Summary:

- Merck’s stock is undervalued, trading at less than 4x expected 2024 revenues, despite strong revenue growth from Keytruda and other drugs.

- Keytruda’s revenue is projected to increase by 70% from 2024 to 2032.

- Declining Gardasil sales in China and competition from Summit Therapeutics and Roche’s Tecentriq may have contributed to recent stock volatility.

- Merck’s pipeline, including Winrevair and Koselugo, offers potential for substantial revenue growth, making the stock a Buy.

JasonDoiy/iStock Unreleased via Getty Images

Thesis

Merck & Co. Inc. (NYSE:MRK) keeps on generating more and more revenue, with revenue guidance for FY 2024 up 6-7% from 2023. Much of the added revenue, and more than the entire revenue of the company, is generated by Keytruda, the company’s oncology product. Although Keytruda keeps on receiving continuous approvals for various indications, its main patent will end in 2028. The question is how this upcoming patent cliff will impact sales, and subsequently, the company’s stock.

The company may need to look for further acquisitions to replace revenue generated from Keytruda. At this time, in spite of an impressive pipeline, I do not see a worthy replacement for Keytruda. However, with Keytruda revenues expected to increase by about 70% between 2024 and 2032, even a patent cliff should not scare away investors. Merck has recently also announced positive Phase 3 results in neurofibromatosis type 1, which the market may have overlooked, I believe.

Merck’s stock has been volatile the past year. With the company’s stock trading at less than 4x the company’s expected 2024 revenue and in spite of an interesting dividend, I believe the company comes at an attractive valuation. However, the market is often also about sentiment, and from that perspective further sales increases from Keytruda may not be able to stop the stock’s decline.

Company Overview

Merck is a large pharmaceutical company a product portfolio that is focused for about 90% on treatments for humans, and about 10% is focused on animals. Merck’s financial performance over the past years has been excellent.

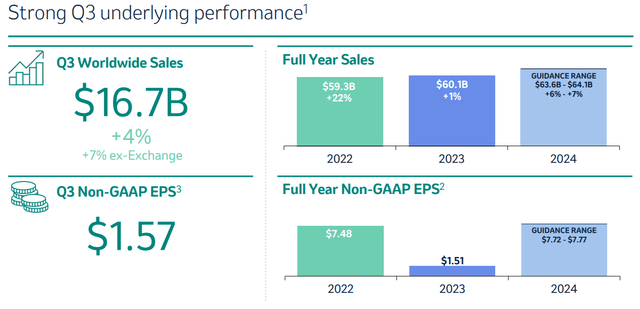

The company’s primary revenue-generating products are Keytruda, Gardasil, Vaxneuvance, Lynparza, Lenvima and Welireg. Total sales for the past quarter were $16.7 billion, and Merck is guiding for $63-$64 billion in revenue for the entire 2024.

Q3 financial performance (Q3 earnings presentation)

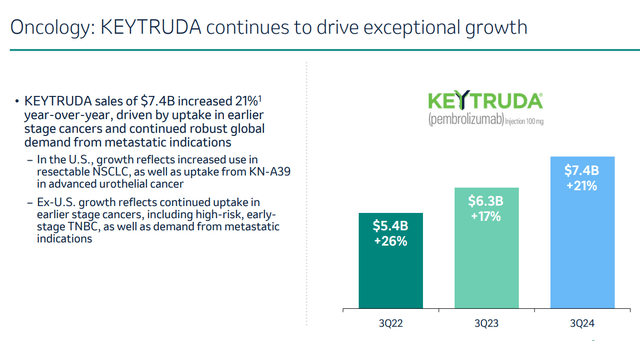

Keytruda, a drug for different cancer indications, generates by far the most revenue, more than half of the company’s total revenue. And those sales keep on increasing year-over-year.

Keytruda Q3 2024 growth (Merck Q3 results presentation)

Keytruda

Keytruda, approved for the first time in 2014, is an anti-PD-1 drug that has been approved in a variety of cancer indications, either as monotherapy or in combination with other therapies. Some of these indications the drug is approved for are cervical cancer, Hodgkin lymphoma, a number of carcinomas, non-small-cell lung cancer, melanoma and certain solid tumors.

