Summary:

- Despite Merck beating analysts’ expectations for the second quarter of 2024, its stock price fell 9%.

- The company’s stock sell-off came as a result of an unexpected decline in sales of the Gardasil franchise in China and a cut in its forecast for full-year adjusted EPS.

- On the other hand, sales of Merck’s oncology franchise totaled about $8.05 billion, up 16.4%, thanks to solid sales of Keytruda, its key blockbuster.

- Also, on August 9, the company acquired CN201, a novel anti-CD3/CD19 bispecific antibody being developed to treat B-cell disorders, ultimately strengthening its immunology portfolio.

- Thus, I continue to cover Merck with a ‘Buy’ rating.

Deagreez/iStock via Getty Images

On July 30, Merck (NYSE:MRK) released its financial results for the second quarter of 2024, which beat my and Wall Street analysts’ expectations, thanks in part to strong sales of its cardiovascular franchise, as well as its blockbuster PD-1 inhibitor Keytruda, which has already been approved for 40 indications in the U.S.

In this article, I will discuss in detail several topics that are stirring the minds of financial market participants, ranging from the reasons behind the 9% decline in the company’s share price over the past two weeks to an analysis of Merck’s key medications and vaccines that will further strengthen its leading positions in various therapeutic markets.

Merck’s Q2 2024 financial results were beyond praise

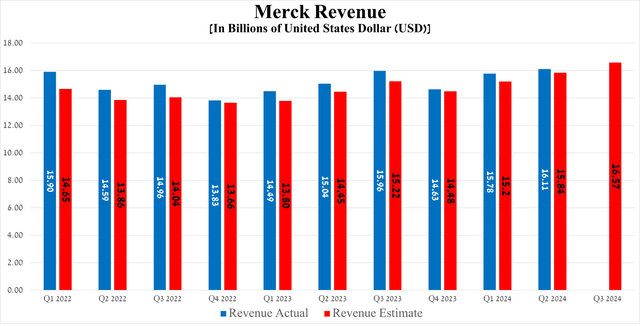

The Rahway-based company’s revenue was $16.11 billion in the second quarter of 2024, up 7.1% year-over-year and beating the consensus estimate by $270 million.

On the other hand, the results of another equally important financial metric, namely earnings per share (“EPS”), also pleasantly shocked me despite the continued growth of R&D expenses in recent months, mainly due to raised clinical development spending of its anti-cancer drugs and vaccines.

So, its EPS was $2.28 for the three months ended June 30, 2024, up 10.1% quarter-on-quarter and beating analysts’ expectations by 14 cents.

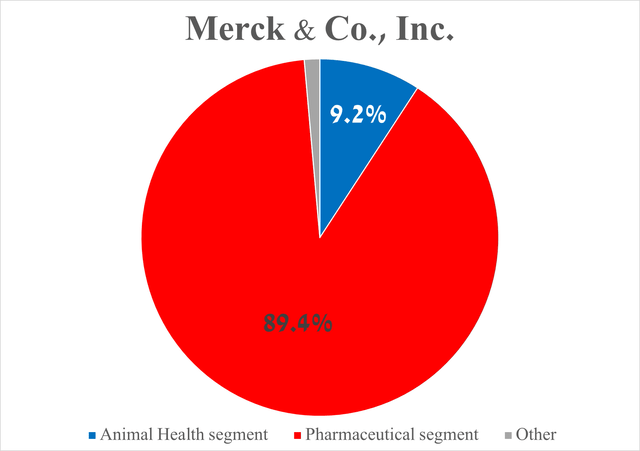

To answer this question, I would like to focus your attention on Merck’s Pharmaceutical segment, whose total sales amounted to $14.41 billion in the second quarter of 2024, increasing by 7.1% year-on-year.

You, Seeking Alpha readers, may wonder why only on it and not also on the Animal Health segment, which is focused on the development and subsequent commercialization of medications and vaccines to combat various diseases in domestic animals, as well as livestock.

The answer is quite simple, and it lies in the fact that the total sales of the company’s Pharmaceutical segment amounted to about 89.4% of its revenue.

Nonetheless, I would like to note that the total sales of the Animal Health segment reached $1.48 billion for the three months ended June 30, 2024, an increase of only $26 million year-on-year.

