Summary:

- Keytruda sales totaled $5,795 million in Q1 2023, up 17% year-on-year, thanks partly to an increase in its indications for use.

- At the same time, Robert Davis does not actively use the share buyback program, and in the first quarter of 2023, Merck repurchased its shares for about $149 million.

- At the end of the first quarter of 2023, Merck’s total debt was about $30.75 billion, a decrease of $3.88 billion from 2021.

- However, due to the declining AI hype in the media, we expect the S&P 500 to drop to$4292-$4300, eventually driving Merck’s share price down to $104-105 in the next two months, after which the accumulation phase will begin.

- We continue our analytics coverage of Merck with an “outperform” rating for the next 12 months.

PeopleImages

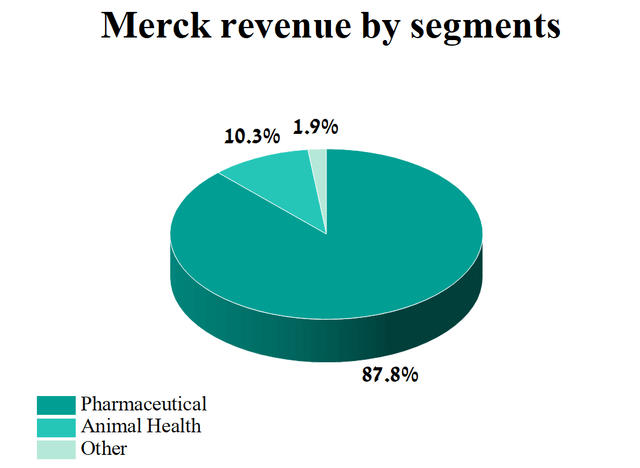

On April 27, 2023, Merck (NYSE:MRK), one of the leaders in the pharmaceutical industry, released its financial results for the first quarter of 2023, which not only continued the trend of Wall Street analysts’ expectations but also managed to demonstrate that the demand for anti-cancer drugs, which account for 44.1% of the company’s total revenue remains high. At the same time, the company conducts business in two operating segments, Animal Health and Pharmaceutical, whose product sales accounted for 87.8% of Merck’s total revenue in the first quarter of 2023.

Author’s elaboration, based on 10-Q

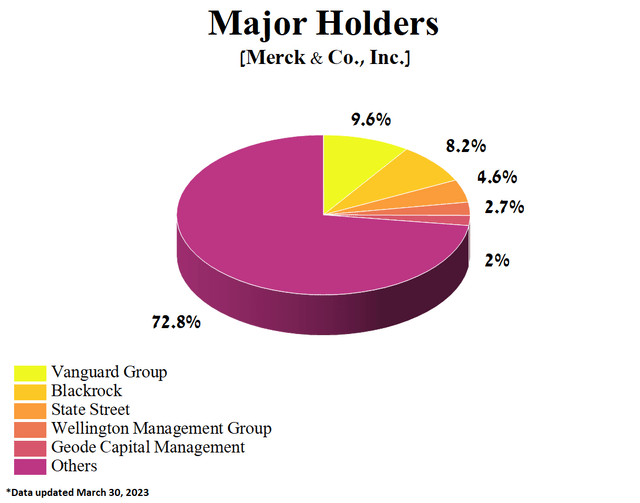

At the same time, the five largest shareholders of Merck, with a combined share in the company equal to 27.16%, have long been such Wall Street mastodons as Vanguard Group, BlackRock, State Street, Wellington Management Group, and Geode Capital Management. As a result, this is one factor in their confidence in Merck’s bright future, despite the looming pressure from President Biden’s Inflation Reduction Act.

Author’s elaboration, based on Yahoo Finance

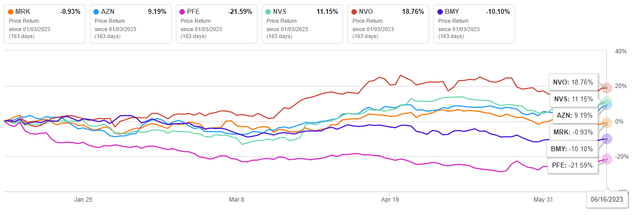

Due to quarterly and year-on-year revenue and net income declines since the beginning of 2023, Merck’s share price has shown a marginal decrease of about 2.7%, behind major healthcare competitors Eli Lilly (LLY), Novartis (NVS), and Novo Nordisk (NVO).

