Summary:

- Merck & Co. has consistently outperformed the S&P 500, largely due to the success of Keytruda, which contributed a third of the company’s total revenue in 2022.

- Despite challenges such as the expiration of Keytruda’s patent and debates over drug pricing, Merck has shown resilience and adaptability.

- The company’s stock is currently experiencing a downward adjustment, which could present an opportunity for long-term investors to establish a stake in Merck.

Extreme Media

Merck & Co., Inc. (NYSE:MRK), a renowned leader in the global healthcare sector, has shown a commendable performance over the past years, consistently surpassing the S&P 500. This impressive track record is predominantly attributable to Keytruda, which has been a significant contributor to the company’s total revenue. Aware of the forthcoming challenges like the expiration of Keytruda’s patent and the global conversation on drug price reductions, Merck has taken proactive measures to fortify its drug development pipeline. This includes strategic acquisitions of therapies with potential, such as the purchase of Prometheus Biosciences. This article provides a technical breakdown of Merck’s stock performance to anticipate its future trajectory and identify potential investment opportunities. Presently, it appears that the stock price is experiencing a downward adjustment. However, such corrections might generally be golden opportunities to buy.

Resilience and Innovation Amid Market Challenges

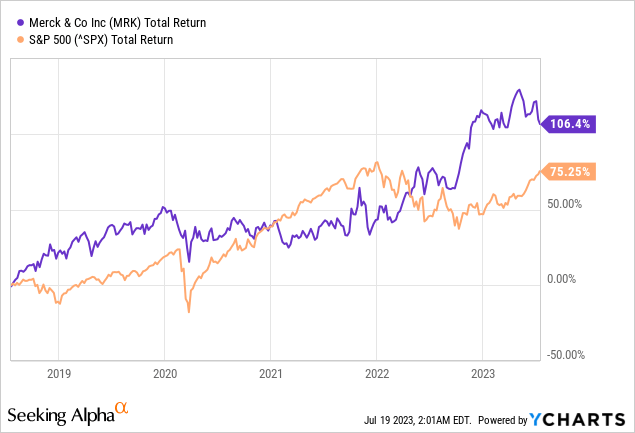

Over the past years, the company has consistently delivered superior total returns, easily outpacing the average S&P 500 as shown in the chart below. This substantial return on investment has primarily been driven by Keytruda, which generated $21 billion in sales in 2022, contributing a third of the company’s total revenue.

While Merck and similar pharmaceutical giants face upcoming patent expirations that might affect their lead drugs’ profitability, these companies are not unprepared for such challenges. Over the past years, Merck has actively prepared for Keytruda’s patent expiration in 2028, by not only bolstering its robust drug pipeline but also strategically acquiring promising therapies. For instance, the $10.8 billion purchase of Prometheus Biosciences showcases Merck’s aggressive investment in potential blockbuster therapies like PRA-023 (renamed as MK-7240), which has shown promising results in treating several autoimmune conditions.

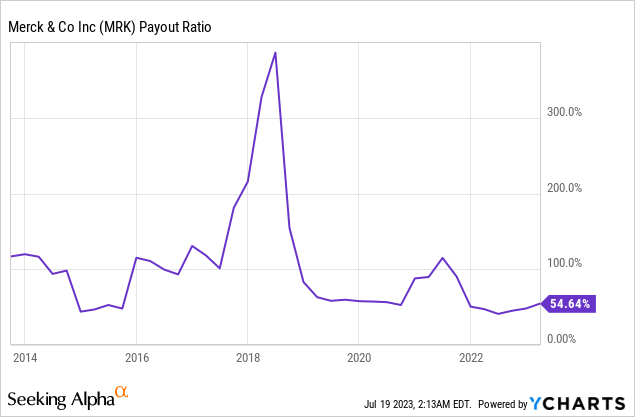

Additionally, Merck’s commitment to shareholder value is demonstrated by its consistent dividend payouts. The company has steadily increased its dividend for 12 consecutive years, with the current annual dividend of 2.72%. With a payout ratio of 54.64%, the likelihood of Merck continuing to raise its dividend is high, enhancing its appeal to long-term investors seeking stable income.