Source: graph was made by Author based on the Merck press release

Which medications and vaccines helped Merck beat Wall Street analysts’ expectations?

To answer that question, I’ll turn your attention, Seeking Alpha readers, to the sales of key products included in its oncology, vaccines, and cardiovascular franchises, as well as the successes and failures in developing its pipeline of product candidates in recent months.

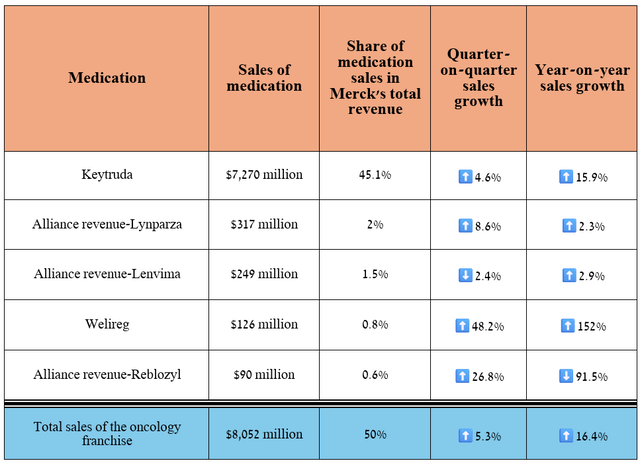

I’ll begin our journey through Merck’s financial results by first looking at its oncology portfolio, since its total sales account for about 50% of its revenue. In addition, many of its experimental drugs have significant potential to become “gold standards” in treating lung, bladder, colorectal, endometrial, and ovarian cancer.

So, its revenue was $8.05 billion for the three months ended June 30, 2024, up 16.4% year-over-year and 5.3% quarter-on-quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

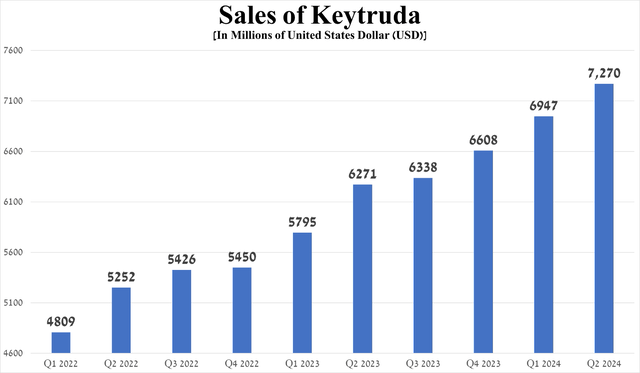

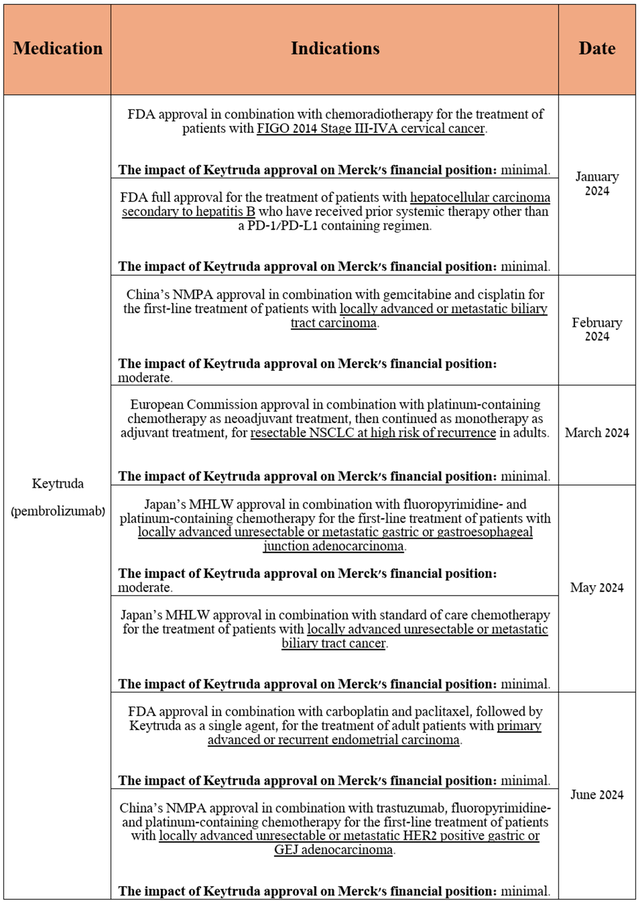

As in the previous article “Merck: The Worst Has Been Avoided,” I want to start the discussion with Keytruda (pembrolizumab), an anti-PD1 monoclonal antibody that was FDA-approved for 40 indications as of the end of June 2024, up five from the end of 2023.

