Summary:

- Merck’s Q1 2023 pharmaceutical sales fell by 10% to $12.7 billion, while Animal Health sales increased by 1% to $1.5 billion.

- The company’s oncology, vaccines, and acute hospital care sectors showed growth, but virology and diabetes sales dropped.

- Despite challenges, Merck’s financial health remains strong, but investors should adopt a ‘Hold’ position due to uncertainties in pharmaceutical sales and heavy reliance on R&D successes.

John Moore/Getty Images News

Introduction

Merck & Co., Inc. (NYSE:MRK), a global healthcare leader, delivers innovative health solutions via prescription medicines, biologic therapies, vaccines, and animal health products. Its operations are organized into two segments: Pharmaceutical and Animal Health. The Pharmaceutical segment focuses on prescription drugs and vaccines for treating human disorders, primarily sold to wholesalers, hospitals, and managed healthcare providers. The Animal Health segment provides pharmaceutical and vaccine products, health management solutions, and digitally connected products for livestock and pets, selling primarily to veterinarians, distributors, and animal producers.

The following article reviews Merck’s most recent earnings report and future prospects.

Q1 2023 Financials

In Q1 2023, Merck & Co.’s pharmaceutical sales fell by 10% to $12.7 billion due to drops in virology and diabetes sales, despite growth in oncology, vaccines, and acute hospital care sectors. The drop in virology is primarily attributed to lower sales of Lagevrio, especially in the U.S. and U.K. Diabetes sales dropped due to decreased sales of Januvia and Janumet because of generic competition, especially in Europe, and less demand in the U.S.

Oncology sales growth was largely due to a 20% increase in sales of Keytruda. The growth in the vaccine sector was due to an increase in sales of Gardasil, Gardasil 9, Vaxneuvance, and Rotateq, which was partly offset by a decline in sales of Pneumovax 23. The growth in hospital acute care was largely driven by increased sales of Bridion.

Animal Health sales experienced a marginal increase of 1% to $1.5 billion, with a 5% growth when accounting for foreign exchange impact. This was primarily due to strong demand for livestock products and higher pricing.

The gross margin for the first quarter of 2023 was higher (72.9%) than the first quarter of 2022 (66.2%), mainly due to lower Lagevrio sales, better product mix, and reduced intangible asset amortization.

Selling, general, and administrative (SG&A) expenses rose by 7% due to higher administrative costs and promotional spending, somewhat offset by the favorable effect of foreign exchange. R&D expenses significantly rose by 66% due to charges for the acquisition of Imago and a collaboration agreement with Kelun-Biotech, as well as increased compensation and higher clinical development spending.

Other expenses decreased compared to Q1 2022, largely due to net gains from equity securities investments and higher interest income, partially offset by a charge related to the Zetia antitrust litigation settlement.

The effective tax rate for Q1 2023 was 22.6%, reflecting various unfavorable impacts, including a charge for the acquisition of Imago that had no recognized tax benefit, higher foreign taxes, and other effects. The GAAP earnings per share [EPS] for Q1 2023 was $1.11, compared to $1.70 for Q1 2022.

