Summary:

- Merck’s strong financial performance in oncology and vaccines drove a 9% sales increase earlier in Q1 of 2024, despite challenges with other products.

- Promising future developments include successful Phase 3 trials for ovarian cancer and positive CHMP opinion for Welireg, enhancing MRK’s oncology and rare disease portfolio.

- MRK’s drug pipeline is robust, with 60% in Phase 2, indicating medium-term revenue potential, and its EV/EBITDA ratio aligns with sector averages.

- Technical analysis shows MRK at a strong support level around $99, presenting a good buying opportunity, with target prices of $119 first and $133 after the level is breached.

Sundry Photography

Merck & Co. (NYSE:MRK) has seen significant changes in its financial performance and market position through 2024. In this article, I attempt to provide investors with a comprehensive analysis of MRK’s past business performance, future growth prospects, and its competitive positioning in the pharmaceutical industry. I will also explain why I assign a Strong Buy rating on MRK stock by examining key financial metrics, pipeline benchmarks and technical indicators.

Past Business Performance

MRK, as investors will recall, reported impressive financial results in the first quarter of 2024. The company’s sales increased by 9% worldwide compared to the same period in 2023, reaching $15.8 billion. The company’s strong performance in oncology and vaccines was the main driver of this growth. CEO Robert M. Davis attributed these developments and the expansion of the commercial portfolio to the company’s continued use of innovations.

These developments and optimism led to the company gaining 22% in the first half of 2024, pushing its shares to $132. However, the stock fell sharply after MRK released its second-quarter earnings report. The company had reported very strong earnings and even expected revenue growth, but the company unexpectedly lowered its full-year non-GAAP EPS guidance, which made investors pessimistic and sold, and the company’s stock has since fallen to $94 by last month.

Most recently, MRK reported global sales of $16.7 billion in Q3 2024, up 4% from Q3 2023. The biggest drivers of this sales performance were KEYTRUDA sales, which increased by 17%, and the Animal Health segment, which increased by 62%, while the company maintained a solid financial outlook with steady growth in key segments. However, MRK’s GAAP net income fell 33% to $3.2 billion due to expenses from recent acquisitions. MRK also narrowed its full-year 2024 sales guidance to between $63.6 billion and $64.1 billion.

Merck’s stock initially fell 7% following its Q3 2024 earnings report, but quickly rebounded as investors reassessed the news. The decline was due to a slight downward revision to its full-year guidance and concerns about weaker-than-expected performance in some areas, such as GARDASIL sales in China. But the recovery suggests that investors, like me, view the company positively when analyzing overall results more broadly. MRK’s long-term resilience, underpinned by innovation, cost discipline and dividend stability, has reassured investors of the company’s future potential despite short-term challenges.

Merck also faced challenges with some of its other products. Sales of its type 2 diabetes drug Januvia fell 27% from a year earlier due to lower demand, pricing pressures and generic competition in several markets.

The company’s reliance on its flagship drug Keytruda also contributed to this decline. Although Keytruda sales increased by 16% YoY in the second quarter of 2024, the company’s reliance on just one drug was another cause for concern for investors. It is worth adding that sales of MRK’s Type 2 diabetes drug Januvia also fell by 27% YoY due to decreasing demand.

Future Business Expectations

Now that I’ve talked enough about the past, let me talk about what’s happening soon and what these developments signal for MRK.

Earlier this month, MRK announced that its Phase 3 trial of the drug KEYLYNK-001 had been successful in patients with advanced epithelial ovarian cancer. The company is making significant progress in cancer research.

MRK has made progress not only in oncology but also in therapeutics. The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has given a positive opinion for the conditional approval of Welireg (belzutifan) for treating certain types of von Hippel-Lindau (VHL) disease in adults. This is a really positive development for MRK’s portfolio. This will particularly expand MRK’s rare disease market and provide the opportunity to develop treatments for those affected by VHL, a disease that involves tumor growth in various parts of the body.

Looking ahead, MRK is particularly focused on immunotherapy-targeted treatments. The company is developing a combination therapy for lung cancer (NSCLC) with its R&D investments. This means that MRK is no longer targeting cancers in general, but rather more personalized and effective treatments based on specific genetic mutations in cancers. If it can do this, MRK looks set to move beyond monotherapies.

