Summary:

- Merck has demonstrated resilience in the current macroeconomic environment.

- MRK has a strong portfolio of drugs, and Keytruda keeps expanding its use cases.

- I also highlight the dividend, valuation, and give my take on the stock.

Sundry Photography

Pharmaceutical companies have proven to be a great hedge against inflation, as they are one of the few asset classes to post gains this year amidst this seemingly unending bear market. As such, this segment is ideal for those who want to deploy capital and want to mitigate volatility, while earning some extra dividend income to boot. This brings me to Merck (NYSE:MRK), which has done well for investors this year. This article highlights whether if Merck is currently a buy or hold, so let’s get started.

Why MRK?

Merck is a global pharmaceutical companies, with a moat-worthy portfolio of specialty drugs in the fields of oncology, cardiometabolic disease and infections. MRK also has a substantial vaccine business that treats Shingles, HPV, Hepatitis B, and pediatric diseases. The company has stood the test of time, having been around for over 130 years. It generated $57 billion in total revenue over the trailing 12 months, about half of which came from the U.S. and the rest internationally.

Unlike some pharmaceutical companies that are heavily reliant on one or two blockbuster drugs, Merck’s strong portfolio of high margin drugs in existence and its pipeline helps to ensure high profitability and returns on invested capital for many years to come. This is especially considering its spin-off of Organon (OGN) back in summer of last year, with Merck retaining a stable of drugs with strong protection of patents.

This has enabled Merck to deliver impressive 28% sales growth during the second quarter (18% excluding LAGEVRIO, Merck’s COVID-19 antiviral drug). This was driven in large part by Keytruda, whose sales grew by 30% YoY. Keytruda continues to show plenty of promise, as it’s seeing accelerating momentum in metastatic indications as well as increased uptake in earlier-stage cancers.

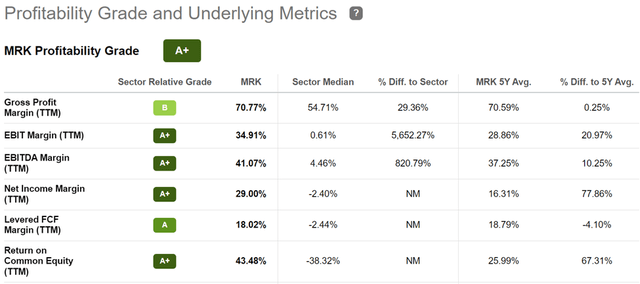

Moreover, Keytruda has use cases beyond just lung cancer, as it was recently approved for 6 more indications. As shown below, Merck maintains industry leading profitability, with a 41% EBITDA margin and a 29% net income margin. Plus, MRK has been a serial repurchaser of its shares, resulting in a very high 43.5% return on common equity.

MRK Profitability (Seeking Alpha)

Risks to Merck include drug pricing caps as a result of negotiations with Medicare. However, two Republicans introduced legislation this week aiming to roll back this provision in the Inflation Reduction Act, arguing that the provision is a form of price control and say that it will worsen problems by leading to fewer new drugs approved. Given the complexities around drug development, I believe the future will be a more nuanced approach rather than strict drug price controls that may stifle innovation.

Looking forward, MRK shows plenty of promise as it maintains an A+ rated balance sheet, giving it the financial wherewithal to fund the high cost of drug development. Plus, one often overlooked strength of large drug companies such as MRK is their vast store of knowledge from which they can draw upon to develop new drugs. This was highlighted by Morningstar in its recent analyst report:

The company’s enormous cash flows support a powerful salesforce that not only sells currently marketed drugs, but also serves as a deterrent for developing drug companies seeking to launch competing products. As a result, Merck offers a powerful partnership opportunity for externally developed drugs.

Merck’s research laboratories still hold a vast database of knowledge that should help the company to maintain its leadership positions in drug discovery and development. Also, the company’s entrenchment in the emerging immuno-oncology area should strengthen Merck’s competitive position with drugs that carry very strong pricing power in areas of unmet medical need.

Merck’s strong entrenchment in vaccines adds a layer of competitive protection from intellectual property and cost advantages, as the company’s large-scale production enables a lower cost base, which can be more important in the vaccine market.

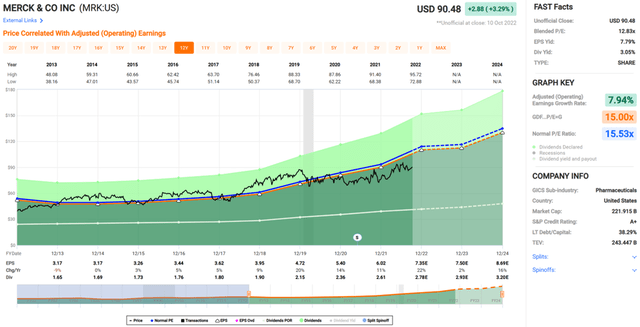

Importantly, MRK sports a respectable 3.1% dividend yield that’s well supported by a low 35% payout ratio. It comes with a 9% 5-year CAGR and 11 years of consecutive growth. Lastly, MRK remains attractively valued at the current price of $90 with a forward PE of 12.3, with analysts expecting annual EPS growth in that average in the low teens over the next few years. As shown below, MRK trades comfortably below its normal PE of 15.5 over the past decade.

MRK Valuation (FAST Graphs)

Investor Takeaway

Both Merck’s stock and underlying business have proven to be rather resilient to macroeconomic headwinds, with fundamentals that are firing on all cylinders. The company has one of the strongest balance sheets in the business, which gives it the financial flexibility to invest in R&D and continue growing its dividend at a solid pace. It also derives a strong moat from its economies of scale, entrenched salesforce, and vast database of proprietary knowledge. Lastly, Merck yields over 3% and remains attractively valued for income and growth investors alike.

Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.