Summary:

- Keytruda is proving effective in treating more and more types of cancer, and its long-term growth potential is massive in my view.

- I believe Keytruda is set to generate $31 billion revenue by the end of 2025.

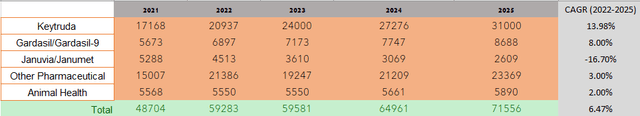

- Januvia/Janumet’s fall should not be that sharp while Gardasil/Gardasil-9 is likely to continue to do well.

- I estimate $71.5 billion in total revenue and $10.29 EPS by 2025, which means 10.4x forward P/E. That is a very cheap valuation considering the company’s position in key markets and dividend payments.

DjelicS/E+ via Getty Images

Main thesis

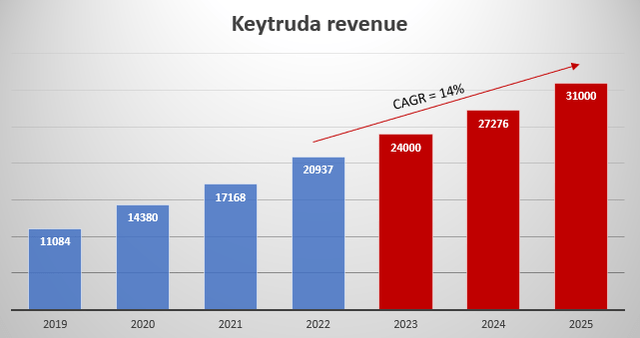

Pharmaceutical giant Merck (NYSE:MRK) has a number of blockbuster drugs in its arsenal, primarily for the treatment of cancer and diabetes. The company’s bestseller, Keytruda (pembrolizumab), is proving effective in treating more and more types of cancer and its long-term growth potential is massive. In fact, I believe Keytruda’s revenue will approach $24 billion this year, and cross $30 billion in 2025.

Keytruda: The best-selling drug in the world

The largest revenue for the pharmaceutical giant comes from the blockbuster drug, first FDA-approved in 2014 for the treatment of various types of cancer, Keytruda (36% of total revenue in the third quarter of 2022). The humanized monoclonal antibody included in the drug is effective in the treatment of a whole list of oncological diseases, including melanoma, various types of lung, head & neck, stomach, cervix, endometrium cancer, etc.

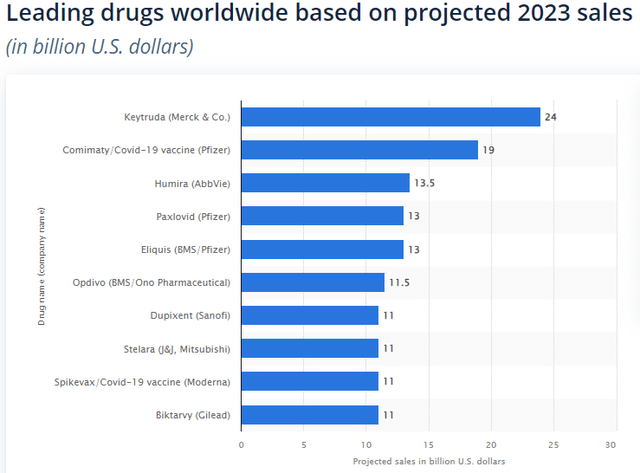

As AbbVie lost its exclusivity for Humira in early 2023, Keytruda is set to become the highest-grossing drug in the world.

In March, positive results were obtained from the third phase of a clinical trial using Keytruda in combination with standard chemotherapy in the treatment of endometrial cancer. The combination treatment was significantly more effective than chemotherapy alone. This year, 66,200 new cases and 13,030 deaths are expected.

In April, the FDA granted accelerated approval to Padtsev, a collaboration between Astellas Pharma and Seagen, in combination with Keytruda for the treatment of advanced bladder cancer. According to Cancer National Institute, more than 82,000 people will be diagnosed with the disease in 2023.