Author’s elaboration, based on Seeking Alpha

We continue our analytics coverage of Merck with an “outperform” rating for the next 12 months.

Merck’s Financial Position

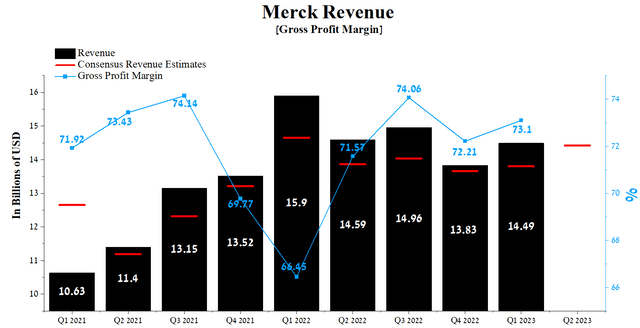

Merck’s revenue for the first three months of 2023 was $14.49 billion, up 4.8% from the previous quarter and down 8.9% from the first quarter of 2022. At the same time, the company’s actual revenue has beaten consensus estimates by Wall Street analysts in the last eight out of nine quarters since the introduction of COVID-19 vaccines to the markets, which have played a significant role in the fight against the virus and the return of people’s lives to normal.

Author’s elaboration, based on Seeking Alpha

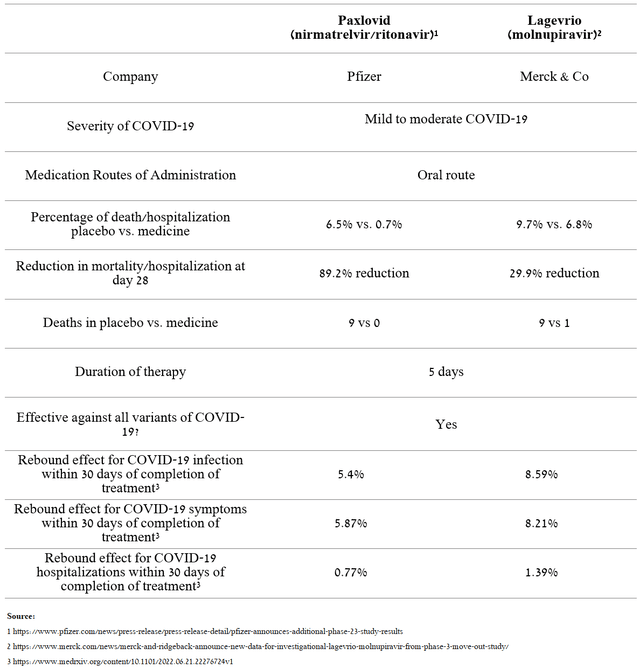

Despite QoQ revenue gains in the company’s two operating segments, Animal Health, and Pharmaceutical, declining demand for Lagevrio (molnupiravir), approved for mild to moderate COVID-19 treatment, continues to affect the company’s total revenue negatively. Thus, sales of Lagevrio amounted to $392 million in the 1st quarter of 2023, down 87.7% year-on-year due to a sharp decline in the number of COVID-19 cases in Europe and the United States and maintaining intense competition with Pfizer’s Paxlovid (PFE), which has some efficiency advantages.

Source: Created by author

However, we believe that the impact of this drug on Merck’s total revenue will continue to decline and reach double-digit by the fourth quarter of 2023. In addition, as expected, the decrease in the company’s revenue in the first quarter of 2023 was affected by the loss of exclusivity of two medicines such as Janumet (sitagliptin and metformin HCl) and Januvia (sitagliptin), as a result of increased competition with their generic versions in the countries of the European Union and China. Cumulative sales of these drugs approved to lower blood sugar levels in patients with type 2 diabetes were $880 million in the first three months of 2023, down 28.6% year-over-year. What’s more, investors should consider that around twenty-five pharmaceutical companies are likely to be able to start selling generic versions of Januvia and Janumet in the US as early as 2026, putting additional pressure on Merck’s diabetes franchise.

