Summary:

- Merck’s strong performance in 2023, driven by key products like KEYTRUDA, demonstrates resilience despite looming patent risks.

- The company’s commitment to dividends, highlighted by a recent dividend hike, reflects confidence in future growth.

- MRK’s focus on innovation and strategic acquisitions positions it well to navigate challenges and reward investors.

Diy13

Introduction

I try to follow a few rules when I invest in dividend (growth) stocks. This includes staying away from car manufacturers, consumer stocks with severe competition risks, and healthcare companies with complex pipelines and elevated patent risks.

So far, I have broken the healthcare rule a few times, especially when I continued buying AbbVie (ABBV) shares for my portfolio after it struggled with the patent loss of its blockbuster Humira drug (which turned out to be a smart decision).

Generally speaking, I prefer investments in healthcare suppliers that benefit from the need for consistent innovation. This includes companies like Danaher (DHR) and Thermo Fisher (TMO).

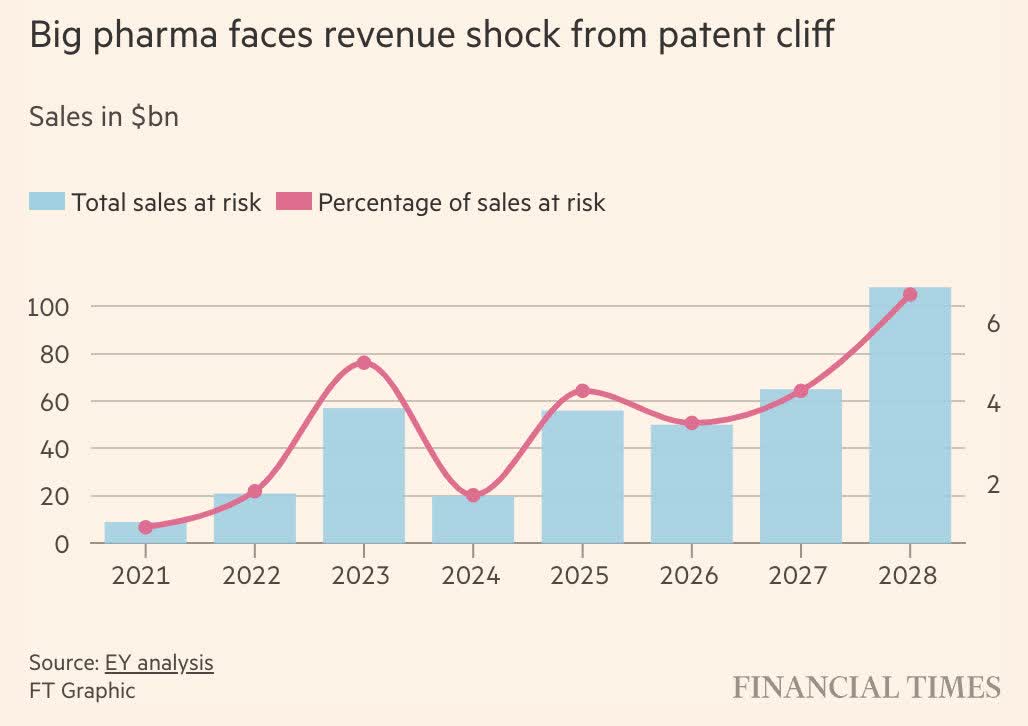

What we are currently dealing with is a wave of patent losses among “big pharma.”

Last year, the Financial Times reported that 2024 would be the last year with low patent losses, followed by a wave that could result in roughly 7% of all big pharma sales losing their patent in 2028 alone.

Financial Times

In other words, over the next few years, hundreds of billions of sales will get cheap biosimilar competition.

This is what CNBC reported last month (emphasis added):

The top 20 biopharma companies have $180 billion in sales at risk from patent expirations between now and 2028, according to estimates from EY.

“It does differ by company at this stage, and I think there are a number of products in the ’25, ’30 timeframe that will be major growth drivers for large biopharma companies … but all in all, there are plenty of companies that have revenue holes to plug,” William Blair & Company analyst Matt Phipps told CNBC.

