Summary:

- Merck remains undervalued with a strong set of growing drugs and new indications in its pipeline.

- Keytruda has been a major revenue driver for MRK, with continued sales growth and potential for extended patent protection through a subcutaneous version.

- It pays a well-covered dividend based on next year’s expected EPS and has a strong balance sheet even after making a multi-billion dollar collaboration payment.

JuSun

It’s almost the end of the year, and is a good time to re-evaluate one’s portfolio in terms of potential winners and losers next year. With the market chasing growth stocks to nosebleed valuations, I believe better opportunities can be found to similar moat-worthy enterprises that are trading at far more reasonable valuations with a dividend kicker.

This brings me to Merck (NYSE:MRK), which I last covered here in October of last year, noting the expansion of its highly profitable Keytruda drug and the stock’s undervaluation. MRK has performed admirably since then, giving investors a 23% total return over the past 14 months, but underperforming the dramatic 32% rise in the S&P 500 (SPY).

In this article, I revisit the stock and discuss why MRK remains undervalued and is a sensible choice for potentially strong returns amidst a frothy market.

Why MRK?

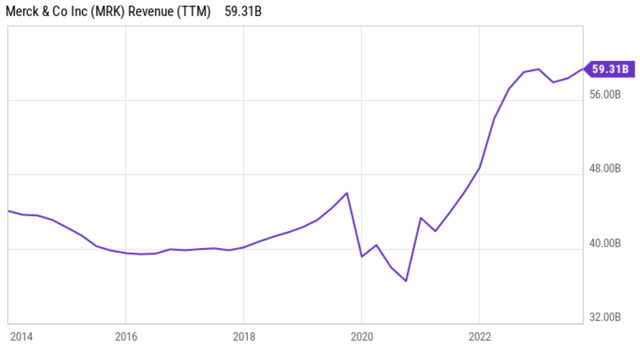

Merck is a leading pharmaceutical company with over 130 years of experience in developing medicines and vaccines. Like most other companies in its space, it’s gone through a series of transformation over its history, and is now an aspiring biopharmaceutical company with innovative drugs such as its blockbuster immune-oncology drug, Keytruda. This drug has greatly helped to propel MRK’s revenues upward in recent years, from around $40 billion annually to $59.3 billion over the trailing 12 months, as shown below.

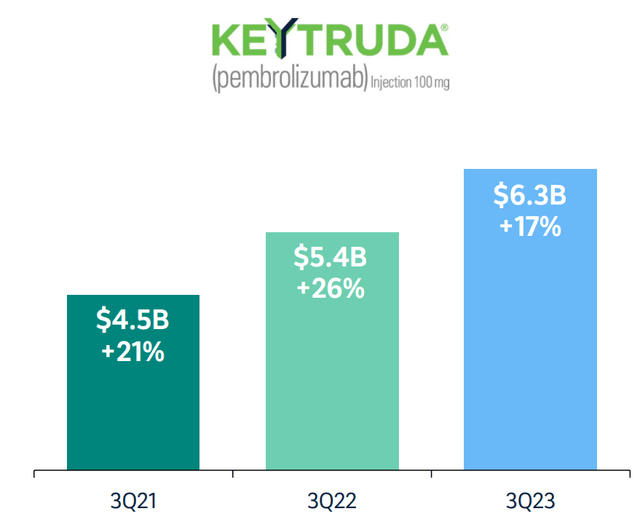

Keytruda has continued to shine for MRK, helping to propel MRK’s worldwide sales by 7% YoY to $16.0 billion during the third quarter. This was driven by Keytruda sales growth of 17% YoY (ex-currency growth is also 17%) to $6.3 billion. As shown below, this is after 21% and 26% annual growth in the prior two years.

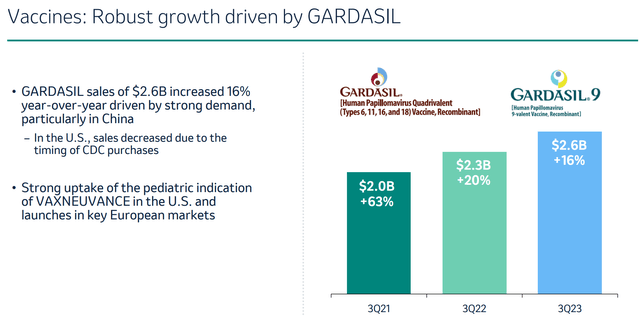

While Keytruda remains a core sales driver, MRK is far from being a one-trick pony, as Gardasil (MRK’s HPV Vaccine) and Lagevrio (COVID anti-viral) saw sales growth of 16% and 51% YoY growth (ex-currency), respectively. Moreover, it’s worth noting that MRK’s Gardasil revenues, which came in at $2.6 billion during the third quarter, could see a meaningful bump in 2024. That’s because the Gardasil’s royalty payments to pharmaceutical peer, GlaxoSmithKline (GSK) is set to cease at the end of this year.