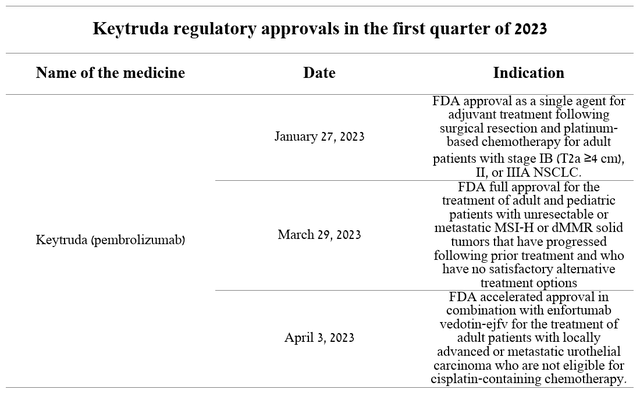

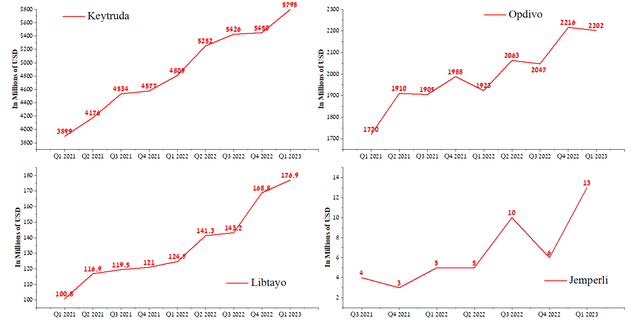

Despite this, Merck’s Q2 2023 revenue is expected to be $14.29-14.55 billion, up 4.5% from analysts’ expectations for the first three months of 2023. We believe that the improvement in the company’s financial position will continue through the expansion of the oncology franchise, in particular through Keytruda (pembrolizumab), which is one of the best-selling drugs in the world and whose mechanism of action is based on blocking the PD-1 pathway. Keytruda sales totaled $5,795 million in Q1 2023, up 17% year-on-year, thanks partly to an increase in its indications for use.

Author’s elaboration, based on 10-Q

In addition, the demand for Merck’s product for treating patients with head and neck squamous cell carcinoma [HNSCC], renal cell carcinoma [RCC], early-stage triple-negative breast cancer, and melanoma is growing rapidly. Unlike Keytruda, sales of PD-1 inhibitors such as Bristol-Myers Squibb’s Opdivo, Regeneron Pharmaceuticals/Sanofi’s Libtayo, and GSK’s Jemperli remain sluggish.

Author’s elaboration, based on quarterly securities reports

Merck’s gross margin was 73.1% in Q1 2023, a significant improvement from the previous year due to lower raw material prices and a sharp decline in sales of Lagevrio, which has a low gross margin. Moreover, this financial indicator is higher than that of the healthcare sector but also that of such major competitors as Takeda Pharmaceutical, Novartis, and Johnson & Johnson, another factor attracting investors to choose Merck as a long-term investment.

We forecast that by 2023 Merck’s gross margin will reach 77.5%, and by 2024 this figure will increase slightly to 78.2%, thanks to lower inflation and the company’s drug portfolio expansion.

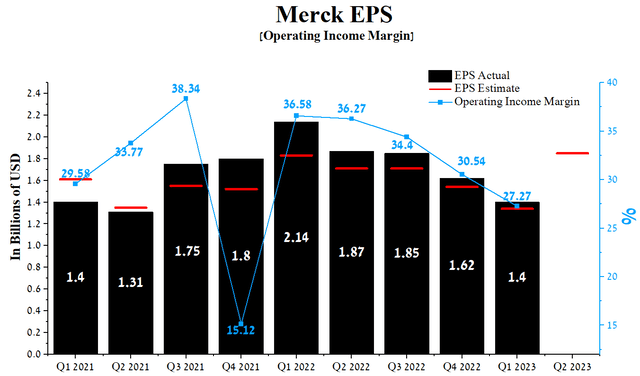

Merck’s operating income margin in Q1 2023 was 27.27%, continuing its downward trend that started in Q1 2022. The company’s earnings per share (EPS) for the first three months of 2023 was $1.4, up 13.6% quarter-on-quarter, and last but not least, it continued to beat analyst consensus estimates in recent quarters.