Its sales were $7.27 billion in the second quarter of 2024, up 15.9% year-on-year.

Source: graph was made by Author based on 10-Qs and 10-Ks

What are the reasons for Keytruda’s commercial success?

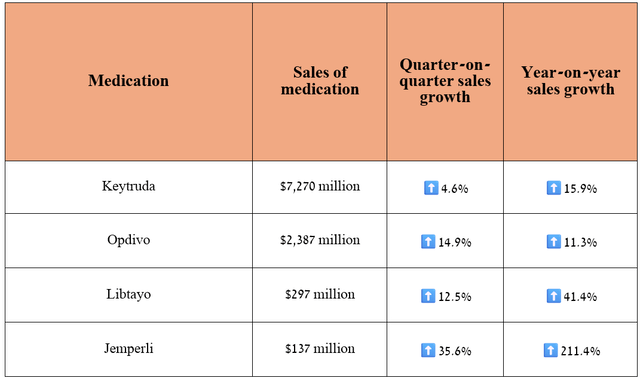

The answer is quite simple and lies in the fact that the demand for Merck’s blockbuster remains exceptionally high, especially for the treatment of patients with lung cancer, early-stage triple-negative breast cancer, and stomach cancer, despite the increasing competition in the global PD-1/PD-L1 inhibitors market from Bristol-Myers Squibb’s Opdivo (BMY), Regeneron’s Libtayo (REGN), and GSK’s Jemperli (GSK).

Source: table was made by Author based on 10-Qs and 10-Ks

In addition, since the beginning of 2024, it has been approved for the following indications in the United States, China, Japan, and the European Union.

Source: table was made by Author based on Merck’s 10-Q

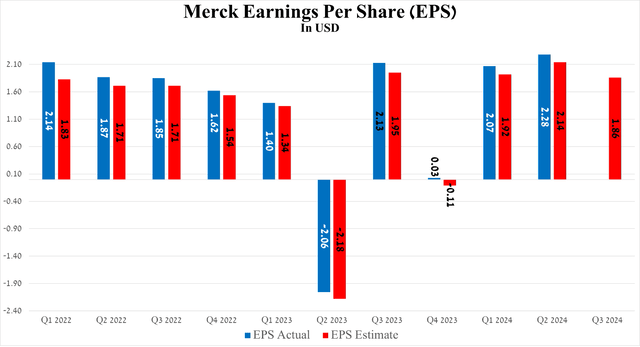

I also want to note that due to the loss of Keytruda exclusivity in 2028, Merck continues to pursue an aggressive R&D policy, which is reflected in the extremely high rate of expansion and strengthening of its portfolio of product candidates in recent quarters.

