Summary:

- Merck & Co has experienced significant share price growth across the past 3 years, bettered only in the big pharma sector by Eli Lilly and Novo Nordisk.

- Merck’s >$20bn selling cancer drug Keytruda’s patents are set to expire in 2028, leading to concerns about declining revenues after that year.

- Merck is focused on developing its pipeline, which includes 8 novel assets undergoing 20 Phase 3 studies, and has invested over $50 billion in M&A since 2019.

- As such, MRK is well positioned to prepare for a post-keytruda patent expiry world, although the drug will likely substantially grow revenues over the next 3 years.

- As such, if the market becomes jittery around keytruda, I’d interpret that as a potential buying opportunity. I am expecting a solid set of earnings from the New Jersey Pharma when they are announced this Thursday.

MCCAIG

Investment Overview

Over the past three years, if we ignore the two outliers Eli Lilly (LLY), and Novo Nordisk (NVO) – whose launching of GLP-1 agonist drugs targeting Type 2 diabetes and obesity, Mounjaro / Zepbound, and Ozempic / Wegovy have helped support a >200% rise in their share prices – Merck & Co. (NYSE:MRK), the world’s fourth largest Pharma by market cap valuation – currently $306bn – has been the “best of the rest” in terms of share price growth.

Merck stock has risen in value by ~65% on a 3-year basis, ~75% on a 5-year basis, 15% on a 6-month basis, and 11% year-to-date. A key difference between Merck, and Lilly / Novo Nordisk, is that while the latter two have launched drugs which the market believes can one day generate revenues >$20bn per annum (potentially in each indication), Merck already has such a drug in keytruda, its immune checkpoint inhibitor (“ICI”) cancer drug that generated nearly $21bn of revenues for the New Jersey based Pharma in 2022, and $18.4bn across 2023, to Q3.

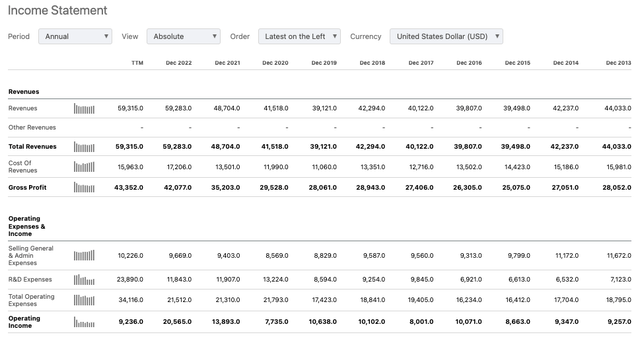

Merck income statements historic (Seeking Alpha)

As we can see above, Merck has grown revenues in nearly every year since 2015, and its ability to generate high operating profit margins is exceptional – margins across the past 5 years (starting from 2018) have been 24%, 27%, 19%, 29%, and 35%. Management is promising that the business can achieve an operating margin of 43% by 2025, and has also promised “strong de-risked revenue growth”, and the “capacity to pursue additional business development” (source: JP Morgan Healthcare conference presentation).

Guidance – released alongside Q3 2022 earnings – is for 2023 revenues of $59.7 – $60.2bn, and earnings per share of $1.33 – $1.38 on a non-GAAP basis – implying a forward price to earnings ratio of ~89x, significantly above my calculated industry average of ~35x. Merck’s current dividend payout of $0.77 per quarter yields ~2.6%, which is a little under my calculated sector average of ~3%.

In the first half of 2023, Keytruda revenues of $12.1bn accounted for >40% of Merck’s entire revenues of $29.5bn, with its oncology division, which includes alliance revenues relating to Merck’s 3 other approved cancer drugs, Lynparza, a PARP inhibitor directed against ovarian cancer, Lenvima, a tyrosine kinase inhibitor (“TKI”) indicated to treat thyroid cancer, and Reblozyl, approved to treat anemia in hematological cancers of $1.2bn, $876m, and $166m respectively – accounting for 45%. of all revenues.