According to the same report, the number one drug set to lose exclusivity is KEYTRUDA, a >$20 billion annual sales drug from Merck & Co. (NYSE:MRK), a company I started covering on December 25, 2023.

Back then, I went with the title “Merck: One Of The Best – Unveiling The Trifecta Of Safety, Dividends, And Growth.”

As the title suggests, I wasn’t worried about patent losses back then.

Now, more than two months later, I’m updating my thesis in light of new important developments that include the company’s earnings and KEYTRUDA news.

Moreover, since then, MRK shares have returned 20%, which not only beats the S&P 500 by roughly 14 points but also suggests that the market isn’t worried about the patent cliff.

So, as we have a lot to discuss, let me explain why I foresee elevated gains to last!

2023 Was A Fantastic Year

Let’s start this part by throwing a few numbers at you, which explain how the company performed in 2023.

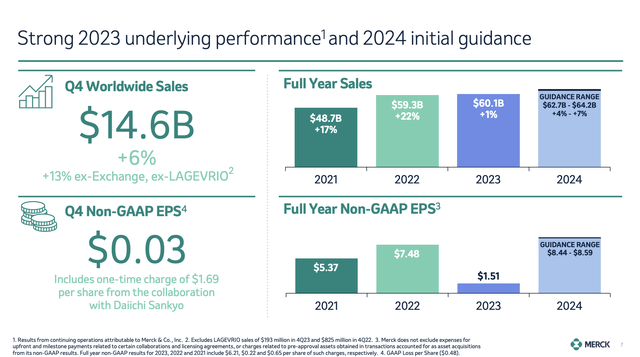

As we can see below, the company saw significant revenue growth of 12%, excluding the impact of LAGEVRIO and currency fluctuations.

This growth was mainly attributed to the strong performance of key segments, including the Oncology, Vaccines, and Animal Health divisions, which we will all discuss in this article.

In the fourth quarter, total revenues came in at $14.6 billion, which translates to a 13% growth rate when excluding the effects of LAGEVRIO and currency changes again.

With these numbers in mind, let’s dig a bit deeper, as a closer look at its segments reveals some very promising trends.

For example, the Human Health segment continued its momentum with a 14% growth rate. According to the company, this was fueled by improvements in Oncology and Vaccines.

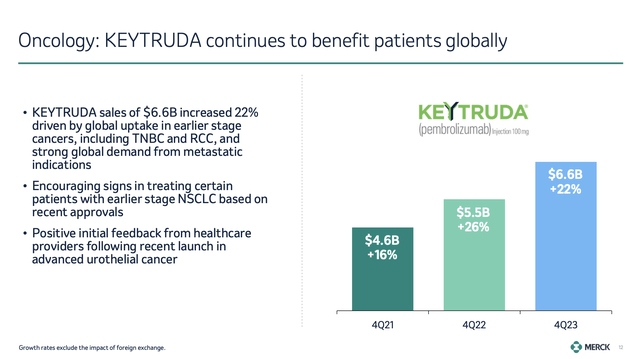

KEYTRUDA, the company’s flagship product, saw a 22% increase in sales, bringing total sales to $6.6 billion in 4Q23 alone. As we can see below, in 4Q21, KEYTRUDA did less than $5 billion in sales!

Growth in KEYTRUDA was mainly due to increased adoption in earlier-stage cancers, including triple-negative breast cancer and renewal cell carcinoma, including recent approvals.

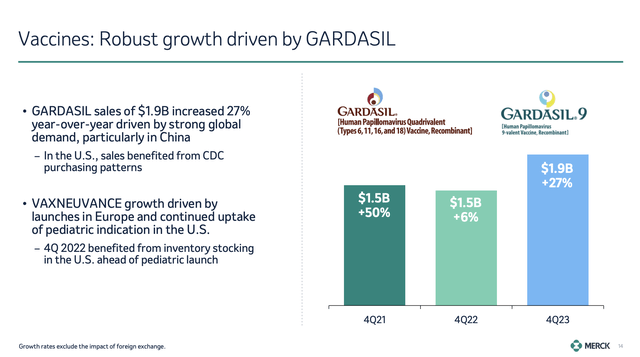

Additionally, the company’s Vaccine portfolio, which is led by its largest product, GARDASIL, saw massive growth as well, with sales surging by 27% to $1.9 billion.