Moreover, Merck’s Q2 EPS is expected to be in the $1.77-$1.97 range, up 38.1% from the Q1 2023 consensus estimate. At the same time, Merck’s Non-GAAP P/E [TTM] is 16.23x, which is 14.29% less than the average for the sector and 8.63% higher than the average over the past five years.

Author’s elaboration, based on Seeking Alpha

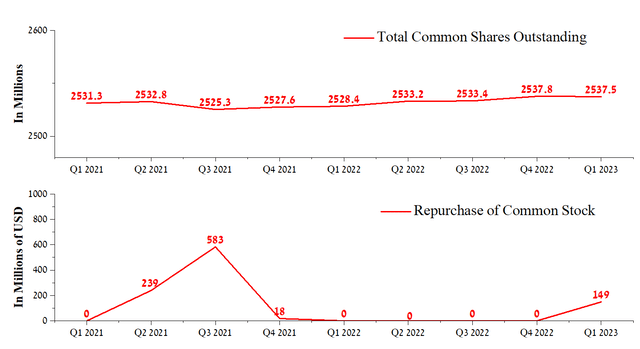

One of the main reasons for beating EPS is due to the high sales of Gardasil 9, Vaxneuvance, and Keytruda. At the same time, Robert Davis does not actively use the share buyback program, and in the first quarter of 2023, Merck repurchased its shares for about $149 million. At the same time, at the end of March 2023, the remaining authorization to buy back Merck’s shares amounted to $4.9 billion. Despite the significant amount, we believe that the company’s management will continue to pursue an active R&D and M&A policy instead of artificially using cash flow to support the price of Merck’s shares. Moreover, this policy continues to meet Mr. Market’s support in the current geopolitical instability period.

Author’s elaboration, based on Seeking Alpha

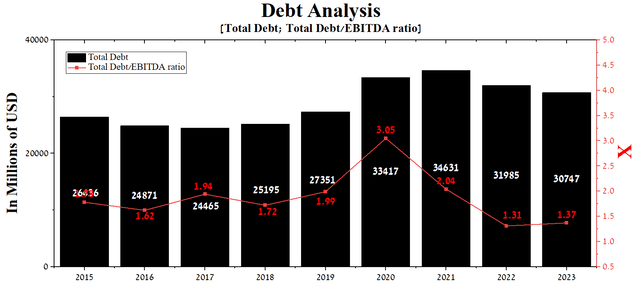

At the end of the first quarter of 2023, Merck’s total debt was about $30.75 billion, a decrease of $3.88 billion from 2021. However, despite a slight decline in EBITDA in recent quarters, the total debt/EBITDA ratio fell from 2.04x to a record low of 1.37x for Merck.

Author’s elaboration, based on Seeking Alpha

Given the maturities of the debentures and senior notes, we do not expect Merck to have any problems with their redemption, and Robert Davis will continue to pursue an active R&D policy to maintain a leading position in the global oncology drugs and vaccines markets.

Conclusion

We continue our analytics coverage of Merck with an “outperform” rating for the next 12 months.

On April 27, 2023, Merck, one of the leaders in the pharmaceutical industry, published financial results for the first three months of 2023, which not only continued to beat analyst expectations but were able to demonstrate that demand for cancer medicines such as Lynparza, Keytruda, and Lenvima remains strong.

Moreover, the company’s management continues to pursue an active R&D policy, which is reflected in the relatively rapid expansion of the portfolio of product candidates. The most promising, and potentially bringing in hundreds of millions of dollars a year to Merck, are MK-0616, sotatercept, belzutifan, and PRA023, which are being developed to treat various immune-mediated diseases.

However, due to the declining AI hype in the media, we expect the S&P 500 to drop to $4292-$4300, eventually driving Merck’s share price down to $103.5-104 in the next two months, after which the accumulation phase will begin.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TAK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.