As far as Merck’s other divisions are concerned – Vaccines, including Gardasil for HPV infections, and ProQuad for measles, mumps and rubella, which earned respectively $4.4bn and $1.1bn across 1H23, accounted for 22% of revenues, Cardiovascular, 1%, Hospital Acute Care, 6%, Immunology – including Simponi and Remicade, directed against rheumatoid arthritis / plaque psoriasis, 2%, Virology, including the COVID therapy Lagevrio, $5.7bn of revenues in 2022, and $595 across 1H23, 3%, Diabetes – including Januvia and Janumet, $1bn and $683m across 1H23, 6%, Other Pharmaceutical, 4%, and Animal Health, 10%.

Merck’s Long Term Keytruda Problem Will Dominate Earnings’ Calls Going Forward

In short, Merck is a large, diversified business, but its reliance on keytruda is also clear. The drug – which has secured 35 Food and Drug Agency (“FDA”) approvals across 16 different types of cancer – has patents that expire in 2028. In that year, there is likely to be a flood of generic versions of keytruda waiting to launch in most, if not all, of keytruda’s indications, which will create downward price pressure and substantially reduce keytruda’s market share over time.

2028 may seem a long way off, but when it comes to valuing pharmaceutical companies, the market tends to think more about “jam tomorrow” than “jam yesterday”. In other words, while Lilly and Novo Nordisk’s valuations have inflated, based on the revenues that Zepbound / Wegovy and Mounjaro / Ozempic will make over the next decade and a half, the valuation of Pfizer (PFE) has shrunk substantially now that its COVID drug franchise – which drove >$50bn of revenues in 2022 – is no longer forecast to drive more than a few billion in annual revenues.

The market has begun to ask questions about how Merck will prepare for shrinking keytruda revenues after 2028, in much the same way it posed questions to AbbVie (ABBV) in the years prior to the patent expiry of its $20bn per annum selling autoimmune drug Humira. Humira generics were permitted to launch in the US this year, leading to Humira’s net revenues falling >30% year-on-year in the US across the first 9m of 2023.

Just as it was for AbbVie, like it or not, the market will focus more closely on keytruda’s upcoming loss of market exclusivity, and how Merck is preparing to maintain top line revenue growth while its biggest selling asset’s revenues decline, than on any other aspect of its business, until the end of the decade.

Luckily for Merck shareholders, however, similarly to AbbVie, Merck management is upbeat about, and apparently on top of the situation. Merck’s Chairman and CEO Rob Davis had this to say during a fireside chat at the JPMorgan (JPM) Healthcare Conference earlier this month:

I know the conversation continues to be about KEYTRUDA and 2028. But increasingly, we’re not focused on 2028. 2028 is just another year, just another point. We’re focused on 2030 to 2040. And why that is, is the confidence we have in the pipeline we’ve developed and the value it’s going to create.

It should be noted that Keytruda is still producing best-in-class study data, such as cutting the risk of disease recurrence or death by 31% after surgery in patients with urothelial carcinoma, a form of bladder cancer, in a recent study, and winning approvals, such as in December, in combination with Seagen’s antibody drug conjugate (“ADC”) Padcev in advanced bladder cancer, or this month, in combo with chemotherapy in stage 3/4 cervical cancer. Adjuvant non-small cell lung cancer and adjuvant kidney cancer are two important new targets for the drug, which will help keytruda to keep building market share in the earliest lines of therapy, in some of the largest oncology markets.

In fact, by 2028 research points to Keytruda being the world’s best selling drug by a significant margin, with revenues of $30bn, and no other drug expected to drive >$20bn in annual revenues. In truth, preparing for a $30bn per annum selling drug’s patent expiry is a much better problem to have than not having such a drug in the first place.

Merck is looking at developing a subcutaneous form of the drug which, if successfully tested and brought to market could be used by 50% of the patients using intravenous keytruda today, CEO Davis believes, and could extend Keytruda’s patent life well into the next decade.

In short, although the impact keytruda’s loss of exclusivity (“LOE”) will ultimately become the key valuation metric the market applies to Merck, it’s important to realize that keytruda’s top line revenue contribution may exceed $30bn per annum by 2028, and that the drug is likely to be a double-digit-billion selling asset well into the second half of the next decade.

Merck’s Pipeline – As Big A Contribution As Keytruda By 2030?