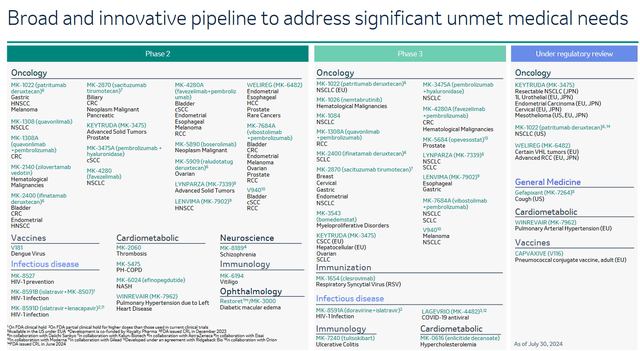

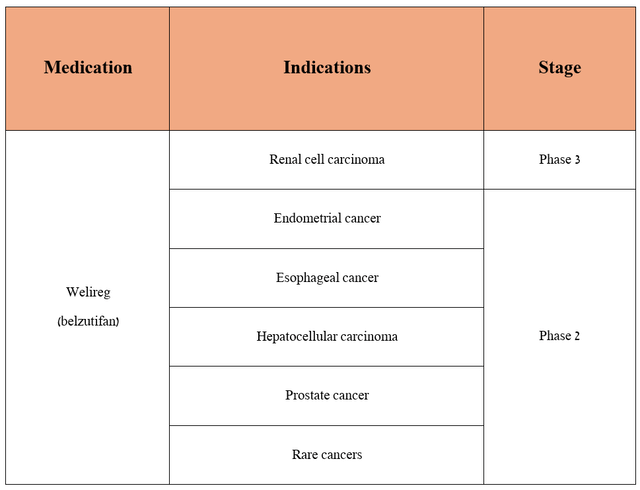

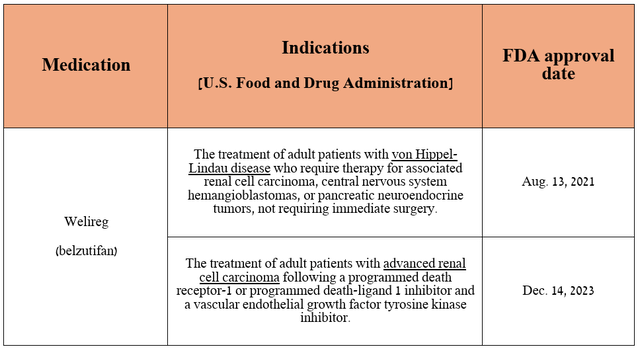

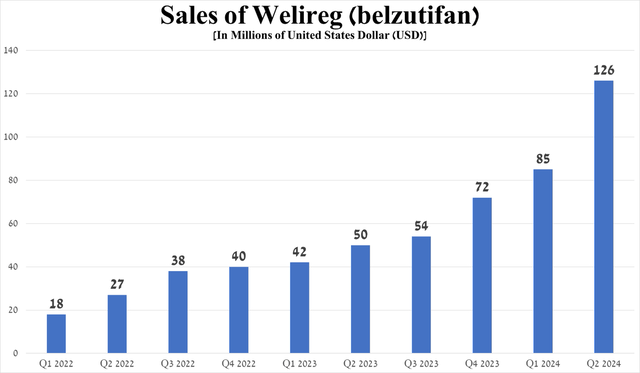

On the other hand, in addition to the experimental drugs of which favezelimab, ifinatamab deruxtecan, and patritumab deruxtecan have the greatest commercial potential, I also believe that Welireg (belzutifan) is a gem in the company’s oncology franchise. It is a hypoxia-inducible factor 2α inhibitor that is FDA-approved for the treatment of certain patients with von Hippel-Lindau disease-associated tumors and advanced renal cell carcinoma (“RCC”).

Source: table was made by Author based on Merck press releases

Its sales were $126 million in the second quarter of 2024, up 152% year-on-year, mainly due to its FDA approval on December 14, 2023, for the treatment of advanced RCC. Overall, renal cell carcinoma is the most common type of kidney cancer, which will affect about 81,610 Americans in 2024, according to the American Cancer Society’s forecast.

Source: graph was made by Author based on 10-Qs and 10-Ks

What additional factors will drive Welireg sales in the short term?

Merck’s medication is currently under review in Japan and the European Union for the treatment of patients with previously treated advanced RCC and for the treatment of VHL disease-associated tumors in the EU.

Seeking Alpha readers should also know that the Rahway-based company is not resting on its laurels and is seeking to expand the indications for Welireg by conducting clinical trials aimed at determining its safety profile and efficacy in the fight against endometrial cancer, esophageal cancer, hepatocellular carcinoma, prostate cancer and more.