Just for the year 2023, the company has received FDA approvals as adjuvant treatment for non-small-cell lung cancer, for unresectable or metastatic MSI-H or dMMR solid tumors, locally advanced or metastatic urothelial carcinoma, for resectable non-small-cell lung cancer as neoadjuvant treatment, Merkel cell carcinoma, biliary tract cancer, HER2-negative gastric or GEJ adenocarcinoma, urothelial cancer. Several other geographies such as the European Union and Japan also gave approval in various indications. In 2024, the same line of further approvals can be seen, for example in stage III-IVA cervical cancer, biliary tract carcinoma, primary advanced or recurrent endometrial cancer and endometrial cancer, and unresectable advanced or metastatic malignant pleural mesothelioma.

In total, Keytruda now has over 40 FDA approvals and 30 EC approvals in distinct indications, based on 25 studies with a benefit shown in overall survival.

Other lead drugs in Merck’s portfolio

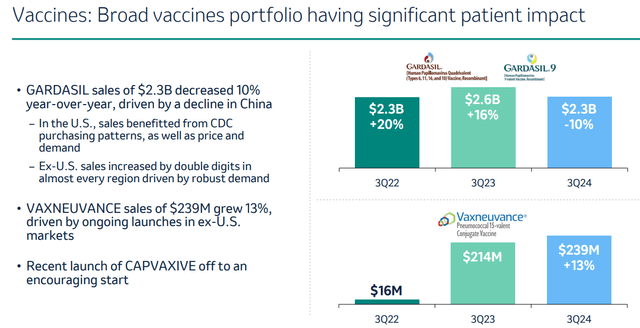

Merck’s other lead drugs Gardasil, Lynparza, Lenvima, Welireg and Vaxneuvance also generate steadily improving income. Gardasil, by far the second-best revenue-generator of Merck’s portfolio, has declining sales in China which worry some investors.

Vaccines portfolio performance Q3 2024 (Q3 results presentation)

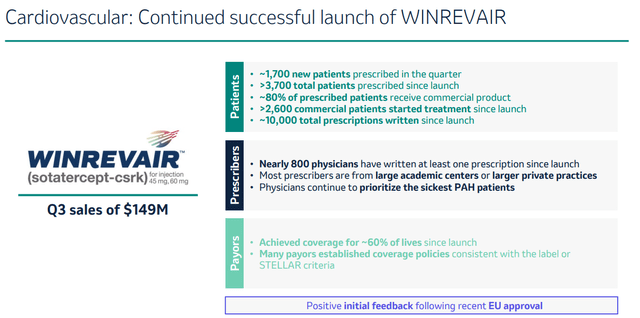

Winrevair is the most recently approved of Merck’s drugs. The drug, acquired by Merck in 2021 through the acquisition of Acceleron Pharma for $11.5 billion, has been approved in March 2024 and already generated sales of $149 million in the third quarter of 2024.

Winrevair slide (Q3 results presentation)

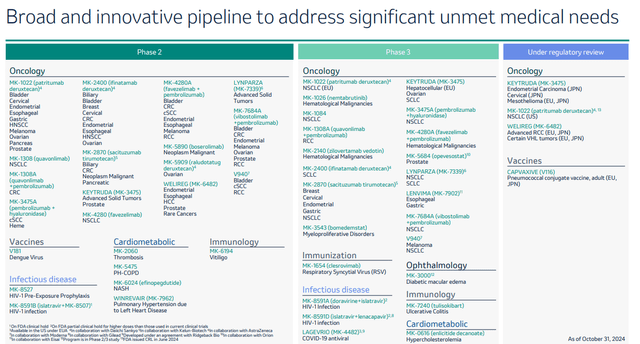

Merck furthermore has an impressive pipeline, with a substantial number of drugs in Phase 2 and Phase 3 trials.

Merck pipeline (Q3 results presentation)

Expectations for the future

The positives: ramping Keytrade revenues and Winrevair expectations

In essence, I would say that Merck has two contrasting dynamics, which make it hard to judge where the company could be going to in a post-2028 scenario. That scenario may already be relevant now, or in the coming years, as the company’s $249 billion valuation – at the time of writing – is based on forward projections related to revenue and earnings.

I will provide some detail in relationship to the two dynamics below, starting with the positive and ending with the negative.

At least for the coming four years, I expect Keytruda sales to keep on improving in light of the company’s approvals for the drug in a variety of indications. Many of these indications have huge markets, and one can expect a continued uptake by healthcare professionals and patients of Keytruda over the coming years.

For the year 2024, Keytruda is expected to generate more than $27 billion in sales. In 2028, the year its main patent will end, Keytruda is expected to be the world’s best-selling drug, with $31.52 billion in revenue expected at that time.