Despite the challenges brought by significant patent expirations and rising debates over drug pricing, pharmaceutical titans like Merck have proven their resilience and adaptability in past market cycles. Merck’s remarkable performance in the last bull market is evidence of its ability to effectively capitalize on biotech innovations, favorable reimbursement conditions, and a growing demand fueled by an aging global population.

Merck is a compelling investment proposition. Despite the looming challenges, I think the company’s proactive strategies, consistent dividend payouts, and robust pipeline make it a promising candidate for long-term investment. Currently, the recent decrease in stock price could indeed present a prime opportunity for investors to establish a stake in this healthcare behemoth, with an eye on achieving long-term profitability.

Unveiling the Long-Term Investment Opportunities with Merck

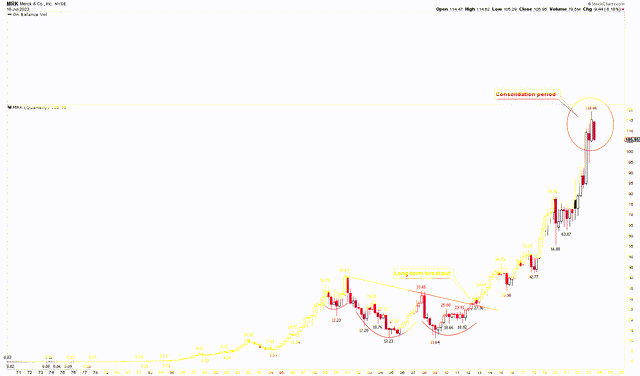

The technical forecast for Merck presents a persuasive image of ongoing bullish momentum, a narrative easily read in the company’s quarterly charts. In 2012, Merck underwent a transformative shift as it diverged from a dominant bullish trend, triggering a long-term surge that has, for a decade, defined its standing in the market. The price peaked at an all-time high of $118.86 before entering a period of consolidation that, despite creating an unfavorable pattern, could not halt the market’s overarching bullish trend. This pattern of resistance has prompted a market correction, triggering potential opportunities for long-term investments. Consequently, the market’s prevailing pulse remains firmly bullish, with each correction serving as an opportunity for investors eyeing long-term prospects.

Merck Quarterly Chart (StockCharts.com)

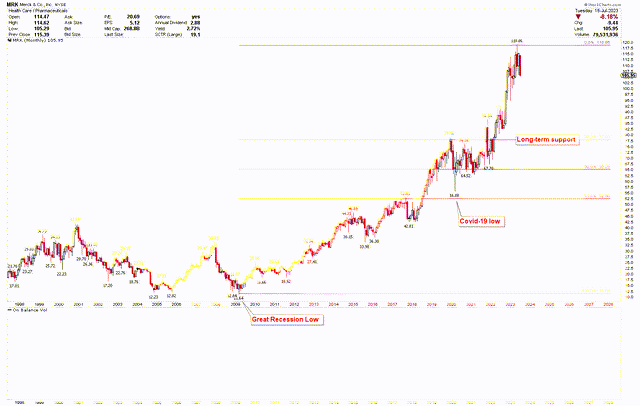

Understanding the market’s rhythms and potential opportunities requires a deep dive into its historical performance. The monthly chart below illustrates the Fibonacci retracement from the Great Recession’s low of $11.64 to the all-time high of $118.86. It quickly becomes apparent that the market has been on a persistent upward trajectory since the Great Recession. This resurgence can be attributed to a combination of strategic corporate maneuvers and the innate resilience of the pharmaceutical industry.

The pharmaceutical sector’s recession-resistant nature is rooted in the constant, often inelastic, demand for healthcare and medicines. During periods of economic uncertainty, the need for ongoing treatments and medication continues unabated. This consistent demand has ensured a level of stability in Merck’s revenue stream both during and in the aftermath of the Great Recession. Furthermore, Merck’s strategic decisions, such as the 2009 merger with Schering-Plough, significantly expanded its product portfolio and pipeline, helping diversify revenue sources, decrease reliance on any single drug, and mitigate risks.

