Summary:

- Merck & Co., Inc.’s Q3 earnings report is anticipated on 31st October — next Thursday.

- Despite strong Q2 performance, Merck’s stock fell due to a guidance downgrade related to issues with key drugs Gardasil and Winrevair.

- Merck’s diversified pipeline includes promising oncology candidates and a new pneumococcal vaccine, but lacks a ready-made Keytruda replacement.

- Investors should monitor R&D updates closely, as Merck’s future hinges on new drug developments amid looming patent expirations.

- Keytruda is now under threat not only from patent expiries but also from new drug candidate ivonescimab, the first to outperform it in a Phase 3 study. It shouldn’t be forgotten that >$9bn p.a. selling Gardasil also loses patent protection in 2028.

Radachynskyi/iStock via Getty Images

Investment Overview

Merck & Co., Inc. (NYSE:MRK) will report its Q3 earnings next Thursday, 31st October. I covered the company shortly before Q2 earnings, assigning the stock a “Hold” rating. My reasoning was fairly straightforward – after surging from $100 per share, in November 2023, to $130 per share, shortly before earnings were set to be announced, I didn’t see compelling reasons for Merck’s valuation to grow much higher, writing:

Today, Merck’s forward price to sales ratio is ~5x, which is about average for the Big Pharma sector, while its price to earnings ratio is ~15x, which is a little lower than average, without being compelling.

I suspect that strong, mid-single digit growth and an increase in profit margins is already baked into Merck’s share price at this time, while the referendum on Keytruda is just beginning. Personally, I am on the sidelines until there is more clarity about what the implications of Keytruda’s loss of market exclusivity may be.

Keytruda is the jewel in Merck’s crown, being its >$25bn selling (in 2023) cancer immunotherapy, which accounts for ~45% of Merck’s total revenues. The programmed death (“PD-1”) pathway inhibitor is approved for multiple types of cancer, mainly solid tumor, and is typically viewed as a “best-in-class” treatment option in most of its indications.

Keytruda’s patents are due to expire in 2028, however, at which point generic versions of the drug will be permitted to enter the market, which will undercut Keytruda on price and reduce its sales volumes – revenues will likely begin to decrease by 25-35% per annum.

As such, I also concluded in my last note that:

the importance of Keytruda to Merck’s business is such that, going forward, almost every quarterly earnings review is likely to become a referendum on how the company will cope before, during, and after, the dreaded patent expiration.

Just for good measure, Merck’s second best-selling asset, the HPV vaccine Gardasil – >$8.9bn of revenues in 2023 – is also set to lose its patent protections in 2028. That is ~$35bn, or 60% of Merck revenues at risk of being eroded at >25% per annum after 2027.

Q2 Earnings Overview: A Beat, But A Bad Market Reaction

In Q2, Merck outperformed analysts expectations on earnings per share (“EPS”) – GAAP and non-GAAP – and on revenues – which were $16.1bn for the quarter, with GAAP EPS of $2.14, and non-GAAP EPS of $2.28.

The company also guided for full-year 2024 revenues of $63.4bn – $64.4bn, and EPS of $7.94 – $8.04. This translates to a forward price to sales (“P/S”) ratio – at current share price of $105 per share, and market cap valuation of $267bn – of ~4.2x, and a forward price to earnings (“P/E”) ratio of ~13x.

The ratios look more compelling today than they did back in July for one primary reason: post Merck’s Q2 earnings, the market sold off Merck stock, which fell in value by nearly 10% overnight.

The above guidance was downgraded from Q1, when management advised FY EPS of $8.53 – $8.65. This was put down to the company’s acquisition of the eye disease drug developer EyeBio, for $1.3 billion in cash and, potentially, a further potential $1.7 billion in developmental, regulatory and commercial milestone payments.

Other issues that affected performance were a slowdown of Gardasil sales in China, and a slightly underwhelming post launch revenue figure of $70m for pulmonary arterial hypertension drug Winrevair, which Merck has suggested could be a ~$6bn peak revenue drug. Winrevair has since secured approval in the EU.

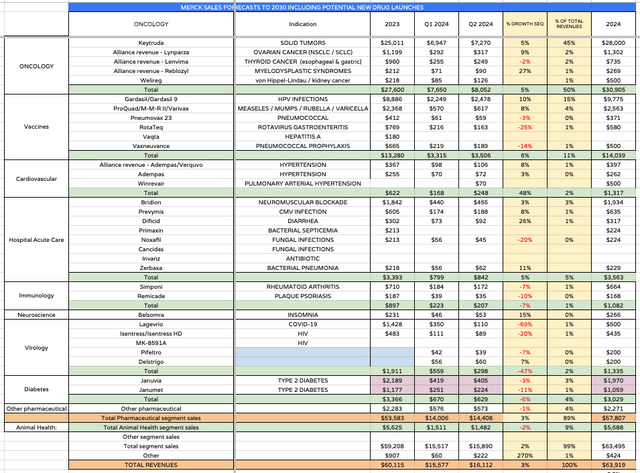

Merck markets and sells numerous drugs. I have provided an overview below, breaking down revenues in 2023, Q1 and Q2 2024, and an estimated final year revenue figure, also showing sequential growth as a percentage, and the percentage of total revenues each product accounts for.