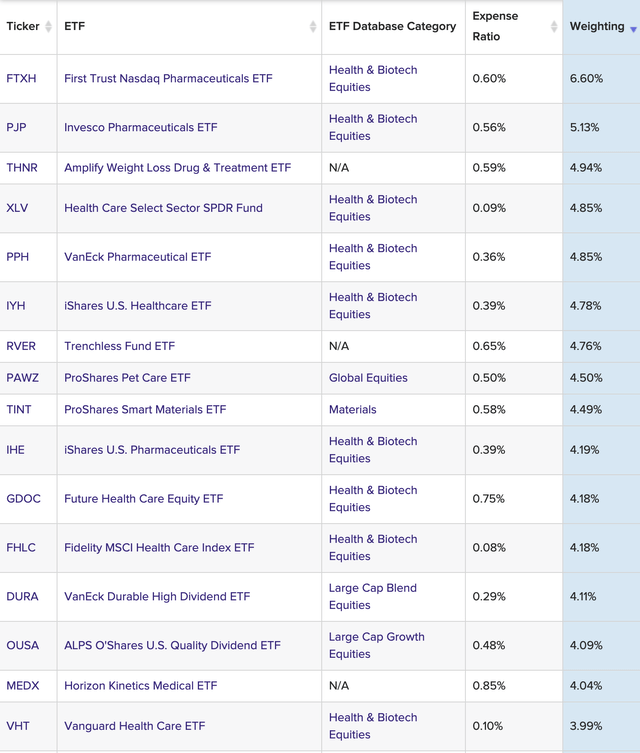

When I look at it from an investor and analyst perspective, I see that MRK’s business development is promising. Not only me, but probably most analysts think so as well, and the world’s leading financial management companies continue to give significant space to MRK in their pharmaceutical ETFs.

Pipeline Benchmark

While valuing a pharma company, I think one of the most important factors is the drug pipeline, as it represents future revenue potential. Pipeline benchmarks vary by company size. For instance, companies with revenues under $50 million typically have fewer than 10 drugs in development, while those with revenues between $50 million and $250 million might have 10–20 drugs in the pipeline.

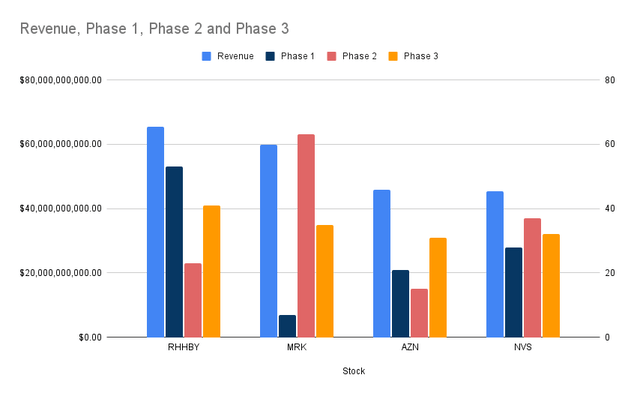

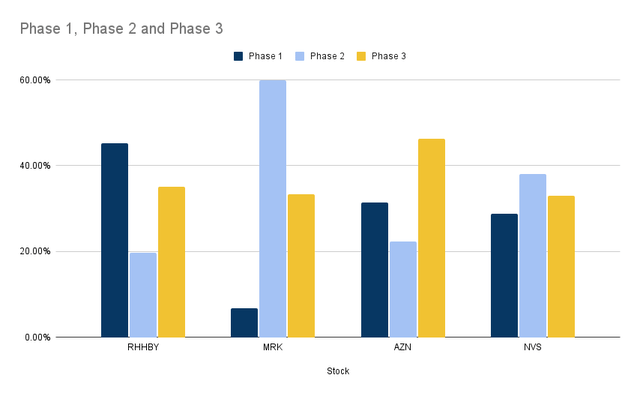

In doing this analysis, I will compare MRK with 3 companies that are its close competitors. These companies are Roche Holding AG (OTCQX:RHHBY), AstraZeneca PLC (AZN) and Novartis AG (NVS). The companies were ranked according to their revenues in 2023. In addition, the drugs in the pipelines of RHHBY, MRK, AZN and NVS were separated according to their phases.

Image created by Yavuz Akbay with data from firms official websites (merck.com, roche.com, astrazeneca.com, novartis.com)

RHHBY which has the highest revenue, has 117 drugs in its pipeline, MRK has 105, AZN has 67, and NVS has 97. It is clear that AZN’s pipeline has fewer drugs than it should, compared to the revenue. However, other companies, including MRK, are performing quite normally in this regard. Therefore, dividing the drugs into phases and the share of these phases in total drugs will give us more detailed information about how quickly the drugs will turn into revenue.

Image created by Yavuz Akbay with data from firms official websites (merck.com, roche.com, astrazeneca.com, novartis.com)

We do not want to see the share of Phase 1 in all drugs as too high. The reason for this is that the company has a long time to convert this drug into revenue. On the graph, it is determined that MRK is quite successful in this regard. Only 19.66% of the drugs are in the first phase. In addition, 60% of the drugs in MRK’s pipeline are in the second phase. In other words, this indicates that more than half of the drugs will be converted into revenue in the medium term. Finally, we determine that the rate of drugs in the third phase is 33%. This is close to the company average of 37%. Therefore, it is not bad at all.