Big Pharmaceutical companies are required to almost completely overhaul their businesses with new and better products every couple of decades – meeting the challenge of doing this is rewarded with lengthy patent protections for sales of drugs that result in substantial profit margins.

In Merck’s case, the challenge of creating a next-generation product portfolio that is comparable to the keytruda era is a harder one than that faced by most other Big Pharma companies, but the company is determined to meet it head on. Management boasts that there are 8 novel assets undergoing >20 Phase 3 studies in its pipeline, and that it has invested >$50bn in M&A since 2019.

Let’s start by considering the future value of that M&A. Sotatercept, for example, is expected to be approved in 2024. The drug candidate – an activin signaling inhibitor – was acquired as part of Merck’s $11.5bn buyout of Acceleron Pharma, and has a Prescription Drug User Fee Act (“PDUFA”) date – the date the FDA announces whether a drug is approved or rejected for commercial use – arriving on March 26th in the indication of pulmonary arterial hypertension (“PAH”).

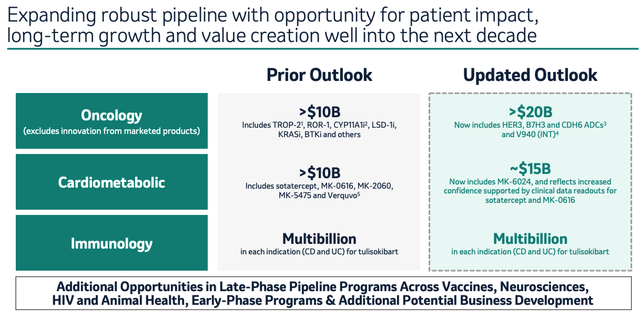

Alongside several other late stage drug candidates, Merck management believes that sotatercept can lead a cardiometabolic portfolio that can contribute >$15bn revenues per annum to the top line. Analysts have suggested sotatercept could generate $3-$4bn in peak revenues, while cholesterol lowering candidate MK-0616 has been pegged for >$5bn per annum, if approved, after achieving 41-61% reductions compared to placebo in a recent clinical study.

Merck pipeline promise (JP Morgan Healthcare conference presentation)

As we can see above, Merck also believes it can extract >$20bn in peak annual revenues from an entirely new set of cancer drugs, both commercial and pipeline.

Much of this is expected to be generated by Merck’s antibody drug conjugate portfolio – ADC’s are the current “big thing” in cancer drug treatment, thanks to their ability to provide targeted cell killing – as per adcreview.com:

Antibody-drug conjugates or ADCs are a new class of highly potent biopharmaceutical drug composed of an antibody linked, via a chemical linker, to a biologically active drug or cytotoxic compound. These targeted agents combine the unique and very sensitive targeting capabilities of antibodies allowing sensitive discrimination between healthy and cancer tissues with the cell-killing ability of cytotoxic drugs.

While Pfizer has spent $43bn acquiring Seagen and its 3 approved ADCs, which generated ~$2bn revenues last year, and AbbVie has spent ~$10bn acquiring ImmunoGen (IMGN), and its approved – for ovarian cancer – ADC elahere, Merck has partnered with Daiichi Sankyo, making a $4bn upfront payment to the Japanese Pharma, plus $1.5bn in follow-on-payments, for the rights to co-develop 3 ADCs – patritumab deruxtecan (“HER3-DXd”), ifinatamab deruxtecan (“I-DXd”) and raludotatug deruxtecan (“R-DXd”). According to a press release:

Patritumab deruxtecan was granted Breakthrough Therapy Designation by the U.S. Food and Drug Administration in December 2021 for the treatment of patients with EGFR-mutated locally advanced or metastatic non-small cell lung cancer (NSCLC) with disease progression on or after treatment with a third-generation tyrosine kinase inhibitor (TKI) and platinum-based therapies.

The submission of a biologics license application (BLA) in the U.S. is planned by the end of March 2024 for patritumab deruxtecan, which is based on data from the HERTHENA-Lung01 Phase 2 trial (ClinicalTrials.gov; NCT04619004) recently presented at the IASLC 2023 World Conference on Lung Cancer and simultaneously published in the Journal of Clinical Oncology.