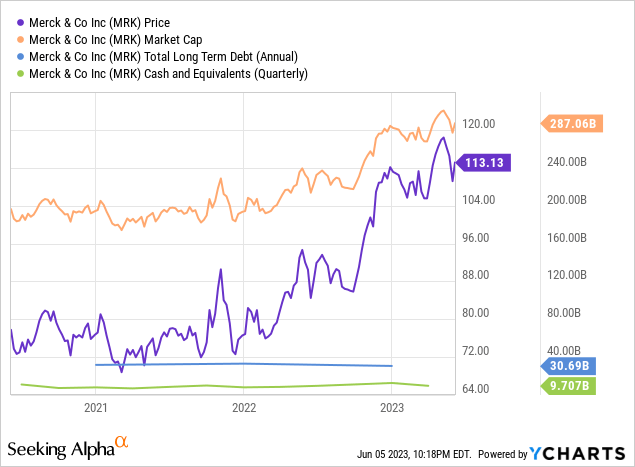

Merck’s valuation indicates a solid position in the market. The forward Price-to-Earnings (P/E) ratio stands at 17.24, which is relatively fair, indicating that the stock is not overly valued. The company has a strong balance sheet with an impressive gross profit margin of 72.75% and a robust return on equity of 29.69%. This indicates the company’s ability to generate profits from its investments. However, revenue growth is moderate at 7.21% YoY, and the diluted EPS has decreased by 6.57% YoY. The company’s EV/EBITDA ratio is 13.68, suggesting that investors are willing to pay a high premium for the company’s earnings. Overall, Merck’s stock appears to be a reliable investment with good profitability, though its growth indicators could be improved.

Q1 2023 Earnings Call Review

Merck’s management, during the recent earnings call, focused heavily on the company’s advances in developing treatments for various conditions. A notable accomplishment is the progress of the STELLAR trial, evaluating sotatercept for pulmonary arterial hypertension [PAH], which showed significant improvement in exercise capacities. They anticipate filing for regulatory approval in the U.S. in Q3 2023, followed by the EU.

In the cardiovascular field, Phase 2b results for MK-0616 showed a notable reduction of LDL-cholesterol levels, and they are initiating multiple Phase 3 studies for the drug.

Oncology has been a major area of focus for Merck. Notably, the FDA accepted the company’s application for Keytruda in combination with chemotherapy for patients with certain stages of non-small cell lung cancer. They also reported results from KEYNOTE-942, a Phase 2b study evaluating Keytruda combined with an individualized neoantigen therapy from Moderna (MRNA), showing improvement in recurrence-free survival. A significant advancement was the FDA’s accelerated approval of Keytruda in combination with enfortumab vedotin for the treatment of certain types of urothelial carcinoma.

In the field of infectious diseases, Merck continues to prioritize global access to Lagevrio for COVID-19 treatment and is also exploring its application for other viral respiratory infections.

Lastly, Merck’s acquisition of Prometheus is seen as a promising step, offering a potential first-in-class clinical candidate for inflammatory bowel disease [IBS]. By combining Prometheus’ deep understanding of IBS with Merck’s biomarker expertise, they hope to usher in a new era in immunology based on a precision medicine approach.

My Analysis & Recommendation

In analyzing Merck’s future prospects, investors should carefully observe several key indicators. Firstly, Merck’s pharmaceutical sector is currently facing headwinds due to decreasing sales in virology and diabetes drugs, which can potentially be a future challenge. However, Merck’s resilience is evident in the growth of its oncology, vaccines, and acute hospital care sectors, notably underpinned by strong sales of Keytruda and various vaccines. The growth in these sectors has the potential to offset the losses from decreased sales in virology and diabetes drugs, but this is not a certainty.

The company’s ongoing R&D initiatives should also be on investor’s radar. Merck’s focus on the development of novel therapeutics, as evident from the promising STELLAR trial results and the FDA’s accelerated approval of Keytruda in combination with enfortumab vedotin, point towards continued growth in their oncology portfolio. Importantly, advancements in non-oncologic indications like PAH and IBS may soon provide much-needed blockbusters outside of Keytruda.

Despite the decreasing sales in certain areas and increased expenses, the company’s robust gross margin and promising forward P/E ratio suggest that Merck’s financial health remains strong. However, the decrease in diluted EPS indicates that the firm’s profitability is under some pressure. The company’s impressive return on equity and relatively stable EV/EBITDA ratio points to its ability to generate consistent returns for shareholders, although the future sustainability of this performance will be dependent on the successful execution of the company’s strategic initiatives.

In light of these insights, investors should adopt a ‘Hold’ position for Merck’s stock. The firm exhibits strong profitability and a sound financial base, but the uncertainty stemming from decreased pharmaceutical sales, rising expenses, and heavy reliance on future R&D successes makes it prudent to adopt a watchful stance at the current moment. Investors should remain cautiously optimistic about Merck’s future prospects, closely monitoring the company’s R&D progress and the subsequent commercialization of their novel treatments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.