Summary:

- Merck & Co will announce Q2 2024 earnings on July 30th.

- Merck’s share price has risen 65% in the past 3 years, driven by the success of Keytruda, the world’s best-selling drug.

- Keytruda revenues were up 25% year-on-year in Q1 2024, contributing nearly 45% of Merck’s total revenues last quarter.

- There is a patent expiry on the horizon in 2028, however, and potentially for the vaccine Gardasil also – Merck’s second-biggest selling asset.

- Merck is guiding for >$63bn revenues in 2024, and there is nothing wrong with that – or its bottom line. It may be early; however, I am seeking some clarity on what a post Keytruda LOE environment might look like.

We Are

Investment Overview

Merck & Co. (NYSE:MRK), the New Jersey based pharmaceutical giant, will announce its Q2 2024 earnings next Tuesday, 30th July. Yesterday, the company declared a $0.77 per share quarterly dividend, representing an annual yield of 2.48%.

After reaching highs of ~$90 per share in 2000 / 2001, Merck’s share price took another 20 years before hitting such heights again, but the past three years have seen shareholders rewarded with exceptional gains. On a 3-year basis, shares have risen in value by 65% – among US and European Pharmas, only Regeneron (REGN), Vertex (VRTX), Novo Nordisk (NVO) and Lilly have posted stronger gains.

In the case of Novo and Lilly, gains have been underpinned by their weight loss / diabetes drugs semaglutide and tirzepatide, better known as Ozempic and Mounjaro in the diabetes indication, and Zepbound and Wegovy in the Obesity indication. These drugs are expected to dominate market share in an industry estimated by Goldman Sachs (GS) analysts to grow in size to ~$130bn by 2030, and become all-time best-sellers.

Readers may be aware that presently, Merck markets and sells the world’s best-selling drug, Keytruda, indicated for a range of solid and hematological cancers. The drug earned revenues of >$25bn in 2023, and $6.95bn in Q1 2024, accounting for nearly 45% of Merck’s total revenues last quarter.

In Q1 2024, Keytruda revenues were up 25% year-on-year (they were also up 24% year-on-year in Q1 2023, and 27% in Q1 2022), thanks primarily to new approvals in earlier stage non-small lung cancer (“NSCLC”), and urothelial cancer.

Across Merck’s divisions as a whole, oncology revenues grew 20% year-on-year, to $7.65bn, Vaccines grew 11%, to $3.3bn, Cardiovascular by 6%, to $168m, Hospital Acute Care by 1%, to $799m, and Animal Health by 1%, to $1.51bn. The Immunology division saw revenues fall by -3%, to $223m, Virology fell by -6%, to $559m, and Diabetes fell by 24%, to $670m.

Overall, revenues grew 9% year-on-year, to $15.8bn, operating expenses fell by 6%, to $6.5bn, and GAAP earnings per share (“EPS”) grew by 68%, to $1.87, and by 48% on a non-GAAP basis, to $2.07. Announcing Q1 results on April 25th, Merck also upped its 2024 guidance, to $63.1bn – $64.3bn, and non-GAAP EPS to $8.53 – $8.56, implying a forward price to earnings ratio of ~14.5x.

It would be fair to say that since AbbVie’s (ABBV) former global best-selling drug, the immunology drug Humira, lost its patent protection in the US in 2023, today, no global Pharma is as reliant for revenue on a single drug than Merck is on Keytruda, and like AbbVie / Humira, Merck has a potential patent expiry issue.

Keytruda’s patent protection in the US is set to expire in 2028 – that may be three and a half years away, but given the importance of the drug to Merck, developing a strategy to offset any lost revenues when the patent expires and generic versions of the drug flood the marketplace is management’s number one priority, just as it was for AbbVie, who were able to develop two new immunology drugs, Skyrizi and Rinvoq, which it believes will drive combined revenues higher than Humira at its peak.

Merck does not yet have any drug candidates in the mold of Skyrizi / Rinvoq; however, it does have initiatives in place. Firstly, the company has developed a pipeline of clinical stage oncology drugs teeming with potential, which it hopes will add ~$20bn in total revenues by the middle of next decade. Secondly, Merck is working on a subcutaneously injected version of Keytruda – currently administered intravenously, that would not only be more convenient for patients, but has the potential to extend the drug’s patent protection for many more years.

Merck is a vast company – its market cap valuation of ~$315bn (at the time of writing) makes it the world’s fourth largest “Big Pharma” concern, behind only Johnson & Johnson (JNJ), Novo Nordisk (NVO) and Eli Lilly (LLY), however, the importance of Keytruda to its business is such that, going forward, almost every quarterly earnings review is likely to become a referendum on how the company will cope before, during, and after, the dreaded patent expiration.

Merck Q2 Earnings Preview – Expectations and Updates

In Q2, analyst consensus is that Merck will report revenues of ~$15.84bn, normalized EPS of $2.14, and GAAP EPS of $1.93. There is potentially good news for shareholders here in that in 2023, Q1 revenues came to $14.49bn, and Q2 revenues $15.04bn. If revenues rise this year as they did last, then Merck ought to beat on the top line.