In June, the FDA accepted an application for the use of Keytruda in combination with standard chemotherapy in the treatment of advanced bile duct cancer. The regulator’s decision is expected in February 2024. Studies have shown a 17% reduction in the risk of death of patients with combination treatment compared to chemotherapy alone. Bile duct cancer is forecasted to affect 41,210 people in the United States in 2023 and has a small survival rate of 21%.

In May, Eisai announced that a phase 3 study of the combination of Keytruda and Lenvima Eisai (lenvatinib) in the treatment of advanced renal cell carcinoma demonstrated significant efficacy, with a death risk 21% lower compared to Pfizer’s Sutent (sunitinib).

In June, the results of a phase IIb study of Keytruda in combination with the personalized cancer vaccine Moderna mRNA-4157 (V940) in melanoma were announced. Patients who received the combination treatment had a 65% lower risk of distant metastases or death than those who received Keytruda alone.

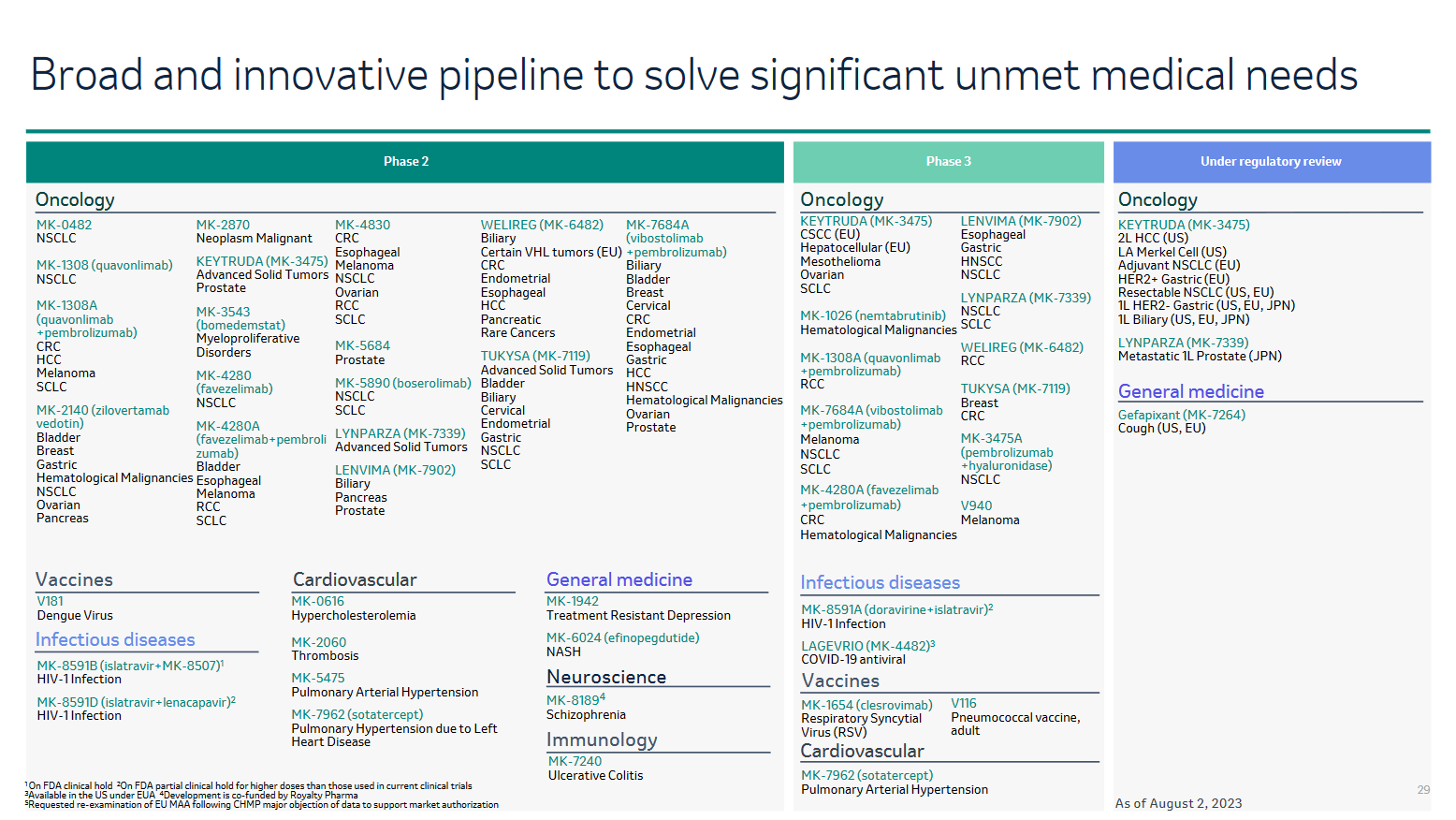

Merck’s pipeline of experimental drugs is one of the broadest and most diversified in the industry. The company has more than 30 programs in the third (final) phase of clinical trials, and another 10 at the stage of regulatory approvals. Almost 80 programs are in phase II.

Merck

I estimate Keytruda’s addressable market will expand by at least 180,000 people in 2024-2025 given a positive FDA approval scenario. Thus, based on Wholesale Acquisition Cost of $10,897 for a dose per 3 weeks and 10% Keytruda treatment for a whole year rate (17 doses annually), the revenue for the blockbuster should rise by $3.3 billion + organic growth of $24 billion (2023 forecasted revenue) base with CAGR of 6-7% (NSCLC, RCC, TNBC market growth), this gives us $31 billion potential revenue by the end of 2025.