This impressive growth rate was driven by improving demand in the Chinese market.

The company also noted tailwinds from VAXNEUVANCE, which saw sales reach $176 million, fueled by launches in Europe and strength in the U.S.

Another sector that did well is Animal Health, which I have started to like a lot in recent years, as the market benefits from major secular growth in Western nations.

The company noted 4% growth in this segment, led by 12% growth among products aimed at companion animals, including BRAVECTO (which my dog uses as well).

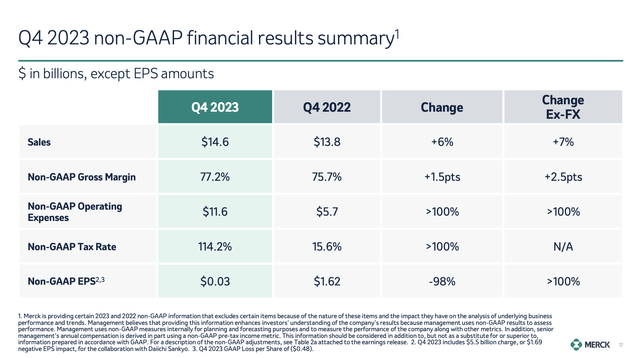

Going back to the 4Q23 overview, we see that non-GAAP EPS declined by 98% despite all the good news I just discussed.

This decline is due to a one-off charge related to a collaboration with Daiichi Sankyo, which I discussed in my prior article as well.

Merck to pay Daiichi Sankyo a $4 billion upfront payment in addition to $1.5 billion in continuation payments over the next 24 months, and may make additional payments of up to $16.5 billion contingent upon the achievement of future sales milestones, for a total potential consideration of up to $22 billion. – Merck

With all of this in mind, I really liked the 2023 performance, as the company is seeing all the benefits it had hoped for.

Now, it’s important to look forward, as that’s where future returns come from.

What’s Next?

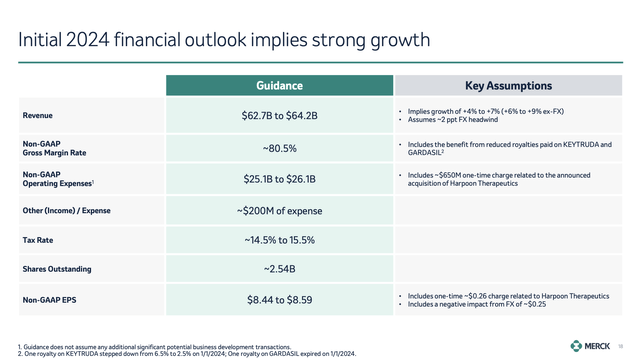

Looking ahead to 2024, the company expects sustained growth driven by key products and upcoming launches, leading to a revenue expectations range of $62.7 to $64.2 billion. This translates to a growth range of 4% to 7%.

As we can see in the chart below, this includes expected currency headwinds. Without these headwinds, the company expects at least 6% revenue growth.

Generally speaking, the company anticipates several longer-term tailwinds that put the business in a good spot for future growth.

On top of its promising pipeline, which we will get to in a second, the company benefits from favorable demographic trends, including an aging population and increasing global healthcare expenditures.

Essentially, the company makes the case that as healthcare awareness and access to better care continue to improve, there is a growing demand for advanced medicines and drugs.

Furthermore, with regard to its pipeline, the company believes that it has significant regulatory tailwinds.

These tailwinds consist of regulatory agencies that prioritize expedited approval for innovative therapies, allowing the company to target accelerated commercialization.

I have seen similar developments among other biotech companies that reported approval (speed) benefits in certain areas.

This is what the FDA wrote last year (emphasis added):

The following four FDA programs are intended to facilitate and expedite development and review of new drugs to address unmet medical need in the treatment of a serious or lifethreatening condition: fast track designation, breakthrough therapy designation, accelerated approval, and priority review designation (see section IV for an overview of the programs).

