Summary:

- Merck’s stock has not performed well in the short term, but the long-term outlook remains bullish.

- Merck’s diverse portfolio, including its flagship cancer drug Keytruda, positions it for future growth and market opportunities.

- My valuation analysis suggests the stock is around 50% undervalued.

Marko Georgiev

Investment thesis

Since I shared my first bullish thesis about Merck (NYSE:MRK) in July, the stock has not been a big mover, and the total return over the quarter was -1.4%. It does not look very good, but the broader U.S. stock market declined by a wider margin over the same period. Despite weak stock price performance over the long term, I remain bullish, and today, I want to reiterate my “Strong Buy” rating for MRK. I am optimistic after analyzing the recent developments, which included a solid Q3 financial performance and the management’s strong commitment to continue building long-term value for shareholders by expanding and protecting Merck’s unmatched offerings portfolio across multiple critical medical needs. Moreover, the valuation looks very attractive, with a massive upside potential.

Recent developments

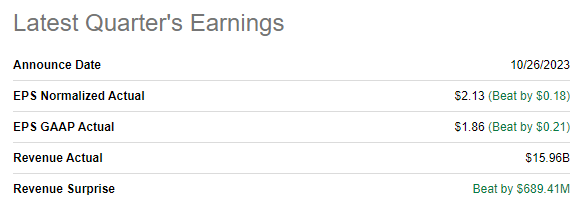

The latest quarterly earnings were released on October 26, when the company topped consensus estimates. Revenue grew YoY by 6.7%, which is a notable improvement compared to the previous three quarters. Despite a slight shrink in the gross margin, the operating margin improved YoY by almost three percentage points. However, it is worth mentioning that the improvement occurred mainly due to the decreased R&D expenses as a percentage of revenue and not SG&A.

Seeking Alpha

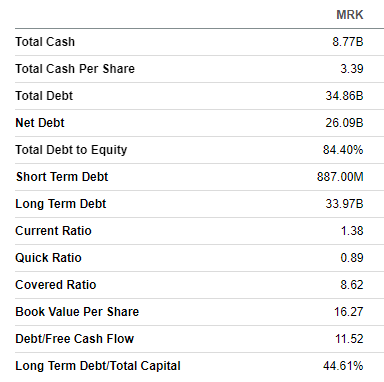

From the free cash flow [FCF] perspective, the quarter was very strong as Merck generated almost $5.6 billion in the levered FCF, which was by far the highest level over multiple quarters over the last three years. This allowed MRK to decrease financial leverage significantly, and its net debt position improved QoQ from $30.5 billion to $26.1 billion. I am comfortable with the massive net debt position because almost all of MRK’s debt is long-term, and the covered ratio of above 8 looks good. Near-term liquidity is also in good shape, and the company’s solid balance sheet gives me high conviction that the 2.8% forward dividend yield is safe.

Seeking Alpha

Apart from the stellar FCF in Q3 and the balance sheet improvement, I also like the fact that during the latest earnings call, the management raised its full FY2023 revenue guidance by approximately $900 million at the midpoint. On the other hand, the adjusted full-year EPS is projected by the management at around $1.35, which is a massive decrease compared to $7.48 in FY 2022. However, it is important to understand that this massive drop is due to one-off items and not due to secular challenges. A notable $4.53 adverse effect on EPS is related to the purchase of Prometheus and Imago BioSciences and an upfront payment to Kelun-Biotech for a licensing deal. Another one-off item with a negative expected effect on the FY2023 adjusted EPS is a $1.70 upfront payment to Daiichi Sankyo as part of the antibody-drug conjugate collaboration. As all these items are investments for the future and are aimed at building long-term value for shareholders, I do not consider the massive EPS drop to be a red flag for investors.