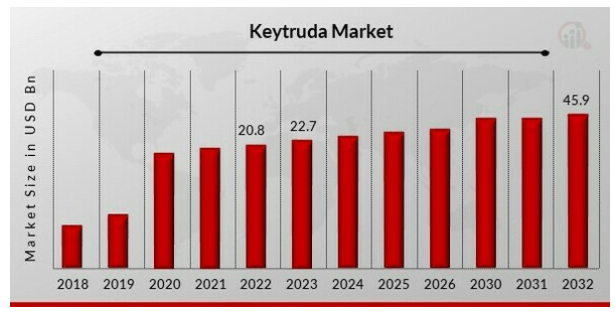

The Keytruda market is expected to grow strongly even beyond that point, namely to $45.9 billion by 2032, at a CAGR of 9.20%.

Keytruda market projections (Marketsearch Future)

This would mean that from 2024 onwards, when sales are expected to be more than $27 billion, to 2028 ($31.5 billion), and further to 2032 ($45.9 billion), an eight-year period overall, revenues for Keytruda are projected to improve by $18.9 billion. That is about a 70% increase. Until 2028, these revenues are solely for Merck.

Apart from other drugs in Merck’s pipeline that are on a steady growth trajectory, Winrevair is one to watch. Expected peak sales here are still unclear, but should be reasonably high. Some analysts had estimates of $2 billion, while another one was expecting $3 to $4 billion. In any case, Winrevair will be a drug to watch in the coming years.

On November 12, 2024, Merck has also announced positive results Phase 3 trial for Koselugo in adult patients with neurofibromatosis type 1. These patients do not have an approved therapy available, meaning the market is largely untapped. And this is a substantial market, valued at $8.3 billion in 2023 and expected to grow to $21 billion in 2027 and $27 billion in 2029.

The above projections are very positive for Merck. Now for the negatives.

The negatives: patent cliff and Roche’s subcutaneous Tecentriq

I assume that, once the main patent for Keytruda has expired, only half of the Keytruda revenues will still go to Merck. That could mean that, for example in 2030, about $20-$25 billion in sales could still be generated from Keytruda. It is also possible that the commercialization of biosimilars may lead to Merck revising its price downward in order to remain competitive.

Furthermore, although Merck may have several additional patents, it does not appear that Keytruda by way of a subcutaneous version may be able to replace the current intravenous version. In fact, although a Phase 3 trial with the subcutaneous version is still ongoing with results expected in 2026, Merck chose not to publish results of another trial with this subcutaneous version which apparently led to a higher morbidity than placebo. Roche’s (OTCQX:RHHBY) (OTCQX:RHHBF) (OTCPK:RHHVF) Tecentriq will be the first anti-PD-(L)1 cancer immunotherapy, in light of its approval in September 2024.

Financials

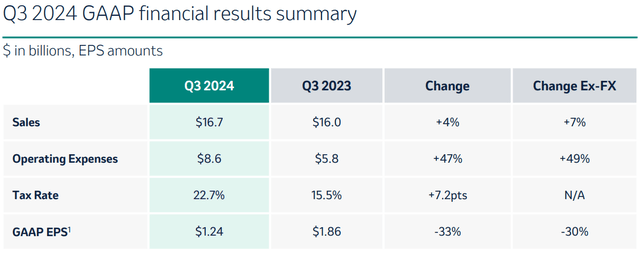

Merck’s latest quarterly results indicate that sales have grown but operating expenses and tax rates have gone up more, leading to lower GAAP earnings per share compared to the year before.

Q3 GAAP results (Q3 results presentation)

The company’s now guides for full-year sales of in between $63.6 billion and $64.1 billion, with a non-GAAP gross margin rate of about ~81%, operating expenses of about $26.8 billion to $27.6 billion, $350 million expenses and a tax rate of in between 15.5% and 16.5%.

The company has about $19.63 billion in cash and currently also pays a dividend of about $3.08 per share on a yearly basis.

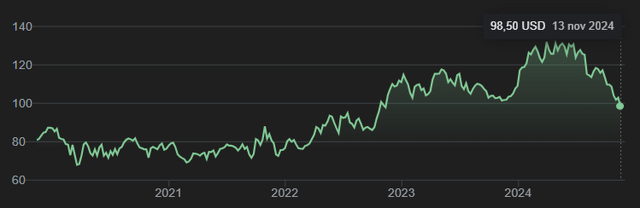

Recent stock developments

The stock has sold off quite considerably since mid-2024, and selling does not seem to be done yet, by the looks of it.