Januvia & Gardasil

The largest share of Merck’s revenue comes from its oncology, diabetes, and vaccine segments. Januvia (sitagliptin) and Janumet (sitagliptin/metformin) – are aimed at treating diabetes, which has become a real scourge of humanity in recent decades. Januvia is one of the best-selling drugs for the treatment of diabetes. Januvia and Janumet together account for about 8% of revenue. Merck lost its initial exclusivity for Januvia in January 2023 but it still has a strong patent wall of intellectual property on dihydrogen phosphate salt and the co-formulation of sitagliptin. Merck said it “would preclude generic manufacturers from making sitagliptin phosphate salt and polymorphic forms until 2027”. Thus, I believe the decline would not be that deep and project a 15% drop in 2024-2025.

Merck is a recognized expert in metabolic diseases. In 2023, approximately 529 million people worldwide have diabetes and by 2030, IDF projects the number of people with the diagnosis will reach 634 million. Moreover, 1 in 3 diabetics do not know about their diagnosis for a long time. Sitagliptin, the main active ingredient in the antidiabetic drugs Januvia/Janumet, is one of the 100 most widely prescribed drugs in the United States, prescribed to over 9 million Americans per year.

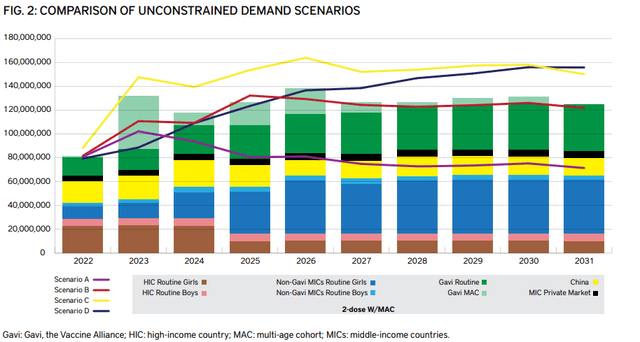

Merck’s Gardasil/Gardasil-9 vaccine is in second place in terms of revenue share. Gardasil protects against sexually transmitted human papillomavirus (HPV) types 6, 11, 16, and 18, and Gardasil-9 protects against types 6, 11, 16, 18, 31, 33, 45, 52, and 58. There are more than 100 types of HPV, of which at least 14 are associated with cancer, which is why Merck’s vaccines are in growing demand globally.