Merck’s continuous focus on research and development has also been instrumental in its prolonged uptrend. The company’s dedication to innovation, evident in the continuous investments in its pipeline, has culminated in the approval and successful launch of several drugs, including its flagship drug Keytruda, contributing to robust sales growth. Additionally, Merck’s ability to manage operational costs effectively has been noteworthy. In the post-recession era, the company initiated several cost-cutting and restructuring programs that enhanced its operational efficiency and bolstered its financial position.

Merck Monthly Chart (StockCharts.com)

The above chart reflects the second-largest drop during the Covid-19 recession when prices hit a low at $56.08 before rallying back to $118.86. This recovery was largely driven by Merck’s diverse product portfolio and a robust pipeline of innovative drugs, ensuring a consistent revenue stream even amidst the pandemic chaos. While Merck wasn’t leading the COVID-19 vaccine race, it played a pivotal role in the global response to the pandemic. The company engaged in numerous partnerships to develop treatments and vaccines for COVID-19, enhancing investor confidence in the stock. For example, Merck partnered with Ridgeback Bio to develop molnupiravir, an oral antiviral treatment for COVID-19 – a significant move given the global demand for treatments and the paucity of oral antiviral options.

Merck’s continued strong bullish trend is undeniable. Nevertheless, a healthy long-term market invariably corrects lower. The recent consolidation at the resistance level signals a correction phase. It presents a lucrative consideration for long-term investors. The 38.2% Fibonacci retracement lies at $77.90, marking a robust support level. If the Fibonacci retracement from the Covid-19 recession low of $56.08 to the all-time highs is considered, short-term support levels sit at $94.86 and $87.45, representing the 38.20% and 50% Fibonacci retracements, respectively. Investors are encouraged to consider adding positions at these levels, accumulating more at $77.90 should the market offer an opportunity to hit this formidable support level.

Market Risk

The upcoming expiration of Keytruda’s patent in 2028 looms as a significant risk for Merck. This event will invite competition from biosimilar drugs, potentially striking a blow to Merck’s revenue and market share. This impact may be particularly severe if Merck cannot introduce new income-generating drugs in time. In tandem, ongoing global discussions about reducing drug prices pose a threat to Merck’s profit margins. If these discussions materialize into policy changes, the company could face reduced profitability due to decreased drug prices. In recent times, a degree of volatility is evident in Merck’s stock, pointing towards market instability. The pharmaceutical industry is also subject to wider economic influences, as witnessed during the Covid-19 recession.

Additionally, Merck is not exempt from the operational risks associated with global business. Factors such as regulatory modifications, geopolitical instabilities, and currency exchange rate fluctuations all contribute to the company’s risk profile. Merck operates under stringent regulatory scrutiny and any breaches in compliance can result in severe financial penalties and reputational damage.

From a technical standpoint, Merck’s stock remains in a solid uptrend. A breakthrough above $118.86 will likely spur a fresh upward rally. However, a downward slide below $94.86 would suggest market focus is shifting toward $77.90 as the primary support.

Bottom Line

Merck presents a compelling investment proposition for those looking toward long-term value creation. The company’s steadfast commitment to research and development, diverse portfolio of drugs, and robust pipeline for future releases affirm its resilient growth trajectory. Despite challenges such as patent expirations and price debates, Merck has exhibited adaptability and innovation that underpin its financial performance and market standing. The recent dip in stock prices may not reflect a lasting downturn but could signify an opportunity for investors to take a position in this healthcare titan. While Keytruda’s patent expiration in 2028 will undeniably pose challenges, the company’s proactiveness in preparing for this eventuality, paired with its strategic acquisitions and ongoing advancements in various clinical programs, indicates a preparedness that is likely to cushion any significant negative impact. The stock price is currently experiencing a downward adjustment, with key support levels identified at $94.86 and $87.45. Should the price drop below $87.45, it could signal a trajectory toward the major support level at $77.90. This presents an opportunity for investors to establish positions at these points with a view toward long-term appreciation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.