Summary:

- Merck reported positive quarterly earnings with 6.7% year-over-year revenue growth and improved operating margin.

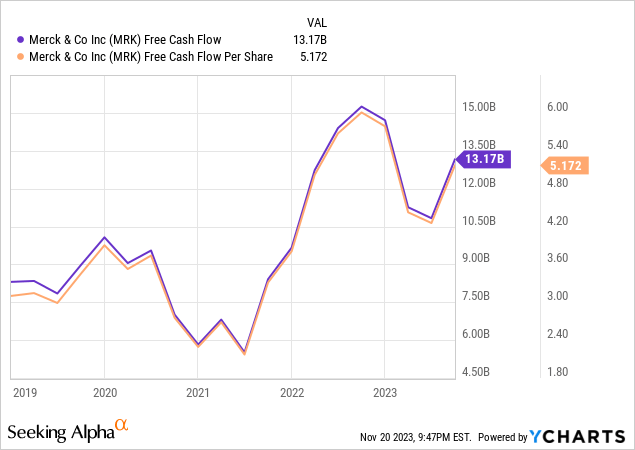

- The company generated strong leveraged free cash flow and reduced financial leverage, improving its net debt position.

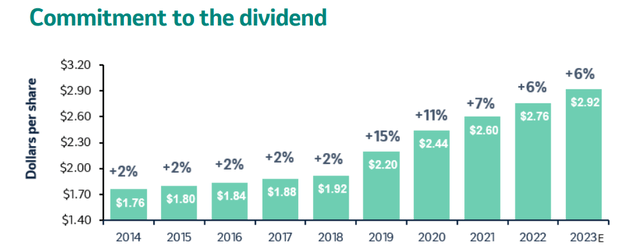

- Merck has raised dividends for 12 consecutive years with an average growth rate nearing 10%.

JasonDoiy

Overview

Merck (NYSE:MRK) is a global healthcare company with two main parts: Pharmaceuticals for human and Animal Health. In the Pharmaceutical section, they provide various human health products, including those for cancer, hospital care, auto immune-related issues, nervous system disorders, heart conditions, and diabetes. They also offer vaccines for kids, teenagers, and adults. In the Animal Health part, Merck works on veterinary products like medicines, vaccines, and health solutions.

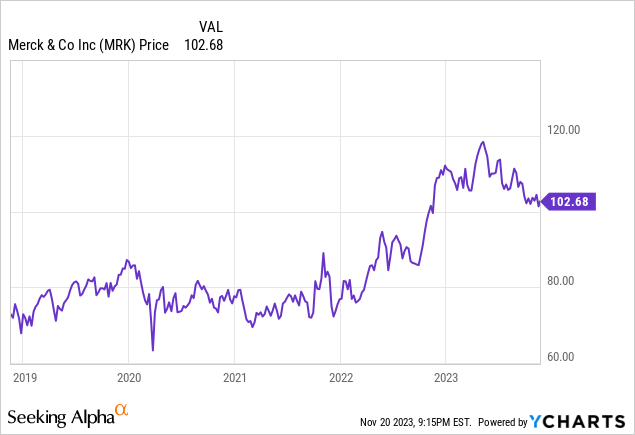

After the initial 2020 drop in price, I picked up shares in the high $60s but then sold off my position once it crossed the $80/share mark. Now, I am looking to re-enter and hold onto my shares for the long term. I believe MRK offers great value, a well-covered dividend, and can provide superior total returns going forward.

Growing Revenue & Expansion

Merck has reported their third quarter earnings about a month ago. The company’s non-GAAP earnings per share exceeded expectations, standing at $2.13, surpassing estimates by $0.18. Moreover, Merck’s revenue for the quarter reached $16 billion, reflecting a notable 7% year-over-year growth and surpassing forecasts by $730 million. MRK’s five-year average EBITDA growth sits at a healthy 21% while their free cash flow per share growth comes in at 29%.

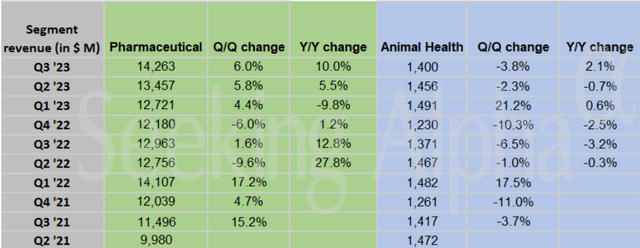

As previously mentioned, MRK has two main segments that make up the bulk of its revenue. Pharmaceutical revenue overall saw a 10% change year over year and Animal Health revenue saw a 2.1% change year over year. Going forward, management expects a 7% annual growth rate for its pharma business and a modest 2% annual growth rate in revenue for the Animal Health division.

Seeking Alpha – Niloofer Shaikh

One of the key contributors to Merck’s positive performance for this earnings report is the significant growth in sales of its flagship product, KEYTRUDA. Sales for KEYTRUDA surged by 17% to $6.3 billion. At the same time, the Animal Health segment experienced a 2% increase in sales, reaching $1.4 billion. This growth was driven by a 7% increase in Livestock sales. KEYTRUDA continues to make breakthroughs and increases the bull case for MRK.

As of June, the FDA granted approval for the application to use Keytruda in conjunction with standard chemotherapy to treat advanced bile duct cancer. The regulatory decision is expected in February 2024 but the odds are looking good. I believe this to be a huge catalyst for price upside with MRK. The results of these studies on effectiveness indicate a 17% reduction in the risk of patient mortality when using the combination treatment, as opposed to chemotherapy.