Merck product revenues (my table using data from Merck)

We might conclude that Merck actually delivered a fairly impressive performance in Q2, with key divisions such as Oncology, Vaccines, Cardiovascular, and Hospital Acute Care all showing good sequential growth. This is despite Virology division revenues falling due to the absence of COVID-19 therapy revenues, and Diabetes division revenues also falling owing to the patent expirations of Januvia and Janumet. Animal Health revenues also fell by ~2%.

Despite the approval of Winrevair in Europe, however, and multiple new approvals for Keytruda in various combinations with either cancer drugs (and some study failures in the same field, it should be acknowledged), shares have not picked up any value in the past few months. In fact, they have fallen in value – and once again, the reasons for this is likely Keytruda related.

A New Keytruda Threat Emerging?

In early September, the share price of a small biotech named Summit Therapeutics (SMMT) went supernova. It rose from $12, to $31 per share, after its Chinese partner, Akeso Therapeutics, became the first company to produce a drug that outperformed Keytruda in a Phase 3 clinical trial.

The drug’s name is ivonescimab, and according to Summit it is:

a novel, potential first-in-class bispecific antibody intending to combine the effects of immunotherapy via a blockade of PD-1 with the anti-angiogenesis effects of an anti-VEGF compound into a single molecule.

Akeso shared data from its study, which indicated that ivonescimab “reduced the risk of disease progression or death by 49% compared to pembrolizumab monotherapy.” Ivonescimab also achieved a median progression free survival (“PFS”) of 11.14 months versus 5.82 months for Keytruda, with a comparable safety profile. The drug also outperformed pembrolizumab (the underlying ingredient in Keytruda) in terms of objective response rate (“ORR”) and disease control rate (“DCR”) as well.

Essentially, Summit, led by the biotech entrepreneur Robert Duggan – whose former company Pharmacyclics developed Imbruvica, a >$10bn per annum peak selling leukemia drug – will attempt to bring ivonescimab to market in the US, and market it as Keytruda 2.0. It appears as effective at PD-1 blocking as Merck’s drug, with the added benefit of VEGF inhibition.

Naturally, it’s early days for Summit and ivonescimab, but it is probably no coincidence that Merck stock has slipped from nearly $120 per share, to $105 since Akeso’s data was released.

During a fireside chat at a recent Bank of America healthcare conference, Merck’s President of Human Health International, Joseph Romanelli, discussed ivonescimab and the ground-breaking data as follows:

I would say, encouraging for them to then start a Phase III study. We’ll see what happens. Typically, our experience in anti-PD-1, combined with an anti-VEGF, generally, they are disparities between regions. And we’ve seen that with anti-VEGF, certainly, it seems to work better in East Asian population.

I mean this is one country. It was in China where they had the study. Again, can you replicate that study internationally, do multinational clinical studies, do the Phase III. And what’s important, particularly for payers for where we are in the world right now is you need overall survival. And so, making sure that you set up the studies, do you prove overall survival.

The other issue is KEYNOTE-189, our combination of KEYTRUDA and chemo, creates a very high bar. And I know that in this particular study it was just KEYTRUDA. So KEYNOTE-189, whether it’s for them, so anyone that’s trying to develop combinations of bispecific or if it’s us using KEYTRUDA with one of the ADCs that we partnered with, whether it’s Kulun or Daiichi Sankyo. And we’re very excited about our entire portfolio ex KEYTRUDA.

On the one hand, it’s pretty clear that Keytruda revenues will not be blown off course by ivonescimab in the short term, while ivonescimab still has so much to prove, especially in the US. On the other hand, we might speculate that one way or the other, whether it’s through generics, or ivonescimab, or another drug, the Keytruda era is approaching the beginning of the end of its natural conclusion.

It is only the beginning of the end because it should be noted that Merck is working on a subcutaneously administered version of Keytruda. If successful, it could provide many more years of patent protection, but likely, only in ~50% of Keytruda’s current markets.

What Should We Expect In Q3?

Analyst’s consensus is that Merck will achieve normalized EPS of $1.58 in Q3, GAAP EPS of $1.48, and revenues of $16.49bn. I doubt Merck will fail to meet that mark. However, I also doubt the company will confound expectations with a strong quarter. It may take time to bring Winrevair up to speed commercially, and the issues affecting Gardasil may not yet be fully resolved.