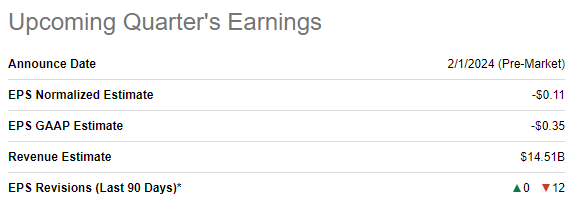

The earnings for the upcoming quarter are scheduled for release on February 1, 2024. Consensus estimates forecast Q4 revenue at $14.5 billion, which indicates a slightly below 5% YoY growth.

Seeking Alpha

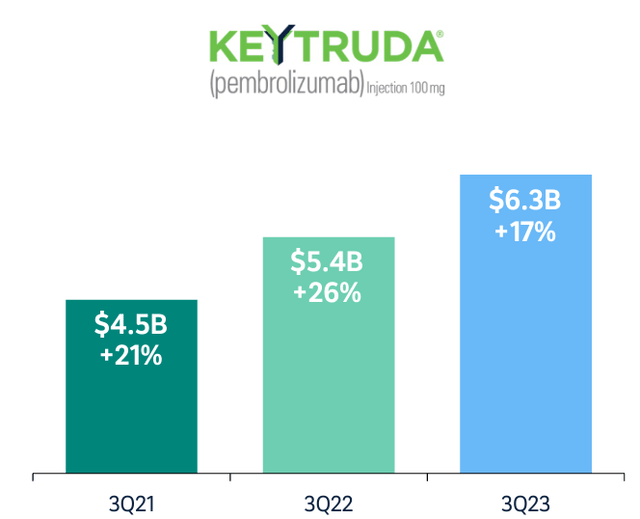

The company continues to deliver best-in-class profitability and generate substantial cash flows thanks to its diverse portfolio of products. This will highly likely ensure MRK’s financial stability, providing the company with ample resources to develop the business further by financing R&D initiatives. Since the company has a strong track record of delivering value to shareholders, there is a high probability that the management will continue demonstrating the ability to convert investments in future cash flows. Another strong bullish sign to me is that the company’s flagship cancer product, Keytruda, continues expanding its reach by receiving regulatory approvals for new indications. Expansion of Keytruda’s role in treating different types of cancer will unlock new market opportunities for Merck. That said, I expect Keytruda to sustain its impressive revenue growth trend.

Merck’s latest earnings presentation

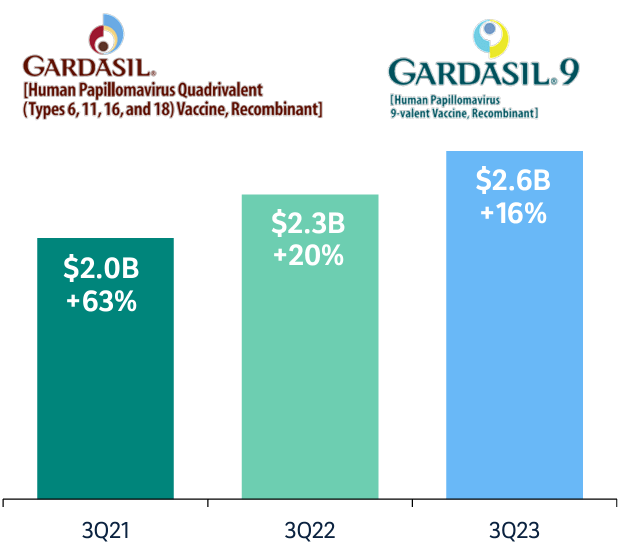

But Keytruda is not the only promising product in Merck’s wide portfolio. Gardasil also stands out and demonstrates solid sales dynamics and contributes significantly to Merck’s overall strong financial performance. This drug to cure human papillomavirus has also demonstrated massive revenue growth over recent years.

Merck’s latest earnings presentation

The company also works hard to drive long-term revenue growth, which I see in the promising pipeline with several programs in their late development phases. The solutions described in the pipeline look promising to me because they are aimed at addressing a very broad set of medical needs. It is also crucial to highlight that Merck has priority review from FDA for several of the solutions from the pipeline, which puts the company into the “pole position”.

