Summary:

- After a forgettable last year, Merck & Co., Inc.’s stock price is up 20% YTD, supported by approvals, a positive outlook for 2024, and an attractive forward P/E.

- Keytruda, the company’s top-selling treatment, received approval from the European Commission, and hypertension treatment Winrevair received FDA approval.

- While its collaboration with Daiichi Sankyo and acquisitions reduced the EPS for 2023, Merck expects a turnaround this year, making for an attractive forward P/E compared to its 5y average.

Sundry Photography

One of the biggest pharmaceutical stocks by market capitalization, Merck & Co., Inc. (NYSE:MRK) has had a good first quarter at the stock markets in 2024. Its price is up by over 20% after a forgettable 2023 that saw it end the year essentially flat, supported by approvals for its treatments as well as its final quarter (Q4 2023) and full-year 2023 results.

Supportive fundamentals might be a necessary condition for a stock’s consistent success in the markets, but they aren’t sufficient. Here, I look at how the balance of its fundamentals and market metrics plays out to assess what’s next for Merck, especially as its trailing twelve months [TTM] GAAP price-to-earnings (P/E) ratio is sky high.

Keytruda’s EC approval bodes well

The company’s single biggest treatment, Keytruda, which contributed to ~42% of total sales in 2023, received a nod from the European Commission last week. The immunotherapy treatment for all kinds of cancers is now permitted in much of Europe to fight lung cancer, with its promising results. Used in conjunction with chemotherapy, it reduces the risk of mortality by 28% and the risk of recurrence of disease, its increase or death by 41%.

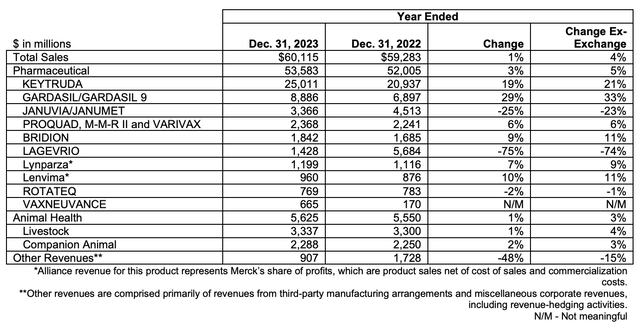

This bodes well for the company not just because of how much Keytruda contributes to sales, but also because the treatment saw a strong 19% sales growth in 2023, compared to just a 1.4% increase in total sales. To be fair, total sales were impacted because of the expected drag from its COVID-19 medication Lagevrio by 75% (see table below). But Keytruda exceeds total sales growth-ex Lagevrio, at 9.5%, as well. Moreover, its growth is second only to the HPV vaccine Gardasil, which grew by 29%.

Sales by product (Source: Merck)

Merck is also expanding its lung cancer portfolio in particular, and oncology portfolio more generally, with its recent acquisition of Harpoon Therapeutics. Harpoon’s lead candidate is MK-6070, which is being developed to treat small lung cancer.

Hypertension treatment gets FDA approval

Its cardiovascular portfolio has also received a fillip, with the US Food and Drug Administration [FDA] approving Winrevair, its injection, for hypertension that can lead to heart failure. The treatment’s unique selling point is its potential to reduce mortality, by targeting the underlying cause of the problem. This is distinct from existing treatments that focus more on the symptoms as per the company.

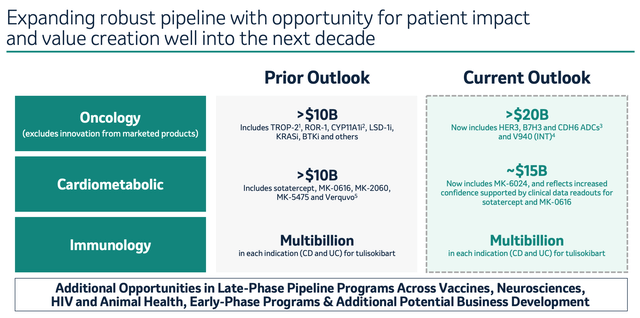

This is a crucial approval for Merck in more ways than one. First, the treatment’s origins lie in Acceleron, which Merck acquired for a notable USD $11.5 billion in 2021. For context, this amounted to 12.5% of the company’s total assets in the year prior. To that extent, its commercialisation is key in assessing whether the buyout can pay off for Merck. Second, it is a step forward in reaching the company’s cardiometabolic sales target of USD $15 billion in a decade (see chart below), bringing it close to the oncology segment.