As far as EPS is concerned, a one-off charge last year related to Merck’s $10.8bn acquisition of Prometheus Biosciences saw the company report EPS of $(2.35) in Q2 2023, but the rising revenue contribution from Keytruda and last quarter’s substantial year-on-year uplift also suggests to me the Pharma can outperform Wall Street’s expectations, which ought to be good for the share price. Last quarter, shares rose from ~$126, to ~$131 after earnings were reported – a 4% jump.

By The Divisions – Oncology – Keytruda’s Dominance

If we go by the divisions, the obvious place to start is in oncology. Merck only markets and sells one other cancer drug exclusively besides Keytruda – Welireg, whose sales doubled year-on-year last quarter, rising to $85m, thanks to an additional approval in certain types of kidney cancer.

The drug is under regulatory review in the EU for both of its approved indications in the US – von hippel syndrome and renal cell carcinoma – so I would expect a positive quarter on quarter growth story, plus an update on pending approval in the EU during the Q2 earnings call.

Merck does not provide product level guidance, so it’s harder to predict exactly what its revenue number will be in Q2, but I would speculate Keytruda’s will be >$7bn, and its revenues as a percentage of total revenues to potentially climb >45%.

Management has begun to push Keytruda more towards earlier stage cancer treatment, and Keytruda is – according to a Merck presentation given at this year’s ASCO conference – the only immuno-oncology drug to have shown “significant overall survival benefit” in four separate early stage studies and indications (lung, renal, breast, cervical), and to receive 9 separate approvals in different early stage indications.

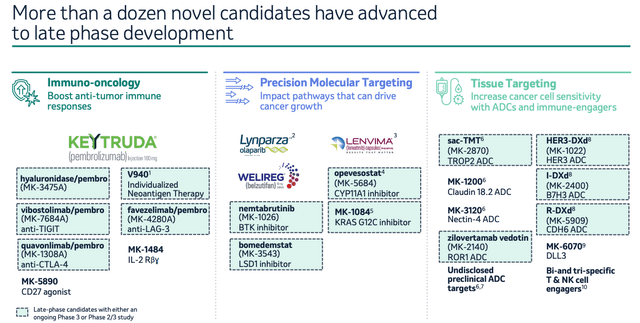

Keytruda works well both as a monotherapy and in combo, and Merck has advanced multiple pipeline candidates into late stage clinical studies alongside Keytruda, as we can see below, and several more candidates that may potentially partner with Lenvima and Lynparza, drugs for which Merck receives alliance revenues (of $255m and $292m respectively in Q1, up 10% and 6% year-on-year), and Welireg.

Merck – late stage oncology pipeline (ASCO presentation)

As we can see above, Merck is leveraging many of the most hotly anticipated / currently successful drug classes in oncology, such as anti-CTLA4, anti-TIGIT, and even a cancer “vaccine” being developed alongside the messenger-RNA giant Moderna (MRNA) (which has cut the risk of death or relapse by >40% in melanoma patients in studies), and I would expect to hear updates on many, if not all of these late-stage programs during the Q2 earnings call.

Remember, Merck has pledged >$20bn in additional oncology revenues by the middle of next decade, with these candidates likely to be amongst the main revenue drivers. The antibody drug conjugate (“ADC”) program updates ought to be especially interesting – Merck has entered a partnership with Japanese Pharma Daiichi Sankyo worth $5.5bn upfront, and potentially as much as $22bn if all candidates make it to market. The competition is fierce in this space, with the likes of AstraZeneca (AZN), Pfizer (PFE) – via its $43bn acquisition of Seagen – and AbbVie all desperate to out-do one another.

Finally, we ought to hear more updates on the progress of Keytruda subQ – on the Q1 2024 earnings call, Merck’s CEO Rob Davis fielded a question on subQ and its potential impact, and replied as follows:

if you look at then the size of the patient population where it could be, just to give you a sense, by 2028, if we look at the patients who are on monotherapy with KEYTRUDA, who are using combinations with orals and those who are moving into earlier stages of disease through some of our adjuvant and new adjuvant areas with KEYTRUDA, that represents about 50% of the patient population at that time. So that is really the addressable market for what we see the subcu offering to be.

That seems to suggest that up to 50% of Keytruda revenues could be preserved post patent expiry if fresh patents are granted for the SubQ version of Keytruda, and pending successful studies. Key study data has been promised for 2025, but it’s possible management will have more to add next week.

By The Divisions – Vaccines, Virology, Diabetes – & The Rest

After Keytruda, Merck’s most important asset is its Gardasil vaccine, indicated for cervical cancer and other human papillomavirus vaccine-related disease, which drove $8.9bn of revenues in 2023, and $2.25bn last quarter. Proquad, a vaccine against measles / mumps / rubella / varicella, drove $2.4bn of revenues in 2023, and both Gardasil and Proquad saw revenues rise – by 14% and 8% respectively – last quarter.