Five-year stock chart (Google)

I attribute that to declining Gardasil sales in China and investor fears that the Keytruda patent cliff may lead to bigger losses in revenue in the coming years than I do. Merck is heavily dependent on that drug. Recent quarterly results showed about 45% of sales came from Keytruda, and last year’s results mentioned that Merck was dependent on Keytruda and Gardasil for 56% of sales [page 32].

Furthermore, there is also increased competition for Keytruda. One recent development to highlight here is the announcement by Summit Therapeutics that ivonescimab reduced the risk of progression or death by 49% compared to Keytruda in non-small-cell lung cancer. Summit’s drug blocks both PD-1 and VEGF, and a caveat in that respect is that VEGF inhibition comes with toxicity, which often leads to lower overall survival. Nonetheless, Merck’s stock dipped and Summit’s soared the day of the announcement.

Valuation

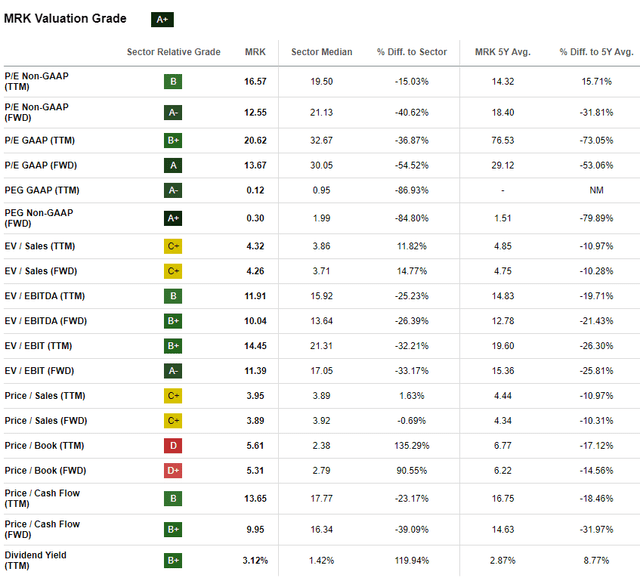

Merck’s stock currently has a $249 billion valuation, down about -4% on a yearly basis and down from about $340 billion at this year’s peak, which represents a decline of about $91 billion. From many perspectives, different valuation indicators show that Merck has a rather low valuation at this time. The stock gets an A+ rating according to Seeking Alpha’s overall valuation measurements.

MRK Valuation metrics (Seeking Alpha)

I believe the drop to a $249 billion is unwarranted. With about $63-$64 billion in expected revenue this year, the stock would currently be trading at a $3.92 EV/2024-sales multiple. If the projections for Keytruda sales would not be expected to improve, I would understand the sell-off. However, Keytruda is expected to generate an additional $4.5 billion in sales from now until 2028, and several of other Merck drugs and therapies such as Winrevair are also on the rise. With all other sales constant, adding another $4.5 billion to earnings would lead to close to $70 billion in earnings by 2028, with high profit margins.

And that growth trajectory for Keytruda may even continue considerably for the years to follow, up to $45.9 billion by 2032 as projected above, which may mean that even the drop in revenues related to Keytruda going off patent could be compensated by overall rising Keytruda sales.

Besides, Merck is still on the dealmaking path, and I assume it will want to strengthen its pipeline with late-stage assets to compensate for declining Keytruda revenues in the years to come.

Conclusion

Merck’s stock has been on the decline since mid-2024, having come off a market cap of about $340 earlier this year to about $249 billion at this time. The company currently trades at less than 4x expected 2024 revenues.

The recent decline in the stock price may have multiple reasons. I mentioned some possible explanations, such as declining Gardasil sales in China, investor fears that the Keytruda patent cliff may lead to big losses in revenue in the coming years, increased competition for Keytruda from Summit Therapeutics and Roche’s approval of subcutaneous Tecentriq, a PD-(L)1-inhibitor.

I believe that drop is unwarranted. I believe the market may underestimate the impact of expected revenues for Keytruda in the coming years, both before and after 2028 when Keytruda’s main patent will expire. Additionally, other drugs such as Winrevair and Koselugo may be able to generate additional billions in revenues in the coming years.

For the above reasons, Merck is a Buy for me here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.