Summary:

- Merck & Co is a strong investment option due to its steady growth in the pharmaceutical industry and potential for minimal risk.

- The company’s key products, Januvia for diabetes and Keytruda for cancer, show promising sales and growth potential.

- Despite some risks such as regulation and debt, Merck’s financials remain strong, making it an attractive option for retail value investors.

FatCamera/E+ via Getty Images

Population increases and improving standards of living are fortuitous portents for the drug industry. We are still bullish on the industry and on shares of Merck & Co.

Do Good Making Profits

Merck & Co., Inc. (NYSE:MRK) is a giant player in the human and animal health pharmaceuticals industry. It develops and sells vaccines and biotherapies; it has a substantial presence in the medical equipment and electronics business. Merck is dedicated to product commercialization from its remarkable R&D, manufacturing infrastructure, and stellar management and marketing.

We own the stock near the 1978 IPO. We keep adding it to our portfolio through dividend reinvestment and purchases, as a core holding. We believe the stock continues to have potential, and we maintain our Strong Buy view about the stock for retail value investors going forward through 2023. Read our personal story at the conclusion of this article.

Bad Rap

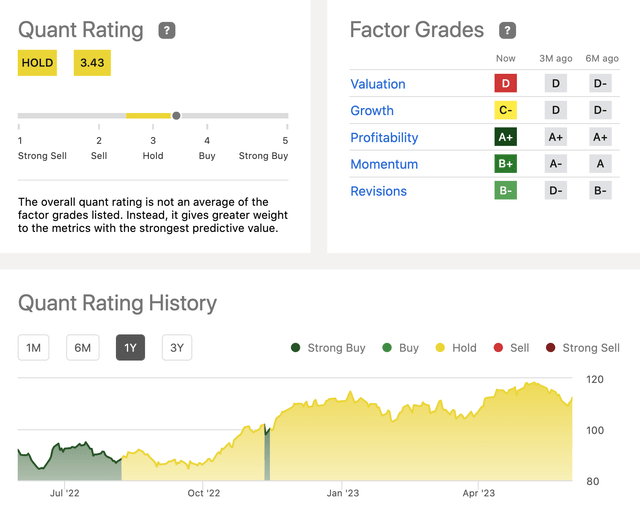

The stock’s ratings and sentiment flummox despite its past achievements and potential. Over the last 9 months, 13 Seeking Alpha investment analysts assessed a Hold rating to the stock and 15 think it a Buy. SA assesses the shares with a Hold Quant Rating for a long time, with one brief exception for 11 months. The rating bar leans more to the Sell-side.

Quant Rating & Factor Grades (Seeking Alpha Quant Ratings)

Merck & Co, with a $285.5B market cap, did not even make one analyst’s list of the top 10 best pharma stocks to buy in 2022, or another list of best pharma stocks in 2023. Of the 20 news articles on average published about Merck & Co each week, sentiment is neutral but with a positive bent; a few are bullish. We feel Merck is treated akin to a laggard red-headed stepchild in the healthcare industry; we view Merck as a consistently robust member and its stock is safe and bounteous for retail value investors.

Better Than It Seems

Pharma industry revenue is growing. According to Statista.com, the largest segment is Oncology Drugs. Revenue is forecast for an annual CAGR of +5.39% between 2023 and 2027. Considering the high costs and decades needed to research, develop, and gain approvals in each country to sell a drug, and to market it to wary medical professionals, we believe this is a core industry that ought to be part of the retail investor’s portfolio. Merck is a good start.

Merck offers investors great upside potential with minimal risk. Here are some factors to consider.

- Pharma is a slow but steady growth industry;

- Global demand for more effective drugs is rising rapidly.

- Merck & Co is the 4th largest U.S. pharma company giving it market power to carve out territories, set prices, control supply, and production, and build brand name recognition in order to limit competition.

The table below is an overview of Merck’s late-stage clinical development programs (updated May 3, 2023).

Merck’s Pipeline (Merck)

The two most important Merck & Co products target diabetes and cancer. 11.3% of the U.S. population has diabetes; another 8.5M people are undiagnosed and thus untreated so far. Januvia (sitagliptin) is one of the best-selling diabetes drugs globally generating about $2.8B in revenue in 2022.

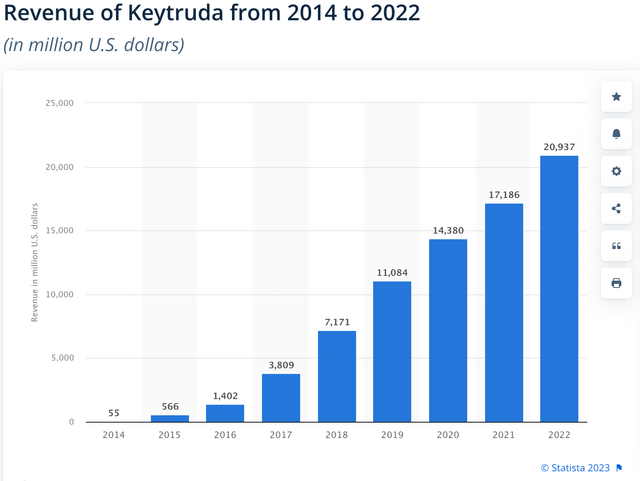

Merck’s blockbuster cancer drug, Keytruda, along with other drugs, claims the National Cancer Institute, treats breast cancer, skin cancer, colorectal cancer, endometrial cancer, renal cell carcinoma, esophageal cancer, gastroesophageal junction cancer, stomach cancer, non-small cell lung cancer, other carcinomas, cervical cancer, urothelial carcinoma, Hodgkin lymphoma, primary mediastinal large B-cell lymphoma, head and neck cancer, and other solid tumors. Keytruda sales show no signs of slowing.