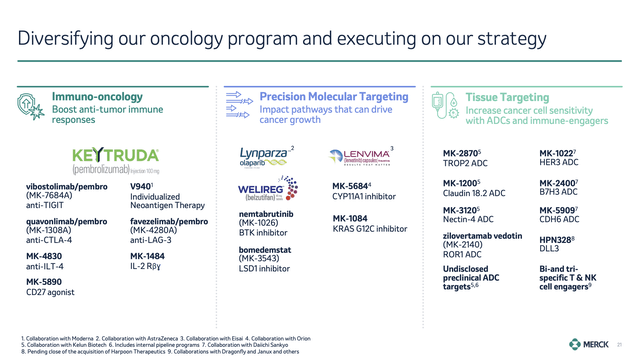

With that in mind and with regard to its pipeline, during its earnings call, the company updated investors on important developments, including FDA and European Commission approvals for KEYTRUDA in gastrointestinal indications and cervical cancer.

The company, which had a focus on early stages of diseases, noted significant survival benefits in studies like KEYNOTE-671 and KEYNOTE-564.

On top of that, the company noted progress in precision oncology, including approval for WELIREG, used in advanced renal cell carcinoma.

According to Merck, this is the first drug approval in a new therapeutic class in roughly a decade.

The company also got approval for KEYTRUDA in combination with PADCEV to treat urothelial cancer, achieving a significant survival benefit and proving that the combination of KEYTRUDA and chemotherapy has a future.

According to the company (emphasis added):

As we continue to harness the potential of KEYTRUDA, we have an increased focus on earlier stages of disease, where we believe timely, effective intervention may significantly improve patient outcomes. Last month, we announced FDA approval for KEYTRUDA in combination with chemo radiotherapy for the treatment of FIGO Stage III through IVa cervical cancer based on the Phase III KEYNOTE-A18 trial. This is an important advancement and provides a new option that has potential to become the standard of care. – MRK 4Q23 Earnings Call

Obviously, patent risks of KEYTRUDA continue to be a big issue, with some sources reporting that a patent loss could cause sales in 2029 to come in at $27.4 billion, a potential decline of 19% from 2028 estimates.

In 2028, KEYTRUDA sales are expected to be $33.7 billion, which shows how massive the potential is if Merck is able to protect its patent.

So far, the market is not too worried, as the company is handling the three ways to mitigate risks (acquisitions, re-development of drugs, and innovation through R&D) very well, which I expect to result in positive headlines in the years ahead.

Especially, its acquisitions seem to be promising, with its Harpoon Therapeutics deal providing the company with a method to target small cell lung cancer and neuroendocrine tumors.

Shareholder Value & Valuation

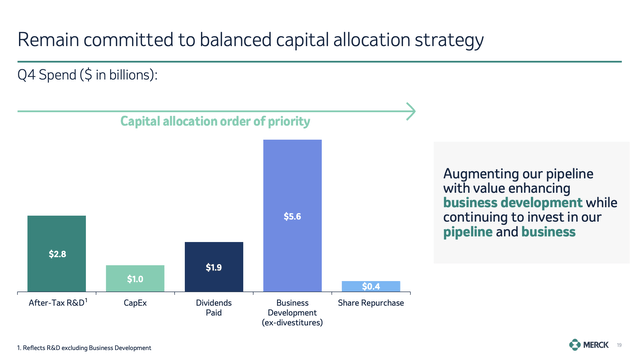

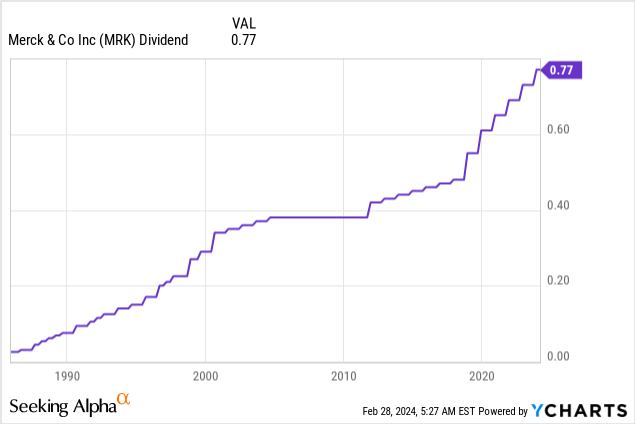

Another sign that Merck is not worried about its future is its commitment to its dividend.