Lastly, Merck’s global expansion efforts have seen significant milestones in Europe and Japan. MRK received approval for KEYNOTE-091, endorsing its use as an adjuvant treatment for specific patients with non-small cell lung cancer.

Furthermore, Merck attained approval for Lynparza which is a type of medication used in the treatment of certain cancers such as breast cancer, ovarian cancer, or prostate cancer. These regulatory approvals underscore Merck’s continued growth and expanding portfolio of medications.

In closing, statements from the CFO confirm that they have been able to decrease operating expenses and there are no significant business development expenses upcoming.

Operating expenses decreased 4% to $5.8 billion. There were no significant business development expenses in the quarter, compared with $690 million of charges a year ago. Excluding these charges, operating expenses grew 9%. This growth reflects increased investments in support of our robust early and late-phase pipeline, with research and development expenses increasing 17%. Taken together, earnings per share were $2.13. – Caroline Litchfield, Chief Financial Officer

Dividend

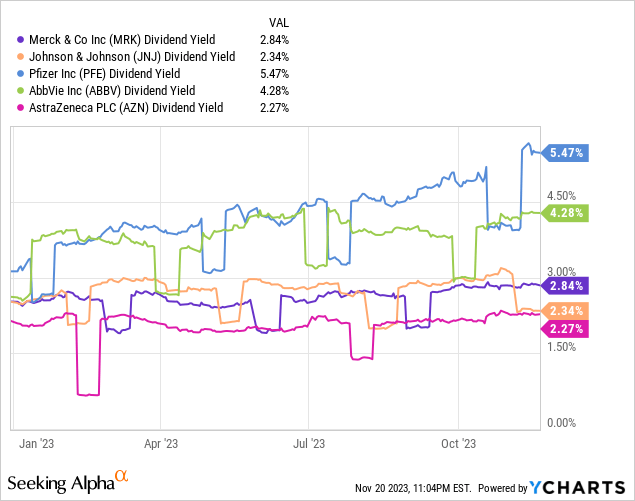

As of the latest declared dividend of $0.73/share, the current starting yield comes in at 2.87%. Merck has been able to successfully grow their dividend distribution for twelve consecutive years while also maintaining a decent dividend growth rate. The average 5-year CAGR (compounded annual growth rate) of the dividend comes in at 9.8%.

For the full year of 2022, Merck paid out $2.76 in dividends per share. Compared to the estimated $8.44 EPS for 2024, I have no doubt that the dividend coverage is strong and that we are likely to see more increases.

Now, compared to some of their peers, the dividend looks rather strong when you take these items into consideration: You are getting a higher upfront yield than Johnson & Johnson (JNJ). AstraZeneca (AZN) lacks any sort of established dividend history. Pfizer (PFE) has a much higher starting yield over 5%, but the dividend growth track record is half as strong as MRK. AbbVie (ABBV) has a strong dividend but MRK has a longer-established track record of consecutive raises.

Valuation

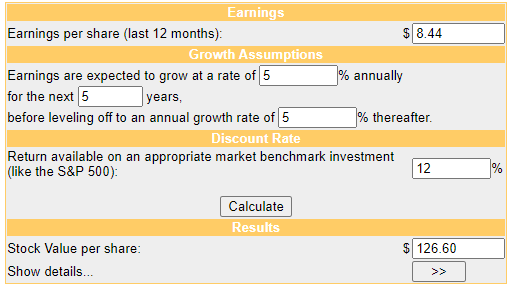

MRK has an average Wall St. price target of $123/share. This represents a decent 20% upside gain from its current price level. However, using an EPS estimate as well as 5% expected growth rate, we can determine a fair stock value using a discounted cash flow method.

The 5-year average revenue growth comes in at 6% so I think a 5% input here serves as a conservative benchmark that leaves some wiggle room.

We can see that using these inputs, we calculate a fair stock value of $126/share which is pretty close to Wall St.’s estimate. This would represent a potential undervaluation by approximately 24%.

Money Chimp

Lastly, I think that it’s worth noting the current forward P/E hovers around 12.02x. The average P/E ratio for Merck has historically sat around 16x. This could further reinforce that the stock is currently trading at a discount to fair value.

Risks

There are notable risks stemming from potential competition for Keytruda once its crucial patent expires in 2028. Projections indicate that Keytruda’s market share may rise to $54 billion at a CAGR of 8.9% by 2032. This poses a significant challenge for Merck’s post-2028 landscape, as offsetting nearly half of the anticipated revenue loss would require considerable time.

Merck is susceptible to operational risks, wherein challenges in its pipeline and development deals could hinder the ability to compensate for declining revenue from flagship drugs like Keytruda. This will be more of a problem for the future but it’s still something to consider. Another risk across the industry is pricing pressure, with negotiations between the U.S. government and pharmaceutical companies potentially impacting Merck’s revenue and profits down the line.

Takeaway

Merck makes a compelling investment opportunity with a diversified portfolio spanning pharmaceuticals for human and animal health. Recent third-quarter earnings underscore Merck’s robust growth, with non-GAAP earnings per share surpassing expectations at $2.13 and a noteworthy 7% year-over-year revenue increase to $16 billion.

The success is attributed to strong sales, particularly for the flagship product KEYTRUDA, which has shown promise in treating advanced bile duct cancer. Global expansion efforts in Europe and Japan, coupled with regulatory approvals for innovative medications like Lynparza, further reinforce Merck’s position in the healthcare landscape.

Lastly, a consistent dividend growth track record, strong dividend coverage, and attractive valuation metrics contribute to MRK’s appeal. However, the looming risk of patent expiration for Keytruda in 2028 poses a significant challenge, requiring careful consideration. Despite this, Merck’s proactive approach, extensive pipeline, and financial strength position it well for potential future success.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.