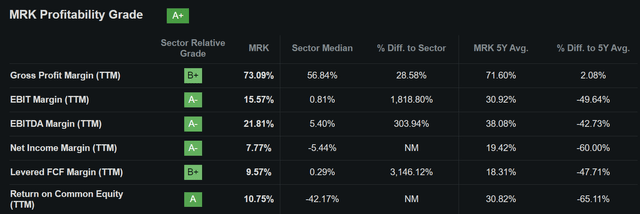

At present, MRK is paying 7% of its revenues from Gardasil to GSK, and that equates to $728 million on an annualized basis based on Gardasil’s Q3 revenues, and that’s assuming no growth in sales in 2024, which is an unlikely scenario. Savings on royalty payments would flow straight to the bottom line and bolster MRK’s already strong profitability. As shown below, MRK scores an A+ grade for Profitability with sector-leading EBITDA and Return on Equity of 22% and 11%, respectively.

Notably, MRK will see loss of exclusivity on Keytruda starting in 2028, which will almost certainly invite competitors to produce biosimilar versions at cheaper prices. As such, this will likely erode the pricing power on the drug, forcing MRK to try to acquire or develop new drugs as a revenue replacement.

However, Keytruda could have more gas in the tank after 2028, as MRK is testing two versions of the drug that can be injected subcutaneously. This serves as an alternative to infusions, which is the current delivery method in which patients visit a clinic every three to six weeks and receive Keytruda through an intravenous drip. According to the NIH, subcutaneous injections hold advantages over IV since skilled personnel are not required, and the injections are less painful with lower infection risks compared to IV. If approved, this new version of Keytruda could see patent protection until 2039, thereby extending the revenue stream for the drug.

In the meantime, Keytruda is seeing additional therapies being approved, including the latest approval by the FDA for a combination therapy with Pfizer’s (PFE) drug Padcev for the treatment of bladder cancer. Beyond Keytruda, MRK also has made progress in its cardiometabolic pipeline, including FDA acceptance for priority review of sotatercept for pulmonary arterial hypertension with potential for approval and launch in early 2024, as well as a drug candidate in the works for the management of cholesterol.

Risks to MRK include the obvious concern that Keytruda’s LOE will expire in 2028, thereby forcing MRK to develop new drugs in its pipeline to plug the potential revenue gap. While the aforementioned work on the new version of Keytruda holds promise, there is no guarantee that it will catch on. In addition, MRK recently paid $5.5 billion upfront for its collaboration with Daiichi Sankyo to develop antibody drug conjugate technology. This will negatively impact MRK’s full year 2023 earnings on a GAAP basis and as with anything, the collaboration come with execution risks.

Nonetheless, MRK carries a strong balance sheet to fund collaborations with other drugmakers, as it carries $8.8 billion in cash and short-term investments after making the aforementioned $5.5 billion upfront payment. It also carries a strong A+ credit rating and has a safe net debt to EBITDA ratio of 2.0x. Notably, the leverage ratio is higher than what it would have been without the aforementioned payment, and I would expect for it to trend down as MRK realizes returns on this collaboration.

MRK also pays a 2.9% dividend yield at the current price of $107.70. The dividend payout ratio is elevated at 93% based on the aforementioned one-time payment, and I would expect for it to trend down to 36% based on analysts expectations for $8.45 EPS next year. MRK also has a respectable 5-year dividend CAGR of 9.3% and 13 years of consecutive dividend growth.

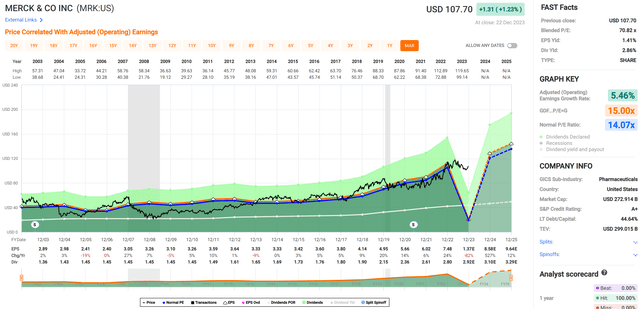

Turning to valuation, MRK is reasonably priced with a forward PE of 12.7 based on the above-mentioned 2024 EPS of $8.45, and analysts expect 6.6% to 11.9% annual EPS growth in the 2025 to 2027 timeframe. This sits lower than MRK’s normal PE of 14.1, as shown below. Given MRK’s robust revenue growth from key drugs, its development pipeline, and the absence of royalty payments on Gardasil starting next year, I believe MRK’s current stock price and valuation is more than reasonable.

Investor Takeaway

While MRK will face challenges with Keytruda’s LOE in 2028, I believe the company is well-positioned to navigate this risk and continue its growth trajectory. With a strong balance sheet, plans to diverse its revenue stream, and promising developments in its pipeline, MRK appears to be a solid long-term investment opportunity. The stock also provides a dividend yield that’s meaningfully higher than that of the S&P 500, making it appealing to both growth and income-oriented investors. As such, MRK appears to be an appealing choice in the current market, especially compared to a number of expensive names also in the large cap category. I maintain a ‘Buy’ rating on MRK.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!