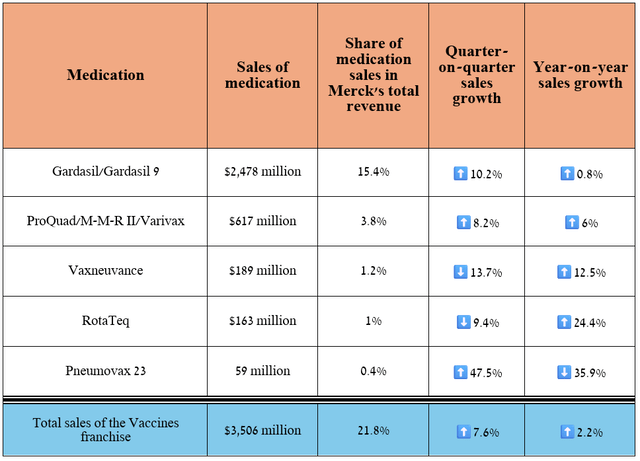

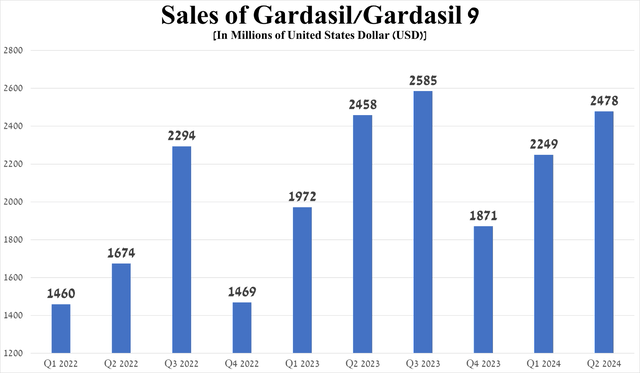

Let’s move on to a discussion of Merck’s vaccine franchise, whose products are approved by regulators to protect against viruses and bacteria that cause a variety of diseases, including measles, chickenpox, rotavirus gastroenteritis, rubella, and pneumococcal disease.

Overall, its total revenue was about $3.51 billion in the second quarter of 2024, up 7.6% year-on-year, despite falling demand for Pneumovax 23.

Source: graph was made by Author based on 10-Qs and 10-Ks

So, sales of Gardasil and Gardasil 9, which are vaccines that protect against various strains of the human papillomavirus, amounted to about $2.48 billion for the three months ended June 30, 2024, up 10.2% quarter-on-quarter, mainly due to continued strong demand in the United States and the European Union, which offset a decline in shipments from Zhifei Biological Products, the distributor of Merck’s vaccines in China, to vaccination points.

Source: graph was made by Author based on 10-Qs and 10-Ks

At the same time, Caroline Litchfield, Merck’s CFO, reassured investors on the quarterly earnings call by stating the following.

We believe the opportunity in China remains very attractive as there are more than 120 million females in the addressable population living in Tier 1 to Tier 5 cities who have not yet received the protection of an HPV vaccine. As we said before, it will take increasing efforts to educate and activate the next wave of patients.

Together with Zhifei, we are focused on and committed to investing in additional resources and patient education on the value of GARDASIL given the important benefits it provides. We also look forward to the potential approval for males which we believe represents a meaningful opportunity.

More broadly, we remain confident in the opportunity for GARDASIL globally based on the protection it provides against HPV-related cancers and low immunization levels overall, and continue to believe we will achieve sales of over $11 billion by 2030.

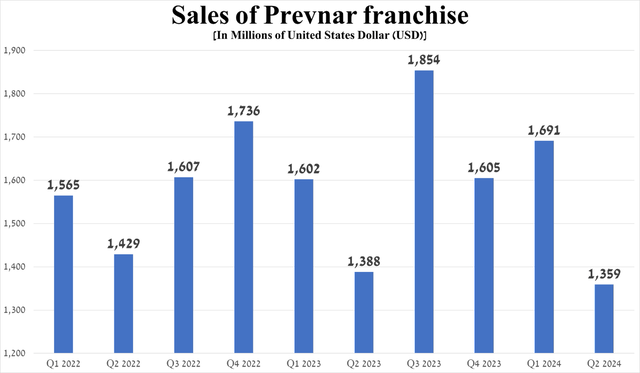

In addition, the company pleased investors with the progress made in developing its vaccine franchise. So, on June 17, 2024, the FDA approved Capvaxive to protect adults against pneumonia and invasive pneumococcal infection.

Just ten days later, experts from the CDC’s Advisory Committee on Immunization Practices recommended this innovative vaccine as an option for pneumococcal vaccination, which became an important milestone for Merck in 2024, as it will allow the company to capture a significant share of the market dominated by Pfizer’s Prevnar franchise (PFE).