On November 28, Merck hiked its dividend by 5.5% to $0.77 per share per quarter. This translates to a yield of 2.3%.

The five-year dividend CAGR is 9.3%, while its dividend is protected by a 36% 2024E payout ratio and a balance sheet with an A+ rating, one of the best in the world.

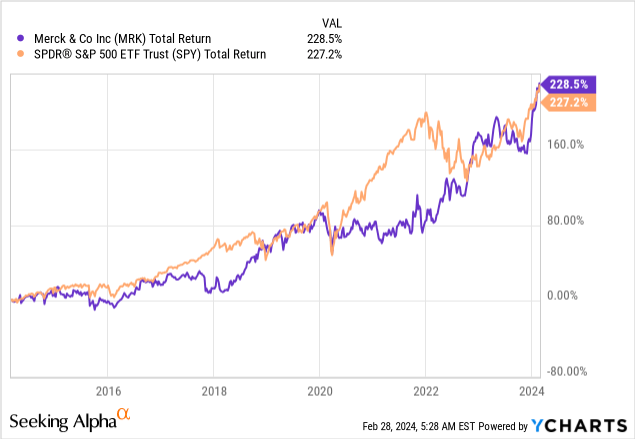

While MRK is not a high-yield stock, it has not kept its investors from benefiting from a very high total return, as the stock has returned close to 230% over the past ten years.

With that said, the valuation remains fair.

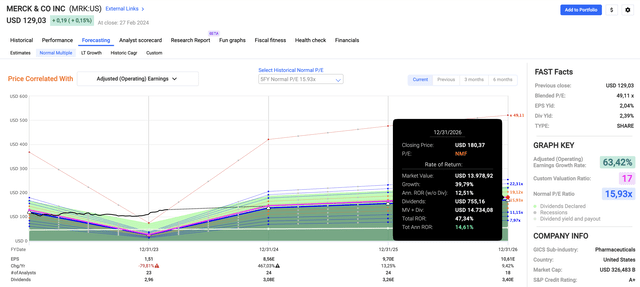

Using the data in the chart below:

- Analysts are upbeat about the company’s growth rates:

| Year | EPS Growth |

| 2024E | 470%* |

| 2025E | 13% |

| 2026E | 9% |

* = This is due to the aforementioned EPS decline in 2024 (one-off items)

- The company’s five-year normalized P/E ratio is 15.9x. I believe that we can go slightly higher due to elevated EPS growth expectations.

- Using a 17x multiple, its 2.3% dividend, and the expected EPS growth rates, we get an expected total return of 14-15% per year.

Since 2009, the stock has returned 12.9% per year.

Nonetheless, patent loss risks remain elevated, which means the market will likely get increasingly nervous as we get close to 2028 – unless the company presents compelling reasons for the market to expect these growth rates to last.

That’s why I expect returns in the next 2-3 years to be likely higher than the potential returns of the years after that – depending on patent news.

Nonetheless, generally speaking, I expect MRK to continue doing what it does best, which is innovating, growing income, and rewarding investors.

Takeaway

In the face of looming patent expirations, Merck stands out with its solid performance and promising outlook. The success of KEYTRUDA supported the company’s potential, despite lingering patent risks.

Meanwhile, Merck’s commitment to dividends, highlighted by a recent dividend hike, underscores its confidence in future growth.

With a balanced portfolio and strategic acquisitions that include the Harpoon Therapeutics deal, Merck appears well-positioned to navigate challenges and reward investors along the way.

Pros & Cons

Pros:

- Resilience: Despite looming patent risks, Merck has shown resilience, with strong revenue growth driven by key products like KEYTRUDA.

- Dividend Commitment: Merck’s recent dividend increase reflects its confidence in future growth.

- Innovative Pipeline: With a focus on innovation and strategic acquisitions like Harpoon Therapeutics, Merck shows potential for future growth and adaptation.

Cons:

- Patent Risks: The impending patent cliff poses a significant risk to KEYTRUDA sales and overall revenue.

- Competitive Landscape: Merck operates in a highly competitive industry, facing challenges from rival companies and biosimilar competition, which could impact its market share and profitability – on a long-term basis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.