As such, I’d expect to see a positive year-on-year comparison in Q2 also, offsetting losses from declines in sales of Pneumovax, and Rotateq. Recently, the approval of a vaxneuvance successor, Capvaxive, indicated for pneumoccal viruses, may allow Merck to challenge Pfizer’s >$6bn per annum Prevnar franchise. Therefore, I’d listen closely for updates on this front.

Another recently approved asset is Winrevair, Merck’s therapy to treat Pulmonary Arterial Hypertension (“PAH”), which was approved by the FDA in March. Merck paid $11.5bn to acquire Acceleron, which developed the drug, in 2021, and, with a list price of ~$240k, Winrevair is expected to generate >$2bn in peak annual revenues.

This is a competitive market, in which Johnson & Johnson and United Therapeutics (UTHR) are dominant (although Merck markets and sells hypertension drug Adempas, so knows the market). We may not learn much from Q2 revenues, it being only 3 months since approval, but management’s discussion of market dynamics may be intriguing.

Merck’s immunology division, consisting of two drugs, simponi and remicade, is somewhat stagnant revenues-wise, with Remicade sales down 24% in Q1, and a total contribution of <$250m, however late stage pipeline asset MK-7240 is in Phase 3 studies in Crohn’s Disease and Ulcerative Colitis, and could provide fresh impetus – I’d expect an update from management on this drug, which targets the Tl1A protein, and whose Phase 2 data mark it out as potentially best-in-class in two multi-billion dollar indications.

Merck’s worst performing division is diabetes, where patent expired drugs Januvia and Janumet earned $670m revenues in Q1, down 24% year-on-year. Clearly, the advent of the GLP-1 agonist class of drugs – of which Lilly’s tirzepatidee and Novo’s semaglutide are members – has completely transformed the diabetes space, but Merck may have a candidate of its own capable of challenging their supremacy.

Efinopegdutide is currently in Phase 2 studies, but the target is non-alcoholic steatohepatitis (“NASH”), as opposed to diabetes – at this stage at least. Merck’s is an oral therapy, potentially handing it a competitive advantage over Lilly and Novo’s injectable drugs, and according to Dean Li, Merck’s President of research, has demonstrated “significant reduction in liver fat and also gives a weight loss of 10% to 12%”.

If there is one sure-fire way for Merck to reward shareholders beyond their wildest dreams, as Lilly and Novo have done over a 5-year period (up 700% and >400% respectively) it would be to deliver a best-in-class, oral weight loss drug. It may take years of more studies to determine if Efinopegdutide could be that drug, but at the very least, it is worth paying attention to any updates management may share next week.

Concluding Thoughts Ahead Of Q2 Earnings – Is MRK Stock A “Buy”, “Sell”, or “Hold”?

In my last note on Merck for Seeking Alpha, previewing Q1 earnings, I gave Merck stock a “Buy” recommendation, suggesting there was “not much to fear, plenty to look forward to”.

Since my note, the share price has barely budged, and as such, ahead of Q2 earnings, I am inclined to downgrade my rating on Merck stock from “Buy”, to “Hold”.

That does not mean I am worried about underperformance when Q2 earnings are announced next week – quite the contrary, I am expecting a slight beat against analysts’ expectations, as discussed above.

With that said, I would stress the word “slight”. Merck’s long term goal is to drive growth at a mid-single digit percentage, targeting a figure of >$70bn per annum before Keytruda’s patent expiry in 2028, which is impressive, but primarily driven by Keytruda – Merck’s greatest strength.

As we approach the patent cliff, however, Merck’s greatest strength will also become its Achilles heel, and the market will require constant reassurance around the new oncology pipeline, and the progress of Keytruda subQ.

Today, Merck’s forward price to sales ratio is ~5x, which is about average for the Big Pharma sector, while its price to earnings ratio is ~15x, which is a little lower than average, without being compelling.

With each passing quarter, my suspicion is, as mentioned above, the market’s focus will increasingly turn to 2028, and we may also note that Gardasil patents may expire in 2028 also.

Merck has a portfolio of >40 drug products, and while there are some outstanding assets among them, there is also some dead wood that needs to be cleared, and >40 pipeline candidates whose success or otherwise is uncertain.

As such, at this time, if I were holding Merck stock, I doubt I’d be selling, but neither do I see this as an optimal time to be buying shares. It is not that there are no exciting catalysts in play – there are plenty, many discussed in this note, but after Merck stock leapt from ~$100 per share, to >$130 per share earlier this year, I don’t see compelling reasons why further gains would be forthcoming, even on a strong set of earnings.

I suspect that strong, mid-single digit growth and an increase in profit margins is already baked into Merck’s share price at this time, while the referendum on Keytruda is just beginning. Personally, I am on the sidelines until there is more clarity about what the implications of Keytruda’s loss of market exclusivity may be.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.