Source: graph was made by Author based on 10-Qs and 10-Ks

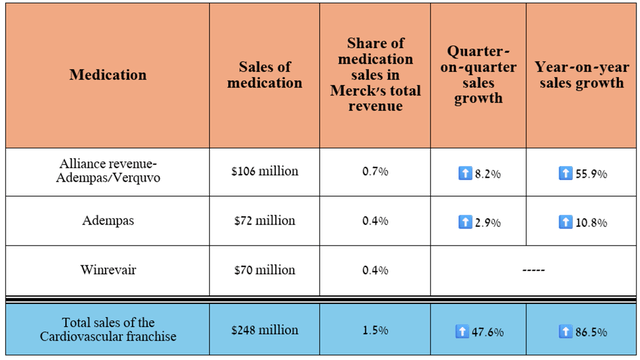

Before I discuss potential financial risks, I also want to highlight the progress in the development of Merck’s cardiovascular franchise. First, its revenue reached $248 million in the second quarter, up 86.5% year over year.

Source: graph was made by Author based on 10-Qs and 10-Ks

What’s driving the franchise’s sales surge?

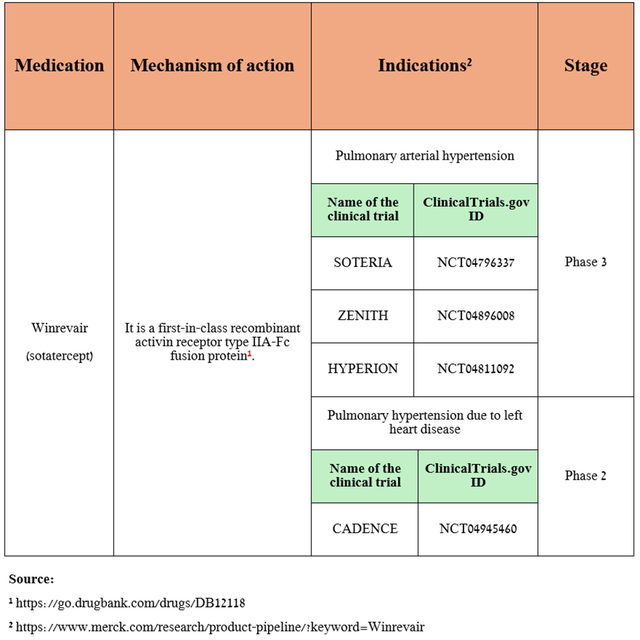

The answer lies in the FDA’s approval of Winrevair on March 26, 2024, for the treatment of patients with pulmonary arterial hypertension (“PAH”), a condition in which the small blood vessels in the lungs become narrower, leading to increased blood pressure in the pulmonary arteries and decreased oxygen delivery from the heart to the lungs.

Its sales pleasantly shocked me, amounting to $70 million for the three months ended June 30, 2024.

Also, based on the favorable decision of the Committee for Medicinal Products for Human Use announced at the end of June of this year, I expect the European Commission to approve Winrevair by the end of the third quarter of 2024. Additionally, Merck continues to evaluate its efficacy in treating other conditions.

