced biliary tract cancer. Earlier last December, the treatment plus Padcev was also authorized as a first-line treatment by the U.S. Food and Drug Administration for adult patients with locally advanced or metastatic urothelial cancer.

Merck’s Gardasil human papillomavirus or HPV vaccine franchise was also a key contributor to growth. The vaccine’s sales shot up by 27.3% year-over-year to nearly $1.9 billion during the fourth quarter. Out of the 100+ types of HPV, some are capable of leading to uterine, anus, and neck cancers per Allied Market Research. Growing awareness of the potential clinical benefits of the Gardasil vaccine (especially in China) should bode well for future growth. Additionally, Allied Market Research thinks the global HPV vaccine market will nearly triple from $3.9 billion in 2021 revenue to $10.8 billion by 2030.

These growth drivers were partially offset by the 76.6% plunge in Lagevrio sales to $193 million for the fourth quarter. A waning in COVID-19 led to lower demand in key markets like Japan and Australia.

Merck’s non-GAAP EPS fell by 98.2% year-over-year to $0.03 in the fourth quarter. That beat the analyst consensus by $0.14, which was also the 10th straight quarter that the company has done so per Seeking Alpha. Factoring out the $1.69 per share charge associated with the Daiichi Sankyo (OTCPK:DSNKY) collaboration, non-GAAP EPS would have been $1.72 – – a 6.2% growth rate over the year-ago period. This $5.5 billion charge was the company’s contribution toward spending on clinical programs in partnership with Daiichi Sankyo.

Looking at 2024, Merck should have no problem growing. The company anticipates that it will generate $63.5 billion in midpoint sales during the year ($62.7 billion to $64.2 billion). That would represent a 5.6% growth rate over the 2023 base of $60.1 billion.

Just as Keytruda and Gardasil were the growth catalysts in 2023, that should continue into 2024. In the U.S. alone, Keytruda received approval for seven additional indications according to Drugs.com in 2023. Along with a score of approvals in other key markets, this should accomplish the otherwise mountainous task of growing the $25 billion 2023 sales base throughout 2024. Gardasil’s momentum also looks like it can be sustained due to the growing awareness of its clinical value that I mentioned before. That’s why I believe Merck’s sales growth forecast for 2024 is attainable.

This higher sales base also is how the company thinks it can record $8.52 in non-GAAP EPS in 2024 ($8.44 to $8.59). Backing out the $6.21 impact of business development transactions in 2023, that would be a 10.3% growth rate over the 2023 base of $7.72. CFO Caroline Litchfield also pointed out in her remarks during the Q4 2023 Earnings Call that the other element that will power this growth is continued improvement in operating margin.

Beyond just 2024, Merck’s future remains promising. That’s because the company had 80-plus programs in phase 2 clinical trials and over 30 programs in phase 3 clinical trials in its pipeline as of Feb. 23 (unless otherwise noted or hyperlinked, all details in this subhead were sourced from Merck’s Q4 2023 Earnings Press Release).

The Next Few Years Should Offer Steady Dividend Growth

In the past five years, Merck’s quarterly dividend per share has cumulatively surged 40% higher to the current rate of $0.77. That is equivalent to a 7% compound annual growth rate. For at least the coming several years, I believe dividend growth will be almost as fast.

That’s because, in 2023, Merck produced $9.1 billion in free cash flow. Compared to the $7.4 billion in dividends paid out for the year, that’s an 81.4% free cash flow payout ratio (info according to page 76 of 370 of Merck’s 10-K filing). When excluding the $5.5 billion charge tied to Daiichi Sankyo, the free cash flow payout ratio was a more viable 50.8%.

Risks To Consider

Merck’s operating fundamentals are encouraging, but there are still risks.

A plurality of the company’s $60.1 billion (41.6%) in 2023 sales were derived from Keytruda (per Merck’s Q4 2023 Earnings Press Release). Merck continues to work on a subcutaneous (under the skin) Keytruda, with the hopes that it can stave off biosimilar competition longer with new patents. But whenever the drug faces competition from biosimilars, the drop-off in revenue will be rather swift and steep. If Merck can’t supplement its pipeline with enough business development deals (e.g., acquisitions and collaborations), its fundamentals could suffer.

As a mega-cap pharmaceutical, Merck is a frequent target of attempted cyber breaches. If the company’s IT network was successfully penetrated, this could compromise proprietary and sensitive personal information and disrupt operations. Such an event may result in substantial penalties against Merck and harm its competitive positioning.

Summary: A Quality Business For The Watch List

Merck is a business in which I am happy to hold a 1.2% weighting within my portfolio. The company should be positioned for decent long-term growth via its existing product portfolio and pipeline. The balance sheet is A-rated. Lastly, the market-beating dividend is adequately covered by earnings and free cash flow. But until shares come down to around $110 a share, they become more valuable, or some combination occurs, I won’t be buying more Merck for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.