Therefore, MRK proves to us that it has a truly positive pipeline by passing the pipeline benchmark test.

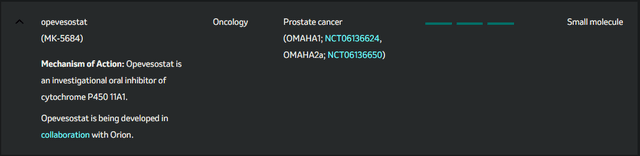

Key Pipeline Candidates

MRK is actively developing several important drug candidates in different therapeutic areas, focusing particularly on oncology, immunology and cardiovascular disease. The company currently has four very important candidates in the pipeline and in phase 3.

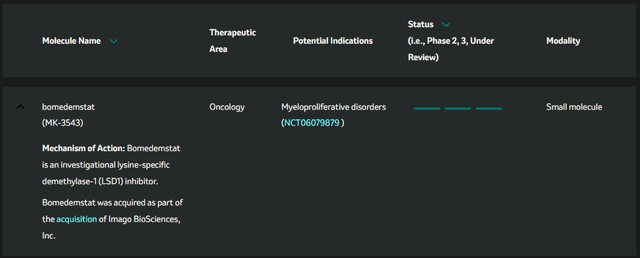

The first candidate, Bomedemstat, is potentially positioned by MRK as a first-line or alternative treatment with fewer side effects or better efficacy than current treatments. Given the complexity of oncology trials, the drug is likely several years away from approval, but the fact that it is in pivotal trials indicates that the drug is now approaching regulatory review.

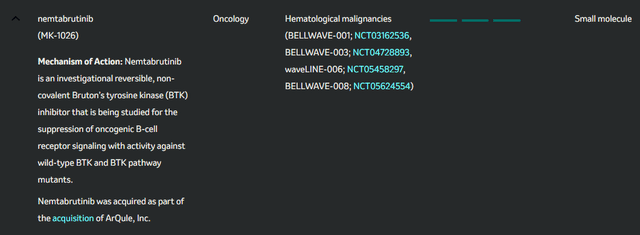

The second candidate is the BTK inhibitor Nemtabrutinib. This drug is being developed by MRK to overcome resistance issues seen in current treatments. Since it is on the same timeline as Bomedemstat, the approval process will be similar. The drug is used for chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL), and it can be said that the drug has a significant market due to the chronic nature of these diseases.

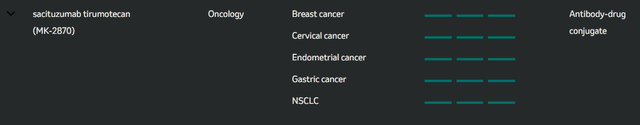

The third candidate, MK-2870, is being developed by MRK for non-small cell lung cancer (NSCLC) and endometrial carcinoma. As previously stated, the drug is in phase 3 trials and if successful, it will be approved in a few years. The lung cancer market is one of the largest in oncology, so there is no doubt that the drug will be in demand.

It is very likely that MRK will place MK-2870 alongside established cancer treatments such as Keytruda and target combination therapies that may offer higher efficacy. While the growing market for ADCs is positive for the drug, the higher development costs of the drug than others raise some concerns.

The latest candidate is MK-5684 for metastatic castration-resistant prostate cancer (mCRPC). This drug, which is being processed in the same timeframe as the other candidates, is specifically targeting the aging population. The drug will be marketed as a new treatment option for advanced prostate cancer in the aging population, along with existing treatments.

EV/EBITDA Ratio

I wanted to include this valuation ratio in my article because it is widely used, especially among pharmaceutical companies. It is one of the ratios used to understand whether pharmaceutical companies are in their values.

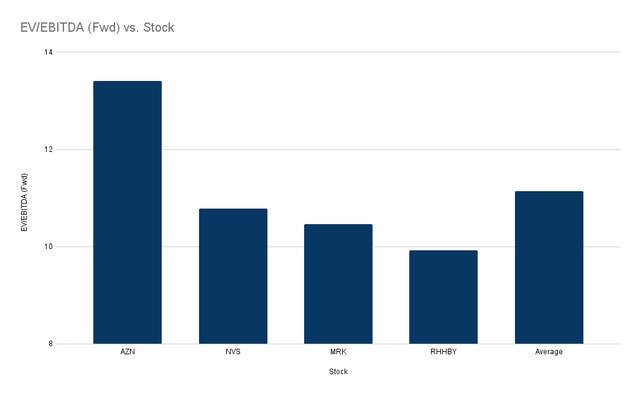

Image created by Yavuz Akbay with data from seekingalpha.com (seekingalpha.com)

When compared to substitute companies, it was determined that MRK is at 10.46x, which is slightly lower than the average EV/EBITDA value of 11.14x. Since extreme deviations are taken into account when making this analysis, this data is a clear indication that MRK is within the sector average. Therefore, the company is valued according to the sector average. Considering the qualitative developments I mentioned in the previous paragraphs, it is clear that the company has growth potential.