Earnings weakness to continue, but for good reasons

Both the sales growth and approvals are good news for Merck. However, its earnings saw a setback in 2023, with a 98% decline in GAAP earnings per share [EPS] at market exchange rates and an 80% decline in non-GAAP EPS. Bad as this looks, though, there are very good explanations for the numbers. These are as follows:

- Weak full-year sales due to the sharp drop in COVID1-19 medication revenues, whose share dropped from 9.6% in 2022 to 2.4% in 2023, are a justifiable reason.

- Completion of the Prometheus Biosciences acquisition in Q2 2023 for USD $10.8 billion, resulted in a loss during the quarter. Much like Acceleron at the time of purchase, Prometheus’s revenue numbers are small so they won’t do anything for Merck’s financials in the near term. But at the same time, it may well have a promising future with its focus on autoimmune diseases. These diseases are estimated to affect one in every ten people globally, which means that a massive 810 million people suffer from them, indicating the potential for the market.

- A partnership with Japan’s Daiichi Sankyo (OTCPK:DSNKY) to expand its oncology portfolio, resulted in a USD $5.5 billion R&D expense. This was in addition to the already increased expenses due to the acquisitions of both Prometheus and oncology specialist Imago BioSciences. The Daiichi Sankyo partnership alone had a USD $1.69 per share impact on the EPS in Q4 2023. The GAAP EPS would have seen a small increase of 2.6% year-on-year instead if it weren’t for the charge.

Outlook and potential stock returns

As a result of the sharp drop in EPS, Merck’s trailing TTM GAAP P/E ratio is impossibly high at 935.6x. However, if the drag because of the latest developments is added back to the full-year GAAP EPS number of 2023, the TTM P/E subsides considerably. It comes down to 20.5x, which is lower than the average P/E for the past five years a 30x, where 2023 has been considered with the said addition in the averaging.

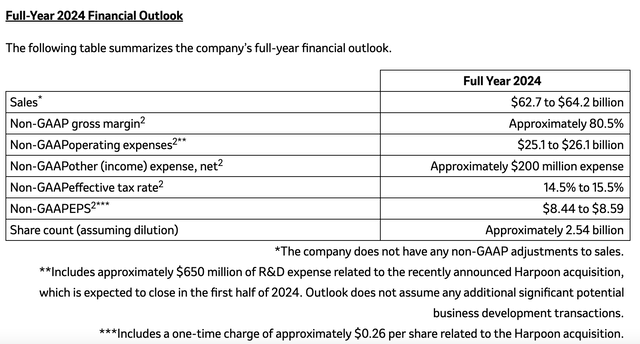

The company’s outlook for 2024 (see table below) is also encouraging for the stock’s prospects. At the midpoint of the sales forecast range, the number would grow by 5.6% this year, and the sales ex-Lagevrio would likely grow at an even higher rate. After 2023’s setback, the non-GAAP EPS is also expected to see a significant increase of 5.6x at the midpoint of the guidance range.

The EPS guidance translates into a non-GAAP forward P/E of 15.3x, which too is less than the five-year average of 18.8x. The TTM and forward P/Es indicate an average further 35% upside to the stock.

There are also the dividends to consider. The company’s TTM dividend yield at 2.3% is higher than the average of 1.49% for the healthcare sector. Also, it has grown dividends consecutively for the past 13 years and paid them for the last 34 years. While there’s a possibility that the dividend growth can pause now going by the latest earnings, the likelihood of resumption in dividend increase is high based on the earnings outlook.

What next?

The discussion reveals that it’s a good time to buy Merck even though it has already risen a fair bit in 2024 so far. The earnings figures are set to improve this year as the company moves past its high acquisition and R&D spending. And these expenses may well result in profitable results down the line.

Revenue growth is slated to rise too as the impact of its COVID-19 medication’s slowing sales fades. The recent EC approval of its blockbuster cancer treatment Keytruda is also a step in the right direction. As is the FDA approval of the hypertension treatment Winrevair, which will also grow its cardiovascular portfolio as Merck targets.

In the meantime, the Merck & Co., Inc. forward P/E looks attractive and so does the TTM P/E if we add back the impact of its recent R&D and acquisition spending to the EPS. The company’s consistent dividend payouts and better-than-healthcare average dividends are notable aspects to consider too. All in all, there are better times ahead for Merck investors than those seen in 2023. I’m going with a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—