Summary:

- Merck’s underlying progress is solid.

- MRK has rallied a lot over the last year.

- This has made its shares more expensive and less attractive.

Sundry Photography

Article Thesis

Merck & Co., Inc. (NYSE:MRK) is one of the largest pharma companies in the world. Thanks to a strong portfolio with huge drugs such as Keytruda, Merck continues to deliver solid results. Its shares have risen quite a lot over the last year, which has made them more expensive than they used to be, and the dividend yield has dropped as well. While Merck will continue to deliver solid operational results, I believe that shares aren’t a great buy any longer.

Merck: Compelling Underlying Performance

Merck is, by market capitalization and revenue, one of the largest pharma companies in the world. Generally, very large and diversified pharma companies are not growing at a very high rate, as new products seldom move the needle in a big way, and since patent losses of older products offset some of the growth from newer products.

But sometimes, even very large pharma companies generate very compelling business growth for a period of time, when they manage to introduce mega blockbuster drugs. That holds true for Merck, which is currently benefitting from the massive growth it is generating with its oncology drug Keytruda.

Merck generated revenues of $15.0 billion during the most recent quarter, for an annual revenue pace of $60 billion. That was up by an impressive 14% year over year, a growth rate that stands out among big pharma players.

Merck’s biggest drug, Keytruda, continued to add sales at an impressive pace. During the third quarter, the drug’s revenue totaled $5.3 billion, which was up 20% year over year. With a sales run rate of more than $21 billion as of the end of the most recent quarter, Keytruda truly has become an absolute game changer for Merck.

With its strong sales growth, Merck unsurprisingly also delivers solid profit growth. Despite a big increase of more than $1 billion in Merck’s research and development spending during a single quarter, Merck grew its earnings per share from $1.78 during the previous year’s quarter to $1.85 in the most recent quarter. If Merck had kept its R&D spending unchanged, profits would have exploded upwards by more than 20%. While increased R&D spending is thus a headwind for profits in the near term, increased investments could pay off via higher sales in the long run, e.g. thanks to new approvals for drugs such as Keytruda (more on that later).

For fiscal 2022, which has ended but which is still missing the Q4 report, Merck has forecasted earnings per share of around $7.35, despite the adverse currency rate impact that is estimated at 4% for the full year. Analysts predict that Merck will grow its earnings per share to a little more than $7.50 in 2023, but I believe that this could be a too-conservative estimate — after all, analysts have a history of severely underestimating Merck, showcased by Merck’s ongoing beats versus Wall Street estimates:

Over the last five quarters, Merck has beaten estimates by $0.22 on average, or by almost $0.90 on an annualized basis. There is no guarantee that profit beats will continue, but history indicates that actual results could be meaningfully better relative to what analysts are predicting right now.

Spending On Future Growth

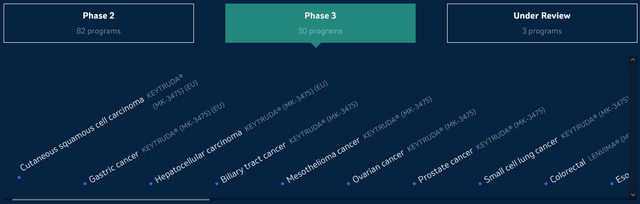

A considerable portion of Merck’s R&D spending is used for further Keytruda programs:

Among the 30 phase 3 programs the company is engaged in right now, 8 of them, or more than one-fourth, are Keytruda studies. Keytruda is studied in a wide range of tumors, including gastric cancer, a $3 billion market, and prostate cancer, a $11 billion market. It is not guaranteed that these trials will be successful — not even Merck’s leading scientists can’t be sure about that. But looking at the success Keytruda has had in different areas of the oncology market, I believe it is highly likely that Keytruda will get at least some additional approvals. Keytruda is also studied in phase 2 programs, although those are riskier and will take more time until a (potential) approval.

Merck is not putting everything into Keytruda, however. The company also owns a wide range of additional pipeline assets, including more than 20 non-Keytruda phase 3 studies. Overall, 24 of Merck’s phase 3 studies are for oncology assets, which makes sense to me: Not only is the oncology market very large and growing, but there are also significant unmet patient needs. Last but not least, Merck itself is the most knowledgeable here, thus focusing on Merck’s own strengths is a good strategy, I believe.

Merck continues to invest in its own pipeline via its R&D programs, but the company also engages in M&A regularly. The company focuses on smaller biotech companies with its M&A strategy, oftentimes acquiring businesses that do not yet have an approved drug on the market yet. When these companies have promising pipeline candidates, an acquisition by Merck can be good for both: It allows Merck to expand its pipeline, while Merck can offer help in getting approvals and eventually commercializing approved drugs via its wide, established sales network.

The most recent such acquisition is Merck’s takeover of Imago Biosciences, for which it paid $1.4 billion. Imago is working on therapies for bone marrow disorders, a potentially promising market, as the bone marrow transplantation market alone is worth more than $10 billion today. Of course, there is no guarantee that Imago’s pipeline candidates will be successful — but even if they aren’t, that would not be a company-threatening issue for Merck at all. Merck has also recently crafted a deal with Japan-based PeptiDream for the development of peptide drug conjugates.