Risks

MRK is currently developing new formulations, such as subcutaneous injections, to extend Keytruda’s patent protection, but if unsuccessful, Keytruda’s patent will expire in 2028, meaning biosimilars will challenge MRK’s market share.

Not only Keytruda, but also drugs like Januvia are at risk of expiring their patents. This will require MRK to implement new product launches and a successful life cycle management strategy. If such compensation methods are not implemented, a potential decrease in revenues is inevitable.

In addition, MRK acquired Harpoon Therapeutics to expand its oncology offerings and fill the revenue gap expected from patent expirations. This strengthened MRK’s pipeline. But this move also carries risks, such as cultural fit, integration, and failure to meet expectations. It’s clear that MRK has risks not only in terms of medicine and business, but also in terms of business management.

Such risks may push the stock price down further and reverse my buy position, so it is beneficial for investors to keep their eyes open to these risks when making their investments.

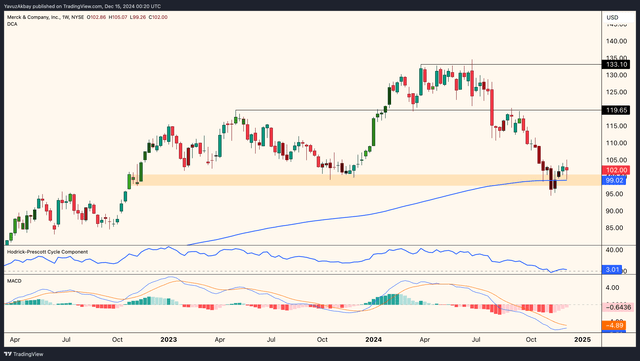

Technical Analysis

When I analyze a company technically, I use both price action and algorithmic indicators. First, I will use the Hodrick-Prescott indicator to determine the trend; the MACD to determine momentum, convergence and divergence; and the DCA indicator to determine overbought-oversold areas.

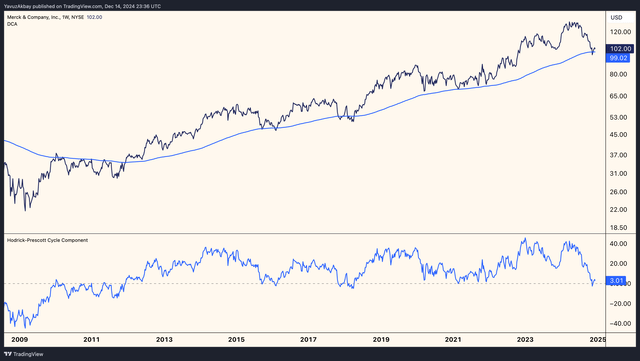

When looking at MRK’s price chart from 2009, it is seen that the price was rejected by the Hodrick-Prescott filter until 2012, and therefore the filter was used as resistance. MRK confirmed its transition to an uptrend by breaking the HP filter in December 2011.

MRK has been in a long-term uptrend since then. In 2015, 2018 and 2021, MRK has been approaching the HP filter again and finding support, making its run even stronger. In recent weeks, MRK has been approaching this HP filter again and is currently finding support on the filter. The filter is exactly at $99.02, and this level seems to be a good support level.

When the MACD indicator is analyzed, it is seen that the price has been in a downward wave since July and the MACD has started to rise. This creates a clear bullish divergence formation. However, the DCA indicator is giving the oversold alarm it gave in November 2023 again this week.

When the price action analysis is made, there is an order block that occurred in October 2022, especially around $99. This order block was also tested in both January 2023 and November 2023. The last test is currently being done, and this level also matches the $99 level where the HP filter is located. Therefore, it can be easily said that this level is a good support level, confirmed by both price action and indicators. MRK, which holds at this support level, offers investors a very good buying opportunity.

I think that the target price will be $119 first and then $133 after this level is broken, as the stock returns from this support area and starts running again. The principle of determining these two target prices is to determine that MRK has used these levels as support and resistance points repeatedly in 2023 and 2024, again using the price action method.

Conclusion

In summary, MRK is at a very good buy point for investors with a qualitatively solid drug portfolio, developments in oncology and rare diseases and quantitatively staying at an oversold position at the $99 support, targeting $133. While risks such as Keytruda dependency and regulatory uncertainty remain, MRK’s diversified portfolio, advantageous position in the sector and ongoing R&D investments provide assurance that the company will grow further.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.