During the latest earnings call, the management also underlined several positive developments from European approval bodies, which means there are substantial new opportunities to expand its geographical revenue mix.

Valuation update

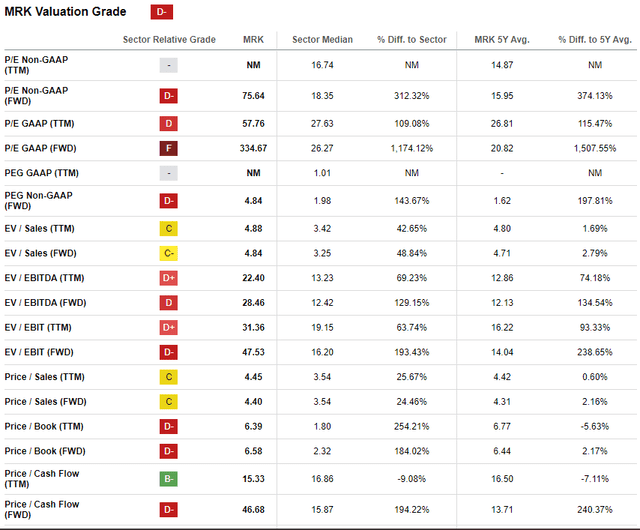

The stock price declined by 6% year-to-date, significantly underperforming the broader U.S. market. On the other hand, MRK’s performance this year was approximately in line with the Healthcare (XLV) sector. Seeking Alpha Quant assigns the stock a low “D-” valuation grade. Indeed, current valuation ratios are substantially higher than the sector median and MRK’s historical averages across the board. This might indicate overvaluation, but I would like to simulate one more approach as well.

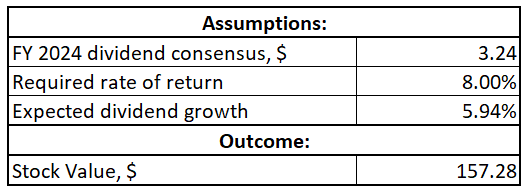

Merck has a vibrant dividend payout and growth history. Therefore, I proceed with the dividend discount model [DDM] simulation. I use the same 8% WACC as I did for MRK previously. Consensus dividend estimates forecast FY 2025 payout at $3.24, which I incorporate into my calculations. Merck has a strong dividend growth track record, and I believe that the past decade’s 5.94% CAGR will be conservative enough.

Author’s calculations

According to my DDM calculations, the stock’s fair price is slightly above $157. This indicates a massive 51% upside potential, which looks very attractive given the company’s solid history of dividend growth.

Risks update

While I consider Merck’s focus on innovation and investments in R&D to expand its product portfolio as a plus for potential investors, there is the other side of the moon as well. Past success in R&D, which Merck demonstrated consistently, is not a guarantee of future substantial FCF from new products. R&D in the pharmaceutical industry is costly, and there shall be a corresponding increase in successful product launches, which will allow the company to succeed. Failed trials, safety concerns, or failure to get regulatory approvals can result in wasted resources and lost competition.

For potential investors in pharmaceutical giants like Merck, it is also crucial to understand that these companies cannot generate substantial profits on their strongest offerings, as many pharmaceutical products have a limited patent life. This means that once patents expire, generic competitors have no legal barriers to limit the market, often leading to revenue decline for the original manufacturer. That said, companies like Merck are always at risk of facing challenges in replacing lost revenue from expiring patents.

Bottom line

To conclude, Merck is still a “Strong Buy”. Merck’s portfolio represents a wide range of healthcare products, including vaccines, antivirals, and oncology drugs. This is a strong competitive advantage, and the company’s strong track record of success and unmatched profitability gives me the high conviction that MRK is capable of sustaining strong financial performance over the long term. The valuation looks very attractive, making Merck a compelling investment opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.