Summary:

- Merck demonstrates its dominant position with its bold move to acquire Prometheus Biosciences for nearly $11 billion, offering a premium of over 75% above RXDX’s Friday closing price.

- Merck faces a critical challenge in reducing its dependence on Keytruda, as the blockbuster drug contributed almost 40% of its revenue in FY22.

- MRK has outperformed its healthcare peers, as its rock-solid profitability and balance sheet encouraged investors to return. However, its valuation is looking steep now.

- Investors eager to increase their holdings in MRK stock should tread carefully, as its recent price action suggests that sellers may be poised to reduce their exposure.

Sundry Photography

Big news for Merck & Co., Inc. (NYSE:MRK) investors as the leading pharma giant announced a $10.8B deal (at about $200 per share) to acquire Prometheus Biosciences, Inc. (RXDX).

The deal is expected to be completed by Q3 of this year as Merck flexes its rock-solid balance sheet to de-risk its ex-Keytruda portfolio. Keytruda accounted for $21.94B in revenue for Merck in FY22, accounting for nearly 40% of its revenue base.

As such, the move helps to diversify its pipeline ahead of the loss of exclusivity or LOE for Keytruda in 2028. Therefore, the acquisition of Prometheus represents the company’s latest effort to shore up its immunology pipeline, estimated to account for just 3.4% (together with neuroscience) of its sum-of-the-parts or SOTP valuation.

The global immunology market is expected to be “worth more than $40 billion.” Accordingly, Merck’s immunology segment posted just over $1B in revenue in FY22, representing less than 2% of its FY22 revenue base.

Hence, there’s a significant opportunity for Merck to leverage to mitigate the valuation risks in its oncology portfolio (anchored by Keytruda), which is projected to account for 43% of its SOTP valuation.

Prometheus Biosciences is an interesting long-term bet, as the company is still at the clinical stage. It’s a specialist in “developing immune treatments for diseases such as ulcerative colitis or UC and Crohn’s disease.” Notably, it has a “lead pipeline drug in development” in PRA023.

PRA023 is understood to have significant potential for Merck, as Prometheus Biosciences has “plans to advance it into pivotal development in 2023, estimated to be a revenue source of $2 billion for UC alone.”

However, the deal price isn’t cheap. Merck’s $200 per share acquisition implies a premium of more than 75% over RXDX’s Friday (April 14) closing price of $114. We believe the acquisition will likely be priced in accordingly in pre-market trading later today (April 17).

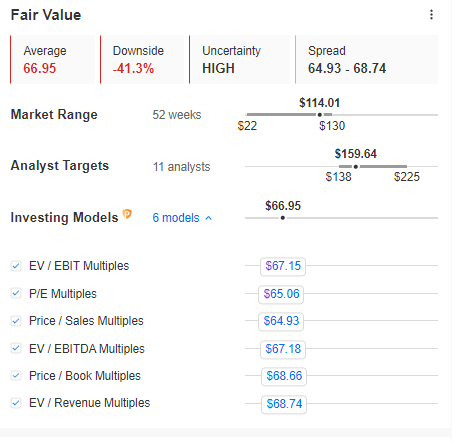

RXDX blended fair value estimate (InvestingPro)

Notwithstanding, Morningstar’s “extreme” fair value uncertainty suggests it’s challenging to model RXDX’s fair valuation. Furthermore, RXDX’s blended fair value estimate suggests a more than 40% implied downside from Friday’s closing price.

With Prometheus Biosciences not expected to turn adjusted EBITDA profitable until 2027, Merck likely sees it as a significant driver of long-term performance. As such, Merck investors will need to be patient as the company works on diversifying its oncology-heavy portfolio with a noteworthy push into immunology.

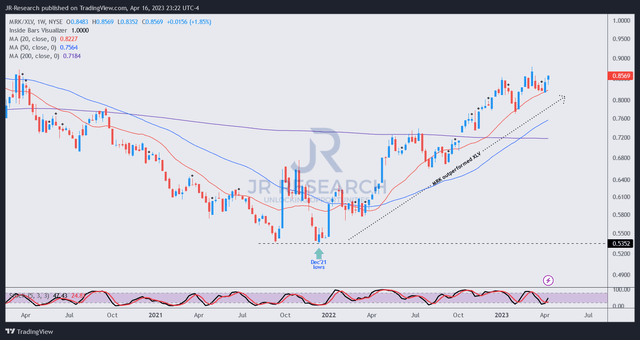

MRK/XLV price chart (weekly) (TradingView)

Despite that, MRK has outperformed its peers in the Health Care Select Sector SPDR ETF (XLV) since it bottomed out in December 2021.

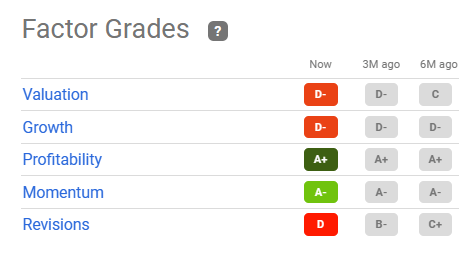

Quant factor ratings (Seeking Alpha)

Merck’s wide moat and diversified portfolio, coupled with industry-leading profitability (Seeking Alpha Quant rated it an A+), encouraged investors to return.

However, MRK’s valuation is no longer cheap, with a D- rating given by the Quant. Its next twelve months or NTM EBITDA multiple of 12.9x is also well above its 10Y average of 10.5x, surging into the two standard deviation zone over its 10Y mean.

Moreover, we gleaned that MRK’s price action suggests a potential bull trap, or false upside breakout, which could encourage sellers who picked its December lows to cut exposure.

Takeaway

Merck’s deal value for RXDX isn’t cheap for a company still in the clinical stage and not expected to turn profitable on adjusted EBITDA terms until 2027.

However, the company likely sees a long-term opportunity to expand its significantly smaller immunology portfolio with Prometheus Biosciences’ potential breakthroughs.

However, MRK’s valuation is no longer cheap. Despite that, the deal value of about $11B represents a mere 3.7% of its market cap, which shouldn’t spook investors about near-term execution risks.

We believe MRK’s unattractive valuation suggests that investors buying up the optimism isn’t encouraged, and buyers should be patient in waiting for a deeper pullback.

Rating: Hold (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!