Nature Journal estimates sales of Keytruda will top $24B in 2023.

Keytruda Revenue (Statista)

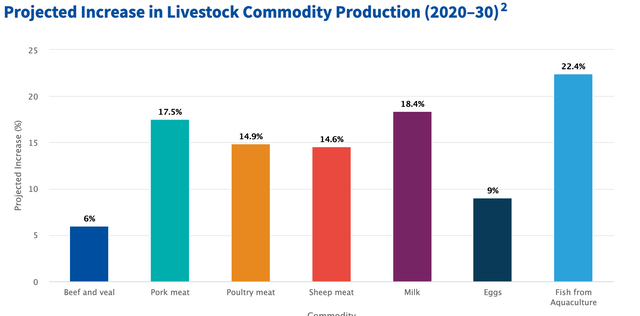

The company’s animal health sector deserves more than the short shrift it gets from the media and analysts. The sector includes livestock, fish, and pet care. Merck’s products and services are growing at a CAGR of over 8% annually in North America. Merck Animal Health has a presence in more than 50 countries. Products are available in ~150 markets.

Animal Healthcare (HealthforAnimals)

Other Numbers

Merck’s finances undergird support for our bullish position. First, the share price is +90.27% over the last 5 years and ~26% over the last 12 months.

Stock Price (Seeking Alpha)

The second reason we are bullish is the dividends safe, and growing, and the yield is a reasonable 2.6% (FWD). The dividend gets A and B grades from SA for safety, growth, yield, and consistency. The payout ratio is a reasonably low 42% after 14 years of growth. Short interest in under one percent despite the share price opening in June ’23 nearer to the stock’s 52-week high ($119) than its low ($83). Q1 ’23 financials reported last April make another case for our bullish position.

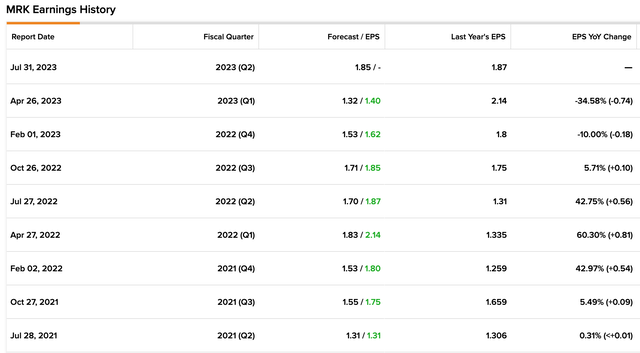

Worldwide revenue in FY ’21 totaled $48.7B. FY ’22 revenue nearly touched $59.3B, and FY ’23 revenue is estimated to pull back to $58.68B. EPS for FY ’23 is forecast to be $6.53 compared to $6.02 in FY ’21; in FY ’22 the EPS was $7.48. We urge investors to keep in mind that Merck & Co consistently beat analysts’ estimates. The next earnings announcement for Merck is July 27, 2023.

EPS Estimates and Actual (TipRanks)

Risks

Pharma and life sciences companies are highly regulated. Risks for delays in the commercialization of drugs are common while years of research and trials slog. Merck spends over $2.5B (2022) for R&D activities. Seeking Alpha reported on May 21, ’23 that the FDA is considering means and procedures to shortcut accelerated approvals of drugs “whose confirmatory trials got delayed by at least six months.” Between May 11 and May 15, Merck shares climbed to around $117 per share.

A second risk revolves around consistent product sales; at times the share price can be influenced by issues with one drug. Q1 ’23 Keytruda sales grew 20% to $5.8B driving the pharma sales of Merck. Gardasil and Gardasil 9 sales were +35% to $2B. But Januvia / Janumet sales were $913M in the quarter, down 34% from the same quarter last year. For the year, sales were $4.5B or -15% Y/Y.

Januvia is characterized as a blockbuster for Merck but the unforeseen, in this case, slippage in quality control, exacerbates risk in this business. Merck reported to the FDA the drug was contaminated in manufacturing and sales were thwarted. One news source observed

Pharmaceutical sales growth was partially offset by lower sales of JANUVIA and JANUMET for the treatment of type 2 diabetes…” Another risk comes from foreign sales. 2022 sales increased in Japan, Australia, and the U.K. but the impact of negative foreign exchange rates negatively affected Merck profitability.