As I am not a medical professional, I can’t know about the precise likelihood of these drug candidates coming to the market eventually — even medical professionals and scientists working at pharma companies can be wrong about these things at times. But I want to note that Merck’s leadership has proven adept when it comes to cash allocation in the past, proven by Merck’s successful long-term record. The company thus seems to have systems in place that help identify promising candidates with solid accuracy. There’s a risk here, however: If Merck has misidentified the assets of its M&A targets as promising, it may have wasted cash on M&A that could have been used in more beneficial ways, e.g. for reducing debt levels or for buybacks.

Merck’s Strong Gains Have Made Shares Less Attractive

Merck is well-positioned for the future from an operational basis, I believe. Investors should consider that valuation matters as well when making investment decisions, however. We last covered Merck in December 2021, when we rated Merck a “Buy”, noting its growth, dividend yield, and inexpensive shares. Since then, Merck has delivered a total return of 46%, while the broad market has dropped by 18% over the same time frame. This massive outperformance of 64% versus the broad market naturally has impacted Merck’s valuation. Following a steep gain like this, equities become less attractive, all else equal — it is best to buy when prices are low, after all.

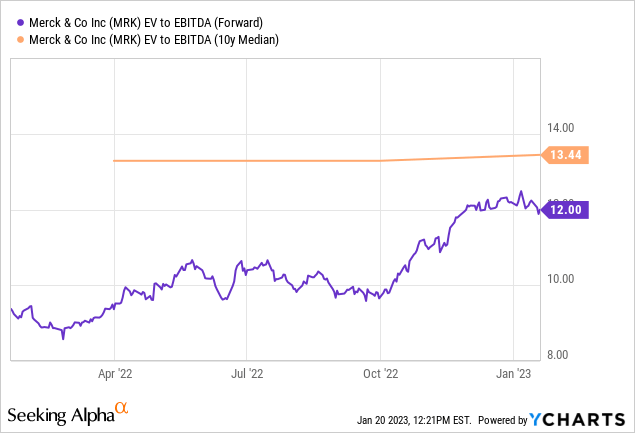

Looking at Merck’s current valuation, we see the following:

Today, Merck is trading with an enterprise value to EBITDA multiple of 12. That compares favorably to the 10-year median EBITDA multiple, which is around 10% higher. But on the other hand, Merck currently is the most expensive it has been over the last year — not too long ago, investors were able to buy shares in the company for less than 9x EBITDA, which represented a much larger margin of safety.

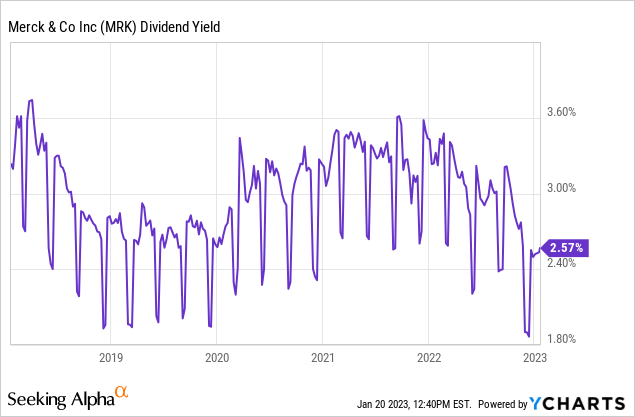

Likewise, the dividend yield suggests that right now is not the best time to buy Merck:

The company trades with a dividend yield of 2.6% right now, which is slightly below average relative to the last five years. It is well below the levels seen around a year ago. At the same time, interest rates have risen, which has made Merck’s dividend yield become even less attractive relative to the yield one can get from treasuries etc. Merck’s dividend still looks pretty safe, however: Thanks to a payout ratio of just 39% versus this year’s expected profits, it is, I believe, highly unlikely that the company will reduce its dividend in the foreseeable future.

Overall, Merck thus doesn’t look like it’s an especially good value today. That does not mean that investors should sell Merck, but a better buying opportunity could easily materialize.

Risks To Consider

As stated above, Merck’s M&A spending is both an opportunity and a risk. It’s not possible to know whether these acquisitions, oftentimes of companies that do not generate any revenue yet, will pay off. Investors have to trust Merck is making the correct calls.

On top of that, there are some other risks. Since Merck is generating so much money with Keytruda, it would be highly vulnerable in case a competitor comes out with an even better drug. For now, that seems unlikely, I believe, as no pharma company has an oncology asset that is expected to be as impactful as Keytruda in the near term. Still, it is possible that a competitor comes out with a drug that takes market share from Keytruda in the future. Patent protection will also end at some point. That will not happen before 2028, and Merck is trying to ensure that Keytruda will be protected through 2040 — although it is far from guaranteed that this will work. Investors thus should assume that Keytruda might lose its patent protection five years from now. Once off patent, Keytruda sales will not fall off a cliff, but competition will lead to declining sales for Keytruda over time, and investors should keep in mind that this could happen towards the end of the 2020s.

Lawsuits are another risk factor for investors to consider. Merck has recently found a cancer-causing agent in some samples of one of its diabetes drugs, which could potentially lead to legal risks down the road. Merck has stated the company has found the source of the contamination and the diabetes drug can still be sold, but it’s possible that this issue will result in claims or other legal costs down the road.

Takeaway

Merck’s underlying performance is solid, and its M&A strategy could work out well in the long run. But due to a steep share price increase over the last year, the dividend yield has declined meaningfully, while the margin of safety has done so, too. I thus do not consider Merck a “Buy” any longer following its hefty gains over the last year.

Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!