Source: table was made by Author

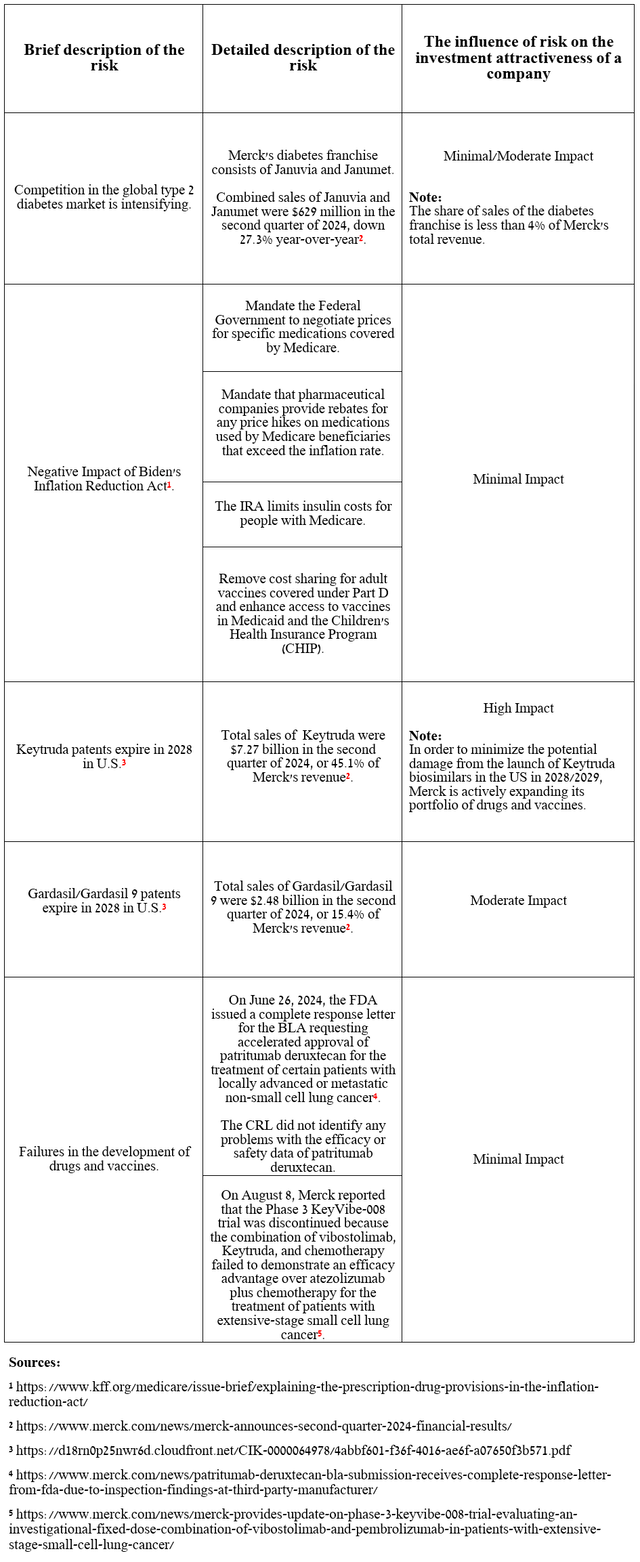

Risks

In the table below, I have highlighted several risks that could negatively impact Merck’s investment attractiveness in the long term and those that continue to put downward pressure on its stock price at the moment.

Source: table was made by Author

Takeaway

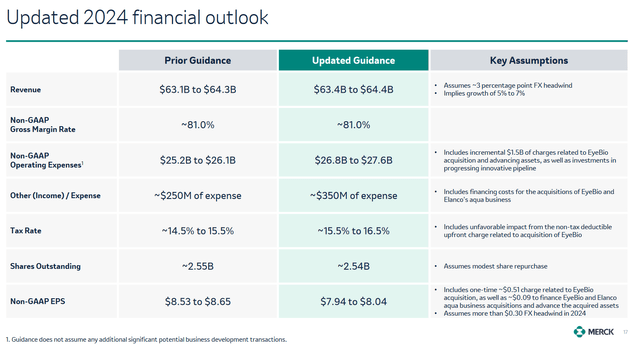

Merck’s stock price has fallen about 9% over the past two weeks, reflecting growing investor concerns about a temporary drop in Gardasil franchise sales in China, as well as a cut in its forecast for full-year adjusted EPS from $8.53-$8.65 to $7.94-$8.04, in part due to higher R&D expenses and the acquisition of EyeBio.

On the other hand, thanks to stronger sales of Keytruda, Prevymis, Welireg, Winrevair, and Reblozyl, the company not only beat analysts’ expectations again but also raised its 2024 full-year revenue guidance.

Furthermore, I believe the company’s stock will continue to rally due to progress in the development of its pipeline of vaccines and experimental drugs, including the publication of encouraging data from a Phase 2b/3 clinical study evaluating the efficacy of clesrovimab in protecting infants against respiratory syncytial virus disease, as well as potential EMA approval of Winrevair in Q3 2024.

As a result, I continue to cover Merck with a ‘Buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.