Management is continuing to acquire other businesses despite an anticipated drop in cash. Merck acquired 14 in the last 5 years, 90% in life sciences and 4% in IT. The company recently announced its proposed acquisition of Prometheus Biosciences to Strengthen Immunology Pipeline.

Debt may appear risky. The debt-to-equity ratio is 65.6%. Even continuing to make acquisitions, Merck is in satisfactory financial shape and appears to be using its debt wisely. Assets total $108B including $10.4B in cash and equivalents. Liabilities total $60.9B. The debt is covered by the company’s operating cash flow and interest payments by EBIT. Merck’s stock buyback in Q1 ’23 reached $149M.

Looking Forward

Looking forward, we have confidence the company will meet NASDAQ’s EPS forecasts of at least $6.95 in 2023, $8.46 in 2024, and $9.69 in 2025. Hedge funds appear confident. They increased their holdings last quarter by over 400K shares. Corporate insiders bought shares in January ’23, bought have been selling when the price topped $116. Multiplying the current PE of 17.24 by the anticipated EPS of $7, we calculate an average price target of $120 per share over the next 12 months. We see a potential opportunity for retail value investors at this time to profit from Merck & Co stock because of its upside consistency and low risk in an industry with products people want and need.

A Short Story

We conclude with one short story.

This is our story of how Merck & Co stock and Merck products impact our family. This is not a puff public relations piece and we get no remuneration from Merck. We are just telling a story from one family’s perspective. We are not irritated with the labyrinth of condemnations of pharmaceutical companies’ profiteering but present the human side of the pharma story.

In the delivery room at Weiss Memorial Hospital, Chicago, my wife Ethel gave birth to our second child. Back in her room, she asked if I had heard about a company called Merck. Being a young, MA student, and teacher, I told her, “No, I had never heard of Merck.”

Ethel instructed me, “We need to buy their stock. They’re everywhere in the hospital. A lot of the equipment in labor and delivery has that name on it.” 50 years ago we took our meager savings and bought some shares. We kept buying MRK over the next 50 years. We sold some shares to help buy our first car, then more to buy our first house, and more to pay for school and college tuition for our 6 kids. But we always bought MRK with money we were able to save.

We still own shares of MRK and are still buying more through the dividend reinvestment program. I retired after decades in government, political life, and our own business, which we sold in 2011. After retiring I taught business and government credit courses for visiting foreign university students in Tel Aviv for 6 years. I continue to consult and write investment articles for companies like Seeking Alpha.

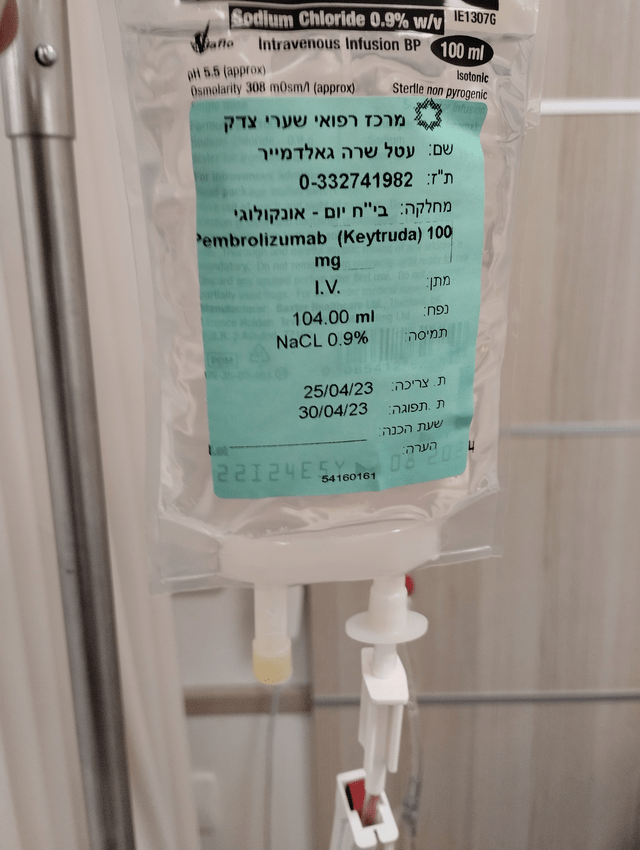

But the story does not end there. Ethel has recently taken ill. After a long and sometimes excruciating series of medical tests and hospital stays, Ethel has been diagnosed with lung cancer. Shaare Zedek Hospital in Jerusalem assigned her a case manager and a visit with a leading immuno-oncologist. The doctor is starting Ethel on treatments with KEYTRUDA.

Keytruda Intravenous (Goldmeier LLC)

By 2019, KEYTRUDA was sanctioned for use in combination with other drug therapies in the U.S., all European countries, Japan, China, and over 70 other countries.

Merck made our 54 good years together even better. Now Merck might extend or, God willing, save Ethel’s life. Hopefully, this story has many more chapters still to be written, but I thought our story thus far might be of interest to you. Sometimes things just work out that way.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.