Ifinatamab deruxtecan has made it into a Phase 2 study in small cell lung cancer (SCLC), while, Raludotatug deruxtecan, targeting ovarian cancer, is in Phase 1/2 studies. Merck has a second collaboration in place with Kelun Biotech, involving two further ADCs, targeting the proteins TROP2, and indicated for lung and breast cancer, and CDH6, targeting ovarian cancer.

Merck enjoys the considerable advantage of being able to test all of its cancer drugs in combo with keytruda, which has led to an intriguing partnership with Moderna (MRNA), designing a “cancer vaccine” that can be deployed alongside treatment with keytruda in melanoma, V940, which has been advanced into a Phase 3 study, plus a Phase examining the candidate as a potential NSCLC adjuvant.

The $1.5bn buyout of Imago Biosciences, and its Phase 2 stage lysine-specific demethylase 1 (“LSD1”) inhibitor, addressing multiple hematological cancer indications, further strengthens an oncology division that appears to be well-positioned to reduce dependence on keytruda going forward.

Outside of oncology and cardiometabolic, immunology is a key market for Merck, partly thanks to its ~$11bn buyout of Prometheus Biosciences in June last year. Prometheus’ candidate PRA-023, now known as MK-7240, is a humanized monoclonal antibody (“MaB”) directed against tumor necrosis factor (TNF)-like ligand 1A (“TL1A”), meaning it has the same target as AbbVie’s Humira.

Merck is less experienced in highly competitive inflammation and fibrosis markets, but MK-7240, or Tulisokibart, has already entered a Phase 3 study in inflammatory bowel disease (“IBD”), and Phase 2 studies in vitiligo, and lupus – markets in which it can expect to generate “blockbuster” (>$1bn) revenues per annum.

Concluding Thoughts Ahead Of Full Year 2023 Earnings – Some Headwinds To Consider, But Few Reasons To Be Fearful

Merck is a powerhouse Pharma with the ultimate powerhouse drug, and although 2024 may be the year that discussion around keytruda’s 2028 patent expiries intensifies, in the near term – for the next 2-3 years – keytruda revenues are only likely to keep growing substantially.

That ought to mean that Merck will be able to dismiss concerns around negligible revenues for its COVID therapy lagevrio in 2024, lower earnings per share than in previous years (i.e. $5.73 in 2022 and $5.16 in 2021), and a dividend whose yield is slightly on the lower side, and bounce back with a strong and more profitable year in 2024 – starting with some bullish guidance, I’d expect.

I would expect Merck to guide for revenues growth in 2024 to be in the mid-to-high single digits, and for EPS to be a marked improvement on 2023, which ought to please the market; although ultimately I expect the market to be more focused on new drug approvals due this year and their initial commercial performance, and on long term guidance that factors in keytruda’s patent expiries more than in the short term.

Ultimately, management has responded bullishly to keytruda’s likely patent expiries in 2028, ramping up its guidance for a long-term, >$20bn revenue contribution from its various new cancer drugs, a >$10bn contribution from metabolics, and multi-billions more in immunology, while its hospital care and animal segments offer steady if unspectacular growth. The pipeline even extends into central nervous system (“CNS”), with Phase 2 stage drugs targeting e.g. Alzheimer’s, and schizophrenia.

Merck reported $8.6bn of cash and $32bn of current assets as of Q3 2023, with current liabilities of $23.1bn, and long term debt standing at $34bn. That is a substantial figure, but with its high operating margins and strong cash flow generation, there seems to be few concerns around maintaining an investment grade debt rating, or paying interest on debt, while there would appear to be further funds for M&A, should Merck management be concerned around any of its existing pipeline drugs not making the grade, or fulfilling expectations.

Ultimately, I expect Merck’s earnings – due on Thursday – to be broadly positive, with no demons lurking in the Q4 earnings figures, either top line or bottom, or in the 2024 guidance.

The fact that the market has already begun looking at a post-keytruda landscape may create some downward pressure on the company share price, however even if earnings and 2024 forecasts are bullish, I would certainly interpret that as a buying opportunity, given we have 4-5 more years of ~$25bn – $30bn revenues contributions from Merck’s wonder drug, which gives the company every chance of renewing and revitalizing the rest of its product portfolio, and maintaining a top line growth trajectory across the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.