I would not be surprised if Keytruda revenue surpasses expectations again, however. It remains the most successful cancer drug on the market by a long way, and will remain so for at least two-or three more years, likely breaking past $30bn revenues per annum. We should also note the recent approval of Capvaxie, a pneumoccocal vaccine expected to drive >$1bn in peak revenues.

Merck is certainly not ignoring the upcoming patent expirations of Keytruda or Gardasil, and is developing a host of intriguing pipeline candidates, and I’d expect there to be plenty of updates shared when earnings are released next week.

By my count, Merck has ten mid-to-late stage oncology candidates in development. Some are leveraging Merck’s partnership with Daiichi Sankyo to develop antibody drug conjugates (“ADCs”), a pioneering new type of dual action therapy (two candidates to date – ifinatamab deruxtecan (I-DXd) and patritumab deruxtecan – have delivered promising data in lung cancer).

There is also a promising late-stage RSV vaccine candidate, cardiovascular drug MK5475, and four immunology drugs (targeting hypercholesterolemia, inflammatory bowel disease, and ulcerative colitis – multi-billion dollar markets).

Strangely, Keytruda is the only cancer drug the company fully owns and markets and sells. However, expect that to change in the coming years. Merck and Daiichi’s partnership involved an initial $4bn payment from Merck, but that could rise to >$23bn based on how many candidates are developed and approved, and their commercial success. We might also note Merck has acquired another biotech, Modifi Biosciences, spun out from Yale University, and specializing in DNA repair proteins known as O6-methylguanine methyl transferase, or MGMT.

Final Thoughts: Merck Rarely Underperforms Expectations, But Hard To Ignore Gardasil / Keytruda Issues

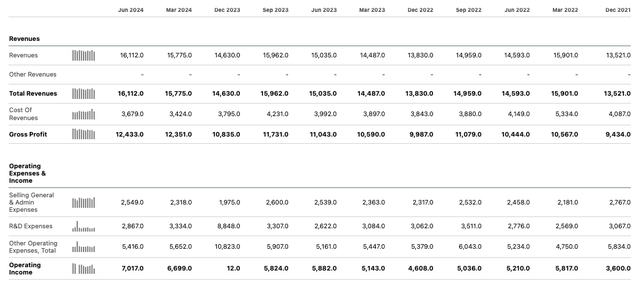

Merck quarterly income statements (Seeking Alpha)

As we can see above, Merck’s quarterly performance is generally solid, and while revenue growth has not been explosive in the past couple of years, profitability in 2024 to date has been exceptional.

Merck shareholders – in my view – are entitled to shrug their shoulders at recent share price losses and ask what the problem is? The company has the world’s best-selling drug, with three more years – at least – of >$30bn per annum revenues (I suspect this figure may be reached in 2024). It is the second or third-highest revenues of any Pharma company globally, a dividend that yields nearly 3% per annum, a share price up >30% on a five-year basis, and current assets of ~$38bn (as of Q2), against long-term debt of ~$35bn (low by Big Pharma standards).

What exactly is the issue? It is a fair argument, but investors chasing near-term value may not find Merck stock especially compelling now. I wrote in Q2 that Keytruda – despite being a miraculous drug and an incredible source of revenues that may well still be earning >$15bn per annum in 2035 – will be a headache for Keytruda’s investor relations team because the questions around loss of exclusivity and new competitive threats will keep coming.

Unlike AbbVie (ABBV), another Pharma giant who once marketed and sold the world’s best-selling drug, Humira, and developed two ready-made replacements in Skyrizi and Rinvoq before Humira even lost US patent protection, Merck does not have a ready-made replacement for Keytruda (although Summit Therapeutics may have one). The challenge of developing four or five highly successful cancer drugs to offset revenues from a single asset will not be easy.

As such, while Merck shareholders may feel they can afford to sit tight and ride out the Keytruda / Gardasil patent storm, they may also be wise – along with anybody searching for short-term value or a decent entry point to open a position in Merck stock – to pay close attention to the R&D updates during the Q3 earnings call. These are arguably more important than the financials, which will take care of themselves, so long as Keytruda is patent protected.

Merck’s new era will begin when Keytruda revenues begin falling – it isn’t here yet, but it may not be too far away, and the company is arguably less well-prepared for this era than it might be. For example, the company may do well to attempt to enter the weight loss market, and develop a GLP-1 agonist to rival the likes of Eli Lilly’s (LLY) tirzepatide or Novo Nordisk’s (NVO) semaglutide.

These drugs will become the world’s new best-selling drugs before the end of the decade, and Merck does not have candidates of note in this field. As such, if I were holding Merck stock, I may be ever so slightly tempted to switch my holding into a comparable Pharma that does have such a candidate – there are a few to choose from.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio, or simply access the investment bank-grade financial models and research. I hope to see you there.