The main growth driver for vaccine demand is massive immunization programs in regions like China. In 3 out of 4 of the WHO’s scenarios, the demand is set to grow at a CAGR of 8%+ in 2022-2025.

My projections

In 2023, Merck’s revenue is expected to stay flat compared to the high base of 2022 as Lagevrio sales are expected to be less than $1 billion in 2023. Net profit in 2023 is likely to be more than halved due to a fairly large acquisition of Prometheus Biosciences for almost $11 billion.

But still, all in all, even if “another pharmaceutical” (non-Keytruda, Januvia, or Gardasil) grows at a historic neutral of 3% and the animal health segment at 2%, this would still mean 6.5% revenue CAGR through 2025.

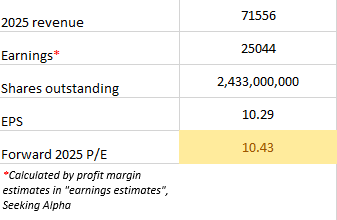

That leaves us with $10.29 in earnings per share and 10.43x forward 2025 P/E. That is a very cheap valuation considering the company’s position in key markets.

Author

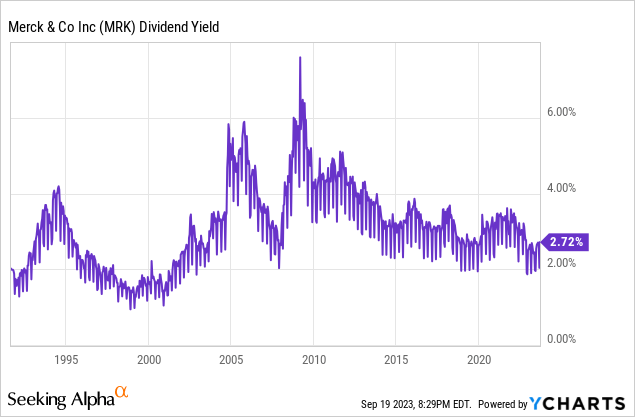

Moreover, the dividends are still in play. Merck has been paying dividends for 33 years in a row and has been increasing them for 12 years in a row. The forward dividend yield (2023E) is 2.7%.

The main risk to consider

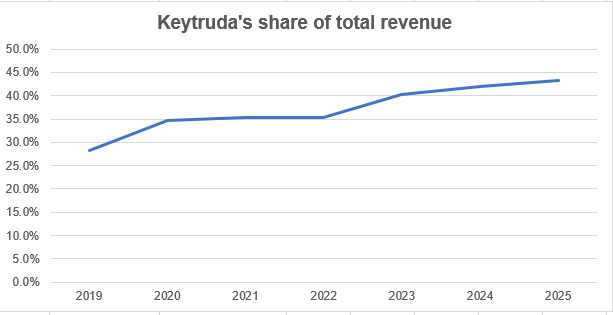

The main risk for Merck in the long term is competition from peers, which Keytruda may face after the key patent expires in 2028. My estimates suggest its share rising to 43.3% in 2025. If it will keep growing at the same pace the contribution to total revenue would reach 48.3% in 2028. For comparison, AbbVie’s Humira share was 36.6% at the moment of the LOE.

Author

Thus, Merck’s prospects after 2028 are still unclear as it would take years to offset nearly half of the revenue loss. The closer we get to 2028, the greater the pressure on stock prices, unless the company manages to find a new bestseller even remotely comparable to Keytruda’s scale.

Final thoughts

Keytruda opportunities are truly massive as more and more studies tend to show the drug’s success in treating new and new diseases. Keytruda’s growth wave reminds me of AbbVie’s Humira back in the days. I believe Merck will be able to hold onto the ‘highest grossing drug in the world’ spot for as long as the patent wall allows and continue its rapid growth until the loss of exclusivity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.